Tesla's Legal Maneuvers: Defending Against Shareholder Lawsuits Post-Musk Compensation

Table of Contents

The Nature of the Shareholder Lawsuits Against Tesla

Shareholder lawsuits against Tesla predominantly center around allegations of mismanagement and breaches of fiduciary duty concerning Elon Musk's compensation package. Shareholders argue that the board of directors acted improperly in approving such a generous package, potentially at the expense of other stakeholders. These lawsuits filed in various jurisdictions, frequently in the Delaware Chancery Court, given Tesla's incorporation there, allege several key issues:

- Breach of fiduciary duty by the board: Shareholders claim the board failed its duty of care and loyalty by approving a compensation plan deemed excessive and not aligned with shareholder interests.

- Misleading disclosures to shareholders concerning the compensation plan: Lawsuits allege that the disclosures surrounding the compensation package were inadequate or misleading, failing to fully inform shareholders of the potential risks and costs.

- Unfair enrichment of Musk at the expense of shareholders: A core argument is that Musk's compensation significantly dilutes the value of existing shares and unfairly benefits him at the expense of shareholders.

- Violation of securities laws: Some lawsuits allege that Tesla violated federal securities laws by failing to adequately disclose the true nature and potential impact of the compensation plan on shareholders.

The sheer number and complexity of these lawsuits underscore the significant legal challenges Tesla faces in defending its actions regarding Musk's compensation.

Tesla's Defense Strategies

Tesla's legal team, aided by prominent external counsel, employs several strategies to defend against these shareholder lawsuits. Their arguments focus on demonstrating the fairness and legality of the compensation plan and emphasizing Musk's crucial role in Tesla's success. Key elements of their defense include:

- Arguments that the compensation package was properly disclosed and approved: Tesla's defense emphasizes that the compensation plan was thoroughly vetted and approved through proper corporate governance processes, including shareholder votes.

- Evidence of Musk's significant contributions to Tesla's success: Tesla highlights Musk's undeniable contributions to the company's growth and market dominance, arguing that his compensation reflects his exceptional value.

- Emphasis on independent board oversight and shareholder approval processes: The defense points to the involvement of independent board members and shareholder votes as evidence of due diligence and transparency.

- Motions to dismiss or counter-arguments: Tesla has filed various motions to dismiss lawsuits, arguing that the plaintiffs lack standing or haven't presented sufficient evidence to support their claims.

The effectiveness of these defense strategies remains to be seen, and the legal battles are likely to be protracted and complex.

The Role of SEC Scrutiny

The SEC's scrutiny of Tesla's compensation practices adds another layer of complexity to the situation. Any findings by the SEC could significantly impact the shareholder lawsuits. If the SEC determines that Tesla's disclosures were inadequate or misleading, it could bolster the claims made in the shareholder lawsuits. Conversely, a clean bill of health from the SEC could strengthen Tesla's defense. The SEC involvement compels Tesla to carefully manage its legal strategy, considering potential ramifications for both the ongoing lawsuits and future regulatory compliance. The SEC's investigation casts a long shadow over Tesla's legal maneuvers, influencing both the defense strategy and the ultimate outcome.

Potential Outcomes and Implications

The potential outcomes of the shareholder lawsuits against Tesla range from settlements to dismissals to a full trial. Regardless of the outcome, the lawsuits have significant implications for Tesla:

- Financial implications: Settlements or judgments against Tesla could result in substantial financial losses.

- Reputational implications: The negative publicity surrounding these lawsuits could damage Tesla's reputation and brand image.

- Impact on Tesla's stock price and investor confidence: The ongoing legal battles create uncertainty, potentially affecting Tesla's stock price and investor confidence.

- Broader implications for corporate governance and executive compensation: The case sets a significant precedent for future discussions and regulations surrounding executive compensation and corporate governance, particularly concerning the compensation of highly influential CEOs in technology companies.

The final resolution of these lawsuits will significantly shape the landscape of corporate governance and executive compensation for years to come.

Conclusion: Navigating the Complex Landscape of Tesla's Legal Maneuvers

Tesla's legal battles surrounding Elon Musk's compensation package represent a significant challenge to the company. The shareholder lawsuits, coupled with SEC scrutiny, require sophisticated legal maneuvers and strategic defenses. The outcomes will significantly impact Tesla's financial health, reputation, and stock price, and will likely influence future discussions around executive compensation and corporate governance. Keep up-to-date on the ongoing developments in Tesla's legal maneuvers and shareholder lawsuits by following our blog for future analysis of this evolving situation. Understanding the intricacies of these legal battles is crucial for anyone interested in Tesla's future and the broader implications for corporate governance.

Featured Posts

-

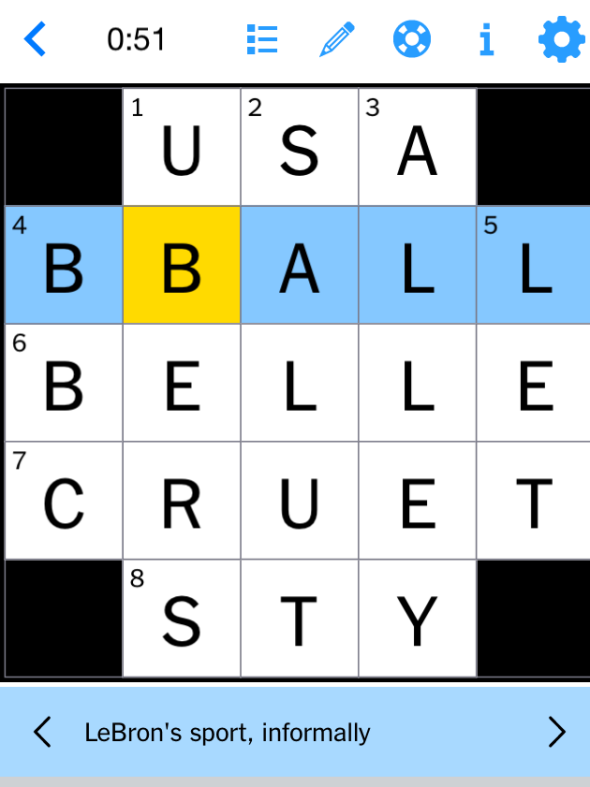

Nyt Mini Crossword February 26 2025 Solutions And Clues

May 18, 2025

Nyt Mini Crossword February 26 2025 Solutions And Clues

May 18, 2025 -

Krisis Ham Palestina Seruan Pbb Untuk Akuntabilitas Israel Dan Hamas

May 18, 2025

Krisis Ham Palestina Seruan Pbb Untuk Akuntabilitas Israel Dan Hamas

May 18, 2025 -

Best No Deposit Bonus Codes April 2025 Offers

May 18, 2025

Best No Deposit Bonus Codes April 2025 Offers

May 18, 2025 -

Mlb History Made Riley Greenes Two Ninth Inning Home Runs

May 18, 2025

Mlb History Made Riley Greenes Two Ninth Inning Home Runs

May 18, 2025 -

Your Path To Fortune A Step By Step Guide To Fortune Coins

May 18, 2025

Your Path To Fortune A Step By Step Guide To Fortune Coins

May 18, 2025