The Case For Measured QE: Greene's Proposal For The Bank Of England

Table of Contents

Willem Buiter's Critique of Unconventional Monetary Policy

Willem Buiter, a highly influential economist, has been a vocal critic of unconventional monetary policies, including large-scale QE. His concerns stem from several key areas.

Buiter's Concerns about QE's Effectiveness

Buiter argues that large-scale QE programs, while intended to stimulate economic growth, have yielded disappointing results and carry significant risks. His central arguments include:

- Increased risk of asset bubbles: The injection of vast sums of liquidity into the market can inflate asset prices, creating unsustainable bubbles in sectors like housing and equities. This can lead to a subsequent market correction with significant economic consequences.

- Exacerbation of wealth inequality: QE disproportionately benefits wealthier individuals who own more assets, widening the gap between the rich and the poor. This creates social and economic instability.

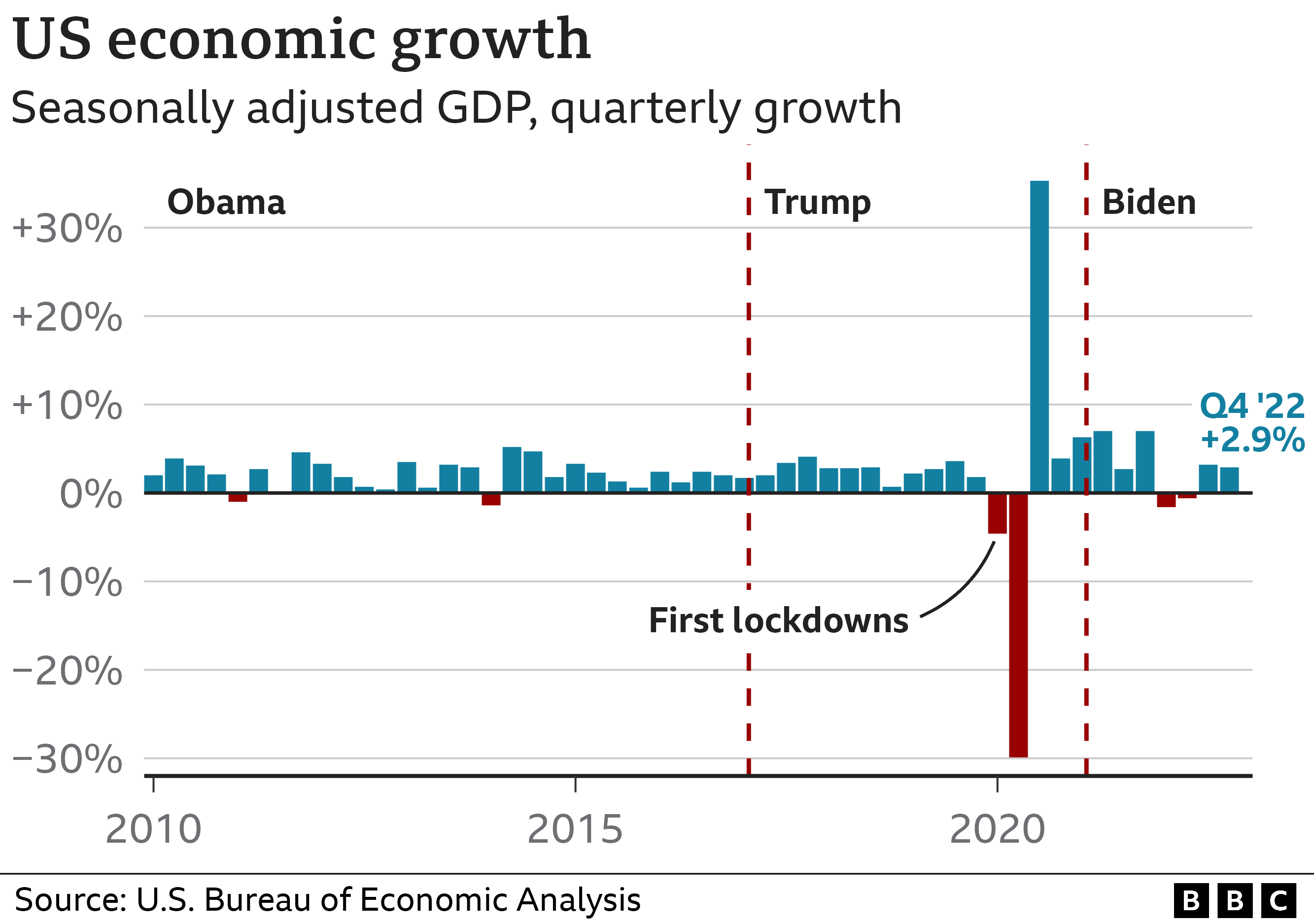

- Limited impact on real economic growth: Buiter argues that QE's impact on real economic activity, such as job creation and investment, has been limited, especially when compared to its impact on asset prices. The “trickle-down” effect has proven weak.

- Potential for inflationary pressures: While inflation has remained relatively subdued in recent years, Buiter warns that large-scale QE programs could eventually lead to significant inflationary pressures, especially if coupled with other expansionary fiscal policies.

The Limitations of Standard QE

Buiter highlighted the limitations of standard QE approaches employed by the Bank of England, arguing that their broad application lacked focus and exacerbated existing economic imbalances. For instance, the indiscriminate nature of past QE programs arguably failed to effectively address specific regional economic disparities within the UK, leading to uneven economic recovery.

Greene's Proposal for Measured Quantitative Easing

In contrast to Buiter’s concerns, [Name of Economist Greene] proposes a more measured approach to QE. This approach prioritizes targeted interventions, transparency, and accountability.

Key Elements of Greene's Proposal

Greene's measured QE approach differs significantly from standard QE in several key aspects:

- Smaller scale interventions: Instead of massive injections of liquidity, Greene advocates for smaller, more targeted QE programs tailored to specific economic needs.

- Focus on specific sectors or goals: The aim is to direct funds towards sectors or industries most in need of support, such as small and medium-sized enterprises (SMEs) or infrastructure projects.

- Greater transparency and accountability: Greene emphasizes the importance of clear communication and accountability mechanisms to ensure that QE programs are effective and transparent, limiting the risk of misuse or unintended consequences.

- Clear exit strategy: A well-defined plan for unwinding QE programs is crucial to avoid a sudden shock to the economy when support is no longer needed.

- Emphasis on data-driven decision making: Policy decisions should be based on rigorous economic data and analysis, rather than relying on intuition or political pressure.

Targeting Specific Economic Goals

Greene's proposal emphasizes the importance of using measured QE to address specific economic challenges. This contrasts with the broader, less targeted approach of standard QE, which often lacked a clear focus.

- Supporting specific industries: Targeted QE can help struggling sectors recover, such as those impacted by technological change or global competition.

- Improving credit availability to SMEs: By purchasing assets from banks, measured QE can free up capital for lending to SMEs, boosting investment and job creation.

- Boosting investment in infrastructure: Targeted QE can finance crucial infrastructure projects, creating jobs and improving long-term economic productivity.

The Role of Transparency and Accountability

Transparency and accountability are central to Greene's proposal. Open communication about the goals, implementation, and effects of QE programs helps build public trust and reduces the risk of adverse consequences. Independent oversight mechanisms can ensure that QE funds are used effectively and ethically.

Comparing Greene's Measured QE with Standard QE

A comparison between Greene's measured QE and standard QE reveals key differences in risk mitigation and potential economic benefits.

Risk Mitigation Strategies

Greene's measured QE incorporates several risk mitigation strategies absent in standard QE: smaller-scale interventions reduce the likelihood of asset bubbles, while targeted support minimizes the risk of exacerbating wealth inequality. The emphasis on transparency and accountability further helps limit potential negative consequences.

Potential Economic Benefits

Greene's proposal offers the potential for stimulating targeted economic activity while minimizing negative side effects. By focusing on specific sectors and goals, it could improve credit availability for SMEs, boost investment in infrastructure, and support struggling industries. Analyzing UK economic data focusing on specific sectors could help assess the potential effectiveness of such targeted interventions.

Challenges and Limitations of Greene's Proposal

Despite its potential benefits, Greene's measured QE approach faces several challenges.

Political and Practical Hurdles

Implementing Greene's proposal faces political and practical hurdles. Securing political consensus on targeting specific sectors might be difficult, and the logistical complexities of administering smaller, targeted programs can be considerable. Furthermore, navigating potential conflicts of interest and ensuring equitable distribution of funds are crucial for successful implementation.

Effectiveness and Measurable Outcomes

Measuring the effectiveness of Greene's measured QE and establishing clear benchmarks for success poses a considerable challenge. Attributing specific economic outcomes solely to targeted QE interventions can be difficult, requiring sophisticated econometric techniques.

Conclusion: Re-evaluating Quantitative Easing at the Bank of England

This article has examined Willem Buiter's critique of standard quantitative easing and contrasted it with [Name of Economist Greene]'s proposal for a more measured approach. Buiter's concerns regarding asset bubbles, wealth inequality, and limited impact on real economic growth highlight the risks associated with large-scale, untargeted QE programs. Greene's measured QE, however, offers an alternative focusing on smaller-scale interventions, targeted support for specific sectors, and enhanced transparency and accountability. The key difference lies in the precision and focus: Greene’s approach aims to maximize the positive impacts while minimizing the risks identified by Buiter.

The key takeaway is that a more nuanced, data-driven approach to QE, like Greene's measured QE, might be more effective in achieving the Bank of England's monetary policy objectives while mitigating the potential negative consequences.

We encourage further research into Greene's proposal and broader discussions on the future of monetary policy at the Bank of England. Considering "measured QE" as a potential solution to economic challenges warrants serious attention. Further reading on the topic can provide a more comprehensive understanding of this crucial debate.

Featured Posts

-

Mlb Betting Player Props And Best Bets For Todays Games

Apr 23, 2025

Mlb Betting Player Props And Best Bets For Todays Games

Apr 23, 2025 -

Economic Data And The Trump Administration A Comparative Analysis

Apr 23, 2025

Economic Data And The Trump Administration A Comparative Analysis

Apr 23, 2025 -

Burky El Doblete Que Le Dio La Victoria A Rayadas

Apr 23, 2025

Burky El Doblete Que Le Dio La Victoria A Rayadas

Apr 23, 2025 -

Three Straight 1 0 Losses For The Reds Analyzing The Trend

Apr 23, 2025

Three Straight 1 0 Losses For The Reds Analyzing The Trend

Apr 23, 2025 -

Walmart Target Ceos Discuss Tariffs With Trump Administration

Apr 23, 2025

Walmart Target Ceos Discuss Tariffs With Trump Administration

Apr 23, 2025