Taiwan's Strengthening Currency: Pressures Mount For Economic Restructuring

Table of Contents

The Impact of a Strong TWD on Taiwanese Exports

A strong TWD significantly impacts the competitiveness of Taiwanese exports. When the TWD appreciates against other major currencies like the US dollar, the price of Taiwanese goods increases in international markets, making them less attractive to foreign buyers. This directly affects Taiwan's export-led growth model. Industries heavily reliant on exports, such as electronics and technology, are particularly vulnerable.

- Reduced export revenue: Higher prices lead to a decrease in demand, directly impacting the revenue generated by Taiwanese exporters.

- Increased pressure on profit margins: Companies may struggle to maintain profit margins when faced with increased production costs and reduced export sales.

- Potential job losses in export-oriented sectors: If businesses can't compete internationally, they may cut costs by reducing their workforce, leading to job losses.

- Need for diversification of export markets: To mitigate the risks associated with a strong TWD, companies must explore new markets less sensitive to currency fluctuations.

Attracting Foreign Investment Despite Currency Appreciation

Attracting foreign direct investment (FDI) becomes more challenging when the TWD is strong. Foreign investors may find it less attractive to invest in Taiwan when their returns are diminished by currency conversion. The government needs proactive policies to counteract this disadvantage and entice foreign investment. Strategies include:

- Investing in advanced technology and innovation: Developing a strong technological base makes Taiwan a more attractive investment destination, even with a strong currency.

- Developing specialized niche markets: Focusing on high-value, specialized goods and services can offset the price disadvantage of a stronger TWD.

- Improving infrastructure and reducing bureaucratic hurdles: Streamlining processes and improving infrastructure can make Taiwan a more attractive place to do business.

- Promoting Taiwan as a hub for high-value-added manufacturing: Positioning Taiwan as a center for sophisticated manufacturing can attract investors seeking high-skilled labor and technological capabilities.

The Role of the Central Bank of Taiwan (CBT) in Currency Management

The Central Bank of Taiwan (CBT) plays a crucial role in managing the TWD's exchange rate. The CBT may intervene in the foreign exchange market to influence the TWD's value, aiming to prevent excessive volatility. However, the effectiveness of these interventions is often debated, and there are potential risks associated with currency manipulation. The appropriate level of CBT intervention is a subject of ongoing discussion, balancing the need for stability with the potential long-term consequences of artificial manipulation.

Economic Diversification as a Key Strategy

Reducing reliance on export-led growth is paramount. Economic diversification requires investing in sectors less susceptible to currency fluctuations. Promising areas include:

- High-tech industries (AI, biotechnology): These sectors offer high-value-added products and services with global demand.

- Green technology and renewable energy: Growing global focus on sustainability presents significant opportunities for Taiwan.

- Domestic consumption-driven sectors (tourism, services): Strengthening domestic demand can offset the negative impact of weak exports.

Government support and investment in these sectors are critical for successful diversification.

The Importance of Domestic Consumption

Boosting domestic consumption can help offset the negative impact of weak exports caused by a strong TWD. Strategies to stimulate domestic demand include:

- Increased wages: Higher wages provide consumers with more disposable income, boosting spending.

- Improved social welfare: Stronger social safety nets can improve consumer confidence and spending.

Conclusion

Taiwan's strengthening currency presents significant challenges, demanding a proactive and strategic response. While a strong TWD offers some consumer benefits, its impact on exports and foreign investment necessitates a comprehensive economic restructuring. By diversifying its economy, focusing on high-value-added industries, and strategically managing its currency, Taiwan can mitigate the negative effects of its strengthening currency and secure long-term economic prosperity. Understanding the complexities of Taiwan's strengthening currency and the pressures it creates is crucial for navigating this critical economic juncture. Businesses and policymakers must embrace innovative strategies to ensure Taiwan’s continued competitiveness and growth in the global market. Proactive management of Taiwan's strengthening currency is key to future success.

Featured Posts

-

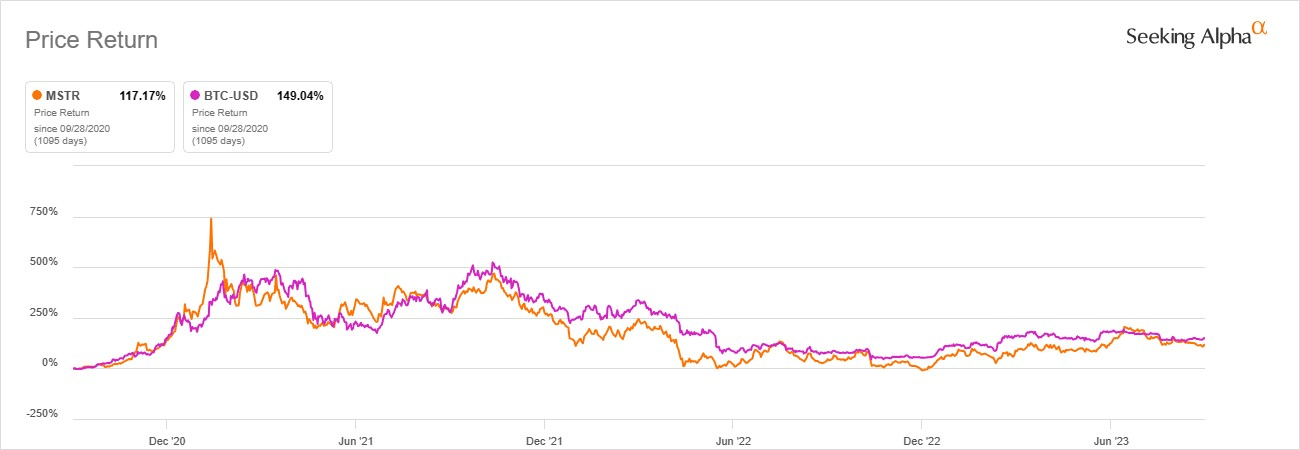

Micro Strategy Vs Bitcoin Investment A Comparative Outlook For 2025

May 08, 2025

Micro Strategy Vs Bitcoin Investment A Comparative Outlook For 2025

May 08, 2025 -

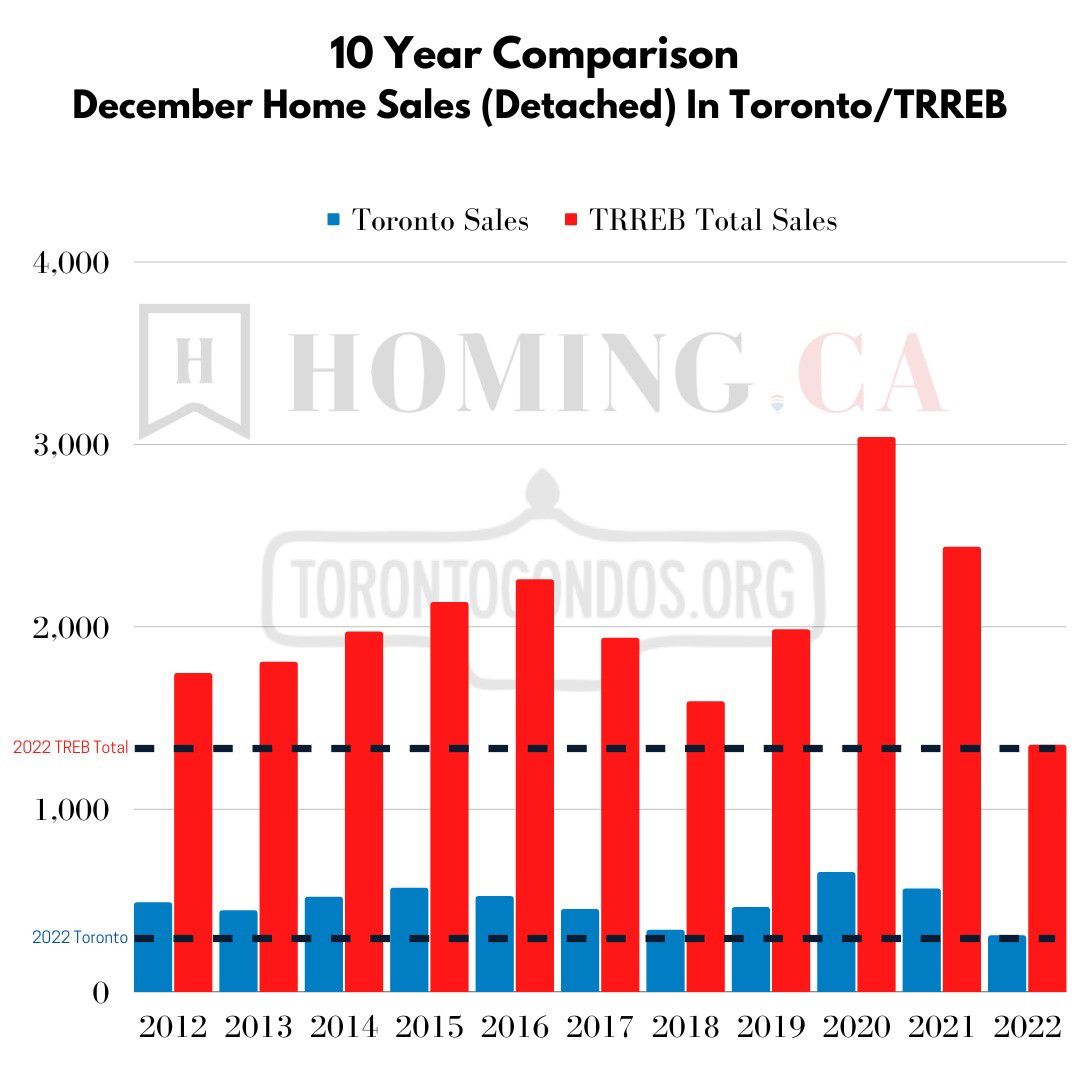

Toronto Home Sales And Prices A 23 And 4 Decrease Respectively

May 08, 2025

Toronto Home Sales And Prices A 23 And 4 Decrease Respectively

May 08, 2025 -

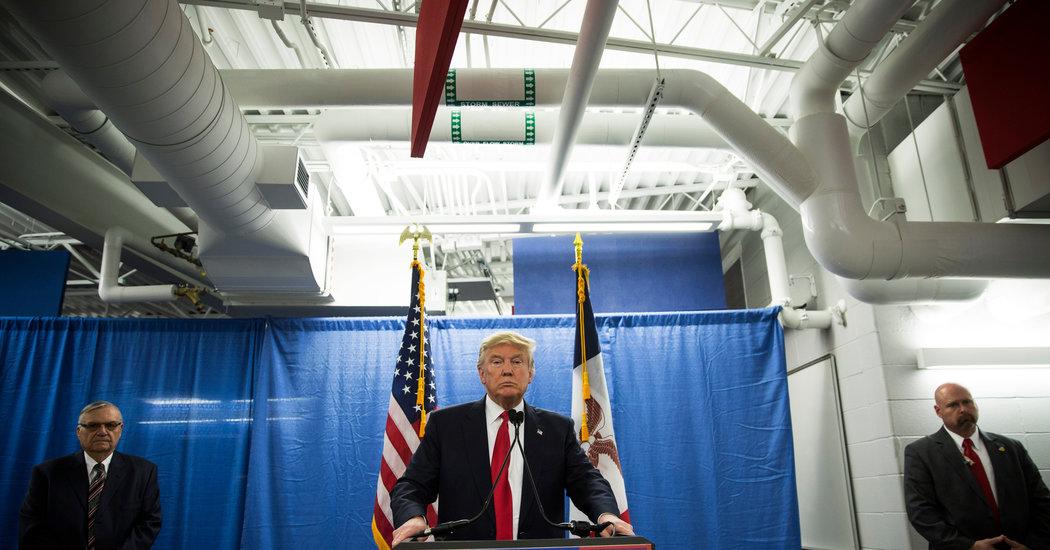

Carney Calls Trump Transformational In D C Meeting

May 08, 2025

Carney Calls Trump Transformational In D C Meeting

May 08, 2025 -

The Next Gen Leap Exploring The New Ps 5 Pro

May 08, 2025

The Next Gen Leap Exploring The New Ps 5 Pro

May 08, 2025 -

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025