Tesla's Q1 Financial Results: The Musk Factor And Its Consequences

Table of Contents

- Q1 Financial Performance: A Deep Dive

- Revenue and Growth:

- Profitability and Margins:

- Cash Flow and Liquidity:

- The Musk Factor: Influence and Consequences

- Musk's Leadership and its Impact on Investor Sentiment:

- Impact of External Factors on Tesla (related to Musk):

- The Long-Term Outlook under Musk's Leadership:

- Competition and Market Dynamics

- Analysis of Key Competitors:

- Market Share and Future Trends:

- Conclusion:

Tesla's Q1 2024 financial results are in, and the numbers tell a complex story. Beyond the headline figures, lies the undeniable "Musk factor"—Elon Musk's influence, both positive and negative, on the company's performance and market perception. This analysis delves into the key aspects of Tesla's Q1, examining the interplay between its financial achievements and the impact of Musk's leadership.

Q1 Financial Performance: A Deep Dive

Revenue and Growth:

Tesla's Q1 revenue demonstrated significant year-on-year growth, although the quarter-on-quarter increase was more moderate. Let's break down the sales figures:

- Model 3: Revenue increased by X% year-on-year, driven by strong demand in key markets. However, this represents a Y% decrease compared to Q4 2023, potentially influenced by seasonal factors.

- Model Y: This remains Tesla's best-selling vehicle, contributing Z% to overall revenue, with a year-on-year growth of A%.

- Model S & Model X: These luxury models saw a B% increase in revenue year-on-year, reflecting a successful refresh and increased production capacity.

Several factors impacted revenue: aggressive price adjustments aimed at boosting sales, increased production output following supply chain improvements, and fluctuating market demand influenced by economic conditions and competition. While exceeding analyst predictions in some areas, Tesla missed targets for overall revenue growth, primarily due to the impact of semiconductor shortages which briefly slowed production of the Model Y.

Profitability and Margins:

Tesla's Q1 profitability showed mixed results. While the company reported a significant net profit, gross margins experienced a slight dip compared to the previous quarter.

- Net Profit: Tesla reported a net profit of $X billion, representing a Y% increase year-on-year.

- Gross Margin: Gross margin decreased to Z%, down from A% in Q4 2023, primarily due to increased raw material costs and price reductions implemented to stimulate demand.

- Operating Margin: Operating margin remained strong at B%, reflecting Tesla's continued efforts to optimize its manufacturing processes and reduce operational expenses.

Cost-cutting measures implemented across various departments helped to mitigate the impact of rising input costs. However, the pressure on margins highlights the ongoing challenge of balancing profitability with maintaining competitive pricing in a rapidly evolving electric vehicle market.

Cash Flow and Liquidity:

Tesla's Q1 cash flow showcased its robust financial health.

- Free Cash Flow: Tesla generated a significant free cash flow of $X billion, demonstrating strong operational efficiency.

- Debt Levels: The company maintained a healthy debt-to-equity ratio, indicating a low level of financial risk.

- Capital Expenditure: Tesla continues to invest heavily in expanding its production capacity and developing new technologies, with capital expenditure reaching $Y billion in Q1.

The healthy cash flow position provides Tesla with ample resources for future investments, including further expansion of its Gigafactories, research and development into new technologies (like battery innovation and autonomous driving), and potential acquisitions of smaller companies to bolster its technological capabilities.

The Musk Factor: Influence and Consequences

Musk's Leadership and its Impact on Investor Sentiment:

Elon Musk's actions, including his frequent tweets and involvement in other ventures (like X), significantly influence investor sentiment towards Tesla.

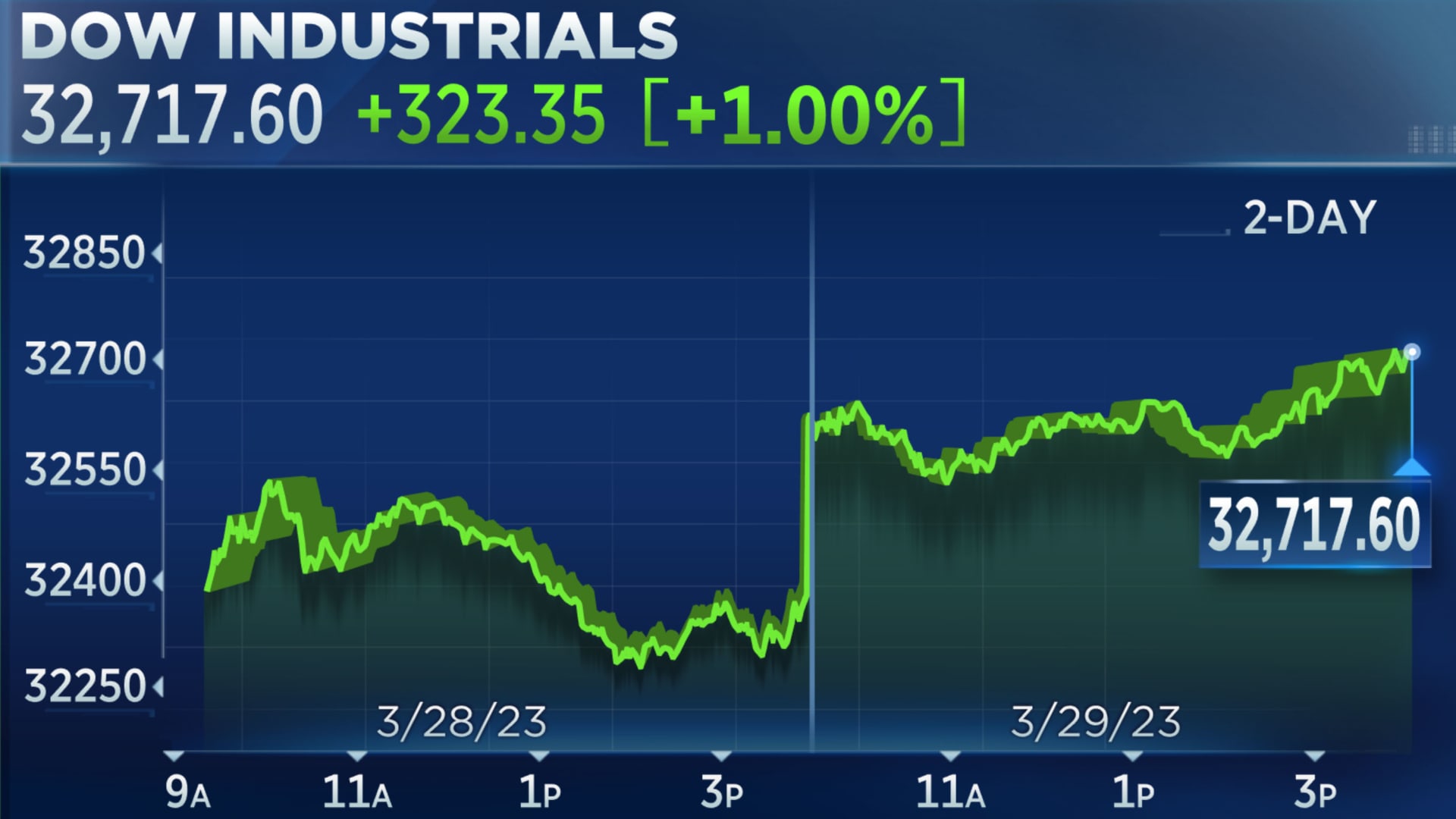

- Twitter Acquisition Impact: The acquisition of Twitter (now X) and subsequent controversies generated significant volatility in Tesla's stock price.

- Market Reactions: Positive news related to Tesla's product development or technological advancements often leads to stock price increases, while negative news or controversial tweets from Musk can trigger substantial declines.

The unpredictable nature of Musk's leadership style presents both a risk and an opportunity. While his vision and innovation drive excitement, the inherent volatility creates uncertainty for investors.

Impact of External Factors on Tesla (related to Musk):

External factors intertwined with Musk's public profile heavily impact Tesla's performance.

- Regulatory Scrutiny: Tesla faces increasing regulatory scrutiny globally, concerning its Autopilot system and its overall safety and environmental impact. This scrutiny can affect investor confidence.

- Competition: The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants vying for market share. Musk's public pronouncements often influence the competitive landscape, sometimes creating friction.

- Geopolitical Events: Global events such as supply chain disruptions, geopolitical tensions, and resource scarcity impact Tesla’s operations and market positioning.

These external challenges are exacerbated by the attention Musk’s public persona attracts. Any negative publicity, regardless of its direct link to Tesla's operations, can affect the company's image and investor confidence.

The Long-Term Outlook under Musk's Leadership:

Tesla's long-term prospects depend significantly on Musk's vision and the successful execution of his ambitious plans.

- Future Product Plans: Tesla's development of new vehicles, including potential entry into more affordable market segments, is vital for sustained growth.

- Expansion Strategies: The expansion of its Gigafactories globally is crucial for meeting rising demand and reducing production costs.

- Technological Advancements: Continued innovation in battery technology, autonomous driving, and other areas will define Tesla's future competitiveness.

While Musk's vision offers enormous potential, the risks associated with his leadership style and the unpredictable nature of external factors pose considerable challenges for long-term sustainability.

Competition and Market Dynamics

Analysis of Key Competitors:

Tesla faces stiff competition from established automakers and rising EV startups.

- BYD: BYD is a major competitor, particularly in the Chinese market, with a wide range of EV models and strong sales figures.

- Rivian: Rivian is a notable competitor in the electric truck and SUV segments, offering compelling alternatives to Tesla's offerings.

- Other Competitors: Many other established automakers (Volkswagen, Ford, GM, etc.) are rapidly expanding their EV portfolios, intensifying the competition.

Analyzing the performance of these competitors against Tesla's Q1 results provides crucial context and insight into Tesla’s market position.

Market Share and Future Trends:

Tesla maintains a significant market share in the global EV market, but this is expected to decrease slightly in the coming years due to increased competition.

- Tesla's Current Market Share: While still a leader, its market share is expected to decline slightly in the coming years as other automakers expand their EV offerings.

- Future Market Trends: Government regulations promoting EV adoption, advancements in battery technology (solid-state batteries), and the widespread development of charging infrastructure will fundamentally shape the EV market's future.

These trends will determine Tesla's long-term competitive advantage. Maintaining innovation and adapting to evolving market dynamics will be paramount for sustaining its leading position.

Conclusion:

Tesla's Q1 2024 financial results present a multifaceted picture, profoundly influenced by the "Musk factor." While the company exhibited strong revenue and growth in certain segments, challenges persist, particularly regarding investor sentiment and the effects of Elon Musk’s leadership style. Understanding the intricate interplay between Tesla’s financial performance and external factors is crucial for evaluating its future trajectory. To stay abreast of the latest developments and future implications, stay informed about Tesla's upcoming financial reports and continued analysis of the impact of Elon Musk’s decisions on Tesla's performance. Closely monitoring future Tesla financial reports will be key to understanding the ongoing evolution of this impactful company in the electric vehicle market.

Live Stock Market Updates Dow Jones And S And P 500 April 23

Live Stock Market Updates Dow Jones And S And P 500 April 23

Understanding Indias Market Momentum Factors Boosting The Nifty

Understanding Indias Market Momentum Factors Boosting The Nifty

Herro Edges Hield In Thrilling Nba 3 Point Contest

Herro Edges Hield In Thrilling Nba 3 Point Contest

Is The 77 Inch Lg C3 Oled Tv Worth It My Comprehensive Review

Is The 77 Inch Lg C3 Oled Tv Worth It My Comprehensive Review

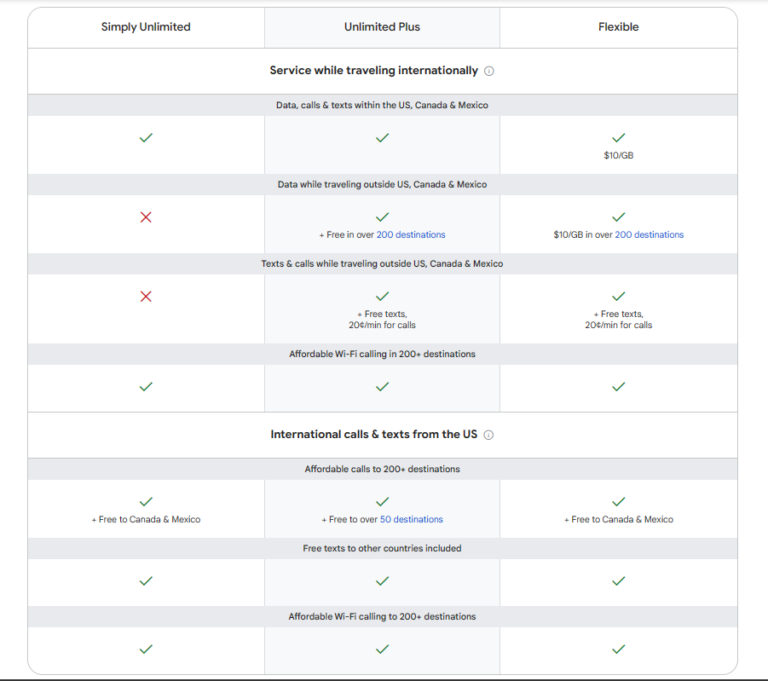

Google Fi Launches Affordable 35 Unlimited Data Plan

Google Fi Launches Affordable 35 Unlimited Data Plan