The Correlation Between US Economic Performance And Elon Musk's Fortune

Table of Contents

The Impact of US Economic Growth on Elon Musk's Net Worth

Tesla's Dependence on Consumer Spending and Economic Confidence

Strong US economic growth directly translates into increased consumer spending, a crucial factor driving the success of Tesla.

- Increased Disposable Income: A booming economy boosts disposable income, allowing consumers to consider luxury purchases like electric vehicles.

- Consumer Confidence: High economic confidence translates into a willingness to invest in long-term assets like Tesla vehicles, impacting demand and stock prices.

- Positive Economic Forecasts: Favorable economic forecasts influence investor sentiment positively, driving up Tesla's market capitalization and consequently, Elon Musk's net worth.

Analyzing historical data reveals a strong positive correlation between US GDP growth and Tesla's stock performance. Periods of robust economic growth have consistently coincided with significant increases in Tesla's stock price, directly boosting Musk's wealth.

SpaceX's Reliance on Government Contracts and Private Investment

SpaceX's success is intricately linked to both government contracts and private investment, both heavily influenced by the health of the US economy.

- Government Spending on Space Exploration: Government investment in space exploration programs provides crucial revenue for SpaceX through contracts awarded for NASA missions and defense-related projects.

- Private Investment in the Space Industry: The overall economic climate heavily influences private investment in innovative ventures like SpaceX. A healthy economy attracts venture capital and private equity, fueling SpaceX's growth and valuation.

- Interest Rates: Lower interest rates make it cheaper for SpaceX to secure funding, facilitating expansion and boosting its valuation.

Successful SpaceX contracts, such as those with NASA for cargo transportation to the International Space Station, have had a direct and significant impact on Musk's wealth. The company's ability to secure these contracts hinges on the overall prioritization of space exploration within the government budget.

The Influence of Macroeconomic Factors on Musk's Businesses

Inflation and its Effect on Tesla Production Costs and Consumer Demand

Inflation significantly impacts both Tesla's production costs and consumer demand for its vehicles.

- Rising Production Costs: Increased costs of raw materials, components, and labor directly impact Tesla's profit margins.

- Reduced Consumer Purchasing Power: High inflation erodes consumer purchasing power, potentially reducing demand for luxury goods like Tesla vehicles.

- Pricing Strategies: Tesla may need to adjust its pricing strategies in response to inflation, impacting profitability and market share.

Specific examples of inflation's impact can be seen in Tesla's adjustments to its pricing over recent years. The company has had to manage rising costs of battery materials and other components, affecting its bottom line.

Recessionary Periods and their Potential Impact on Musk's Holdings

Recessions significantly impact consumer spending and investment in the tech sector, affecting both Tesla and SpaceX valuations.

- Decreased Consumer Spending: During recessions, consumers tend to cut back on discretionary spending, including luxury items like electric vehicles.

- Reduced Investment in Tech: Economic downturns lead to reduced investment in riskier ventures, impacting funding for both Tesla and SpaceX.

- Market Volatility: Recessions often increase market volatility, impacting the stock prices of both companies and consequently, Musk’s net worth.

Historical data shows that during previous recessions, Tesla and SpaceX stock prices experienced fluctuations, though their resilience varied depending on the severity and duration of the downturn.

The Reciprocal Relationship: Musk's Influence on the US Economy

Job Creation and Technological Innovation

Tesla and SpaceX are significant contributors to job creation and technological innovation in the US.

- Direct Employment: Both companies employ tens of thousands of people across various roles, driving economic activity.

- Indirect Employment: Their operations create numerous indirect jobs through suppliers, contractors, and related industries.

- Technological Innovation: Musk's companies drive technological innovation in areas such as electric vehicles, renewable energy, and space exploration, fostering economic growth.

Statistics regarding employment numbers at Tesla and SpaceX highlight their significant contribution to the US labor market. The ripple effects extend across numerous industries, creating a broader positive economic impact.

Market Leadership and Investor Confidence

Musk's leadership and success influence investor confidence in the tech sector and the broader US markets.

- Tesla's Market Capitalization: Tesla's substantial market capitalization significantly impacts the overall stock market.

- Investor Sentiment: Musk's entrepreneurial achievements boost investor confidence in innovative technologies and related companies.

- Influence on Other EV Companies: Tesla's success has spurred significant investment and growth within the broader electric vehicle market.

Tesla’s market performance acts as a barometer for investor sentiment towards electric vehicles and the broader clean energy sector. This, in turn, impacts the overall stock market performance.

Conclusion

The correlation between US economic performance and Elon Musk's fortune is undeniable. Macroeconomic factors like economic growth, inflation, and recessionary periods significantly impact the performance of Tesla and SpaceX, directly affecting Musk’s net worth. Conversely, Musk's entrepreneurial endeavors contribute to the US economy through job creation, technological innovation, and investor confidence. Understanding this intricate relationship provides valuable insights into market trends and future economic forecasts. Stay informed about the correlation between US economic performance and Elon Musk's fortune by regularly checking for updates and analysis on relevant financial news and economic indicators.

Featured Posts

-

The Ethics Of Wildfire Betting Exploring The Los Angeles Case

May 09, 2025

The Ethics Of Wildfire Betting Exploring The Los Angeles Case

May 09, 2025 -

Ftc Probe Into Open Ai And Chat Gpt Implications For Ai Regulation

May 09, 2025

Ftc Probe Into Open Ai And Chat Gpt Implications For Ai Regulation

May 09, 2025 -

Pozitsiya Germanii Ugroza Novogo Bezhenskogo Krizisa Iz Ukrainy Vsledstvie Politiki S Sh A

May 09, 2025

Pozitsiya Germanii Ugroza Novogo Bezhenskogo Krizisa Iz Ukrainy Vsledstvie Politiki S Sh A

May 09, 2025 -

Car Crash At Jennifer Anistons Home Leads To Felony Charges

May 09, 2025

Car Crash At Jennifer Anistons Home Leads To Felony Charges

May 09, 2025 -

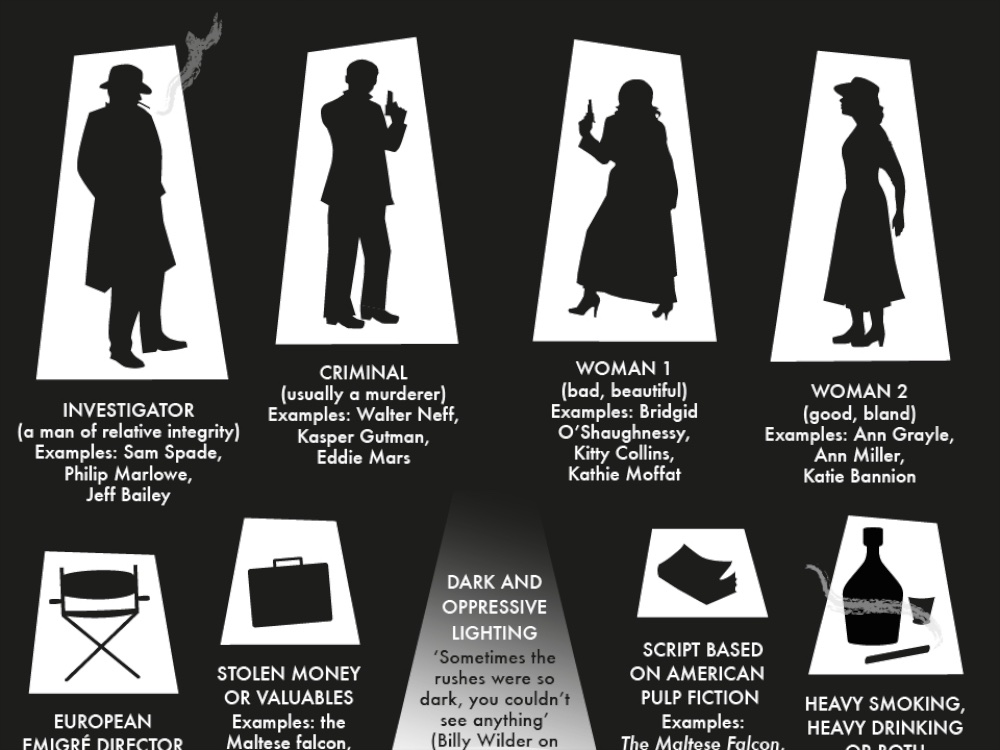

The 10 Best Film Noir Movies From Beginning To End

May 09, 2025

The 10 Best Film Noir Movies From Beginning To End

May 09, 2025