Tesla And Tech Stocks Drive U.S. Market Surge

Table of Contents

Tesla's Impact on Market Sentiment

Tesla's recent performance has been a major catalyst for the overall market surge. The company's strong financial results and continued innovation are driving investor confidence and pushing up its stock price, influencing other tech stocks and the broader market.

Strong Q2 Earnings and Production Numbers

Tesla's Q2 2024 earnings significantly exceeded analyst expectations. The company reported a substantial increase in revenue and profits, driven by strong vehicle deliveries and robust demand for its electric vehicles (EVs).

- Revenue: Increased by X% compared to Q1 2024 and Y% compared to Q2 2023.

- Vehicle Deliveries: Exceeded Z units, surpassing analyst predictions and showcasing strong market demand for Tesla vehicles.

- EV Market Share: Tesla maintained a leading position in the global EV market, further solidifying its dominance.

- Analyst Reactions: Several prominent analysts upgraded their price targets for Tesla stock following the impressive earnings report, contributing to the positive market sentiment.

This strong performance fueled a significant surge in Tesla's stock price, impacting the broader market and boosting investor confidence in the EV sector and the tech industry as a whole.

Innovation and Future Outlook

Tesla's relentless innovation continues to drive its success and influence market sentiment. Advancements in battery technology, autonomous driving capabilities, and new vehicle models are shaping the future of mobility and attracting significant investor interest.

- Battery Technology: Tesla's advancements in battery technology are leading to increased range and reduced charging times for its EVs, driving consumer demand and attracting investment.

- Autonomous Driving: Tesla's ongoing development of its Full Self-Driving (FSD) system is a key differentiator in the EV market and is viewed positively by investors.

- New Vehicle Models: The introduction of new vehicle models, such as the Cybertruck and Roadster, is generating considerable excitement and anticipation among consumers and investors alike.

- AI Advancements: Tesla’s focus on artificial intelligence and machine learning across its operations is viewed as a significant long-term competitive advantage.

These innovations underpin the positive market outlook for Tesla and contribute to its significant influence on the broader tech sector.

Broad Tech Stock Performance

The recent market surge wasn't solely driven by Tesla. A broad-based rally in tech stocks contributed significantly to the overall positive market sentiment.

Positive Earnings Reports Across the Sector

Many major tech companies reported strong Q2 earnings, contributing to the overall market optimism. This positive performance reflected strong revenue growth, healthy profit margins, and positive future outlooks from these companies.

- Company X: Reported a Y% increase in revenue and a Z% increase in earnings per share.

- Company Y: Showcased strong growth in its cloud computing segment, driving overall revenue and profit growth.

- Company Z: Exceeded expectations in its advertising revenue, indicating continued strength in the digital advertising market.

This widespread positive performance across the tech sector reinforces investor confidence and further fueled the market surge.

Investor Sentiment and Market Confidence

The positive earnings reports from leading tech companies significantly boosted investor sentiment and market confidence. This renewed optimism translated into increased risk appetite and higher stock valuations across the sector.

- Nasdaq Composite: The Nasdaq Composite, a key indicator of the tech sector's performance, experienced a significant increase, reflecting the broad-based rally in tech stocks.

- Investor Behavior: Increased buying activity and reduced selling pressure contributed to the upward movement of tech stock prices.

- Market Optimism: Analysts attribute the positive market sentiment to a combination of strong earnings reports, easing inflation concerns, and positive expectations for future economic growth.

This positive feedback loop between strong earnings, investor sentiment, and market performance drove the overall market surge.

Economic Factors Contributing to the Surge

Macroeconomic factors also played a role in the recent market upswing. Easing inflation concerns and supportive government policies contributed to the positive market environment.

Easing Inflation Concerns

Easing inflation concerns are a major factor contributing to the market surge. As inflation shows signs of cooling down, investors become more confident in the future economic outlook.

- Inflation Rate: The recent decline in inflation rates has reduced concerns about aggressive interest rate hikes by central banks.

- Interest Rates: The expectation of a less hawkish monetary policy stance from central banks has positively impacted investor sentiment.

- Federal Reserve Policy: The Federal Reserve's actions and communication regarding monetary policy greatly influenced market expectations and investor behavior.

Reduced inflationary pressures led to a more positive market outlook, contributing to the overall market surge.

Government Policies and Regulations

Supportive government policies and regulations also play a significant role in fostering market growth, particularly in the tech and EV sectors.

- Infrastructure Investment: Government investments in infrastructure, particularly in areas supporting electric vehicle adoption and technology development, are seen positively by investors.

- Tax Policies: Tax incentives for investments in renewable energy and technology have encouraged capital investment and stimulated economic growth.

- Technology Regulation: While regulation in the technology sector is ongoing, a balanced approach could contribute to market confidence and stability.

These government initiatives contribute to a positive environment, further boosting investor confidence and contributing to market gains.

Conclusion

The recent surge in the U.S. market was significantly driven by the impressive performance of Tesla and other leading technology companies. Tesla's strong Q2 earnings, continued innovation, and market leadership in the EV sector were major catalysts. Furthermore, positive earnings reports across the broader tech sector, easing inflation concerns, and supportive government policies all contributed to the positive market sentiment. Understanding the interconnectedness of these factors is crucial for navigating the market effectively. To stay informed about the performance of Tesla and tech stocks and their impact on the broader market, actively track their financial reports, follow market analysis from reputable sources, and consider diversifying your investment portfolio to manage risk. Continue learning about investing in Tesla and tech stocks to make informed decisions.

Featured Posts

-

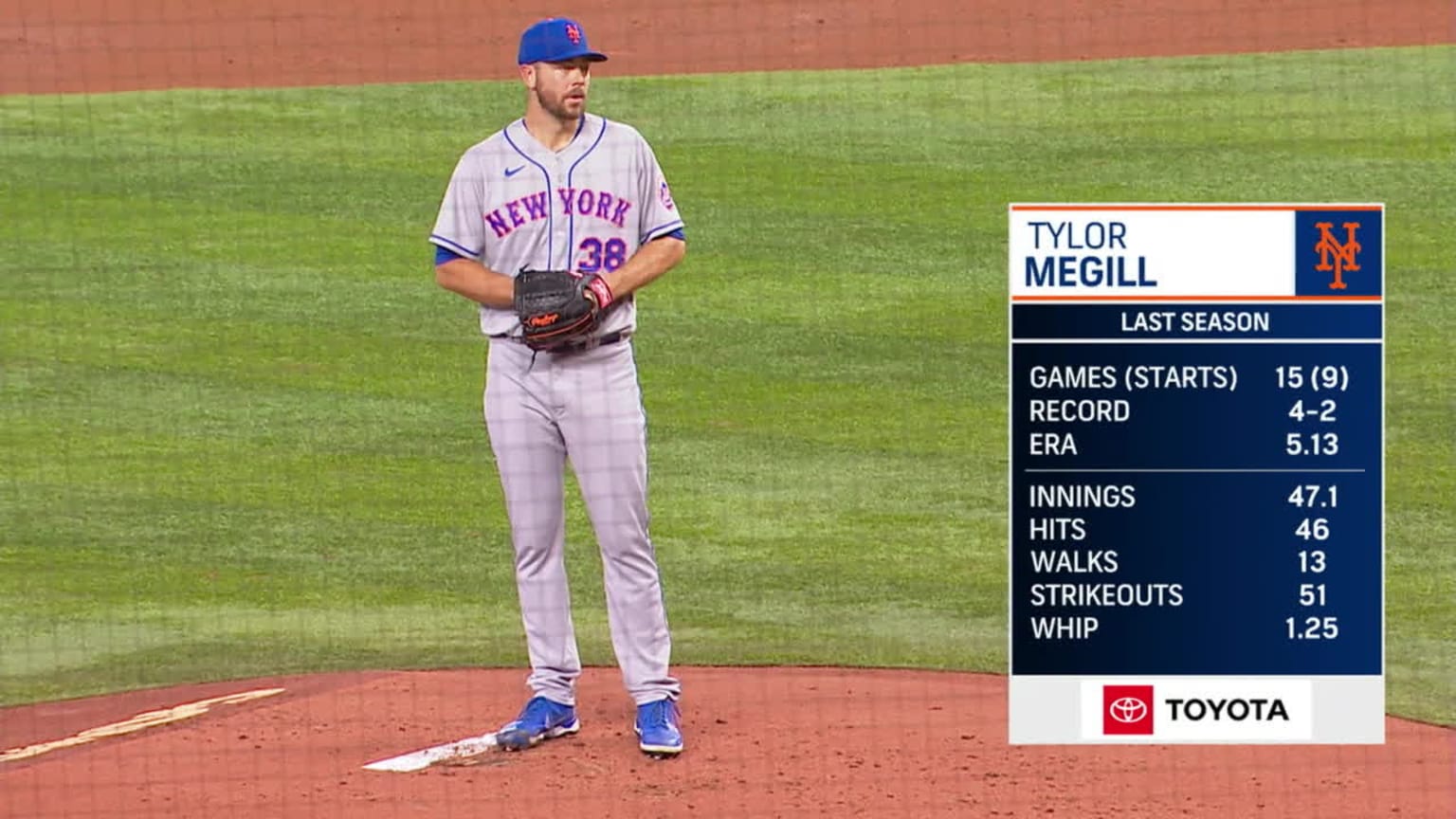

Mets Make Roster Adjustments Megill In Nez Out

Apr 28, 2025

Mets Make Roster Adjustments Megill In Nez Out

Apr 28, 2025 -

Espns Bold Prediction Red Sox 2025 Season Outlook

Apr 28, 2025

Espns Bold Prediction Red Sox 2025 Season Outlook

Apr 28, 2025 -

This Mets Rivals Pitcher Is On Fire

Apr 28, 2025

This Mets Rivals Pitcher Is On Fire

Apr 28, 2025 -

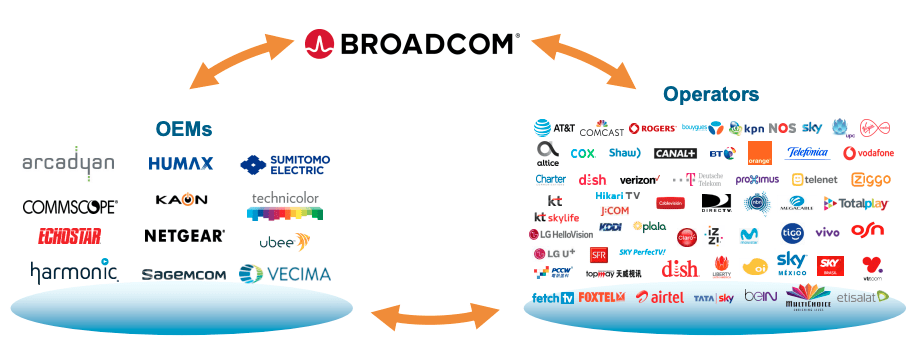

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025 -

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 28, 2025

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 28, 2025