The 10-Year Mortgage: Why It's Not A Popular Choice For Canadian Homebuyers

Table of Contents

Higher Initial Interest Rates Compared to Shorter-Term Mortgages

One of the most significant deterrents to choosing a 10-year mortgage is the higher initial interest rate compared to shorter-term options like 5-year or even 3-year mortgages. Lenders typically charge a premium for the increased risk associated with a longer-term loan. This difference can be substantial. For example, a 5-year fixed mortgage might carry an interest rate of 4.5%, while a comparable 10-year mortgage could be offered at 5.5% or even higher.

This seemingly small difference in interest rates translates into significantly higher monthly payments and a much larger total interest paid over the life of the mortgage. Let's consider a $500,000 mortgage: the higher interest rate on a 10-year mortgage will result in considerably larger monthly payments, putting potential buyers under greater financial strain, particularly those with fluctuating incomes.

- Increased upfront costs: Higher interest translates to a larger total cost of borrowing.

- Higher total interest paid: The longer term means you pay significantly more interest over the life of the loan.

- Potential for financial strain: Fluctuating income can make higher monthly payments difficult to manage.

Predicting Long-Term Financial Stability

Committing to a 10-year mortgage requires a high degree of confidence in your long-term financial stability. Predicting your financial situation a decade into the future is inherently challenging. Life throws curveballs – job loss, unexpected medical expenses, family growth, and other unforeseen events can significantly impact your ability to afford your mortgage payments.

Being locked into a high interest rate for ten years presents a substantial risk. If your financial circumstances change for the worse, you could find yourself struggling to make payments, potentially leading to foreclosure. Refinancing a 10-year mortgage early usually comes with hefty penalties.

- Uncertainty of future income: Job security and career progression are difficult to predict over such a long period.

- Unforeseen expenses: Medical emergencies, home repairs, or other unexpected costs can strain your budget significantly.

- Difficulty in refinancing: Breaking a 10-year mortgage early often involves substantial penalties.

Limited Flexibility and Refinancing Options with a 10-Year Mortgage

One of the biggest drawbacks of a 10-year mortgage is the limited flexibility it offers. Unlike shorter-term mortgages, which allow for refinancing or rate adjustments after the term expires, a 10-year mortgage typically ties you to the initial interest rate for the entire duration. This inflexibility can be costly if interest rates decrease during the term, as you'll miss the opportunity to secure a lower rate and potentially save money.

Breaking a 10-year mortgage before the term ends usually involves substantial prepayment penalties, making it a financially risky move. This contrasts sharply with the flexibility of shorter-term mortgages, which allow you to adjust your payments and interest rates periodically according to market conditions.

- High prepayment penalties: Breaking the mortgage early can result in significant financial penalties.

- Difficulty securing a better rate: You're locked into your initial rate, even if better rates become available.

- Limited options for changing mortgage terms: You have significantly less control over your mortgage terms compared to shorter-term options.

The Psychological Barrier of a Long-Term Commitment

Beyond the financial considerations, there's a significant psychological aspect to committing to a 10-year mortgage. The prospect of being "locked in" for such an extended period can be daunting for many homebuyers. It can create a sense of being trapped, potentially leading to buyer's remorse, especially if circumstances change. The shorter-term commitment of a 5-year mortgage offers a sense of predictability and the option to reassess your financial situation and explore other options after five years.

- Feeling trapped by a long-term commitment: The length of the term can feel overwhelming and restrictive.

- Fear of unforeseen circumstances impacting repayment ability: The long-term nature amplifies concerns about future financial stability.

- Preference for shorter-term predictability and flexibility: Many homebuyers prefer the shorter-term approach for greater control over their finances.

Lack of Awareness and Understanding of 10-Year Mortgage Options

Finally, the low popularity of 10-year mortgages in Canada can be partly attributed to a lack of awareness and understanding among consumers. These mortgages aren't heavily marketed, and many Canadians simply aren't aware of the options available or the potential benefits and drawbacks. This lack of consumer education contributes to the perception of risk and uncertainty surrounding 10-year mortgages.

Before committing to a 10-year mortgage, securing professional financial advice is crucial. This will help determine if it aligns with your long-term financial goals and risk tolerance.

- Limited availability from lenders: Not all lenders offer 10-year mortgage options.

- Insufficient consumer education on this product: Many consumers lack sufficient information to make informed decisions.

- Need for expert guidance before making a decision: Consulting a mortgage broker or financial advisor is vital.

Conclusion

In summary, while a 10-year mortgage might offer some theoretical advantages, the disadvantages – higher interest rates, inherent financial uncertainty, lack of flexibility, psychological barriers, and limited awareness – often outweigh the benefits for most Canadian homebuyers. Before committing to a significant financial decision like choosing a 10-year mortgage, seek professional advice to determine if it aligns with your long-term financial goals. A mortgage broker can help you explore various mortgage options and find the best solution for your individual circumstances.

Featured Posts

-

Corinthians Vence Al Novorizontino 0 1 Resumen Y Goles

May 05, 2025

Corinthians Vence Al Novorizontino 0 1 Resumen Y Goles

May 05, 2025 -

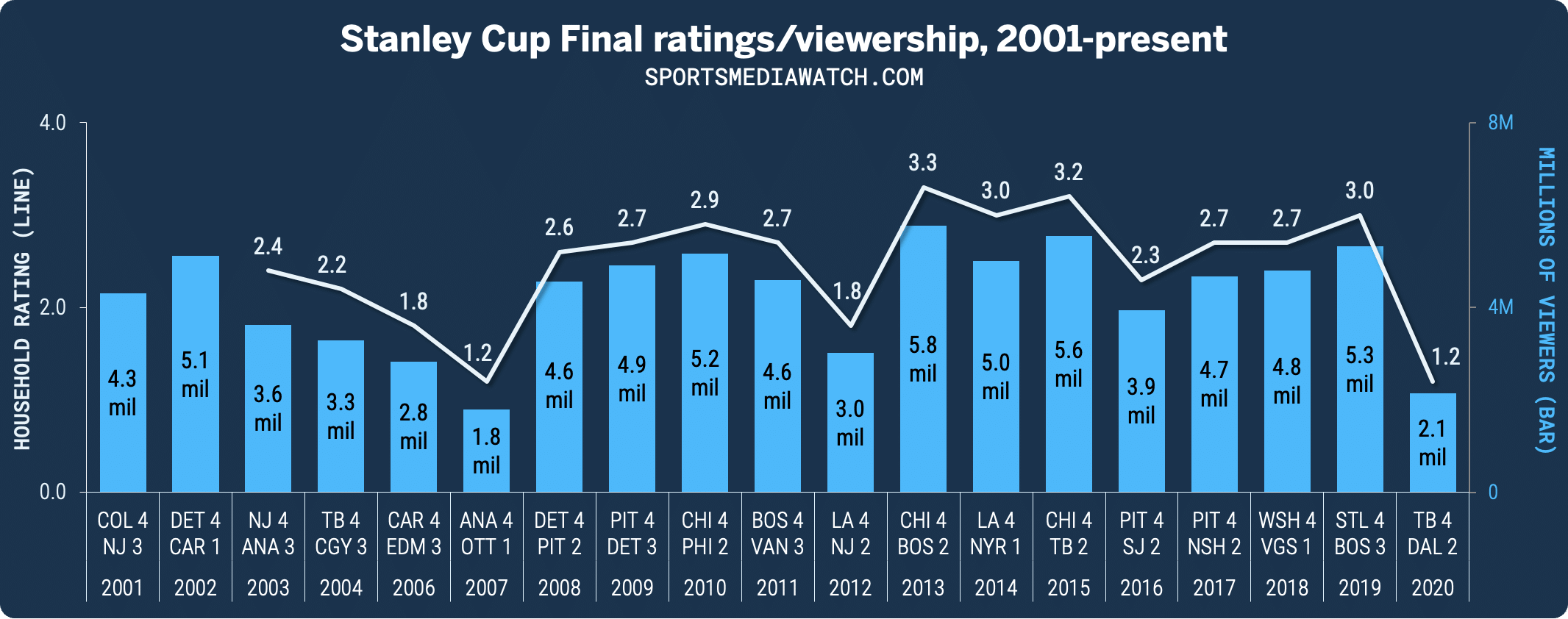

Lower Stanley Cup Playoff Ratings In The Us A Detailed Analysis

May 05, 2025

Lower Stanley Cup Playoff Ratings In The Us A Detailed Analysis

May 05, 2025 -

Fred Luz A Rescisao Do Contrato Com O Corinthians

May 05, 2025

Fred Luz A Rescisao Do Contrato Com O Corinthians

May 05, 2025 -

Anna Kendricks Age Revealed Fans React To Upcoming Milestone

May 05, 2025

Anna Kendricks Age Revealed Fans React To Upcoming Milestone

May 05, 2025 -

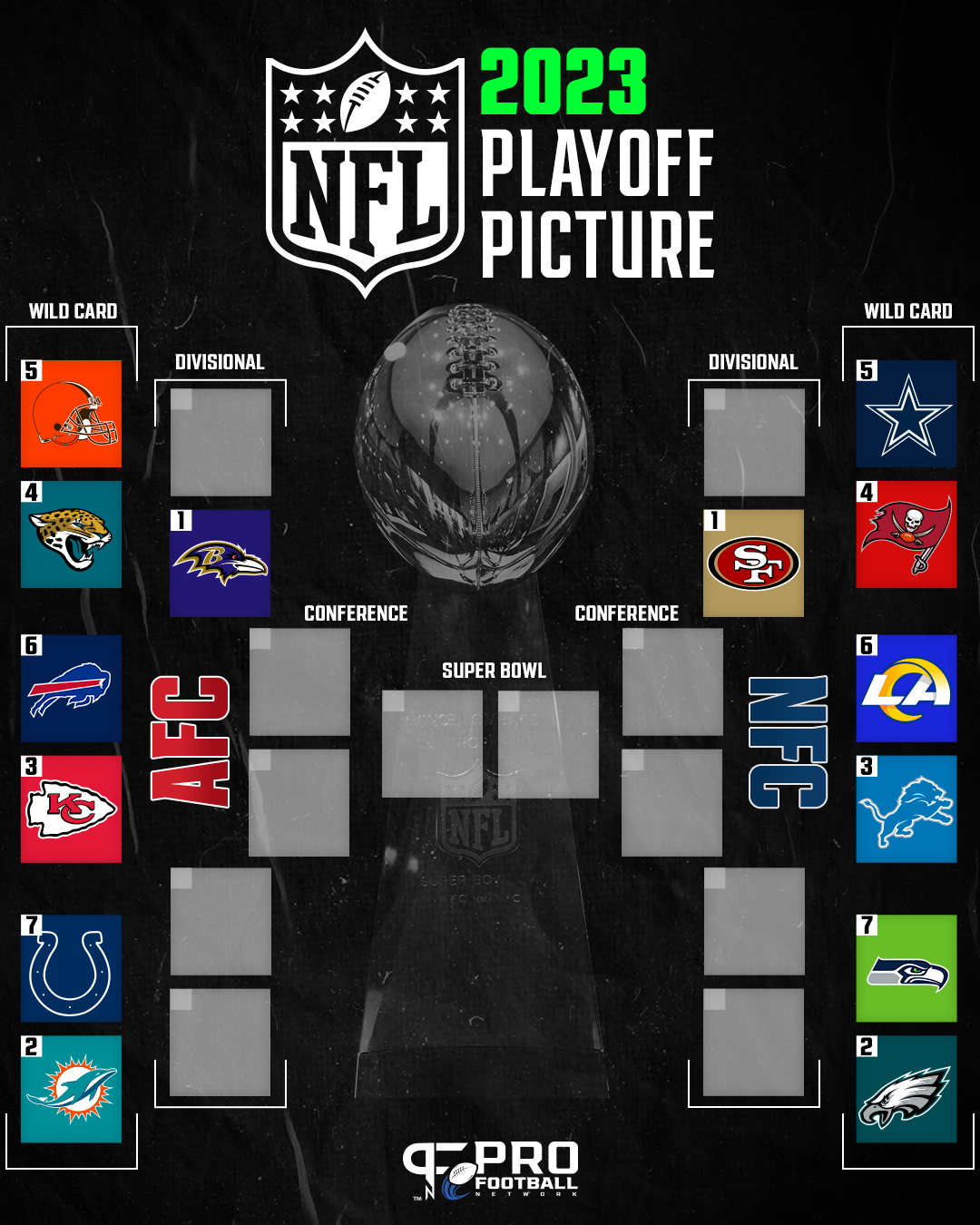

Nhl Playoffs Fridays Crucial Games And Standings Implications

May 05, 2025

Nhl Playoffs Fridays Crucial Games And Standings Implications

May 05, 2025