The $67 Million Ethereum Liquidation: Understanding The Market's Volatility

Table of Contents

Understanding Ethereum Liquidations

An Ethereum liquidation occurs when a trader using margin trading fails to meet the minimum margin requirements set by their exchange. Margin trading involves borrowing funds from the exchange to amplify trading positions, using leverage. Leverage magnifies both profits and losses. For example, 5x leverage means a 10% price increase results in a 50% gain, but a 10% price drop results in a 50% loss. When the value of the collateral (usually the cryptocurrency itself) falls below a certain threshold, the exchange automatically closes the trader's position to limit potential losses for the exchange. This process is an Ethereum liquidation. The trader loses the borrowed funds and a portion or all of their initial investment.

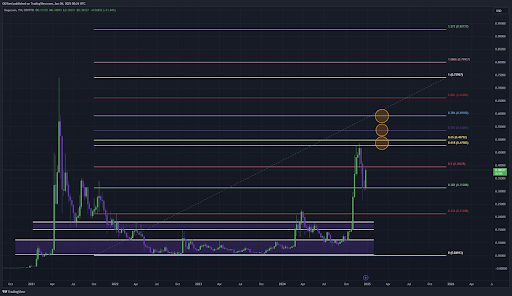

The Mechanics of the $67 Million Liquidation

The $67 million Ethereum liquidation, which occurred on [Insert Date of Event - replace with the actual date], was triggered by a sharp and sudden drop in the price of ETH. Contributing factors likely included:

- A cascade of sell orders: A large volume of sell orders overwhelmed the market, driving the price down rapidly.

- Negative market sentiment: Prevailing bearish sentiment may have predisposed traders to sell, exacerbating the price drop. [mention any specific news events or market trends that contributed]

- Algorithmic trading: Automated trading bots may have contributed to the rapid price decline and increased liquidation pressure.

- Liquidation cascades: The initial liquidations likely triggered a cascade effect, as further price drops led to more margin calls and subsequent liquidations, creating a vicious cycle.

The event saw approximately [Insert approximate number - replace with actual number if available] traders affected, with a significant impact on the ETH price, temporarily driving it down by [Insert percentage - replace with actual percentage if available] %.

Analyzing Market Volatility in the Crypto Space

The cryptocurrency market is notoriously volatile. Unlike traditional financial markets, it's characterized by:

- Regulatory uncertainty: The lack of clear regulatory frameworks creates uncertainty and volatility.

- Market manipulation: The potential for market manipulation by "whales" (individuals or entities holding large amounts of cryptocurrency) contributes to price swings.

- Technological advancements: New technologies and innovations can significantly impact market sentiment and price.

- Whale activity: Large transactions by whales can trigger significant price movements.

Past events, such as the 2018 crypto winter or the 2021 Bitcoin crash, demonstrate the dramatic price swings the market can experience. The $67 million Ethereum liquidation serves as a stark reminder of this inherent volatility.

Risk Management Strategies for Crypto Traders

Effective risk management is paramount in the volatile crypto market. Strategies to mitigate losses include:

- Diversification: Spreading investments across different cryptocurrencies reduces the impact of losses on any single asset.

- Stop-loss orders: These orders automatically sell an asset when it reaches a predetermined price, limiting potential losses.

- Position sizing: Carefully determining the amount to invest in each trade minimizes risk.

- Leverage management: Using leverage cautiously, or avoiding it altogether, can significantly reduce the risk of liquidation.

In the $67 million Ethereum liquidation, traders who employed these strategies, particularly stop-loss orders and prudent leverage management, would have likely mitigated their losses significantly.

Learning from the $67 Million Ethereum Liquidation

The $67 million Ethereum liquidation offers valuable lessons for both individual and institutional investors:

- Due diligence is crucial: Thoroughly research any cryptocurrency before investing.

- Understand market dynamics: Familiarize yourself with the factors influencing cryptocurrency prices.

- Practice responsible trading: Never invest more than you can afford to lose, and always use risk management strategies.

Future Implications and Predictions

This significant liquidation event may lead to increased regulatory scrutiny of the crypto market and encourage exchanges to implement stricter risk management measures. It could also cause some investors to become more risk-averse, leading to periods of lower trading volume and potentially less volatility in the short term. However, the long-term implications remain uncertain, and the market's inherent volatility is likely to persist. Traders should anticipate continued periods of both high volatility and significant price swings, requiring ongoing vigilance and robust risk management.

Conclusion

The $67 million Ethereum liquidation serves as a powerful case study in the volatility of the cryptocurrency market and the critical importance of risk management. Understanding the mechanics of Ethereum liquidations, the factors driving market volatility, and the implementation of effective risk management strategies are crucial for success in the crypto trading world. The unpredictable nature of this market necessitates careful planning, thorough research, and the application of proven risk mitigation techniques. Mastering Ethereum trading involves understanding not only potential gains but also the inherent risks. By learning from events like this and implementing effective strategies, you can mitigate Ethereum liquidation risks and navigate the volatile crypto market more successfully. Learn more about mitigating Ethereum liquidation risks and mastering Ethereum trading by visiting [link to related resources on Ethereum trading or risk management].

Featured Posts

-

Oklahoma Citys Tough Road Ahead Facing Memphis

May 08, 2025

Oklahoma Citys Tough Road Ahead Facing Memphis

May 08, 2025 -

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Antisemitic Incidents Prompt Investigation At Boeings Seattle Campus

May 08, 2025

Antisemitic Incidents Prompt Investigation At Boeings Seattle Campus

May 08, 2025 -

Ubers Shift To Subscriptions Impact On Driver Earnings And Commissions

May 08, 2025

Ubers Shift To Subscriptions Impact On Driver Earnings And Commissions

May 08, 2025