Telus Reports Higher Q1 Profit And Dividend Hike

Table of Contents

Strong Q1 Financial Performance: Key Highlights

Telus' Q1 2024 financial performance exceeded expectations, demonstrating strong growth across various sectors. This success underscores the company's strategic initiatives and its ability to navigate the competitive telecommunications landscape.

Revenue Growth and Drivers

Telus reported a significant percentage increase in revenue compared to Q1 2023. This growth can be attributed to several key factors:

- Increased Subscriber Base: A substantial increase in subscribers across wireless, wireline, and internet services contributed significantly to revenue growth. This reflects the strong appeal of Telus' service offerings and successful marketing strategies.

- Higher Average Revenue Per User (ARPU): The company also saw a rise in ARPU, indicating customers are adopting higher-value plans and add-on services. This reflects the success of upselling and cross-selling initiatives.

- Strong Growth in Wireless and Internet Services: Both wireless and internet services experienced robust growth, driven by increased demand for high-speed data and connectivity solutions. The increasing adoption of 5G technology also plays a significant role.

The breakdown of revenue streams shows substantial contributions from each segment, demonstrating a diversified and resilient business model. This diversified revenue stream is crucial for long-term financial stability and growth.

Increased Profitability and Margins

The Q1 results showcase not only revenue growth but also enhanced profitability. Telus reported a notable increase in net income and operating income, driven by:

- Improved Operational Efficiency: Cost-cutting measures and streamlined operations contributed to improved margins. Telus' commitment to operational excellence is a key driver of profitability.

- Effective Cost Management: The company successfully managed costs while investing in growth areas, striking a balance between expenditure and returns.

- Strong EBITDA Growth: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) also saw significant growth, reflecting the underlying strength of the business.

These improvements in key profitability metrics point to a financially sound and well-managed company, setting the stage for continued success.

Investment in Infrastructure and Future Growth

Telus' continued investment in advanced network infrastructure is a key driver of future growth. The company's commitment to:

- 5G Network Expansion: Significant investments in expanding its 5G network will provide customers with enhanced speed and reliability, attracting new subscribers and supporting higher ARPU.

- Fiber Optic Network Deployment: Expansion of the fiber optic network will further enhance internet speeds and capacity, ensuring a competitive edge in the market.

- Strategic Partnerships and Acquisitions: Strategic collaborations and acquisitions will contribute to expanding service offerings and market reach.

These investments demonstrate Telus’ long-term vision for growth and its commitment to delivering superior services to its customers.

Dividend Increase: Benefits for Shareholders

The announcement of a dividend hike is a testament to Telus' confidence in its financial strength and future prospects.

Details of the Dividend Hike

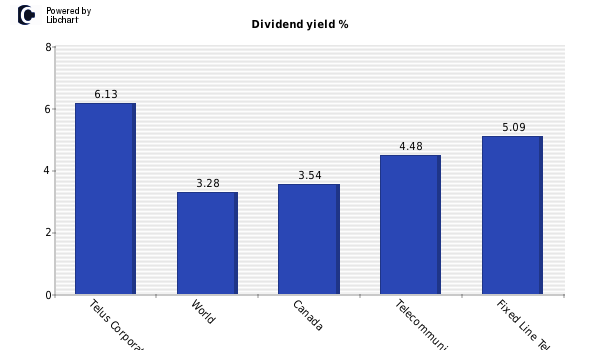

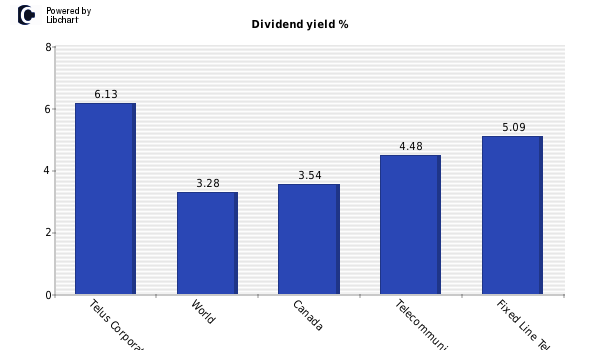

Telus announced a [Insert Percentage]% increase in its dividend, resulting in a new quarterly payout of [Insert Amount]. This translates to a [Insert Percentage]% dividend yield, making it an attractive investment opportunity for income-seeking investors. The increased dividend payout reflects the company's commitment to delivering shareholder value.

Impact on Share Price and Investor Sentiment

The market reacted positively to the news of the increased Q1 profit and dividend hike, with Telus' share price [Insert Market Reaction, e.g., experiencing a significant increase]. This positive investor sentiment reflects confidence in the company's future growth trajectory. Analysts have generally expressed optimistic views, forecasting further growth in the coming quarters. The increased dividend is likely to attract new investors and enhance the appeal of Telus stock.

Conclusion: Telus' Positive Outlook and Future Implications

Telus' Q1 2024 report paints a picture of robust financial health and strong growth prospects. The significant increase in profit, coupled with the attractive dividend hike, strongly positions Telus for continued success. The company's strategic investments in infrastructure and its commitment to delivering shareholder value highlight a positive outlook for the future. Learn more about Telus' strong performance and consider investing in this growing telecommunications leader. Explore Telus stock and Telus investment opportunities to capitalize on this exciting growth story. Stay updated on future Telus financial results for continued insights into this thriving company.

Featured Posts

-

Is Black Gold Within Reach Analyzing Uruguays Offshore Drilling Prospects

May 12, 2025

Is Black Gold Within Reach Analyzing Uruguays Offshore Drilling Prospects

May 12, 2025 -

Ranking Washington Dcs Power Elite The 500 Of 2025

May 12, 2025

Ranking Washington Dcs Power Elite The 500 Of 2025

May 12, 2025 -

Bellinger To Bat Behind Judge A Strategic Move For The Yankees

May 12, 2025

Bellinger To Bat Behind Judge A Strategic Move For The Yankees

May 12, 2025 -

Local Senior Trips Activities And Events Calendar

May 12, 2025

Local Senior Trips Activities And Events Calendar

May 12, 2025 -

Jessica Simpson Returns To The Stage After A 15 Year Absence

May 12, 2025

Jessica Simpson Returns To The Stage After A 15 Year Absence

May 12, 2025