The Economic Fallout Of Trump's China Tariffs: Higher Costs And Empty Shelves

Table of Contents

Soaring Consumer Prices: The Direct Impact of Trump's China Tariffs

Trump's tariffs directly increased the cost of imported goods from China, leading to a noticeable rise in consumer prices. This "pass-through" effect, where increased import costs are passed down the supply chain to consumers, had a significant impact on household budgets.

Increased Import Costs

- Electronics: Tariffs on electronics, including smartphones, laptops, and televisions, resulted in noticeable price increases. Many consumers found themselves paying significantly more for the same technology.

- Clothing and Apparel: The cost of clothing and apparel imported from China rose sharply, impacting everything from everyday clothing to more specialized items.

- Furniture and Home Goods: Furniture and home goods, a significant portion of which are imported from China, also saw considerable price increases, making furnishing a home more expensive.

These price hikes weren't isolated incidents. Data from the Bureau of Labor Statistics (and other relevant sources – insert actual data and citation here if possible) clearly demonstrate the correlation between the imposition of tariffs and increased consumer prices for these goods and others.

Inflationary Pressures

The increased import costs fueled broader inflationary pressures throughout the US economy. This cost-push inflation, where higher production costs lead to higher prices for consumers, created a ripple effect across numerous sectors.

- Increased Prices of Domestic Goods: Higher import costs for raw materials and intermediate goods impacted the prices of domestically produced items, creating a domino effect on inflation.

- Wage Increases to Combat Inflation: In some sectors, businesses responded to increased costs by increasing wages, further adding to the inflationary pressure.

- Higher Cost of Living: The combined effect of higher prices for imported and domestically produced goods and potential wage increases contributed to a significant increase in the overall cost of living for American families. The potential for a sustained inflationary spiral became a real concern.

Disrupted Supply Chains and Shortages: The Ripple Effect

Trump's China tariffs and the subsequent retaliatory tariffs imposed by China created significant disruptions in global supply chains, leading to both delays and shortages of goods in the US market. This ripple effect severely impacted businesses and consumers alike.

Supply Chain Bottlenecks

- Shipping Delays: Tariffs contributed to increased shipping times and logistical difficulties, further exacerbating existing supply chain vulnerabilities.

- Difficulties Sourcing Materials: Businesses faced challenges in sourcing key components and raw materials from China due to tariffs and trade restrictions.

- Reduced Production Efficiency: The disruption of supply chains hampered the ability of businesses to produce goods efficiently, leading to production slowdowns and increased costs. Examples of specific industries affected (e.g., manufacturing, automotive) should be cited here with supporting evidence.

Product Scarcity and Reduced Choice

The disrupted supply chains resulted in shortages of various goods in the US market, limiting consumer choice and creating economic inefficiencies.

- Specific Product Shortages: (Insert specific examples of products experiencing shortages due to tariffs, backed by evidence). This shortage meant consumers either paid more for existing stock, or went without.

- Limited Product Variety: The reduced availability of imported goods resulted in a decrease in product variety for consumers, limiting options and potentially impacting consumer satisfaction.

- Opportunity Cost: The reduced availability of goods created an "opportunity cost" – the loss of potential economic benefits due to the decreased availability of goods and services.

Long-Term Economic Damage: The Enduring Legacy of Trump's China Tariffs

The trade war initiated by Trump's China tariffs had long-lasting negative consequences extending far beyond immediate price increases and shortages.

Retaliatory Tariffs and Trade Wars

China responded to Trump's tariffs with retaliatory tariffs, creating an escalating trade war that harmed both economies.

- Impact on US Exports: Chinese retaliatory tariffs negatively affected numerous US export industries, leading to job losses and reduced economic activity. Specific examples and data are needed here to support the claim.

- Reduced Economic Growth: The trade war contributed to a slowdown in economic growth for both the US and China, with negative global implications.

Damage to US Businesses and the Global Economy

The uncertainty surrounding trade policies damaged business confidence and investment, hindering long-term economic growth.

- Reduced Investment: Businesses became hesitant to invest in new projects and expansion due to the unpredictable nature of trade relations.

- Decreased Competitiveness: The trade war potentially reduced the long-term competitiveness of US businesses in the global market.

- Damage to Global Trade: The escalation of trade tensions between the two largest economies in the world had a broader destabilizing effect on global trade and the international economic order.

Conclusion

Trump's China tariffs resulted in increased consumer prices, disrupted supply chains, and potential long-term economic damage. The "pass-through" effect of tariffs directly impacted consumer wallets, while the disruption of global supply chains led to shortages and reduced choice. Further, the retaliatory tariffs and escalating trade war created significant uncertainty, damaging business confidence and potentially harming the long-term competitiveness of the US economy. Understanding the full economic fallout of Trump's China tariffs is crucial. Continue your research to learn more about the impact on specific industries and long-term consequences for consumers. The lasting effects of Trump's China tariffs highlight the complexities and potential downsides of protectionist trade policies.

Featured Posts

-

Cancer Drug Setback Akeso Stock Plummets On Disappointing Trial Results

Apr 29, 2025

Cancer Drug Setback Akeso Stock Plummets On Disappointing Trial Results

Apr 29, 2025 -

Lynas Rare Earths Seeks Us Funding For Texas Refinery Amid Cost Increases

Apr 29, 2025

Lynas Rare Earths Seeks Us Funding For Texas Refinery Amid Cost Increases

Apr 29, 2025 -

Jeff Goldblums Wife Emilie Livingston Age Kids And Their Life Together

Apr 29, 2025

Jeff Goldblums Wife Emilie Livingston Age Kids And Their Life Together

Apr 29, 2025 -

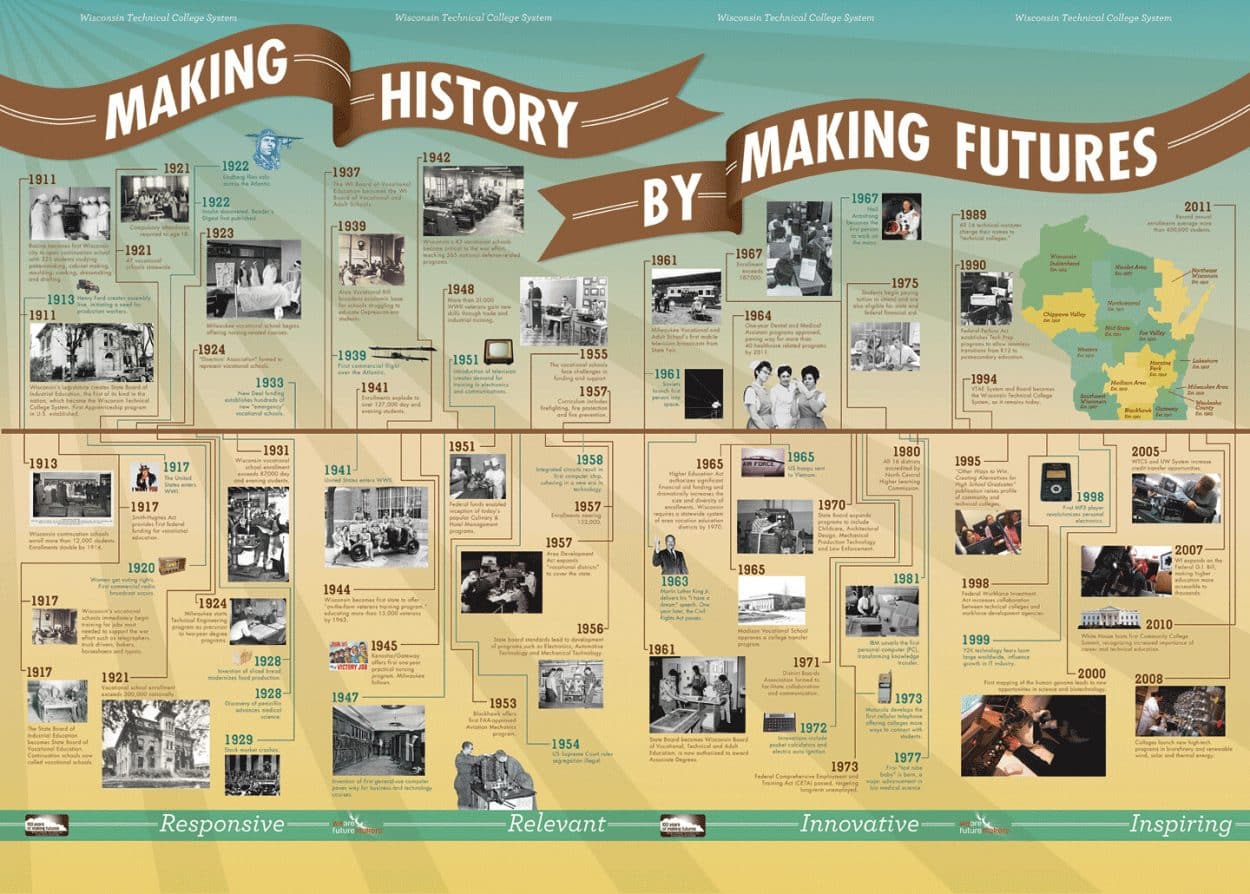

Lgbt Legal History A Timeline Of Key Figures And Events

Apr 29, 2025

Lgbt Legal History A Timeline Of Key Figures And Events

Apr 29, 2025 -

Analyzing Trumps Next 100 Days Trade Deals Deregulation And Executive Orders

Apr 29, 2025

Analyzing Trumps Next 100 Days Trade Deals Deregulation And Executive Orders

Apr 29, 2025