The China Market: Challenges Facing BMW, Porsche, And Other Automakers

Table of Contents

Intense Competition from Domestic Brands

The Chinese automotive industry has witnessed a meteoric rise of domestic brands. Companies like BYD, NIO, and Xpeng are rapidly gaining market share, posing a significant threat to established international players. This intense competition stems from several factors:

- Superior Understanding of Local Consumer Preferences: Domestic brands possess an inherent advantage in understanding the nuances of Chinese consumer tastes, preferences, and cultural sensitivities. They are adept at tailoring their products and marketing to resonate with specific demographics.

- Aggressive Pricing Strategies and Innovative Features: Chinese automakers often leverage aggressive pricing strategies, offering competitive features and technology at lower price points compared to international counterparts. This makes them attractive to price-sensitive buyers.

- Government Support and Subsidies: The Chinese government actively supports the development of domestic automakers through subsidies, tax breaks, and favorable regulations. This provides a considerable competitive edge.

- Rapid Technological Advancements: Chinese brands are investing heavily in research and development, leading to rapid technological advancements, particularly in the electric vehicle (EV) and autonomous driving sectors.

This intense competition directly impacts the profitability and market positioning of international brands. For example, BMW and Porsche have witnessed a decrease in their market share in certain segments due to the aggressive pricing and innovative features offered by Chinese competitors. Price wars have become more frequent, squeezing profit margins for established players.

Navigating Complex Regulatory and Legal Landscape

China's regulatory environment for the automotive industry is notoriously intricate. Stringent emission standards, complex safety regulations, and substantial import tariffs significantly impact automakers' operational costs and market entry strategies. Key challenges include:

- Homologation and Certification Processes: The homologation and certification processes for new vehicles in China are lengthy and complex, often involving multiple government agencies and bureaucratic hurdles.

- Varying Regulations Across Different Provinces: Regulations can vary significantly across different provinces in China, adding complexity to operational planning and compliance.

- Intellectual Property Protection Concerns: Protecting intellectual property rights can be challenging in China, leading to concerns about counterfeiting and unauthorized use of technology.

- Impact of Government Policies on Electric Vehicle Adoption: Government policies promoting electric vehicle (EV) adoption are constantly evolving, creating both opportunities and challenges for automakers.

These bureaucratic hurdles and legal complexities create significant barriers to entry and operational efficiency for foreign automakers. Successfully navigating this landscape requires significant investment in legal expertise and ongoing adaptation to changing regulations.

Understanding Evolving Chinese Consumer Preferences

The preferences of Chinese car buyers are rapidly evolving. Beyond basic transportation, consumers increasingly prioritize technology, luxury features, and a strong brand image. Key trends shaping the market include:

- Growing Popularity of Electric Vehicles (EVs) and Hybrid Vehicles: The demand for EVs and hybrid vehicles is exploding in China, driven by government incentives and growing environmental awareness.

- Demand for Connected Car Features and Advanced Driver-Assistance Systems (ADAS): Chinese consumers are increasingly demanding advanced technology features such as connected car capabilities and ADAS, driving innovation in vehicle technology.

- Importance of Digital Marketing and Online Sales Channels: Digital marketing and online sales channels are crucial for reaching Chinese consumers, who are highly digitally engaged.

- Preference for Specific Vehicle Types and Designs: Consumer preferences vary significantly regarding vehicle type and design, requiring automakers to offer a diverse range of models to cater to specific tastes.

These shifting preferences necessitate that international brands adapt their product offerings and marketing strategies to resonate with the evolving needs and desires of Chinese consumers.

Supply Chain Disruptions and Production Challenges

Global supply chain disruptions, particularly the ongoing semiconductor shortage, have significantly impacted the production and delivery of vehicles in China. This has led to:

- Increased Production Costs Due to Supply Chain Disruptions: The shortage of key components has driven up production costs, impacting profitability.

- Delays in Vehicle Deliveries and Customer Dissatisfaction: Production delays have resulted in significant delays in vehicle deliveries, leading to customer dissatisfaction.

- Impact on Production Capacity and Overall Profitability: Supply chain issues have significantly constrained production capacity and negatively impacted overall profitability for automakers.

- Strategies to Mitigate Supply Chain Risks: Automakers are actively exploring strategies to mitigate supply chain risks, including diversifying sourcing, establishing local partnerships, and investing in inventory management.

Furthermore, sourcing parts and materials locally, particularly for premium components, presents additional challenges for international brands.

The Rise of Electric Vehicles (EVs) and the Transition to a New Energy Vehicle (NEV) Market

The rapid growth of the New Energy Vehicle (NEV) market in China is transforming the automotive landscape. The government's ambitious targets for NEV adoption and significant incentives are driving this rapid expansion. This presents both opportunities and substantial challenges for traditional Internal Combustion Engine (ICE) vehicle manufacturers:

- Government Incentives and Targets for NEV Adoption: Government policies heavily favor NEV adoption through substantial subsidies and mandates, pushing automakers to invest in EV technologies.

- Competition from Chinese EV Startups and Established Players: The NEV market is fiercely competitive, with both established Chinese automakers and numerous startups vying for market share.

- Investment Needs in EV Infrastructure and Charging Networks: Significant investments are needed to develop the necessary infrastructure, including charging networks and battery recycling facilities, to support the growth of the EV market.

- Challenges in Balancing EV Development with Traditional Vehicle Production: Automakers face the challenge of balancing investments in EV technology with the continued production and sales of traditional ICE vehicles.

Conclusion: Overcoming Challenges in the China Market

The China market presents a significant opportunity, but also formidable challenges for automakers like BMW and Porsche. Intense competition from domestic brands, a complex regulatory landscape, evolving consumer preferences, and supply chain disruptions all demand strategic adaptation. Understanding and responding to these unique dynamics is crucial for long-term success in this vital market. To succeed, international automakers must prioritize localization, invest heavily in R&D, and build strong relationships with both government entities and local partners. Further research into "The China Market: Challenges Facing Automakers" is essential for any company considering market entry or expansion in this dynamic and rapidly evolving environment.

Featured Posts

-

U S Federal Reserve Rate Decision Economic Uncertainty And Policy Implications

May 10, 2025

U S Federal Reserve Rate Decision Economic Uncertainty And Policy Implications

May 10, 2025 -

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 10, 2025

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 10, 2025 -

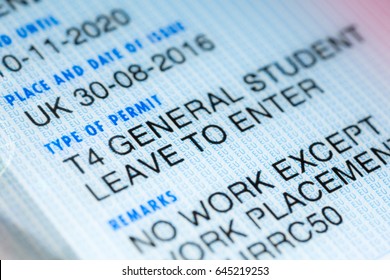

Uk Student Visa Restrictions Impact On Pakistani Students And Asylum Seekers

May 10, 2025

Uk Student Visa Restrictions Impact On Pakistani Students And Asylum Seekers

May 10, 2025 -

Stock Market Update Sensex Nifty 50 Unchanged Amidst Geopolitical Uncertainty

May 10, 2025

Stock Market Update Sensex Nifty 50 Unchanged Amidst Geopolitical Uncertainty

May 10, 2025 -

Is This High Potential Character The Perfect Season 2 Victim

May 10, 2025

Is This High Potential Character The Perfect Season 2 Victim

May 10, 2025