Tesla Seeks To Block Shareholder Litigation After Musk's Compensation Dispute

Table of Contents

The Heart of the Dispute: Musk's Compensation Package

At the heart of the Tesla shareholder litigation lies Elon Musk's unprecedented compensation package, approved in 2018. This package grants him stock options potentially worth tens of billions of dollars, contingent upon Tesla achieving ambitious performance milestones. The sheer magnitude of the package, coupled with the perceived lack of transparency surrounding its structure, has sparked outrage among some shareholders.

Key elements fueling the Tesla shareholder litigation include:

- Stock options granted: The package includes billions of stock options, vesting based on reaching predetermined market capitalization and operational targets.

- Performance metrics tied to the options: These metrics, while ambitious, are arguably achievable given Tesla's rapid growth trajectory, leading to accusations of being easily manipulated.

- Allegations of insufficient board oversight: Critics argue that the Tesla board failed to adequately scrutinize the compensation package, potentially breaching their fiduciary duty to shareholders.

- Potential conflicts of interest: The close relationship between Musk and the board raises concerns about potential conflicts of interest, further fueling the shareholder lawsuit.

The Shareholder Lawsuit: Key Arguments and Claims

The shareholder lawsuit against Tesla centers on several key arguments, alleging that Musk's compensation package constitutes a breach of trust and a misuse of corporate resources. The legal basis for these claims rests on several pillars:

- Violation of fiduciary duty: Shareholders argue that the board failed to act in their best interests by approving such a lavish and potentially self-serving compensation package. This directly impacts the value of their investments.

- Waste of corporate assets: The sheer size of the compensation package is seen as a waste of corporate assets that could have been used for more beneficial purposes, such as research and development or paying down debt.

- Breach of contract: While not explicitly stated in all lawsuits, some arguments may suggest a breach of the implicit contract between the company and its shareholders regarding responsible corporate governance.

- Demand for board accountability: The lawsuit aims to hold the Tesla board accountable for their actions and to initiate reforms in corporate governance and executive compensation practices. This aspect is crucial to future Tesla shareholder litigation cases.

Tesla's Defense Strategy: Motion to Dismiss

Tesla's legal strategy focuses on a motion to dismiss the shareholder litigation. Their arguments seek to undermine the claims made by the plaintiffs, emphasizing the company's overall success under Musk's leadership. Key points in their defense include:

- Claims of insufficient evidence: Tesla argues that the plaintiffs have failed to provide sufficient evidence to support their claims of mismanagement and breach of fiduciary duty. They focus on demonstrating the merit of the compensation plan in driving Tesla's success.

- Arguments against shareholder standing: Tesla may argue that some shareholders lack the legal standing to bring forth this litigation, based on technicalities related to ownership and timing of investment.

- Defense of board's actions: Tesla defends the board's actions, claiming that the compensation package was carefully considered and aligned with Tesla's long-term strategic goals. They emphasize the independent expertise within the board.

- Emphasis on Tesla's overall success under Musk's leadership: A central element of Tesla's defense is highlighting the phenomenal growth and success of the company under Musk's leadership, indirectly suggesting the compensation package was justified by results.

Implications for Corporate Governance and Executive Compensation

The Tesla shareholder litigation has significant implications for corporate governance and executive compensation practices across various sectors. This case is setting a precedent and potentially influencing future regulations and practices.

- Increased scrutiny on executive pay packages: The lawsuit has heightened the scrutiny given to executive compensation packages, particularly in high-growth technology companies. Expect more detailed disclosures and justification for such large payouts.

- Potential changes in board oversight mechanisms: The case may prompt changes in board composition and oversight mechanisms, potentially leading to more independent directors and stricter review processes for executive compensation.

- Impact on shareholder activism: This legal battle is empowering shareholder activism, showing that significant challenges to executive compensation can be launched and potentially succeed.

- The role of regulatory bodies: Regulatory bodies may respond by revising corporate governance guidelines and possibly implementing stricter regulations regarding executive compensation, potentially stemming from insights gleaned from this case.

Potential Outcomes and Future Developments

The outcome of the Tesla shareholder litigation remains uncertain. Several possibilities exist:

- Settlement negotiations: Tesla and the shareholders may reach a settlement, potentially involving adjustments to the compensation package or other concessions.

- Court ruling on the motion to dismiss: The court may rule on Tesla's motion to dismiss, potentially dismissing the case entirely or allowing it to proceed to trial.

- Potential appeals process: Regardless of the initial court ruling, either party could appeal the decision, leading to a lengthy and complex appeals process.

- Long-term impact on Tesla's reputation and shareholder relations: The outcome of the lawsuit will significantly impact Tesla's reputation and its relationship with its shareholders, potentially affecting investor confidence and future stock performance.

Conclusion:

The Tesla shareholder litigation represents a pivotal moment in the ongoing debate surrounding executive compensation and corporate governance. Both sides present strong arguments; shareholders highlight alleged breaches of fiduciary duty and misuse of corporate assets, while Tesla emphasizes its exceptional growth under Musk’s leadership. The case's implications are far-reaching, potentially reshaping executive pay practices and board oversight across numerous industries. Stay informed about the developments in this crucial case of Tesla shareholder litigation. Further updates and analysis will be provided as the legal battle unfolds. Understanding the intricacies of this dispute is crucial for anyone interested in corporate governance, executive compensation, and the future of Tesla.

Featured Posts

-

Novak Djokovic In Zenginligi 186 Milyon Dolarlik Gelirin Sirri

May 18, 2025

Novak Djokovic In Zenginligi 186 Milyon Dolarlik Gelirin Sirri

May 18, 2025 -

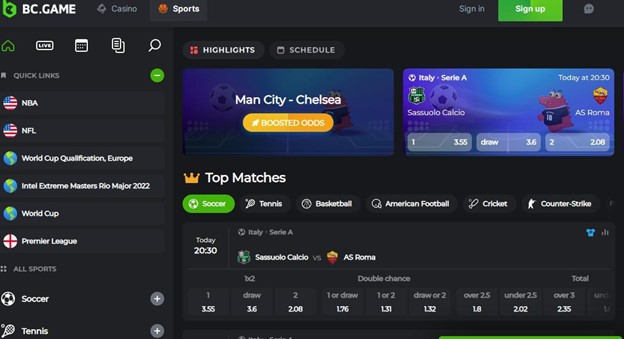

2025s Leading Bitcoin Casinos A Players Guide To Crypto Gambling

May 18, 2025

2025s Leading Bitcoin Casinos A Players Guide To Crypto Gambling

May 18, 2025 -

Las Vegas Casino Labor Expert Perspectives On Recent Events

May 18, 2025

Las Vegas Casino Labor Expert Perspectives On Recent Events

May 18, 2025 -

8 Casino Scenes That Defined Cinema History

May 18, 2025

8 Casino Scenes That Defined Cinema History

May 18, 2025 -

3 Dendam Israel Ke Paus Fransiskus Mengapa Mereka Boikot Pemakaman

May 18, 2025

3 Dendam Israel Ke Paus Fransiskus Mengapa Mereka Boikot Pemakaman

May 18, 2025