Surviving The Trade War: A Cryptocurrency's Path To Success

Table of Contents

Decentralization as a Shield Against Geopolitical Risks

Cryptocurrencies' inherent decentralization provides a powerful buffer against the unpredictable shocks of global trade disputes. This inherent characteristic offers several key advantages in navigating the complexities of a trade war.

Reduced Dependence on Centralized Systems

Traditional financial systems are vulnerable to trade war impacts, including sanctions, capital controls, and currency manipulations. Cryptocurrencies, operating outside these centralized systems, offer a significant advantage:

- Reduced exposure to currency manipulation: Unlike fiat currencies susceptible to devaluation during trade conflicts, cryptocurrencies maintain their value based on their underlying blockchain technology and market demand.

- Bypass of traditional banking systems and their regulations: Transactions are processed directly between parties, circumventing potential delays, restrictions, and censorship imposed by traditional banking systems during geopolitical tensions.

- Increased resilience to geopolitical instability: The decentralized nature of cryptocurrencies makes them less susceptible to the ripple effects of trade wars, offering a more stable store of value and a more reliable means of exchange.

Global Accessibility and Liquidity

Crypto markets operate beyond national borders, providing unparalleled access to liquidity and trading opportunities regardless of national trade policies or sanctions.

- 24/7 trading, unaffected by national market closures: Unlike traditional stock markets that adhere to specific time zones and national holidays, crypto markets operate continuously, providing constant access to trading and investment.

- Access to global markets and diverse investor pools: This allows for diversification of risk and increased liquidity, mitigating the impact of any single national market downturn caused by trade disputes.

- Reduced dependence on single-country economies: This global accessibility makes cryptocurrencies less vulnerable to the economic fallout experienced by nations heavily impacted by trade wars.

Technological Innovation and Adaptability

The constantly evolving nature of blockchain technology presents a powerful tool for navigating the challenges posed by trade wars. This adaptability is crucial for long-term success in this uncertain environment.

Evolution of Blockchain Technology

Ongoing advancements in blockchain technology directly address many of the challenges presented by trade wars, particularly in cross-border payments and supply chain transparency.

- Improved scalability and transaction speed: Faster transactions translate to quicker and more efficient cross-border payments, reducing delays and costs associated with international trade during periods of uncertainty.

- Enhanced security features against cyber threats: Robust security measures protect against fraudulent activities, ensuring the integrity of transactions even amidst heightened geopolitical tensions.

- Development of privacy-enhancing technologies: These technologies offer increased user privacy and anonymity, crucial for navigating potentially restrictive regulatory environments brought on by trade wars.

Adapting to Regulatory Changes

Navigating the evolving regulatory landscape is essential for cryptocurrency projects to maintain market access and viability. Proactive adaptation is key.

- Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations: Adherence to these standards helps build trust and credibility with regulators, reducing the risk of restrictions.

- Working with regulatory bodies to establish clear guidelines: Open communication and collaboration with regulatory authorities can foster a more supportive and predictable regulatory framework.

- Seeking legal counsel to navigate jurisdictional differences: Expert legal advice is essential for navigating the complexities of varying international laws and regulations.

Strategic Partnerships and Community Building

Collaboration and community building are critical to enhancing the resilience of the cryptocurrency ecosystem during times of global economic uncertainty.

Collaboration within the Crypto Ecosystem

Partnerships and collaborations among cryptocurrency projects and businesses create a more robust and resilient ecosystem capable of weathering trade war disruptions.

- Shared resources and technological advancements: Collaboration allows for the pooling of resources and expertise, accelerating innovation and development.

- Joint marketing and community engagement initiatives: United marketing efforts can enhance awareness and adoption of cryptocurrencies globally.

- Developing industry standards and best practices: Standardization strengthens the ecosystem's reliability and trustworthiness, attracting broader adoption.

Cultivating a Strong Community

A thriving community is the bedrock of cryptocurrency success. A strong, engaged community can navigate challenges and advocate for widespread adoption.

- Community forums and social media engagement: These channels allow for open communication, information sharing, and collective problem-solving.

- Educational initiatives to promote understanding and adoption: Increased understanding helps counter misinformation and fosters trust in cryptocurrencies.

- Active participation in industry events and conferences: These events offer opportunities for networking, collaboration, and advocacy.

Conclusion

The global trade war presents both challenges and exciting opportunities for the cryptocurrency market. By leveraging decentralization, technological innovation, and strategic partnerships, cryptocurrencies are well-positioned not only to survive but to thrive in this volatile environment. The path to success lies in adapting to the evolving landscape, building strong communities, and embracing the unique strengths of decentralized finance. Don't be left behind – explore the potential of cryptocurrencies and chart your course towards success in this new era of global trade. Learn more about navigating the complexities of the trade war and securing your financial future with strategies for Surviving the Trade War: A Cryptocurrency's Path to Success.

Featured Posts

-

Otkaz Ot Vizita V Kiev Makron Starmer Merts I Tusk I Ikh Politicheskie Motivy

May 09, 2025

Otkaz Ot Vizita V Kiev Makron Starmer Merts I Tusk I Ikh Politicheskie Motivy

May 09, 2025 -

Pakistan Economic Crisis Imf Review Of 1 3 Billion Loan And Latest News

May 09, 2025

Pakistan Economic Crisis Imf Review Of 1 3 Billion Loan And Latest News

May 09, 2025 -

Bayern Munich Vs Fc St Pauli Who Will Win Prediction And Analysis

May 09, 2025

Bayern Munich Vs Fc St Pauli Who Will Win Prediction And Analysis

May 09, 2025 -

Barbashevs Overtime Heroics Send Series To Game 5 Knights Top Wild 4 3

May 09, 2025

Barbashevs Overtime Heroics Send Series To Game 5 Knights Top Wild 4 3

May 09, 2025 -

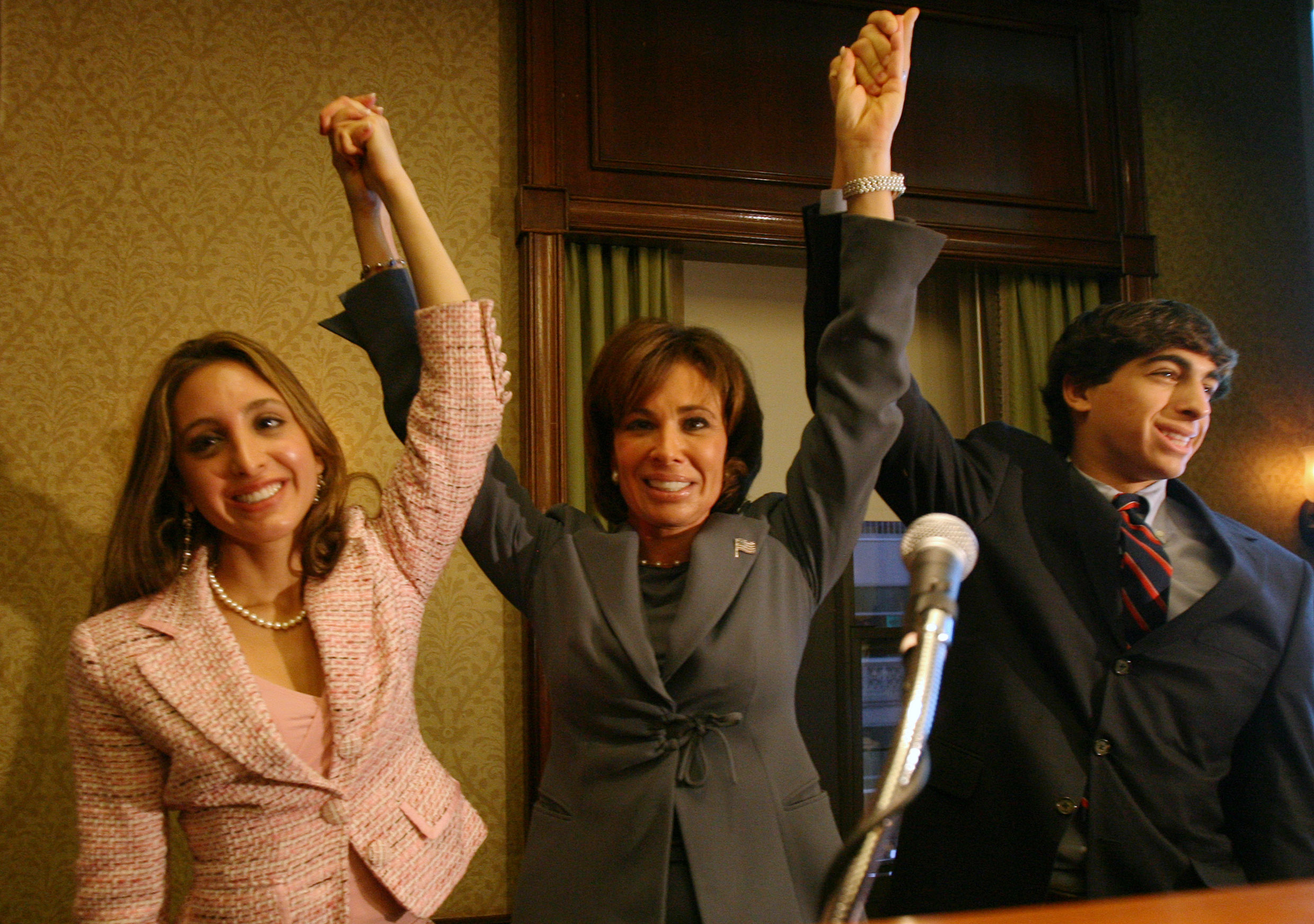

Jeanine Pirros Appointment As Dc Prosecutor Trumps Choice Analyzed

May 09, 2025

Jeanine Pirros Appointment As Dc Prosecutor Trumps Choice Analyzed

May 09, 2025