Tesla Board Faces Pressure From State Treasurers Over Musk's Priorities

Table of Contents

State Treasurers' Concerns Regarding Tesla's Investments and Musk's Diversification

State treasurers, responsible for managing billions of dollars in public funds, are vocal critics of Musk's management style and its effect on Tesla's financial performance. Their concerns center on several key areas:

- Underperforming Financial Metrics: Several key performance indicators (KPIs) are under scrutiny. These include:

- Slowdown in Tesla's vehicle production and delivery growth compared to previous years.

- Increasing competition in the electric vehicle (EV) market eroding Tesla's market share.

- Margin compression due to increased raw material costs and price reductions.

- Over-allocation of Resources: State treasurers argue that Musk's significant time and resources dedicated to Twitter and SpaceX detract from Tesla's core business and strategic investments in research and development, hindering long-term growth.

- Impact on Tesla Stock Price and Investor Confidence: The volatility in Tesla's stock price, often linked to Musk's controversial actions and tweets, significantly impacts investor confidence and erodes shareholder value. This instability is a major concern for long-term investors.

- Potential Legal and Regulatory Scrutiny: Musk's actions have attracted increased regulatory scrutiny. The potential for legal challenges and regulatory fines further threatens Tesla's financial stability.

The Impact of Elon Musk's Leadership Style on Tesla's Corporate Governance

Elon Musk's unconventional leadership style presents a unique challenge to Tesla's corporate governance. The effectiveness of the Tesla board in overseeing Musk's activities is a primary area of concern:

- Effectiveness of Board Oversight: Questions remain about the board's ability to effectively monitor and constrain Musk's actions, particularly concerning resource allocation and strategic decision-making.

- Innovation vs. Risk Management: While Musk's leadership fosters innovation, the lack of robust risk management procedures and oversight has raised concerns about reckless decision-making and potential financial vulnerabilities.

- Transparency and Accountability: Critics argue for greater transparency and accountability in Tesla's decision-making processes, especially concerning the allocation of resources across Musk's various ventures.

- Potential Conflicts of Interest: The potential for conflicts of interest between Musk's personal investments and his responsibilities as Tesla's CEO requires careful examination and more stringent corporate governance mechanisms.

ESG Considerations and Tesla's Long-Term Sustainability

ESG factors are increasingly important for investors, and Musk's actions pose challenges to Tesla's standing in this area:

- Environmental Concerns: Critics highlight potential inconsistencies between Tesla's commitment to environmental sustainability and Musk's other ventures' environmental impact.

- Social Responsibility Initiatives: The effectiveness and scope of Tesla's social responsibility programs are subject to increased scrutiny.

- Governance Standards: Concerns persist about the strength of Tesla's corporate governance structure, especially in light of Musk's often unpredictable leadership.

- Long-Term Value and Reputation Management: The overall impact of Musk's priorities on Tesla's long-term value and reputation is a key concern for investors and stakeholders. A damaged reputation can significantly impact the company's future success.

Conclusion: The Pressure Mounts on Tesla's Board

The pressure on Tesla's board regarding Elon Musk's priorities is intensifying, driven by legitimate concerns about shareholder value, corporate governance, and ESG performance. State treasurers are leading the charge, highlighting the significant risks associated with Musk's diversification strategy and its impact on Tesla's long-term sustainability. The future of Tesla hinges on addressing these concerns effectively and implementing stronger corporate governance measures. The evolving situation demands continuous observation. Stay informed about the ongoing developments and the pressure on Tesla's board regarding Elon Musk’s priorities. Consider engaging with shareholder advocacy groups to learn more and participate in influencing the direction of this critical situation.

Featured Posts

-

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Purchase

Apr 23, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Purchase

Apr 23, 2025 -

Jangan Lewatkan Program Tv Spesial Ramadan 2025 Untuk Menemani Buka Dan Sahur

Apr 23, 2025

Jangan Lewatkan Program Tv Spesial Ramadan 2025 Untuk Menemani Buka Dan Sahur

Apr 23, 2025 -

Reecouter Good Morning Business Du Lundi 3 Mars

Apr 23, 2025

Reecouter Good Morning Business Du Lundi 3 Mars

Apr 23, 2025 -

E Bay And Section 230 A Ruling On Banned Chemical Listings

Apr 23, 2025

E Bay And Section 230 A Ruling On Banned Chemical Listings

Apr 23, 2025 -

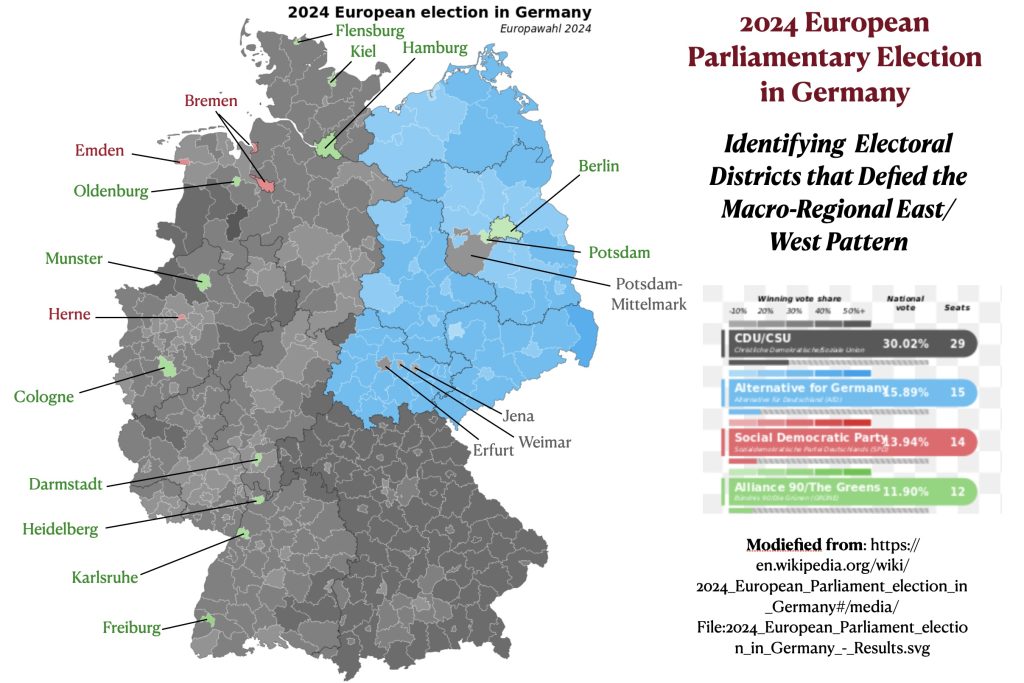

Elections Allemandes 2024 Guide Complet A J 6

Apr 23, 2025

Elections Allemandes 2024 Guide Complet A J 6

Apr 23, 2025