Thailand Inflation Dip: More Rate Cuts On The Horizon?

Table of Contents

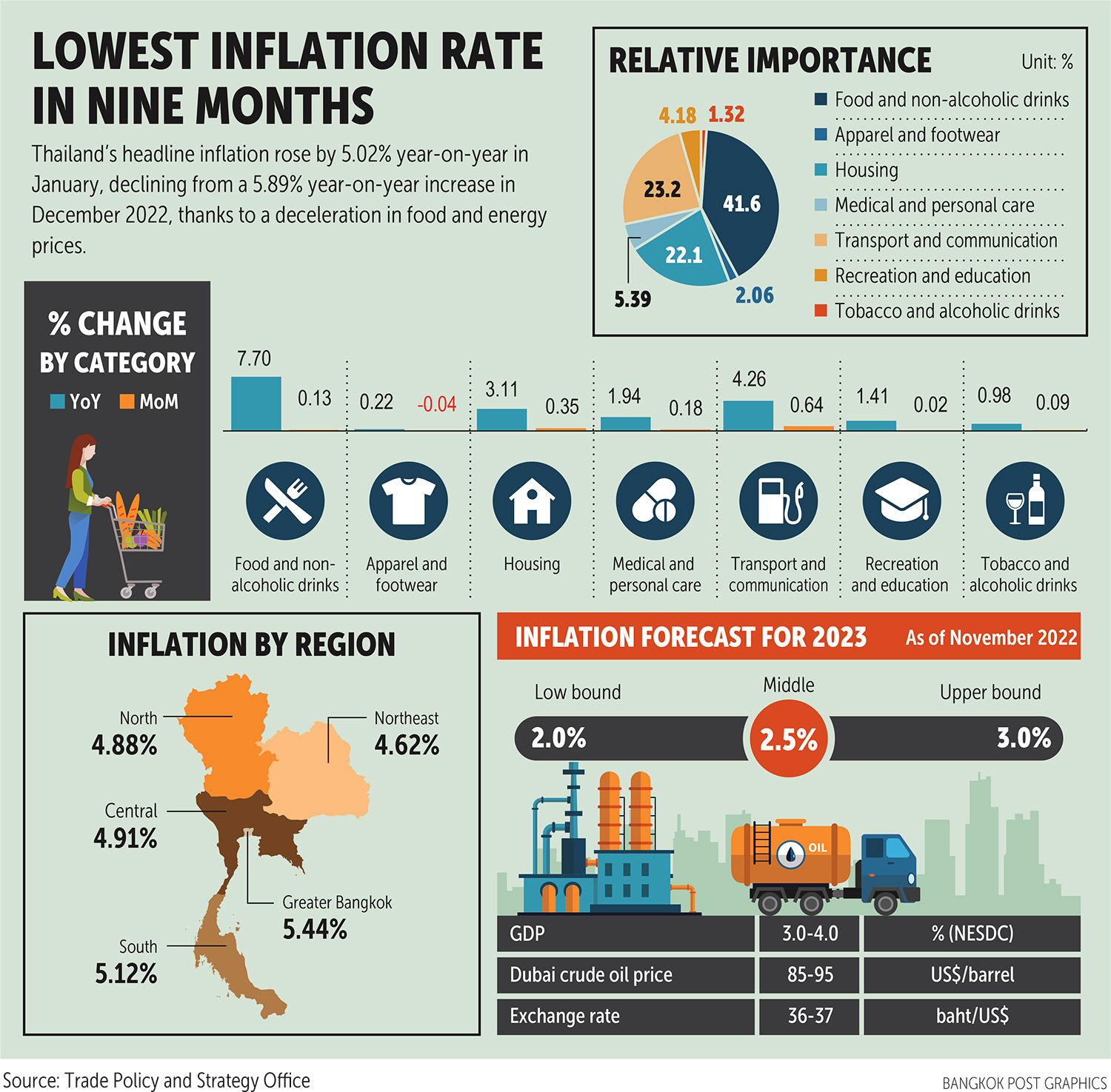

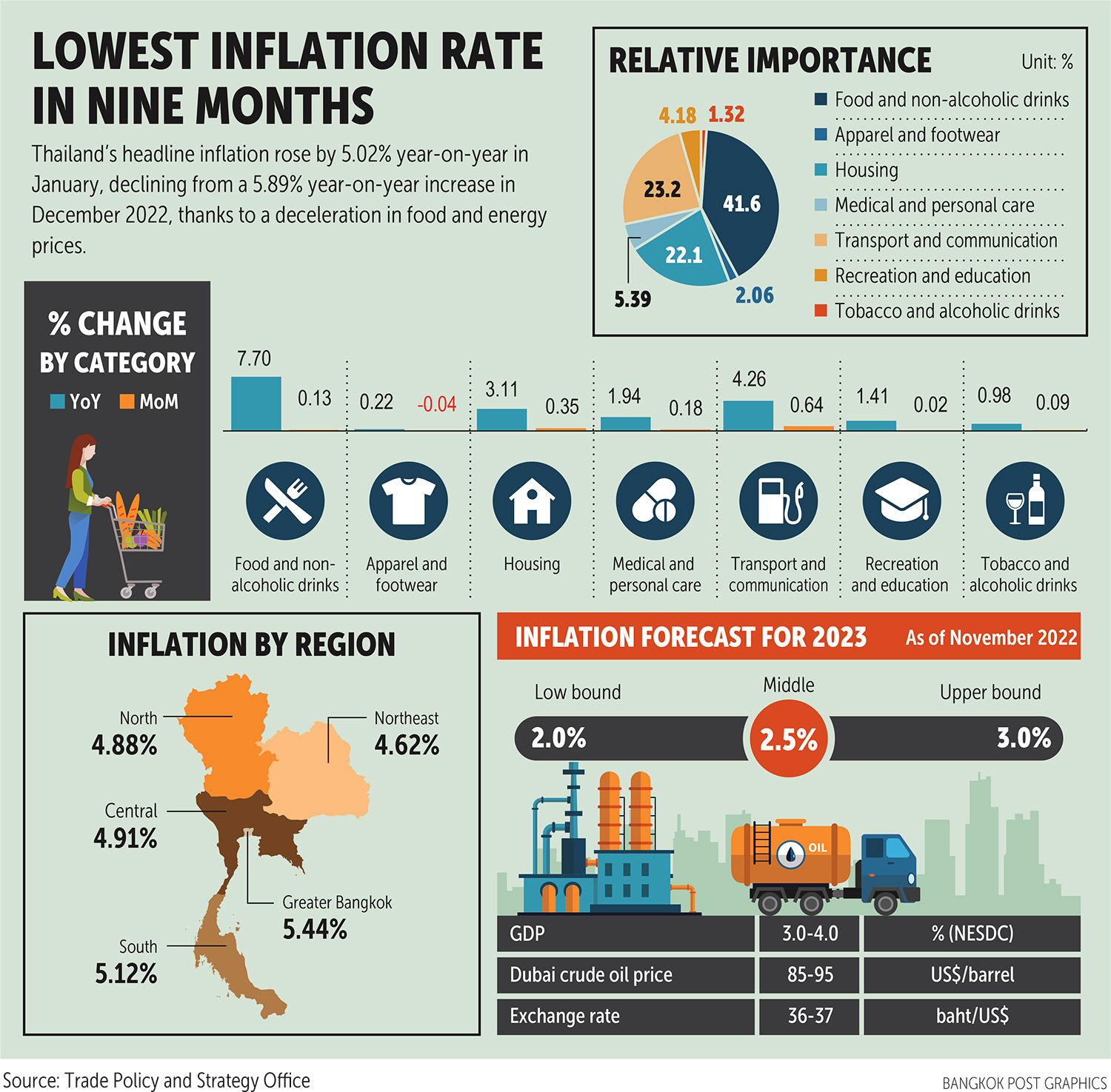

The Recent Decline in Thailand's Inflation Rate

Factors Contributing to the Inflation Dip

Several factors have contributed to the recent decrease in Thailand's inflation rate. These include:

- Decreased global oil prices: Lower global energy prices have significantly reduced the cost of transportation and energy-intensive goods, directly impacting the Consumer Price Index (CPI).

- Improved agricultural yields: Increased agricultural production has led to a more stable supply of food, lessening inflationary pressures on food prices, a major component of Thailand's CPI.

- Government subsidies: Targeted government subsidies on essential goods and services have helped mitigate price increases for consumers, particularly lower-income households.

- Easing supply chain issues: While still present, global supply chain disruptions are showing signs of easing, contributing to lower prices for imported goods.

The interplay of these factors has resulted in a noticeable downward trend in Thailand inflation, offering some respite to consumers and businesses.

Analyzing Inflation Data and Trends

Recent data shows a clear deceleration in Thailand's inflation rate. While the CPI remained elevated compared to pre-pandemic levels earlier in the year, recent figures indicate a marked decrease. [Insert chart or graph showing inflation data here – Source: Bank of Thailand or reputable statistical agency]. This trend is encouraging, suggesting that inflationary pressures may be waning. The Bank of Thailand closely monitors the CPI and other key inflation metrics to inform its monetary policy decisions. Analyzing these trends is crucial for understanding the overall health of the Thai economy.

The Bank of Thailand's Monetary Policy and Potential Rate Cuts

Current Interest Rate Situation

The Bank of Thailand currently holds its policy interest rate at [Insert current interest rate]%. This follows [Number] previous rate hikes implemented to combat rising inflation. The Bank's inflation target is typically within the range of [Insert Target Range]%, reflecting its commitment to price stability.

Arguments For and Against Further Rate Cuts

Arguments for further rate cuts often center on:

- Stimulating economic growth: Lower interest rates can encourage borrowing and investment, boosting economic activity and creating jobs.

- Supporting consumer spending: Reduced borrowing costs can stimulate consumer spending, leading to increased demand and overall economic growth.

However, arguments against further cuts include:

- Potential for increased inflation: Premature rate cuts could reignite inflationary pressures if demand increases too rapidly.

- Currency depreciation: Lower interest rates could weaken the Thai Baht, potentially impacting import costs and overall price stability.

Market Expectations and Analyst Predictions

Market analysts hold diverse opinions regarding the Bank of Thailand's next move. Some predict further rate cuts in the coming months, citing the sustained decline in Thailand inflation and the need to support economic growth. Others remain cautious, highlighting the risks associated with premature easing of monetary policy. [Cite reputable sources such as Bloomberg, Reuters, etc. for analyst predictions]. The uncertainty underscores the complexity of the situation and the careful considerations involved in the Bank's decision-making process.

Economic Implications of Further Rate Cuts in Thailand

Impact on Consumer Spending and Investment

Lower interest rates can significantly influence consumer spending and business investment. Reduced borrowing costs incentivize consumers to make larger purchases, such as homes and vehicles, while businesses might invest more in expansion and new projects. This increased spending and investment can contribute to a more robust economic recovery.

Effects on the Thai Baht and Foreign Investment

Rate cuts might lead to a weakening of the Thai Baht against other currencies. This can be both positive and negative. While it might boost exports by making Thai goods more competitive globally, it could also increase import costs and potentially impact inflation. The impact on foreign investment is complex and depends on various factors, including investor sentiment and global economic conditions.

Risks and Challenges Associated with Rate Cuts

While rate cuts can stimulate economic growth, they also pose several risks. These include:

- Asset bubbles: Low interest rates can fuel excessive borrowing and speculation, potentially leading to asset bubbles in the property market or other sectors.

- Increased debt levels: Easier access to credit could lead to a rise in household and corporate debt, potentially increasing financial vulnerability.

The Bank of Thailand must carefully weigh the potential benefits of further rate cuts against these risks, ensuring a balanced approach to maintaining economic stability.

Conclusion

The recent dip in Thailand inflation presents a complex scenario for the Bank of Thailand. While lower inflation creates room for potential interest rate cuts to stimulate growth, the Bank must cautiously weigh the risks of fueling inflation or currency depreciation. Understanding the interplay of these factors is crucial for assessing the future trajectory of the Thai economy. The potential impact on consumer spending, investment, and the Thai Baht highlights the significance of the Bank's upcoming decisions. Stay tuned for further updates on Thailand inflation and the Bank of Thailand's monetary policy decisions. Understanding these trends is crucial for navigating the evolving Thai economic landscape.

Featured Posts

-

Steelers Pickens Ex Gm Says Future In Jeopardy Trade Possible

May 07, 2025

Steelers Pickens Ex Gm Says Future In Jeopardy Trade Possible

May 07, 2025 -

Zendaya Dazzles In See Through Gown In Southern France

May 07, 2025

Zendaya Dazzles In See Through Gown In Southern France

May 07, 2025 -

Nba Playoffs Heat Vs Cavaliers Your Guide To Game 1 Predictions And Bets

May 07, 2025

Nba Playoffs Heat Vs Cavaliers Your Guide To Game 1 Predictions And Bets

May 07, 2025 -

Lewis Capaldi Spotted Thumbs Up Signals Positive Update

May 07, 2025

Lewis Capaldi Spotted Thumbs Up Signals Positive Update

May 07, 2025 -

Rihannas Engagement Ring And Stylish Red Shoe Choice

May 07, 2025

Rihannas Engagement Ring And Stylish Red Shoe Choice

May 07, 2025