Taiwan Regulator Investigates Firms Over ETF Sales Pressure On Staff

Table of Contents

The SFDA Investigation: Scope and Allegations

The SFDA, the primary regulatory body overseeing the securities and futures markets in Taiwan, plays a crucial role in ensuring market integrity and investor protection. This investigation focuses on allegations of excessive pressure tactics employed by multiple financial firms to meet ambitious ETF sales targets. These allegations include:

- Unrealistic Sales Targets: Employees reportedly face impossibly high sales quotas, leading to undue stress and potential burnout. The pressure to achieve these targets often overrides ethical considerations.

- Excessive Working Hours and Pressure to Meet Quotas: Many employees report working excessive overtime, often unpaid, solely to meet the demanding sales targets. This creates an unsustainable and unhealthy work environment.

- Potential Violations of Employee Rights and Labor Laws: The relentless pressure to sell ETFs may constitute violations of Taiwanese labor laws concerning working hours, employee well-being, and fair compensation.

- Aggressive Sales Tactics Used: Reports suggest the use of aggressive and potentially manipulative sales techniques, pushing products onto investors who may not fully understand the risks involved. This includes high-pressure sales calls and misrepresentation of product features.

While the SFDA has not yet publicly named all firms under investigation, sources suggest that several major financial institutions are involved. The SFDA has released a statement confirming the ongoing investigation and emphasizing its commitment to ensuring ethical conduct within the financial industry. The full extent of the allegations and the outcome of the investigation remain to be seen.

Impact on ETF Sales and Market Integrity

The SFDA's investigation into ETF sales pressure in Taiwan has the potential to significantly impact the country's burgeoning ETF market. The negative publicity surrounding these allegations could erode investor confidence, leading to decreased investment in ETFs. Unethical sales practices can also lead to:

- Mis-selling of ETFs to Unsuitable Investors: Aggressive sales tactics might result in investors purchasing ETFs that are inappropriate for their risk tolerance or financial goals, leading to significant financial losses.

- Market Instability: A loss of confidence in the market due to these revelations could create instability, affecting the broader financial landscape in Taiwan.

The investigation could also prompt much-needed regulatory reforms, including stricter guidelines on sales practices, increased oversight of financial institutions, and enhanced investor protection measures. The long-term impact on ETF market growth in Taiwan will depend heavily on the outcome of the investigation and the subsequent regulatory response. While precise statistics on ETF market growth impacted by this are unavailable at this time, the potential negative effects on investor trust are a significant concern.

Investor Protection and Due Diligence

This situation underscores the critical importance of investor awareness and due diligence when investing in ETFs. Investors need to be cautious and conduct thorough research before making any investment decisions.

- Consequences of Mis-selling: Investors who have been subjected to mis-selling may be entitled to compensation or other remedies.

- Identifying Unethical Sales Practices: Watch out for high-pressure sales tactics, unrealistic promises of returns, and a lack of transparency about fees and risks.

- The Role of Regulatory Bodies: The SFDA and other regulatory bodies play a vital role in protecting investors from unethical practices and ensuring market fairness.

Ethical Concerns and Corporate Responsibility

The investigation highlights broader ethical concerns regarding aggressive sales tactics within the financial services industry. The firms involved bear the responsibility for fostering a culture of ethical conduct and ensuring that their employees are not subjected to undue pressure.

- Ethical Sales Practices: Financial institutions must prioritize ethical sales practices and ensure that their employees are properly trained and supervised.

- Corporate Responsibility: Companies must take responsibility for creating a supportive and ethical work environment that prioritizes the well-being of their employees.

- Long-term Consequences: Firms found to have engaged in unethical behavior face severe consequences, including fines, reputational damage, and loss of investor trust.

Conclusion

The SFDA's investigation into ETF sales pressure in Taiwan is a significant development that underscores the urgent need for ethical sales practices and enhanced investor protection. The potential impact on the ETF market, investor confidence, and the well-being of financial employees is substantial. The investigation's outcome and subsequent regulatory changes will shape the future of ETF sales and investment in Taiwan. Stay informed about the ongoing investigation into ETF sales pressure in Taiwan and advocate for fair and ethical business practices within the financial industry. Further research on the impact of ETF sales pressure on employee well-being and investor outcomes is needed. Learn more about responsible ETF investing in Taiwan to protect your investments and promote a healthier financial market.

Featured Posts

-

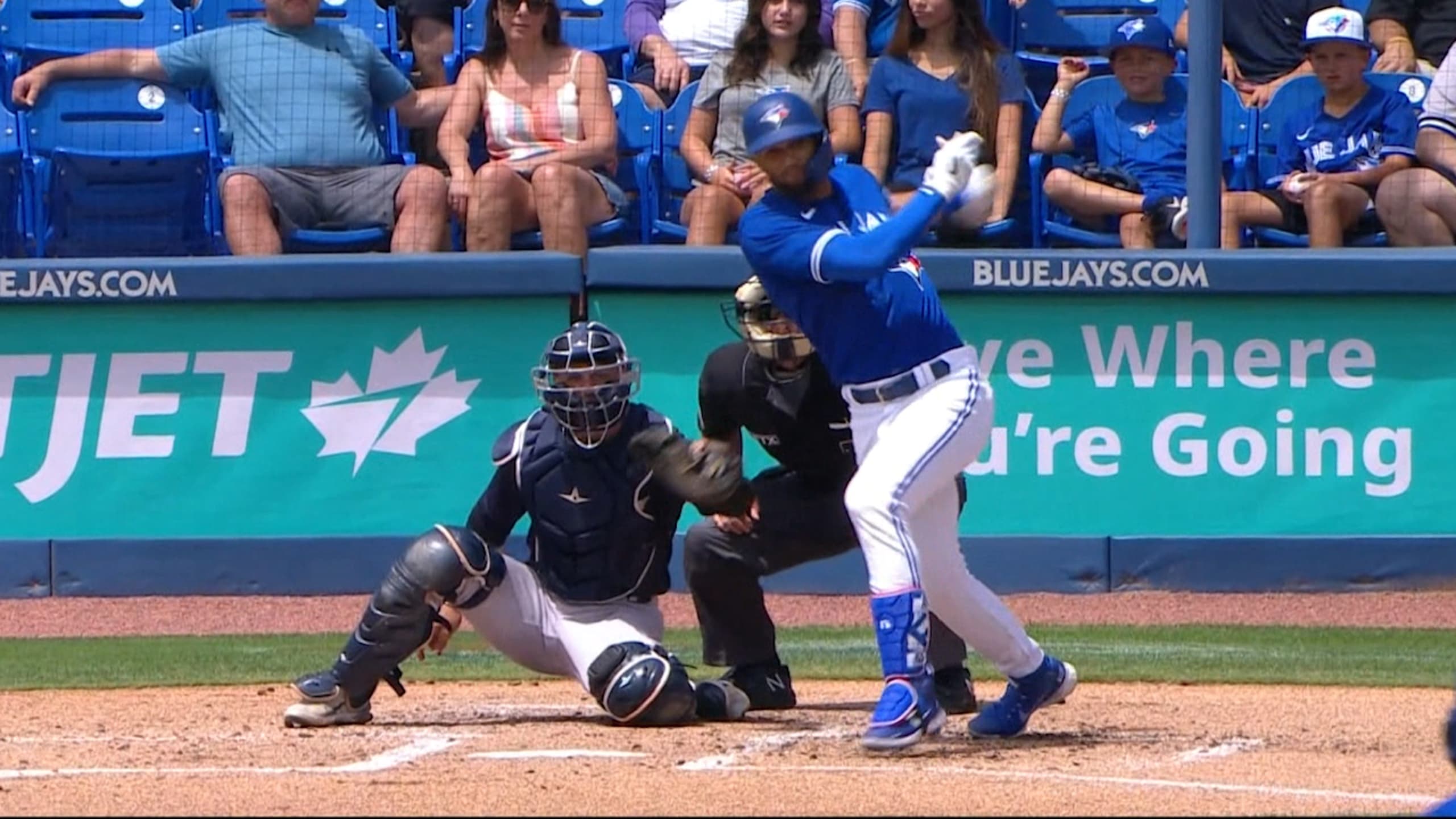

Pinch Hit Magic Gurriel Delivers Rbi Single Padres Win

May 15, 2025

Pinch Hit Magic Gurriel Delivers Rbi Single Padres Win

May 15, 2025 -

Creatine Benefits Side Effects And How To Use It Safely

May 15, 2025

Creatine Benefits Side Effects And How To Use It Safely

May 15, 2025 -

Test Your Nba Knowledge The Second Leading Scorer Quiz 1977 Present

May 15, 2025

Test Your Nba Knowledge The Second Leading Scorer Quiz 1977 Present

May 15, 2025 -

Venom Page On Pimblett Vs Chandler A Victory Roadmap

May 15, 2025

Venom Page On Pimblett Vs Chandler A Victory Roadmap

May 15, 2025 -

Times Kaysimon Stin Kypro Odigos Gia Oikonomia

May 15, 2025

Times Kaysimon Stin Kypro Odigos Gia Oikonomia

May 15, 2025