Tesla Stock And Elon Musk's Recent Outbursts

Table of Contents

Elon Musk's Recent Controversies and Their Market Impact

Elon Musk's recent controversies have repeatedly shaken investor confidence and sent Tesla's stock price on a rollercoaster ride. The impact of his actions is undeniable, highlighting the significant correlation between Musk’s behavior and Tesla's market capitalization.

-

Specific Examples: Musk's tumultuous acquisition of Twitter, coupled with subsequent organizational changes and controversial policy decisions, triggered significant stock price fluctuations. Similarly, his pronouncements on various political issues and even seemingly off-hand product announcements on social media have repeatedly influenced market sentiment. For instance, his tweets regarding potential production numbers or technology breakthroughs often lead to immediate and sometimes dramatic shifts in Tesla's share price.

-

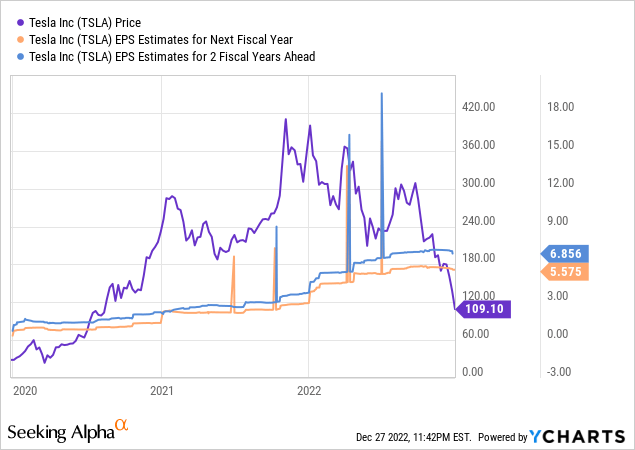

Market Reaction Data: Analyzing Tesla's stock price charts in relation to these events reveals a clear pattern. Often, positive announcements lead to short-term gains, while controversial statements or actions lead to sharp drops. While pinpointing the exact causal relationship is complex, the correlation is undeniable. (Insert relevant chart or graph illustrating Tesla stock price fluctuations correlating with specific Musk events). This illustrates the powerful influence of media coverage as well; news outlets widely report on Musk’s actions, amplifying their effect on investor perception.

The Correlation Between Musk's Behavior and Tesla Stock Performance

The historical correlation between Elon Musk's behavior and Tesla's stock performance is strong, albeit complex. It's not just about the news itself; it's about the underlying sentiment it creates.

-

Discernible Patterns: While not perfectly predictable, there's a clear trend. Periods of relative calm in Musk's public appearances and pronouncements often correspond to periods of relative stability in Tesla's stock price. Conversely, periods of high-profile controversies invariably result in increased volatility.

-

Psychological Factors: Investor confidence is significantly influenced by perception of risk and leadership. Musk's actions, even if unrelated to Tesla's core business, affect investor sentiment. This is a psychological factor that can't be ignored. Positive news builds confidence, while controversial actions introduce uncertainty.

-

Risk Factors: Investing in Tesla stock inherently carries increased risk due to this volatility. The unpredictable nature of Musk's actions introduces a significant element of uncertainty, making it a more speculative investment than many others.

-

Expert Opinions: Numerous financial analysts have commented on this correlation, highlighting the need for investors to carefully consider the potential impact of Musk's behavior before investing in Tesla stock.

Impact on Long-Term Investors

The unpredictability inherent in Musk's public persona presents unique challenges for long-term investors.

-

Long-Term Implications: While Tesla's long-term prospects in the electric vehicle market remain strong, the short-term volatility driven by Musk's actions can significantly impact returns.

-

Growth Potential: Despite the risks, Tesla’s innovative technology and strong market position point towards substantial long-term growth potential. However, this potential is tempered by the significant uncertainty introduced by Musk’s behavior.

-

Risk Mitigation: Long-term investors can mitigate some risk through diversification, dollar-cost averaging, and a high tolerance for volatility. However, understanding and accepting this volatility is paramount.

Analyzing the Future of Tesla Stock

Predicting the future of Tesla stock is inherently difficult, but a balanced perspective is crucial.

-

Positive Factors: Tesla's technological advancements, expanding market share in the EV sector, and ambitious expansion plans remain significant positive factors.

-

Negative Factors: Increased competition from established automakers and emerging EV startups presents a challenge. Supply chain disruptions and macroeconomic factors also pose risks. The continued impact of Elon Musk’s actions on investor sentiment must also be considered a crucial negative factor.

-

Competition Analysis: The EV market is rapidly evolving, with numerous competitors entering the field. Tesla's ability to maintain its competitive edge will significantly influence its future stock performance.

-

Future Events: Unexpected events – whether positive (new product launches, technological breakthroughs) or negative (regulatory hurdles, production issues) – could significantly impact Tesla's stock price.

Conclusion

Elon Musk's recent outbursts have undeniably influenced Tesla stock volatility. The correlation between his actions and market reactions is clear, presenting both opportunities and substantial risks for investors. While Tesla's long-term potential in the electric vehicle market remains significant, the unpredictable nature of Musk's behavior adds a layer of complexity that requires careful consideration. Before making any investment decisions regarding Tesla stock, conduct thorough research, consult with financial advisors, and closely monitor both Tesla's business performance and Elon Musk's public actions. Investing in Tesla stock carries significant risk due to the inherent volatility connected to both Elon Musk’s behavior and the dynamics of the rapidly evolving electric vehicle market. Remember to carefully assess your risk tolerance before investing in Tesla stock.

Featured Posts

-

Soaring Us China Trade Impact Of The Approaching Trade Truce

May 25, 2025

Soaring Us China Trade Impact Of The Approaching Trade Truce

May 25, 2025 -

No Tariff Mention In G7 Finance Ministers Concluding Statement

May 25, 2025

No Tariff Mention In G7 Finance Ministers Concluding Statement

May 25, 2025 -

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025 -

La Primera Comunion De Los Gemelos De Alberto De Monaco

May 25, 2025

La Primera Comunion De Los Gemelos De Alberto De Monaco

May 25, 2025 -

Alterya Joins Chainalysis Boosting Blockchain Security With Artificial Intelligence

May 25, 2025

Alterya Joins Chainalysis Boosting Blockchain Security With Artificial Intelligence

May 25, 2025