The Canadian Dollar's High Value: Economic Implications And Solutions

Table of Contents

Impacts on Canadian Exports

A high Canadian dollar (CAD) significantly impacts Canadian exports, primarily by reducing their competitiveness on the global market. This means Canadian goods and services become more expensive for international buyers, leading to a decrease in demand.

Reduced Competitiveness

The most immediate impact of a high CAD is reduced competitiveness. When the Canadian dollar appreciates against other currencies, the price of Canadian exports increases in those foreign markets. This makes them less attractive compared to similar products from countries with weaker currencies.

- Reduced export volume: Businesses experience a decline in the quantity of goods and services sold internationally.

- Lower profitability for exporters: Higher production costs coupled with lower demand squeeze profit margins.

- Job losses in export-related sectors: Reduced demand forces businesses to cut costs, often leading to layoffs in export-oriented industries.

- Increased pressure on businesses to lower prices or improve efficiency: To remain competitive, businesses face pressure to reduce prices or enhance productivity, impacting profitability.

Impact on Specific Sectors

The effects of a strong CAD are not uniform across all sectors. Resource-based industries, such as mining, forestry, and energy, are particularly vulnerable due to their significant reliance on global commodity markets. These sectors often face stiff competition from countries with lower production costs and weaker currencies.

- Case study: The impact on the Canadian lumber industry: A high CAD can severely impact the competitiveness of Canadian lumber on the international stage, leading to decreased sales and potential mill closures.

- Case study: The effect on the automotive sector: The automotive sector, heavily reliant on both exports and imports, faces a double-edged sword. While imported parts become cheaper, exporting finished vehicles becomes more challenging.

Effects on Imports and Consumers

While a high CAD poses challenges for exporters, it offers benefits to consumers and importers.

Cheaper Imports

A strong CAD makes imported goods cheaper for Canadian consumers. This translates into lower prices for a wide range of products, from electronics and clothing to automobiles and food.

- Increased consumer spending power on imported goods: Consumers enjoy increased purchasing power for imported items.

- Potential for increased inflation if the benefits aren't passed on to consumers: While cheaper imports initially benefit consumers, businesses might not always fully pass on these savings, leading to potential inflation.

Increased Travel Abroad

The strengthened CAD also makes international travel more affordable for Canadians. This leads to increased tourism spending abroad.

- Boost in tourism revenue from foreign visitors: A strong CAD can attract more foreign tourists to Canada.

- Negative impact on domestic tourism: However, cheaper international travel may divert spending away from domestic tourism.

Government Policy Responses to a High Canadian Dollar Value

The Canadian government employs various policy tools to address the economic consequences of a high CAD.

Fiscal Policy

Fiscal policy, involving government spending and taxation, can influence the overall strength of the Canadian economy and its attractiveness to foreign investment, indirectly impacting the CAD.

- Discussion of potential fiscal stimulus or austerity measures: Stimulus measures can boost economic activity, potentially weakening the CAD, while austerity can strengthen it.

Monetary Policy

The Bank of Canada's primary tool is monetary policy, specifically adjusting interest rates. Lower interest rates can weaken the Canadian dollar, making exports more competitive.

- Explanation of how interest rate changes impact currency value: Lower interest rates reduce the return on Canadian investments, making the CAD less attractive to foreign investors, thus weakening it.

- Potential drawbacks of interest rate manipulation: Lowering interest rates too much can lead to inflation and other economic risks.

Trade Agreements

Negotiating and maintaining favourable trade agreements are crucial for enhancing the competitiveness of Canadian goods and services internationally.

- Importance of diversifying export markets: Reducing reliance on any single market reduces vulnerability to currency fluctuations.

- Impact of CUSMA (formerly NAFTA): Trade agreements like CUSMA create larger markets and reduce trade barriers, helping to mitigate the negative effects of a high CAD.

Strategies for Businesses to Navigate a Strong Canadian Dollar

Businesses can implement various strategies to mitigate the negative impacts of a high CAD.

Cost Reduction Strategies

Focusing on efficiency gains and cost-cutting measures is vital for maintaining competitiveness.

- Automation and technological improvements: Investing in automation can improve productivity and reduce labour costs.

- Supply chain optimization: Streamlining the supply chain can reduce costs and improve efficiency.

- Negotiating better deals with suppliers: Stronger negotiation skills can lead to better prices from suppliers.

Product Diversification and Innovation

Offering unique products or services with a strong value proposition can help offset the impact of a high CAD.

- Investing in R&D: Innovation leads to the creation of high-value products less susceptible to price competition.

- Developing niche markets: Focusing on specialized markets reduces direct competition.

- Focusing on value-added products: Adding value to products increases their price and competitive edge.

Market Diversification

Reducing dependence on specific markets by expanding into new international territories is crucial.

- Exploring emerging markets: Emerging markets offer growth potential and less vulnerability to currency fluctuations.

- Adapting products to suit different markets: Tailoring products to local needs increases their appeal and competitiveness.

Conclusion

The high value of the Canadian dollar presents a complex economic situation with both positive and negative aspects. While cheaper imports and increased travel opportunities benefit consumers, the decreased competitiveness of Canadian exports poses significant challenges for businesses and the overall economy. Government policies and proactive strategies by businesses are crucial in mitigating the negative effects. Understanding the implications of a strong Canadian dollar's value is vital for policymakers, businesses, and consumers alike. By actively implementing the solutions discussed above, Canada can navigate this economic landscape and achieve sustainable growth, even with a robust CAD. Learn more about managing the implications of the Canadian Dollar's High Value and find solutions that best suit your needs.

Featured Posts

-

Uber Driver Subscription Details On The New Commission Structure

May 08, 2025

Uber Driver Subscription Details On The New Commission Structure

May 08, 2025 -

Transferred Data A Comprehensive Guide To Secure Data Migration

May 08, 2025

Transferred Data A Comprehensive Guide To Secure Data Migration

May 08, 2025 -

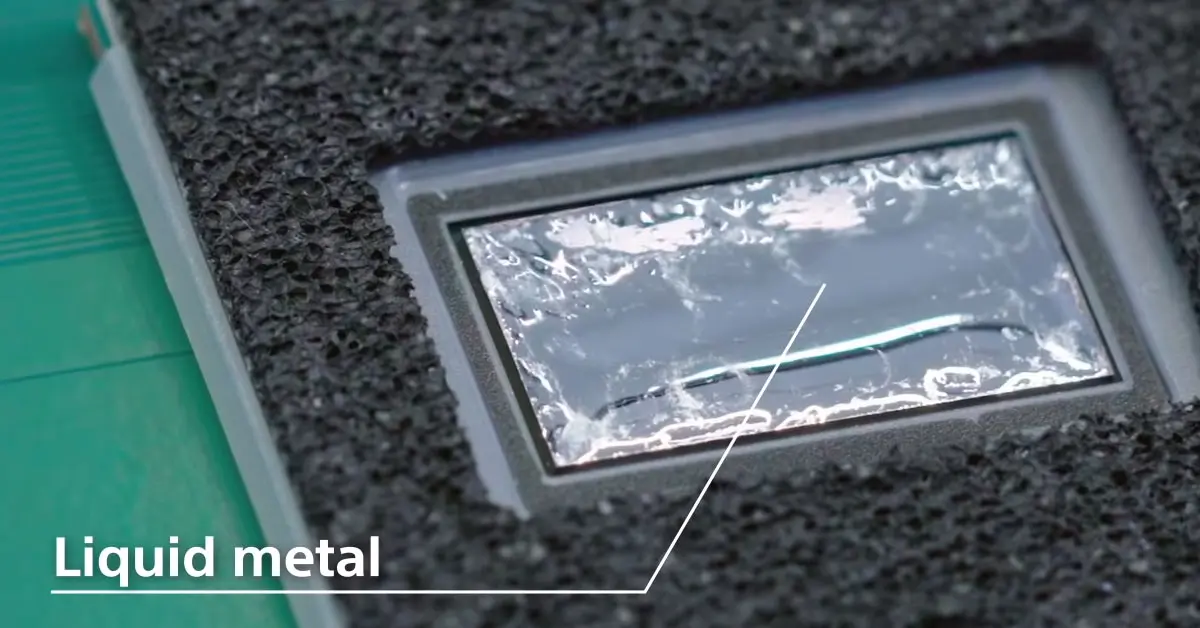

Official Ps 5 Pro Teardown Examining The Liquid Metal Cooling Solution

May 08, 2025

Official Ps 5 Pro Teardown Examining The Liquid Metal Cooling Solution

May 08, 2025 -

2025 Ptt Alimlari Kpss Li Ve Kpss Siz Pozisyonlar Ve Basvuru Tarihleri

May 08, 2025

2025 Ptt Alimlari Kpss Li Ve Kpss Siz Pozisyonlar Ve Basvuru Tarihleri

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kw Sht Ky Anshwrns Ky Shwlt

May 08, 2025

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kw Sht Ky Anshwrns Ky Shwlt

May 08, 2025