Tariff War Concerns: Leading Philippine Banker Issues Grim Forecast

Table of Contents

Impact on Philippine Exports

The imposition of tariffs internationally has significant repercussions for Philippine exports, impacting key sectors like electronics and agricultural products. This negative impact on Philippine trade manifests in several ways:

Reduced Global Demand

The imposition of tariffs directly leads to reduced global demand for Philippine exports. This is because tariffs increase the price of Philippine goods in foreign markets, making them less competitive.

- Decreased export volumes: Philippine businesses may experience a significant drop in the quantity of goods exported.

- Lower prices for exported goods: To remain competitive, businesses may be forced to lower their prices, reducing profitability.

- Loss of market share: Competing nations offering similar products without the tariff burden will gain market share.

- Potential job losses: Reduced export orders can lead to job losses in export-oriented industries, impacting livelihoods across the country.

Increased Production Costs

Tariffs on imported raw materials and intermediate goods significantly increase production costs for Philippine businesses, eroding their competitiveness in the global market.

- Higher input costs for manufacturing: Businesses relying on imported components will face higher production costs.

- Increased prices for consumers: These increased costs are often passed on to consumers, leading to higher prices for goods and services.

- Reduced profit margins: Higher production costs directly impact profit margins, potentially threatening the viability of businesses.

- Potential for business closures or relocation: Some businesses might be forced to close down or relocate to countries with lower production costs.

Inflationary Pressures and Consumer Spending

The ripple effects of tariff wars extend directly to consumers, impacting their purchasing power and overall economic well-being.

Rising Prices of Goods

Tariffs on imported goods inevitably lead to higher prices for consumers in the Philippines. This is especially concerning for essential goods and services.

- Increased inflation rate: The cost of living increases, eroding purchasing power.

- Reduced purchasing power for consumers: Higher prices mean consumers can afford less, impacting their standard of living.

- Potential for social unrest: Significant price increases can lead to social unrest and dissatisfaction.

- Impact on low-income households disproportionately affected: The impact of rising prices is felt most acutely by low-income households.

Dampened Consumer Confidence

Uncertainty surrounding tariff wars significantly dampens consumer confidence, leading to reduced spending and investment.

- Decreased consumer spending: Uncertainty about the future leads to cautious spending habits.

- Lower economic growth: Reduced consumer spending translates to lower economic growth overall.

- Reduced investment in businesses: Businesses are less likely to invest when the economic outlook is uncertain.

- Negative impact on overall economic activity: A decline in consumer confidence has a cascading negative impact on the entire economy.

Investment and Economic Growth Slowdown

Tariff wars create an environment of uncertainty that discourages investment and slows economic growth.

Foreign Direct Investment (FDI) Decline

The uncertainty caused by tariff disputes discourages foreign direct investment (FDI), hindering economic development in the Philippines.

- Reduced FDI inflows into the Philippines: Investors are hesitant to commit capital in an uncertain economic climate.

- Slowdown in infrastructure development: Reduced FDI negatively impacts infrastructure projects crucial for economic growth.

- Limited job creation opportunities: Lower FDI translates to fewer job creation opportunities.

- Negative impact on long-term economic growth: Reduced FDI hinders the country's long-term economic potential.

Weakening Peso

The Philippine Peso may weaken against other major currencies, exacerbating inflationary pressures and impacting the economy negatively.

- Increased cost of imports: A weaker Peso makes imports more expensive, further fueling inflation.

- Reduced purchasing power: The weakening Peso reduces the purchasing power of the Philippine currency.

- Potential for capital flight: Investors may move their capital out of the country, leading to further economic instability.

- Negative impact on the overall economy: A weaker Peso has a detrimental effect on the overall health of the Philippine economy.

Conclusion

The grim forecast issued by the leading Philippine banker regarding tariff war concerns is a serious cause for alarm. The potential consequences—reduced exports, inflationary pressures, weakened investment, and slowed economic growth—highlight the urgent need for proactive measures to mitigate the negative impacts of these escalating trade disputes. Staying informed about the evolving situation and understanding the potential ramifications of these Tariff Impact Philippines is crucial for businesses and consumers alike. It is imperative to monitor the developments closely and prepare for the potential challenges ahead. Active engagement in advocating for responsible trade policies is crucial to safeguard the Philippine economy from the devastating effects of prolonged Philippine Tariff Wars. Understanding these Tariff War Concerns and their potential impact on the Philippines is essential for navigating this challenging economic landscape.

Featured Posts

-

How California Became The Worlds Fourth Largest Economy

Apr 26, 2025

How California Became The Worlds Fourth Largest Economy

Apr 26, 2025 -

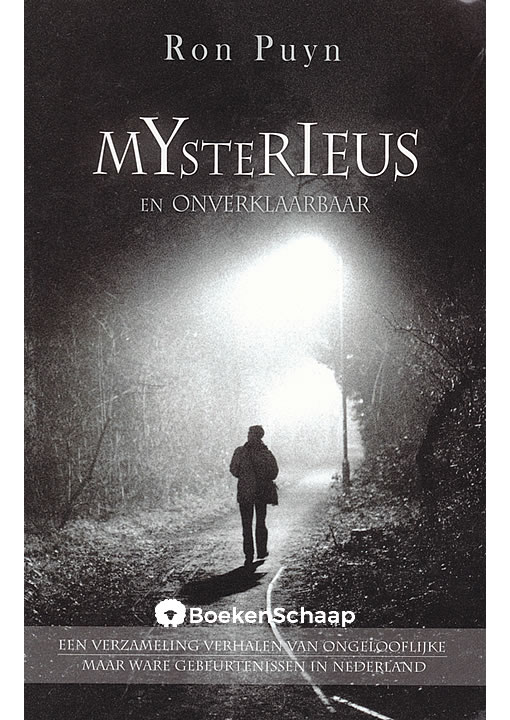

Een Nederlandse Broodje Paradox Zoet En Onverklaarbaar

Apr 26, 2025

Een Nederlandse Broodje Paradox Zoet En Onverklaarbaar

Apr 26, 2025 -

Secret Service Closes Investigation Into White House Cocaine Incident

Apr 26, 2025

Secret Service Closes Investigation Into White House Cocaine Incident

Apr 26, 2025 -

Mission Impossible The Final Reckoning Everything We Learned From The Full Trailer

Apr 26, 2025

Mission Impossible The Final Reckoning Everything We Learned From The Full Trailer

Apr 26, 2025 -

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025