Swissquote Bank: Euro And European Futures Rise As US Dollar And US Futures Fall

Table of Contents

The global currency markets are experiencing significant shifts, with the Euro and European futures experiencing a notable surge while the US dollar and US futures are witnessing a decline. Swissquote Bank, a prominent player in the forex market, provides invaluable insights into this dynamic situation. This article will delve into the reasons behind this trend, analyzing the factors contributing to the rise of the Euro and the fall of the US dollar, as observed through the lens of Swissquote Bank's market analysis.

<h2>The Weakening US Dollar: Factors Contributing to the Decline</h2>

The decline of the US dollar against the Euro is a multifaceted issue, driven by several key factors. Understanding these factors is crucial for navigating the current market conditions and making informed trading decisions using resources like those offered by Swissquote Bank.

<h3>Inflation Concerns in the US</h3>

Rising inflation rates in the US are significantly impacting the value of the US dollar. The Consumer Price Index (CPI) consistently exceeding expectations indicates persistent inflationary pressures. The Federal Reserve's response to this – potential interest rate hikes and quantitative tightening – adds further uncertainty to the market. These actions, while aimed at curbing inflation, can also slow economic growth, making the dollar less attractive to investors.

- Rising inflation erodes purchasing power. Higher prices mean the dollar buys less, reducing its relative value.

- Higher interest rates can curb inflation but slow economic growth. This creates a delicate balancing act for the Federal Reserve.

- Uncertainty around Fed policy creates volatility. The market reacts strongly to any hints about future Fed actions, leading to fluctuations in the dollar's value. For example, a surprise interest rate increase could temporarily strengthen the dollar, but sustained high interest rates could eventually weaken it.

<h3>Geopolitical Uncertainty and its Impact</h3>

Geopolitical events play a significant role in influencing currency values. The US dollar, often considered a "safe-haven" asset during times of global uncertainty, has seen its safe-haven status challenged recently. Ongoing conflicts and political instability worldwide create uncertainty, causing investors to reassess their risk tolerance.

- Global conflicts create market uncertainty. This leads to capital flight from riskier assets, including the US dollar.

- Investors seek safer assets, potentially reducing US dollar demand. This shift in investor sentiment can lead to a decline in the dollar's value.

- Geopolitical risk premiums can impact currency valuations. Higher perceived risk in certain regions can increase the demand for currencies perceived as safer, such as the Euro in comparison to the US dollar.

<h2>The Strengthening Euro: Factors Driving the Rise</h2>

The Euro's rise against the US dollar is fueled by a combination of positive economic indicators within the Eurozone and the European Central Bank's (ECB) monetary policy decisions. Understanding these dynamics is crucial for anyone looking to leverage trading opportunities through platforms like Swissquote Bank.

<h3>Stronger-than-Expected European Economic Data</h3>

Positive economic news from the Eurozone has boosted investor confidence and increased demand for the Euro. Stronger-than-anticipated GDP growth figures and improving employment numbers paint a picture of a resilient European economy.

- Positive economic data boosts investor confidence. This leads to increased investment flows into the Eurozone, strengthening the Euro's value.

- Increased investment flows strengthen the Euro. More capital entering the Eurozone increases demand for the Euro, pushing its value higher.

- Improved economic outlook makes the Euro more attractive. A healthy European economy is a key driver of the Euro's strength.

<h3>European Central Bank (ECB) Monetary Policy</h3>

The ECB's monetary policy decisions have a direct impact on the Euro's value. Interest rate changes, quantitative easing programs, and the ECB's communication strategy all influence market sentiment.

- ECB policy decisions directly impact the Euro's value. Changes in interest rates or quantitative easing programs can affect the Euro's attractiveness to investors.

- Interest rate hikes can attract investment. Higher interest rates can make the Euro more attractive to investors seeking higher returns.

- Clear communication from the ECB reduces uncertainty. Transparent communication from the ECB can stabilize the market and boost investor confidence.

<h2>Swissquote Bank's Perspective and Trading Opportunities</h2>

Swissquote Bank, with its extensive market expertise, offers valuable insights into the current market dynamics. Their analysis provides a crucial perspective for traders seeking to capitalize on the changing landscape.

<h3>Swissquote Bank's Market Analysis</h3>

Swissquote Bank's analysts closely monitor global economic indicators, geopolitical events, and central bank policies to provide accurate market forecasts. Their insights on the Euro and US dollar trends can inform effective trading strategies. (Note: For specific Swissquote Bank forecasts, refer to their official website and publications.)

<h3>Trading Strategies and Risk Management</h3>

The current market situation presents both opportunities and risks. Utilizing the tools and resources offered by Swissquote Bank is essential for managing these risks effectively.

- Consider using stop-loss orders to limit potential losses. This risk management technique can protect your capital from significant losses.

- Diversify your portfolio to reduce risk. Don't put all your eggs in one basket. Spread your investments across different assets to mitigate risk.

- Stay informed about market developments through Swissquote Bank's resources. Regularly review market analysis, news updates, and educational materials to stay ahead of the curve.

<h2>Conclusion</h2>

The interplay between the weakening US dollar and the strengthening Euro is a complex situation influenced by inflation concerns, geopolitical uncertainty, and robust economic data within the Eurozone. Swissquote Bank’s analysis provides valuable tools to understand this complex market. By carefully considering these factors and using sound risk management techniques while utilizing the resources offered by Swissquote Bank, traders can potentially identify lucrative opportunities in the forex market. Remember to always stay informed about market changes and utilize the resources available through Swissquote Bank to make informed decisions regarding your Euro and US dollar trading strategies. Start exploring the insights offered by Swissquote Bank today!

Featured Posts

-

Fsu Shooting Victims Father A Cuban Exile And Cia Operative

May 19, 2025

Fsu Shooting Victims Father A Cuban Exile And Cia Operative

May 19, 2025 -

Grammy Winners Farewell Retirement After 5 Nominations Due To Health Concerns

May 19, 2025

Grammy Winners Farewell Retirement After 5 Nominations Due To Health Concerns

May 19, 2025 -

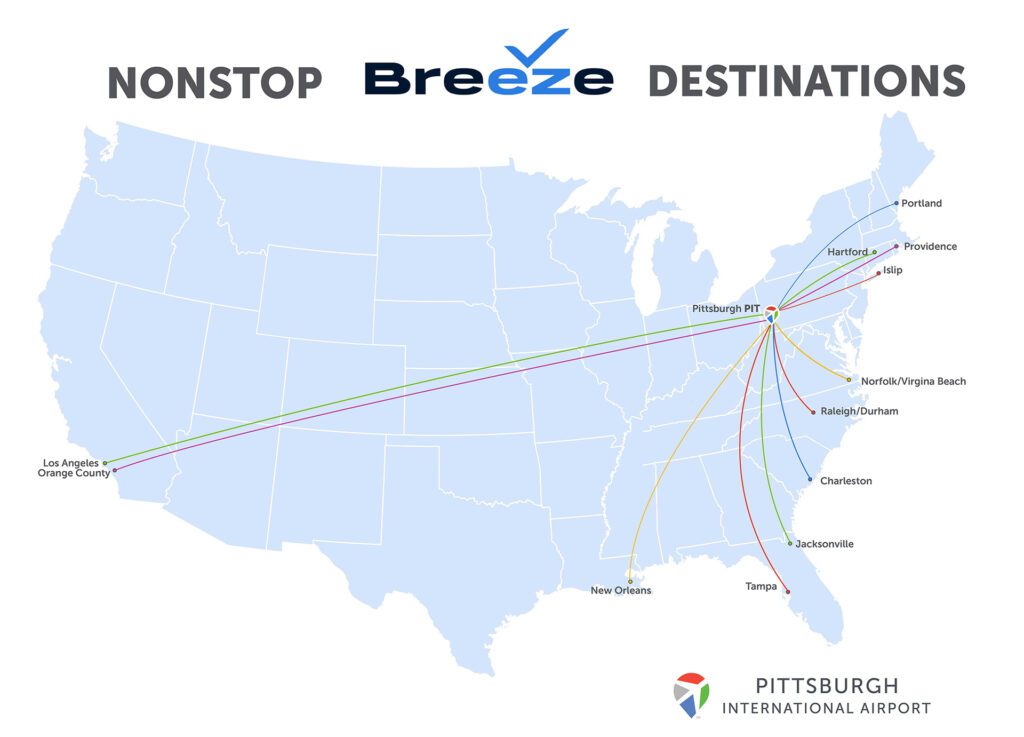

Breeze Airways Expands Two New Routes Announced

May 19, 2025

Breeze Airways Expands Two New Routes Announced

May 19, 2025 -

Alleged Leak To Pakistan Jyoti Malhotras Case And Digital Footprint

May 19, 2025

Alleged Leak To Pakistan Jyoti Malhotras Case And Digital Footprint

May 19, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike

May 19, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike

May 19, 2025