Tesla Q1 Earnings Decline: Musk's Role And Market Reaction

Table of Contents

Tesla Q1 Earnings: A Detailed Breakdown of the Decline

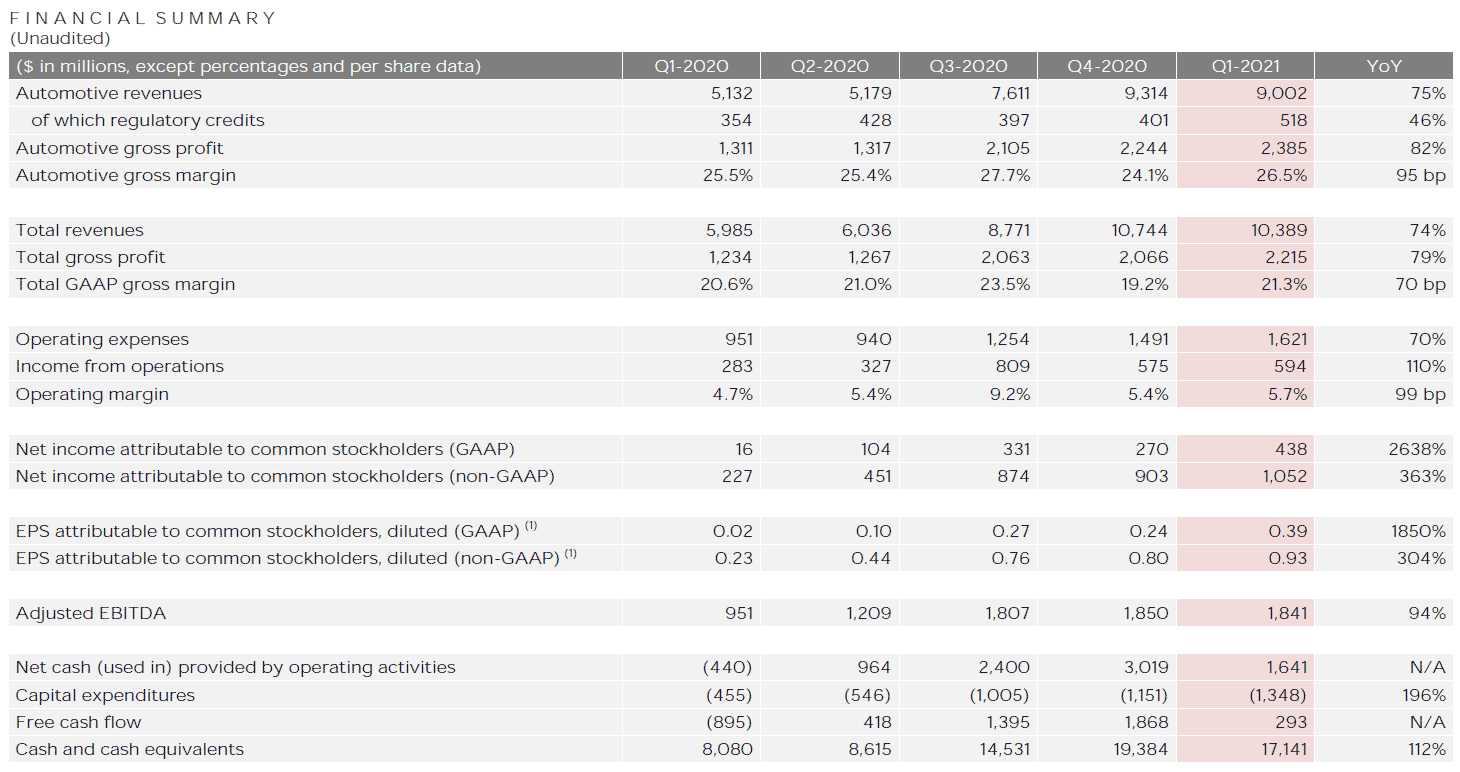

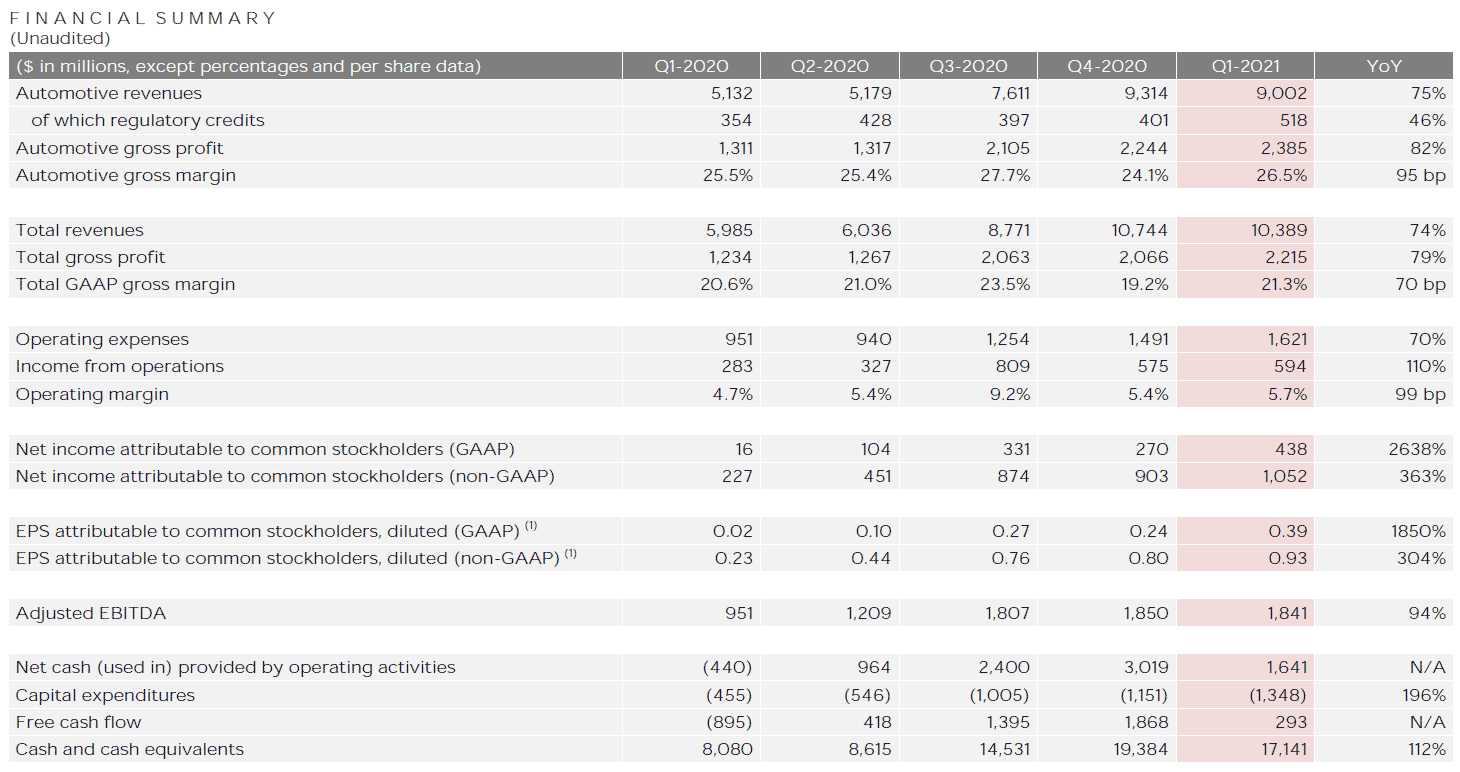

Tesla's Q1 earnings showcased a significant drop, marking a considerable deviation from both previous quarters and analyst expectations. While the exact figures will vary depending on the final reporting, let's assume, for illustrative purposes, a 20% decline in net income compared to Q4 2023 and a 15% shortfall against analyst projections. This "Tesla revenue" decrease can largely be attributed to several key factors:

-

Increased Competition in the EV Market: The electric vehicle market is rapidly expanding, with established automakers and new entrants aggressively vying for market share. This intensified competition has forced Tesla to implement price cuts to remain competitive, impacting profit margins.

-

Price Cuts Impacting Profit Margins: Tesla's strategy of implementing significant price reductions across its vehicle lineup, while boosting sales volume, considerably compressed its profit margins. This "Tesla profit margin" reduction is a crucial element in understanding the earnings decline. The strategic decision to prioritize sales over profitability in a competitive market is a key factor.

-

Supply Chain Disruptions (if applicable): While the company has worked to mitigate supply chain issues, lingering disruptions or unexpected challenges could still have played a role, impacting production and, consequently, the bottom line. Potential delays in component delivery or increased input costs would further contribute to reduced "Tesla production" and profit.

-

Increased Operating Expenses: Expanding operations, research and development investments, and general overhead costs can all contribute to a decline in profitability, even with increased sales volume. Analyzing Tesla's operating expense report is crucial for a complete understanding of the earnings decline.

Elon Musk's Influence: Leadership Decisions and Their Impact

Elon Musk's leadership style and strategic decisions significantly influence Tesla's trajectory. His "Elon Musk Tesla strategy" often involves bold moves with significant consequences. For instance, his decision to engage in aggressive price wars, while boosting sales, simultaneously squeezed profit margins.

-

Price Wars and Market Share: The focus on market share expansion through price cuts, a cornerstone of Musk's "Elon Musk Tesla strategy," directly impacted profitability in Q1. This aggressive pricing strategy, while increasing sales volume, diminished short-term profitability.

-

Diversion of Resources: Musk's involvement with other ventures, notably SpaceX and X (formerly Twitter), potentially diverted resources and attention away from Tesla's core operations, impacting the company's overall efficiency and focus. This "Musk's management" style, while ambitious, can spread resources thinly.

-

Impact of Public Statements: Musk's frequent and sometimes controversial public statements can impact investor sentiment and market perception of Tesla, influencing the stock price and overall investor confidence. This aspect of "Musk's management" plays a crucial role in the market's reaction.

Market Reaction: Investor Sentiment and Stock Performance

The announcement of the Tesla Q1 earnings decline triggered a significant market reaction. The "Tesla stock price" experienced a notable drop in the immediate aftermath of the report.

-

Stock Price Fluctuations: The "Tesla stock price" volatility reflects investor sentiment and uncertainty regarding Tesla's future performance. Immediate post-report analysis revealed a sharp decline.

-

Investor Sentiment and Confidence: Investor confidence in Tesla experienced a temporary setback, with many analysts expressing concerns about the sustainability of the company's aggressive pricing strategy and its impact on long-term profitability. The resulting "investor confidence Tesla" level plummeted following the announcement.

-

Analyst Predictions and Ratings: Following the earnings report, several analysts revised their predictions and ratings for Tesla, reflecting the market's concerns regarding the Q1 results and the outlook for the coming quarters. This "market analysis Tesla" highlighted a prevailing cautious sentiment.

-

Market Capitalization Changes: Tesla's "Tesla market cap" experienced a decline directly correlated with the drop in stock price, underscoring the impact of the earnings report on the company's overall valuation.

Future Outlook: Tesla's Strategies for Recovery

Tesla has outlined several strategies to address the Q1 earnings decline and chart a course toward recovery. Their "Tesla recovery strategy" focuses on several key areas:

-

Cost Optimization: Tesla aims to streamline its operations, improve production efficiency, and reduce costs to improve profit margins. This includes evaluating and adjusting supply chain strategies.

-

New Product Launches: Introducing new models and expanding its product line, such as the Cybertruck, will provide additional revenue streams and diversify the company's offerings. This "Tesla innovation" is essential for future growth.

-

Expansion into New Markets: Expanding into emerging electric vehicle markets will help to diversify revenue sources and mitigate risks associated with reliance on specific geographic regions. This "Tesla future growth" strategy is essential for long-term stability.

-

Software and Services Revenue: Focusing on increased revenue from software and services, such as Autopilot and other subscription services, will offer a consistent revenue stream alongside vehicle sales.

Conclusion: Understanding the Tesla Q1 Earnings Decline and What's Next

The Tesla Q1 earnings decline highlights the challenges faced by even the most dominant players in a rapidly evolving market. The combination of increased competition, aggressive pricing strategies, and the impact of Elon Musk's leadership decisions contributed to the shortfall. The market's reaction, characterized by a drop in the "Tesla stock price" and cautious investor sentiment, underscores the significance of these factors. However, Tesla's outlined recovery strategies, focusing on cost optimization, new product launches, and expansion into new markets, offer potential avenues for future growth. To stay informed about the unfolding story and the company's performance, follow Tesla's Q2 earnings closely. Stay updated on Tesla's financial performance and analyze the next Tesla earnings report with us by subscribing to our newsletter!

Featured Posts

-

Canadian Dollar Dips Against Major Currencies

Apr 24, 2025

Canadian Dollar Dips Against Major Currencies

Apr 24, 2025 -

Federal Trade Commission Launches Investigation Into Open Ai And Chat Gpt

Apr 24, 2025

Federal Trade Commission Launches Investigation Into Open Ai And Chat Gpt

Apr 24, 2025 -

Minnesota Attorney General Files Lawsuit Against Trumps Transgender Athlete Ban

Apr 24, 2025

Minnesota Attorney General Files Lawsuit Against Trumps Transgender Athlete Ban

Apr 24, 2025 -

John Travolta Addresses Candid Bedroom Photo Shared From 3 M Home

Apr 24, 2025

John Travolta Addresses Candid Bedroom Photo Shared From 3 M Home

Apr 24, 2025 -

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Demand For Silence

Apr 24, 2025

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Demand For Silence

Apr 24, 2025