Successfully Navigating The Private Credit Job Market: 5 Do's & Don'ts

Table of Contents

5 Do's for Success in the Private Credit Job Market

Do 1: Network Strategically

Building a strong network is paramount in the private credit job market. Don't underestimate the power of personal connections.

- LinkedIn Optimization: Create a compelling LinkedIn profile highlighting your skills and experience in areas like credit underwriting, debt financing, and due diligence. Actively engage with posts and connect with professionals in the private credit industry.

- Industry Events: Attend conferences, webinars, and networking events focused on private credit, private equity, and alternative investments. These events offer invaluable opportunities to meet potential employers and learn about current market trends. Look for events related to specific niches like distressed debt or real estate finance.

- Informational Interviews: Reach out to professionals working in private credit firms for informational interviews. These conversations can provide valuable insights into the industry, specific firms, and potential job opportunities.

- Alumni Networks & Professional Organizations: Leverage your alumni network and join relevant professional organizations like the CFA Institute or the Association for Corporate Growth (ACG) to connect with potential mentors and employers.

Cultivating genuine connections, rather than simply collecting contacts, is key to long-term success in navigating the private credit job market.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

- Highlight Relevant Skills: Emphasize your skills in quantitative analysis, financial modeling, credit analysis, and valuation. Showcase your proficiency in Excel, financial modeling software, and relevant database management tools.

- Quantify Achievements: Instead of simply listing responsibilities, quantify your achievements whenever possible. For example, instead of "Managed a portfolio of loans," write "Managed a $50 million loan portfolio, resulting in a 10% reduction in non-performing loans."

- Target Each Application: Don't use a generic resume and cover letter. Tailor your application materials to each specific job description and the firm's investment strategy. Research the firm's recent transactions and highlight your skills relevant to their focus areas (e.g., direct lending, mezzanine financing, distressed debt).

- Incorporate Keywords: Use keywords relevant to the specific private credit niche you're targeting (e.g., "credit underwriting," "debt financing," "due diligence," "portfolio management," "leveraged buyout"). Review job postings carefully to identify relevant keywords.

A well-crafted resume and cover letter are essential for getting your foot in the door in this competitive private credit job market.

Do 3: Prepare for Behavioral and Technical Interviews

Private credit interviews are rigorous. Thorough preparation is vital.

- Behavioral Questions: Practice answering common behavioral interview questions, such as "Tell me about a time you failed," "Describe your leadership style," and "How do you handle working under pressure?" Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Technical Questions: Be prepared to answer technical questions on financial modeling, credit analysis, valuation techniques (DCF, LBO modeling), and accounting principles. Practice building financial models and understand key financial ratios.

- Company Research: Thoroughly research the firm, its investment strategy, recent transactions, and the interviewer. Demonstrate your understanding of their business model and investment philosophy.

- Prepare Questions: Asking insightful questions demonstrates your interest and knowledge. Prepare a few questions related to the firm's investment strategy, culture, or recent deals.

Do 4: Master Financial Modeling and Credit Analysis Skills

Strong financial modeling and credit analysis skills are non-negotiable in the private credit job market.

- Excel Proficiency: Develop advanced Excel skills, including functions like VBA, pivot tables, and data manipulation techniques.

- Financial Modeling Software: Become proficient in financial modeling software, such as Argus or Bloomberg Terminal.

- Credit Analysis Techniques: Master credit analysis techniques including financial statement analysis, ratio analysis, cash flow forecasting, and covenant compliance monitoring.

- Relevant Certifications: Consider pursuing relevant certifications, such as the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) designations, to enhance your credibility.

Continuous learning and development in these areas are crucial for staying competitive in the evolving private credit job market.

Do 5: Follow Up After Interviews

Don't let your efforts end with the interview. Effective follow-up is critical.

- Thank-You Note: Send a personalized thank-you note within 24 hours, reiterating your interest and highlighting key aspects of the conversation.

- Follow-Up Email: If you haven't heard back within the expected timeframe, send a polite follow-up email expressing your continued interest.

- Maintain Communication: Keep your contacts updated on your job search progress and any relevant developments.

5 Don'ts in the Private Credit Job Market

Don't 1: Neglect Networking

Networking is crucial. Don't rely solely on online job boards.

- Passive Networking is Ineffective: Actively engage in networking events; don't just attend and observe.

- Online Presence is Important: Maintain an active and professional online presence on platforms such as LinkedIn.

Don't 2: Submit Generic Applications

Generic applications show a lack of effort and interest.

- Tailored Applications are Key: Customize your resume and cover letter to each specific job and company.

Don't 3: Underprepare for Interviews

Thorough preparation is key to success in private credit interviews.

- Research is Essential: Research the firm and the interviewer before the interview.

- Practice Makes Perfect: Practice answering common interview questions and technical questions related to the role.

Don't 4: Lack Financial Acumen

Private credit requires strong financial skills.

- Continuous Learning: Continuously enhance your financial modeling and credit analysis skills through courses, certifications, or self-study.

Don't 5: Fail to Follow Up

Following up demonstrates your continued interest.

- Timely Follow-up: Follow up after interviews to reiterate your interest and maintain communication.

Conclusion

Successfully navigating the private credit job market demands a proactive and well-prepared approach. By following these five "dos" and avoiding the five "don'ts," you significantly increase your chances of securing a rewarding career in this dynamic field. Remember to network strategically, tailor your applications, master essential skills, and follow up effectively. Start building your network and refining your skills today to successfully navigate the private credit job market and achieve your career aspirations in private credit and alternative investments.

Featured Posts

-

De Toekomst Van De Samenwerking Tussen Brekelmans En India

May 09, 2025

De Toekomst Van De Samenwerking Tussen Brekelmans En India

May 09, 2025 -

Babysitting Bill Leads To Even Higher Daycare Costs A Financial Burden

May 09, 2025

Babysitting Bill Leads To Even Higher Daycare Costs A Financial Burden

May 09, 2025 -

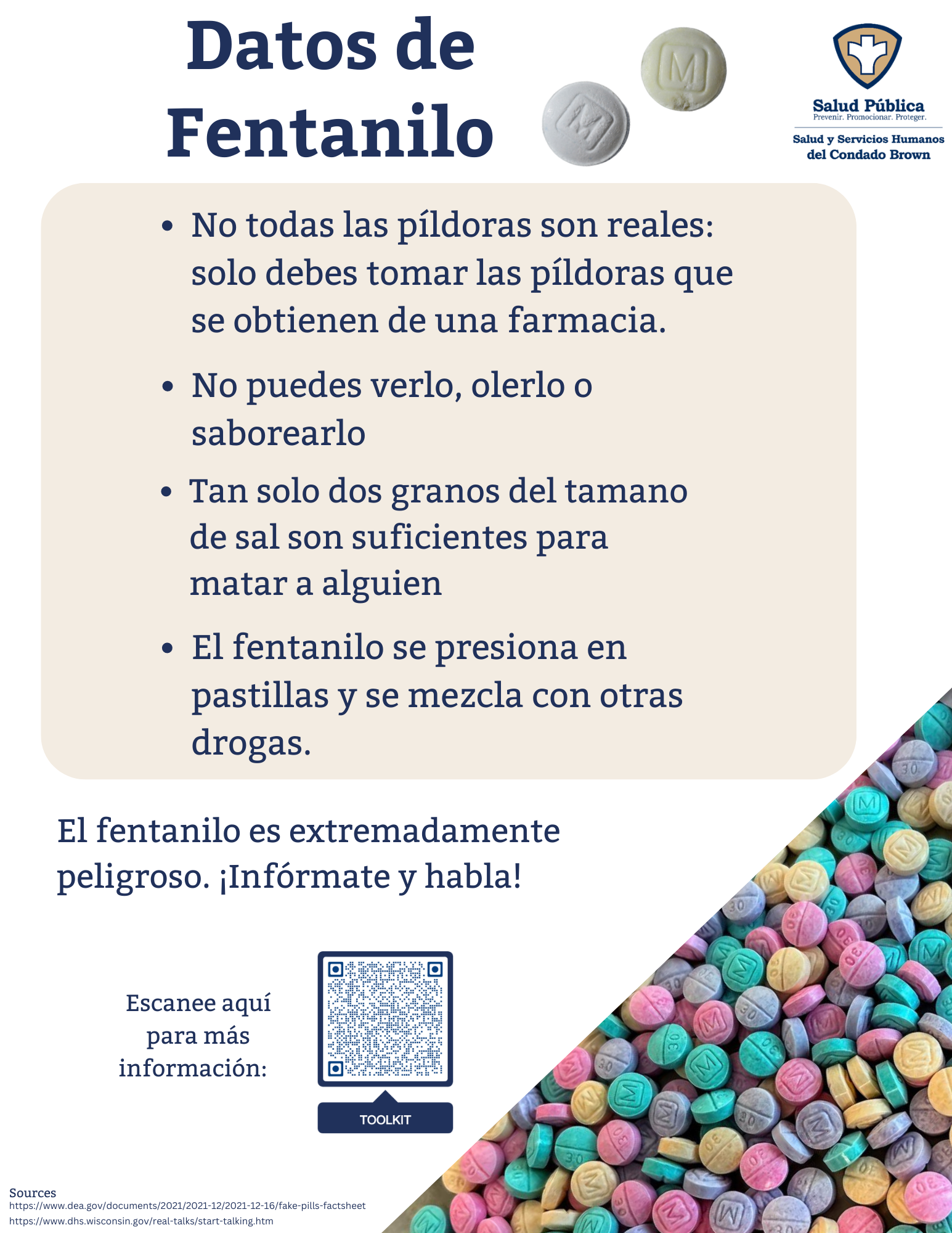

Attorney Generals Fentanyl Display A Deeper Look

May 09, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 09, 2025 -

Uk To Tighten Visa Rules For Pakistan Nigeria And Sri Lanka

May 09, 2025

Uk To Tighten Visa Rules For Pakistan Nigeria And Sri Lanka

May 09, 2025 -

Houthi Truce Announced By Trump Faces Shipper Doubt

May 09, 2025

Houthi Truce Announced By Trump Faces Shipper Doubt

May 09, 2025