The Bitcoin Rebound: Should You Buy, Sell, Or Hold?

Table of Contents

Analyzing the Bitcoin Rebound: Technical Indicators

Technical analysis is a crucial tool for understanding price trends and predicting potential future movements. By studying charts and using various indicators, we can gain valuable insights into the current state of the Bitcoin market and the strength of the rebound. Key indicators to consider include:

-

Moving Averages (MA): Moving averages, such as the 50-day and 200-day MA, smooth out price fluctuations to identify trends. A bullish crossover (short-term MA crossing above the long-term MA) can signal a potential upswing, while a bearish crossover suggests a possible downturn. In a rebound scenario, a sustained position of the price above the moving averages could be a positive sign.

-

Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 generally indicates an overbought market, suggesting a potential correction, while an RSI below 30 suggests an oversold market, hinting at a possible rebound. During a Bitcoin rebound, a rising RSI above 50 can signify buying pressure.

-

Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that identifies changes in the strength, direction, momentum, and duration of a trend. A bullish MACD crossover (the MACD line crossing above the signal line) can signal a potential upward trend.

-

Support and Resistance Levels: Support levels represent price points where buying pressure is likely to outweigh selling pressure, preventing further declines. Resistance levels are price points where selling pressure is likely to outweigh buying pressure, hindering further price increases. A break above a significant resistance level during a rebound can be a strong bullish signal.

(Insert relevant charts and graphs illustrating these indicators and their application to a recent Bitcoin price chart here.)

Limitations of Technical Analysis: Technical analysis is not foolproof. It relies on historical data and may not always accurately predict future price movements. External factors, such as regulatory changes or major news events, can significantly impact Bitcoin's price regardless of technical indicators.

Market Sentiment and News Impacting the Bitcoin Rebound

News events and overall market sentiment play a crucial role in shaping Bitcoin's price. Positive news, such as regulatory approvals, institutional adoption, or technological advancements, can fuel a Bitcoin rebound and increase investor confidence. Conversely, negative news, such as security breaches, regulatory crackdowns, or macroeconomic instability, can trigger sell-offs and dampen enthusiasm.

-

Examples of Positive News: Adoption by major corporations like Tesla, positive regulatory statements from governments, successful scaling solutions for Bitcoin.

-

Examples of Negative News: Major hacks or security breaches on exchanges, negative regulatory pronouncements, market crashes in traditional financial markets.

Tracking market sentiment requires monitoring various sources:

-

Social Media: Platforms like Twitter and Reddit often reflect the prevailing sentiment among Bitcoin investors. Tools that analyze social media sentiment can provide valuable insights.

-

News Outlets and Financial Publications: Major news outlets and financial publications cover Bitcoin regularly, offering valuable information about market trends and influencing investor decisions.

Fear, Uncertainty, and Doubt (FUD) can significantly influence market sentiment and cause price volatility. Understanding and managing FUD is crucial for making informed investment decisions.

Risk Assessment and Portfolio Diversification in a Bitcoin Rebound

Bitcoin is highly volatile, and investing in it involves substantial risk. It's essential to assess your risk tolerance before making any investment decisions. Holding Bitcoin through a rebound may offer potential gains, but also carries considerable risk of price drops.

-

Risk Levels: Buying Bitcoin during a rebound carries moderate to high risk, selling reduces risk, while holding has a similar risk profile to buying, depending on your entry point.

-

Diversification: Diversifying your investment portfolio is a key risk management strategy. Don't put all your eggs in one basket. Consider investing in other asset classes, such as stocks, bonds, or real estate.

-

Risk Mitigation Strategies:

- Dollar-cost averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Stop-loss orders: Setting predetermined sell orders to automatically sell your Bitcoin if the price drops below a specified level.

Regulatory Landscape and its Effect on the Bitcoin Rebound

The regulatory landscape surrounding Bitcoin varies significantly across different countries. Regulatory uncertainty can affect investor confidence and market stability.

-

Examples of Positive Regulations: Countries with clear regulatory frameworks for cryptocurrency exchanges and trading activities can attract more investors and potentially boost Bitcoin's price.

-

Examples of Negative Regulations: Countries with strict regulations or outright bans on cryptocurrencies can stifle growth and lead to price declines.

Staying updated on regulatory developments is crucial for understanding the potential impact on Bitcoin's price and making informed investment decisions.

Conclusion: Making Informed Decisions about the Bitcoin Rebound

Deciding whether to buy, sell, or hold Bitcoin during a rebound requires careful consideration of several factors: technical analysis indicators, prevailing market sentiment, your risk tolerance, and the ever-evolving regulatory landscape. Thorough research and a clear understanding of your investment goals are essential. Carefully consider your risk tolerance and the factors discussed above before making any decisions regarding your Bitcoin holdings during this rebound. Learn more about managing your Bitcoin investments effectively. Remember that this information is for educational purposes only and does not constitute financial advice. Conduct your own research and consult with a qualified financial advisor before making any investment decisions. Keywords: Bitcoin rebound, Bitcoin investment strategy, cryptocurrency trading, risk management.

Featured Posts

-

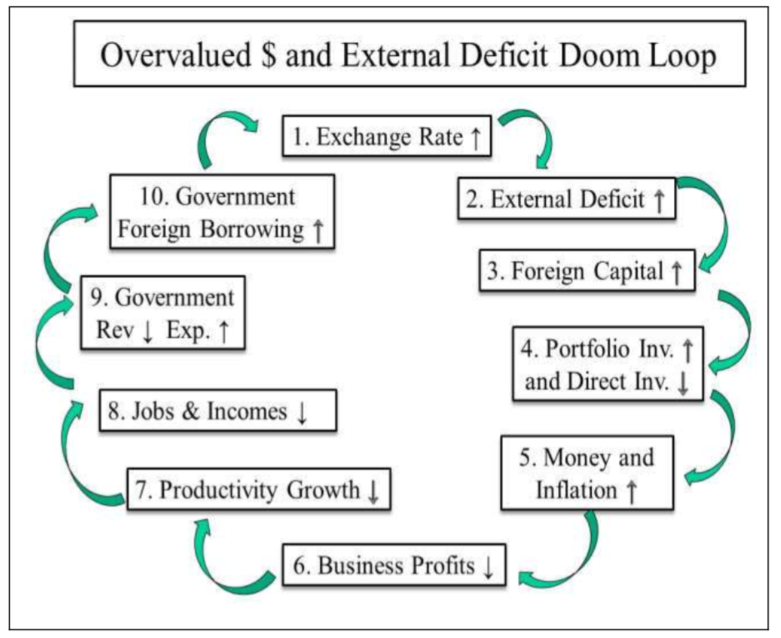

Canadas Economy And The Overvalued Canadian Dollar A Timely Analysis

May 08, 2025

Canadas Economy And The Overvalued Canadian Dollar A Timely Analysis

May 08, 2025 -

Inter Milan Goalkeeper Yann Sommers Thumb Injury Impact On Upcoming Fixtures

May 08, 2025

Inter Milan Goalkeeper Yann Sommers Thumb Injury Impact On Upcoming Fixtures

May 08, 2025 -

Dwp Benefit Stoppage 355 000 Affected 3 Month Notice Given

May 08, 2025

Dwp Benefit Stoppage 355 000 Affected 3 Month Notice Given

May 08, 2025 -

Ahsan Advocates For Tech Adoption To Boost Made In Pakistan Globally

May 08, 2025

Ahsan Advocates For Tech Adoption To Boost Made In Pakistan Globally

May 08, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025