The ECB On Inflation: How Pandemic Fiscal Support Continues To Affect Prices

Table of Contents

The Surge in Pandemic Spending and its Immediate Impact

The COVID-19 pandemic necessitated a massive injection of fiscal stimulus across the Eurozone. This surge in pandemic spending had a dual impact on inflation, creating both demand-pull and cost-push pressures.

Increased Money Supply

Government stimulus packages, designed to support businesses and individuals, led to a rapid increase in the money supply. This injection of liquidity fueled demand-pull inflation.

- Increased Government Spending: Massive government spending programs translated into higher disposable income for households, boosting consumer spending and driving up demand for goods and services.

- Quantitative Easing (QE): The ECB's quantitative easing programs further increased the money supply by purchasing government bonds and other assets, injecting additional liquidity into the financial system.

- Pandemic Support Measures: Specific measures like furlough schemes, direct cash payments, and loan guarantees significantly boosted disposable income, contributing to increased consumer demand and inflationary pressures. For instance, the German Kurzarbeit scheme, while mitigating job losses, also contributed to maintaining consumer spending power during lockdowns.

Supply Chain Disruptions Exacerbated by Pandemic Support

While increased demand fueled by pandemic support pushed prices upward, simultaneous supply chain disruptions exacerbated the inflationary pressures. Lockdowns, border closures, and logistical bottlenecks created cost-push inflation.

- Sectoral Impacts: The energy sector, particularly reliant on global supply chains, experienced significant price increases. Similarly, the semiconductor industry faced major disruptions, impacting the production of various goods.

- Transportation and Labor Shortages: Increased transportation costs due to fuel price hikes and port congestion added to production costs. Simultaneously, labor shortages in various sectors contributed to higher wages and increased production costs.

- Supply Chain Disruptions and Fiscal Stimulus: The increased demand generated by fiscal stimulus collided with constrained supply, creating a perfect storm for inflationary pressures. The inability to meet the increased demand with sufficient supply led to significant price increases across numerous sectors.

Lagging Effects of Pandemic Support on Inflation

Even as the immediate crisis subsided, the lingering effects of pandemic support continue to fuel inflation. The accumulated savings and altered spending habits of consumers are key factors.

Delayed Impact on Consumer Behaviour

Pandemic support measures led to significant savings accumulation for many households. This pent-up demand continues to drive consumer spending, even as the immediate need for support diminishes.

- Pent-Up Demand: Consumers, having accumulated savings during lockdowns, are now spending this accumulated wealth, further fueling demand-pull inflation.

- Shifting Spending Patterns: Consumer spending has shifted, with increased demand for services (travel, hospitality) as restrictions eased, further impacting price levels in these sectors.

- Eurozone Savings and Spending Data: Statistical data from Eurostat and other sources clearly demonstrate the increase in savings during the pandemic and the subsequent rise in consumer spending, highlighting the delayed impact on inflation.

Wage Growth and Inflationary Pressures

The increased demand for goods and services is leading to increased competition for labor, resulting in higher wages. This wage growth further fuels the inflationary spiral.

- Labor Market Tightness: The tight labor market within the Eurozone is contributing to significant wage growth, as employers compete for workers.

- Wage-Price Spiral: The upward pressure on wages is creating a self-perpetuating cycle, as higher wages lead to higher production costs, resulting in further price increases.

- Eurozone Wage Growth and Inflation Correlation: Analysis of Eurozone data reveals a strong correlation between wage growth and inflation, underscoring the concerns of the ECB.

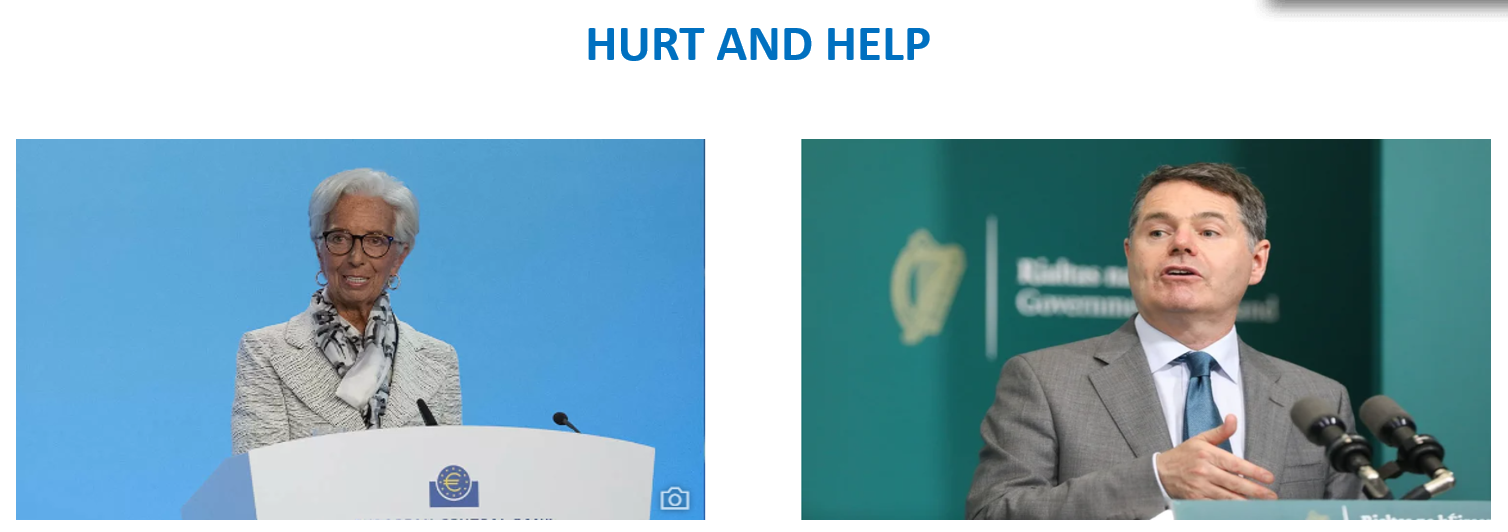

The ECB's Response to Inflationary Pressures

Faced with persistently high inflation, the ECB has implemented a series of measures to curb inflationary pressures.

Monetary Policy Tightening

The ECB has embarked on a path of monetary policy tightening, primarily through interest rate hikes and a reduction of its asset purchase program.

- Interest Rate Hikes: Raising interest rates increases borrowing costs for businesses and consumers, dampening demand and slowing down inflation.

- Balancing Growth and Price Stability: The ECB faces the challenge of balancing the need to control inflation with the need to avoid triggering a recession. Finding the right level of interest rate hikes is a delicate balancing act.

- ECB Communication Strategy: The ECB's communication strategy plays a crucial role in managing market expectations and guiding the response of businesses and consumers to its monetary policy actions.

Challenges and Future Outlook

The ECB faces significant challenges in managing inflation while avoiding a recession. The lasting effects of pandemic fiscal support, combined with geopolitical factors, complicate the task.

- Stagflation Risk: The combination of high inflation and slow economic growth (stagflation) poses a significant risk.

- Geopolitical Factors: The war in Ukraine and subsequent energy crisis have added to inflationary pressures, further complicating the ECB's policy decisions.

- Future Monetary Policy: The future direction of ECB monetary policy will depend on the evolution of inflation, economic growth, and geopolitical developments. Continued monitoring of these factors is crucial.

Conclusion

The lingering effects of pandemic fiscal support continue to significantly influence inflation within the Eurozone, presenting a complex challenge for the ECB. Understanding the interplay between increased money supply, supply chain disruptions, and persistent consumer demand is crucial to effectively manage inflationary pressures. The ECB's response, involving monetary policy tightening, is aimed at restoring price stability, but navigating this delicate balance requires careful consideration of potential economic downsides. Staying informed about the ECB on inflation and its policy decisions is paramount for businesses and individuals alike. Continue to monitor developments related to the ECB and inflation for a better understanding of the economic landscape.

Featured Posts

-

Ambanis Reliance Strong Earnings Signal Positive Outlook For Indian Market

Apr 29, 2025

Ambanis Reliance Strong Earnings Signal Positive Outlook For Indian Market

Apr 29, 2025 -

Co Occurrence Of Adhd Autism And Intellectual Disability In Adults A Recent Study

Apr 29, 2025

Co Occurrence Of Adhd Autism And Intellectual Disability In Adults A Recent Study

Apr 29, 2025 -

Jeff Goldblums Wife Emilie Livingston Age Kids And Their Life Together

Apr 29, 2025

Jeff Goldblums Wife Emilie Livingston Age Kids And Their Life Together

Apr 29, 2025 -

Analyse Deutsche Teams In Champions League Klassikern

Apr 29, 2025

Analyse Deutsche Teams In Champions League Klassikern

Apr 29, 2025 -

Nine African Countries Affected By Pw Cs Operational Closure

Apr 29, 2025

Nine African Countries Affected By Pw Cs Operational Closure

Apr 29, 2025