The Bank Of Canada And Rising Unemployment: Predicting Future Interest Rate Decisions

Table of Contents

The Bank of Canada's Mandate and Current Economic Challenges

The Bank of Canada operates under a dual mandate: maintaining price stability and achieving full employment. This delicate balancing act becomes considerably more challenging during times of economic uncertainty. Currently, Canada faces a confluence of difficulties, including stubbornly high inflation, lingering supply chain disruptions, and the looming threat of a recession. The Bank must carefully consider these factors when setting interest rates. How does it reconcile the need to curb inflation – often achieved by raising interest rates – with the desire to avoid fueling unemployment?

- Current inflation rate and its impact on monetary policy: The current inflation rate significantly influences the Bank's approach. High inflation typically prompts interest rate hikes to cool down the economy, but this can have negative consequences on employment.

- Unemployment rate and its trajectory: The rising unemployment rate is a key concern. The Bank needs to assess whether the increase is temporary or signals a more serious economic downturn.

- GDP growth forecasts and their implications for interest rates: GDP growth forecasts provide crucial insights into the overall health of the economy. Slowing GDP growth might necessitate a more cautious approach to interest rate adjustments.

Analyzing the Correlation Between Unemployment and Interest Rate Decisions

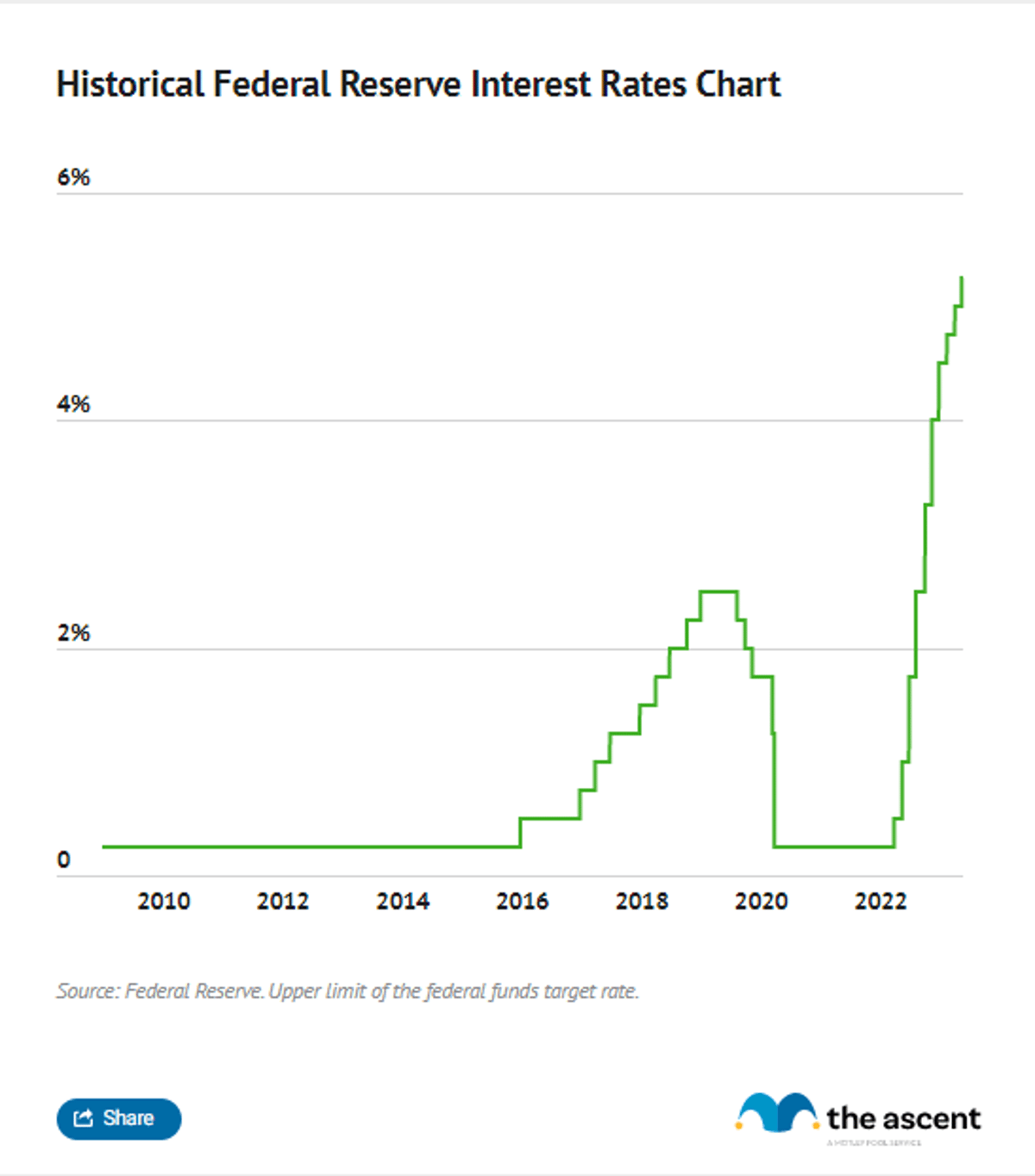

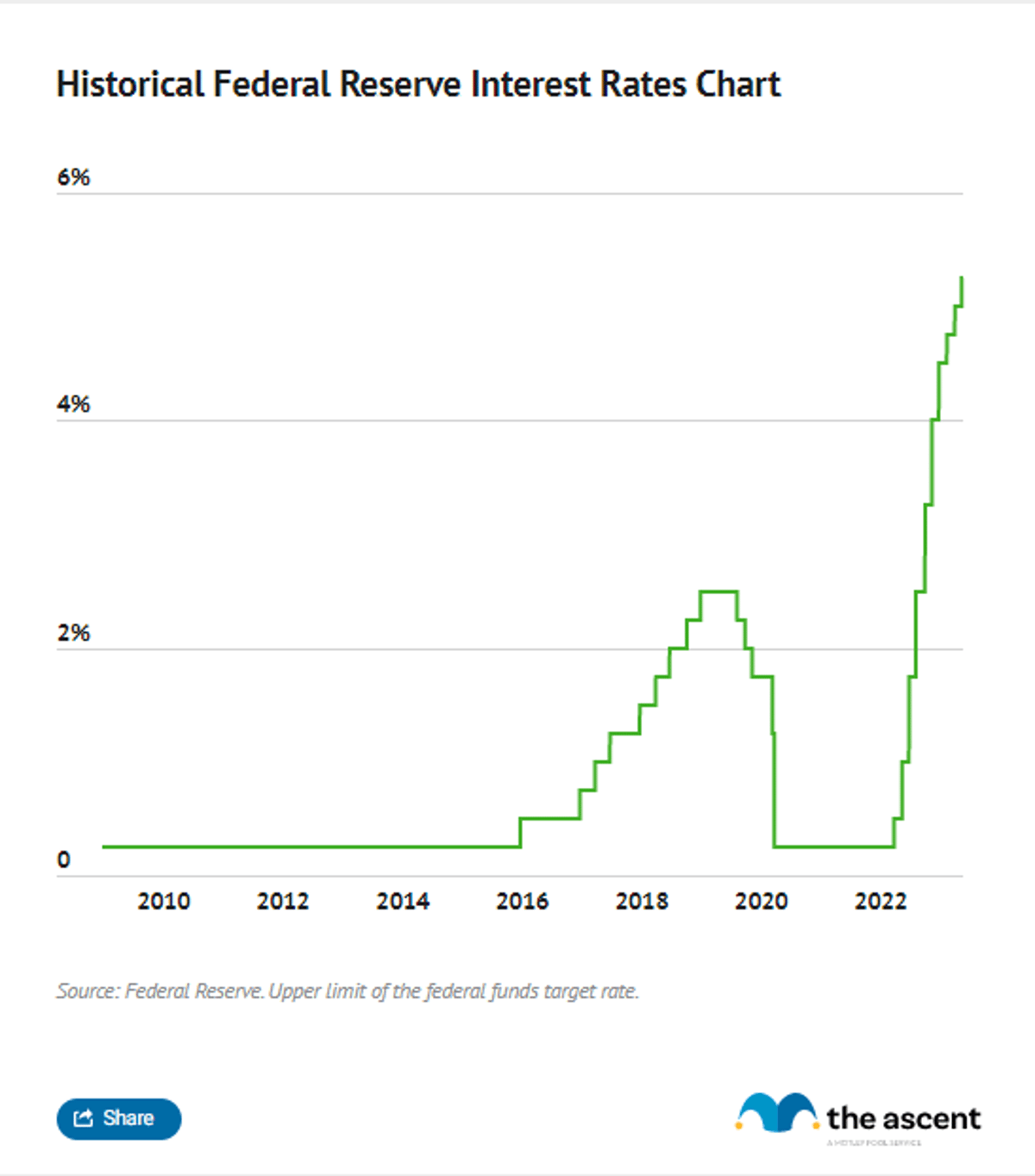

Historically, there's been an inverse relationship between unemployment and interest rates in Canada. Lower interest rates often stimulate economic activity, potentially leading to job creation, while higher rates can dampen economic growth and lead to job losses. The Phillips Curve, an economic model illustrating this inverse relationship, provides a useful framework for understanding the Bank's decision-making process. However, the relationship isn't always straightforward; sometimes, controlling inflation might necessitate accepting a temporary increase in unemployment.

- Examples of past Bank of Canada decisions in response to unemployment fluctuations: Reviewing past instances where the Bank responded to rising or falling unemployment offers valuable insights into its typical approach.

- Discussion of leading economic indicators influencing interest rate predictions: The Bank considers various leading economic indicators beyond just unemployment and inflation, including consumer confidence, business investment, and housing starts.

- Analysis of the impact of global economic events on Canadian unemployment and interest rates: Global events, such as geopolitical instability or international economic slowdowns, can significantly influence both Canadian unemployment and the Bank's interest rate decisions.

Predicting Future Interest Rate Moves Based on Unemployment Trends

Predicting future interest rate moves is inherently challenging, but analyzing current unemployment trends and projections offers valuable clues. If unemployment continues its upward trajectory, the Bank might adopt a more accommodative monetary policy, potentially cutting interest rates to stimulate economic growth and job creation. Conversely, if unemployment stabilizes or starts to fall, the Bank might be more inclined to maintain or even slightly raise interest rates to manage inflation.

- Discussion of different economic models used for prediction: Economists employ various models, from simple statistical analyses to sophisticated econometric models, to forecast future economic conditions and guide interest rate predictions.

- Potential interest rate hike or cut scenarios and their likely impact: Depending on the economic outlook, different scenarios are possible. An interest rate hike could curb inflation but might worsen unemployment, whereas a cut might boost employment but risk exacerbating inflation.

- Explanation of factors beyond unemployment influencing the Bank's decisions (e.g., global economic conditions, exchange rates): The Bank's decisions aren't solely based on domestic unemployment. Global economic conditions, exchange rates, and commodity prices also play a crucial role.

The Importance of Monitoring Bank of Canada Communications

Staying informed about the Bank of Canada's actions and communications is crucial for anyone seeking to understand and predict future interest rate decisions. The Bank regularly publishes statements, press releases, and monetary policy reports, providing valuable insights into its thinking and intentions. Paying close attention to its forward guidance – indications of the Bank's future policy direction – is especially important.

- Key phrases and indicators to watch for in Bank of Canada communications: Certain keywords and phrases signal the Bank's leaning towards rate hikes or cuts. Careful analysis of these communications can help in forecasting future moves.

- Where to find reliable information on Bank of Canada policy: The Bank's official website is the primary source of reliable information. Reputable financial news outlets also offer valuable analysis.

- How to interpret the language used by Bank of Canada officials: Understanding the nuances of the Bank's language is key to accurate interpretation. Financial literacy and careful analysis are necessary to decipher the subtle hints and signals.

Understanding the Bank of Canada's Response to Rising Unemployment and Future Interest Rate Decisions

The relationship between the Bank of Canada and rising unemployment is complex and multifaceted. The Bank must carefully balance its dual mandate, considering the interplay of inflation, unemployment, and overall economic growth. Predicting future interest rate decisions requires close monitoring of unemployment trends, GDP growth, inflation rates, and, critically, the Bank of Canada's own communications. While forecasting remains inherently uncertain, staying informed through official channels and reputable economic analysis significantly improves the accuracy of predictions. Stay informed about the Bank of Canada and rising unemployment situation by regularly consulting reliable economic news sources and returning to this site for further analysis and updates on this crucial economic issue.

Featured Posts

-

Nottingham Forests Victory Awoniyi Leads Team To Third Spot Beating Tottenham

May 14, 2025

Nottingham Forests Victory Awoniyi Leads Team To Third Spot Beating Tottenham

May 14, 2025 -

Jet Blues Haiti Flight Cancellations Extended April Update

May 14, 2025

Jet Blues Haiti Flight Cancellations Extended April Update

May 14, 2025 -

Ontario And Canada Recall Alert Check Your Dressings And Birth Control Pills

May 14, 2025

Ontario And Canada Recall Alert Check Your Dressings And Birth Control Pills

May 14, 2025 -

Nolte On Snow Whites Second Box Office Failure Mothers Day Weekend Results

May 14, 2025

Nolte On Snow Whites Second Box Office Failure Mothers Day Weekend Results

May 14, 2025 -

Solidarite A Bourg En Bresse Une Situation Amelioree Pour Les Demandeurs D Asile

May 14, 2025

Solidarite A Bourg En Bresse Une Situation Amelioree Pour Les Demandeurs D Asile

May 14, 2025