The China Market: Headwinds For Luxury Carmakers Like BMW And Porsche

Table of Contents

Economic Slowdown and Shifting Consumer Sentiment

China's economic growth has slowed, impacting consumer spending, particularly in discretionary categories like luxury vehicles. Uncertainty about the future is leading to more cautious purchasing decisions. The impact is being felt across the board, affecting not only the volume of luxury car sales in China but also the average transaction value. High-net-worth individuals (HNWIs), the primary target market for luxury car brands, are becoming more discerning with their spending.

- Declining GDP growth impacting high-net-worth individuals (HNWI): Slower economic expansion directly translates to reduced disposable income for HNWIs, impacting their willingness to purchase luxury goods.

- Increased savings rates and decreased consumer confidence: Economic uncertainty is pushing consumers to prioritize savings over luxury purchases, leading to a decrease in consumer confidence and impacting the luxury car sales China figures.

- Shift in spending priorities towards essential goods and experiences: Consumers are increasingly focusing their spending on essential goods and experiences perceived as more valuable in uncertain times, leaving luxury car purchases lower on the priority list.

- Impact on luxury car sales volume and average transaction value: The combined effect of these factors leads to a decrease in both the number of luxury cars sold and the average price paid, significantly impacting the profitability of luxury carmakers. This necessitates a deeper understanding of the changing China economy and its implications for the luxury sector.

Rise of Domestic Competitors

Chinese luxury car brands are rapidly gaining market share, offering competitive pricing and features tailored to local preferences. This intensifies competition for established international players like BMW and Porsche. The rise of brands like Nio, Xpeng, and Li Auto is particularly noteworthy, challenging the dominance of foreign luxury car brands in the China luxury car market.

- Growing popularity of brands like Nio, Xpeng, and Li Auto: These domestic brands are successfully attracting Chinese consumers with their innovative designs, advanced technologies, and competitive pricing.

- Aggressive marketing and technological advancements by domestic brands: Chinese manufacturers are investing heavily in marketing and technological innovation, leveraging digital platforms and focusing on features that resonate with local consumers.

- Focus on electric vehicles (EVs) and technological innovation: The strong focus on EVs is a key factor driving the success of domestic brands. They are leveraging technological advancements to offer cutting-edge features, appealing to a tech-savvy Chinese consumer base.

- Price competitiveness and localized features appealing to Chinese consumers: Domestic brands often offer lower prices and features specifically designed to cater to Chinese consumer preferences, gaining a competitive edge in the market. This increase in domestic competition is reshaping the landscape of the market share China for luxury cars.

Evolving Consumer Preferences and Demands

Chinese consumers are becoming more discerning and demanding, seeking unique experiences and personalized services beyond just the car itself. This shift necessitates a fundamental change in the approach of luxury carmakers targeting this market. Understanding the evolving Chinese consumer preferences is crucial for success.

- Increased emphasis on technological features and advanced driver-assistance systems (ADAS): Technological sophistication is a key driver for purchasing decisions, with consumers prioritizing advanced features and ADAS technologies.

- Demand for sustainable and environmentally friendly vehicles (EVs and hybrids): The increasing awareness of environmental issues is driving demand for electric and hybrid vehicles, with Chinese consumers actively seeking eco-friendly options. This push for EV adoption China is crucial for luxury brands.

- Preference for personalized branding and customization options: Consumers are seeking unique and personalized experiences, demanding more customization options and tailored branding to express their individual style.

- Growing importance of digitalization and online car purchasing experiences: The rise of digital platforms and e-commerce is changing the way luxury cars are bought and sold, with online experiences becoming increasingly important. This impacts digital marketing luxury cars strategies.

Government Regulations and Policies

Government regulations, including emission standards and import tariffs, significantly impact the profitability and operational efficiency of luxury carmakers in China. Navigating the complexities of the China automotive regulations is a crucial aspect of operating in this market.

- Stringent emission standards pushing for electrification: Strict emission regulations are driving the transition to electric and hybrid vehicles, creating both opportunities and challenges for luxury carmakers.

- Import tariffs and taxes influencing pricing strategies: Import duties and taxes can significantly impact pricing strategies and profitability, requiring careful planning and cost optimization.

- Government incentives for domestic EV manufacturers: Government incentives often favor domestic EV manufacturers, creating an uneven playing field for international competitors.

- Navigating complex bureaucratic processes and regulations: Understanding and navigating the complexities of Chinese bureaucracy and regulations is crucial for smooth operations and compliance. This affects all aspects of the government policy China automotive sector.

Conclusion

The China luxury car market, once a goldmine for international brands like BMW and Porsche, is now presenting significant challenges. Economic headwinds, rising domestic competition, evolving consumer preferences, and government regulations demand a strategic reassessment. Luxury carmakers must adapt to these changes through targeted marketing, technological innovation, and a deep understanding of the evolving Chinese consumer. Successfully navigating these headwinds will require a long-term commitment to understanding and adapting to the complexities of the China luxury car market. Failing to do so risks losing significant market share to increasingly competitive domestic players. Invest in understanding the nuances of the China luxury car market and tailor your strategy accordingly.

Featured Posts

-

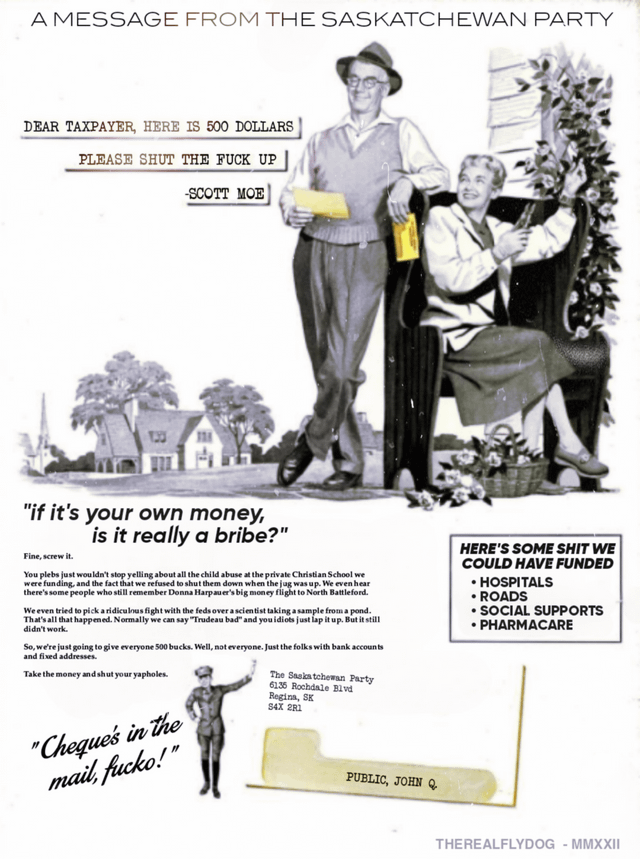

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025 -

The Ftv Live Story A Hell Of A Run Through Broadcast News

May 21, 2025

The Ftv Live Story A Hell Of A Run Through Broadcast News

May 21, 2025 -

31 Pay Cut For Bps Chief Executive Officer

May 21, 2025

31 Pay Cut For Bps Chief Executive Officer

May 21, 2025 -

Couple Arrested Following Antiques Roadshow Appraisal Of National Treasure

May 21, 2025

Couple Arrested Following Antiques Roadshow Appraisal Of National Treasure

May 21, 2025 -

Teknik Direktoer Degisikligi Ancelotti Nin Yerine Klopp Uygun Mu

May 21, 2025

Teknik Direktoer Degisikligi Ancelotti Nin Yerine Klopp Uygun Mu

May 21, 2025