The Economic Fallout Of Trump's Trade Offensive: A Risk To US Financial Supremacy

Table of Contents

Increased Tariffs and Their Ripple Effects

Trump's trade offensive, characterized by aggressive tariff increases on imported goods, had a multi-faceted negative impact on the US economy. The increased tariffs triggered a chain reaction, affecting consumer prices, businesses, and export markets alike.

Impact on Consumer Prices

Tariffs directly increased the price of numerous imported goods. This inflationary pressure squeezed consumer spending, a crucial driver of US economic growth.

- Examples: Increased prices on steel, aluminum, washing machines, and numerous consumer electronics.

- Statistics: Studies showed significant price increases ranging from 5% to 20% on affected goods, depending on the tariff rate and product.

- Consumer Sentiment: Consumer confidence surveys reflected a palpable decrease in optimism, as consumers faced higher prices for everyday goods.

Damage to US Businesses and Industries

Many US businesses, especially those relying on imported components or exporting to affected markets, suffered significantly. The increased costs and reduced competitiveness led to job losses and business closures.

- Industries Impacted: Manufacturing, agriculture, and retail sectors experienced the most substantial negative effects.

- Job Losses: Studies estimate thousands of jobs lost due to reduced competitiveness and factory closures resulting from the tariffs.

- Case Studies: Numerous case studies documented the struggles of specific companies forced to lay off workers or shut down operations due to increased input costs.

Retaliatory Tariffs and Reduced Exports

Trump's tariffs provoked retaliatory measures from several countries, notably China and the European Union. These counter-tariffs significantly reduced US exports and further hindered economic growth.

- Retaliatory Measures: China, the EU, and other countries imposed tariffs on various US goods, including agricultural products and manufactured items.

- Reduced Exports: Statistics showed a decline in US exports to key trading partners, impacting industries reliant on global sales.

- Specific Sector Impacts: The agricultural sector was particularly hard hit, with farmers facing reduced demand for their products in retaliatory markets.

Disruption of Global Supply Chains

The unpredictable nature of Trump's trade policies created significant uncertainty, disrupting established global supply chains and negatively impacting economic growth.

Increased Uncertainty and Reduced Investment

Businesses, facing fluctuating tariff rates and uncertain trade relationships, became hesitant to invest. This reduced capital expenditure further hampered economic expansion.

- Delayed Investments: Many companies postponed expansion plans, fearing further trade disruptions and increased costs.

- Reduced Capital Expenditure: Statistics revealed a decline in business investment during the period of increased trade tensions.

- Expert Opinions: Economists widely cited the uncertainty caused by the trade offensive as a major factor suppressing economic growth.

Shifting Global Trade Dynamics

Trump's trade policies accelerated a shift in global trade relationships. Countries began forging new trade partnerships, reducing US influence in the global economic landscape.

- New Trade Alliances: The rise of regional trade agreements and alternative partnerships weakened the US's traditional dominance in global trade.

- Shifting Trade Flows: Statistics illustrate a redistribution of trade flows, with some countries bypassing the US in favor of new partners.

- Impact on US Global Standing: The unpredictable and protectionist approach damaged US credibility as a reliable trading partner, diminishing its influence on global trade negotiations.

Erosion of US Financial Supremacy

The economic fallout from Trump's trade offensive poses a serious threat to US financial supremacy in the long term.

Damage to US Reputation and Credibility

The imposition of tariffs and unpredictable trade policies damaged the US's reputation as a reliable and predictable trading partner. This eroded investor confidence and negatively impacted financial markets.

- International Criticism: US trade policies faced widespread criticism from international organizations and governments.

- Decline in Rankings: The US's ranking on various global economic indicators declined, reflecting the negative impact of the trade war.

- Long-Term Consequences: Experts warn that the damage to US credibility could have lasting consequences for its global financial standing.

Weakening of the US Dollar

Fluctuations in the value of the US dollar have been partly attributed to the uncertainty generated by the trade policies. A weaker dollar increases the cost of imports and could inflate debt burdens.

- Correlation between Trade Policies and Dollar Value: Studies suggest a correlation between the escalation of trade tensions and fluctuations in the US dollar's exchange rate.

- Potential Future Scenarios: A sustained weakening of the dollar could have significant consequences for the US economy and its global financial role.

- Impact on US Debt: A weaker dollar can increase the cost of servicing US debt, potentially straining the nation's finances.

Rise of Alternative Global Financial Centers

The diminished US influence in global trade and finance creates opportunities for rival financial centers to emerge as significant players in the global economy.

- Alternative Financial Hubs: Countries like China and the EU are actively positioning themselves as alternative financial hubs.

- Shift in Global Capital Flows: The trade policies could accelerate a shift in global capital flows away from the US.

- Long-Term Implications: This shift could erode US dominance in global finance, affecting its economic power and influence.

Conclusion

Trump's trade offensive inflicted significant economic damage, impacting consumer prices, businesses, and global trade relationships. The resulting disruption to supply chains, reduced investment, and damage to US credibility pose a substantial risk to US financial supremacy. Increased tariffs, retaliatory measures, and a weakening dollar have all contributed to this economic fallout. Understanding the economic fallout of Trump's trade offensive is crucial for navigating the future of US financial supremacy. Continue exploring the complexities of global trade and its impact on the US economy to better understand and address these challenges.

Featured Posts

-

Chainalysis Expands With Ai Acquisition Of Alterya

Apr 22, 2025

Chainalysis Expands With Ai Acquisition Of Alterya

Apr 22, 2025 -

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Analysis

Apr 22, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Analysis

Apr 22, 2025 -

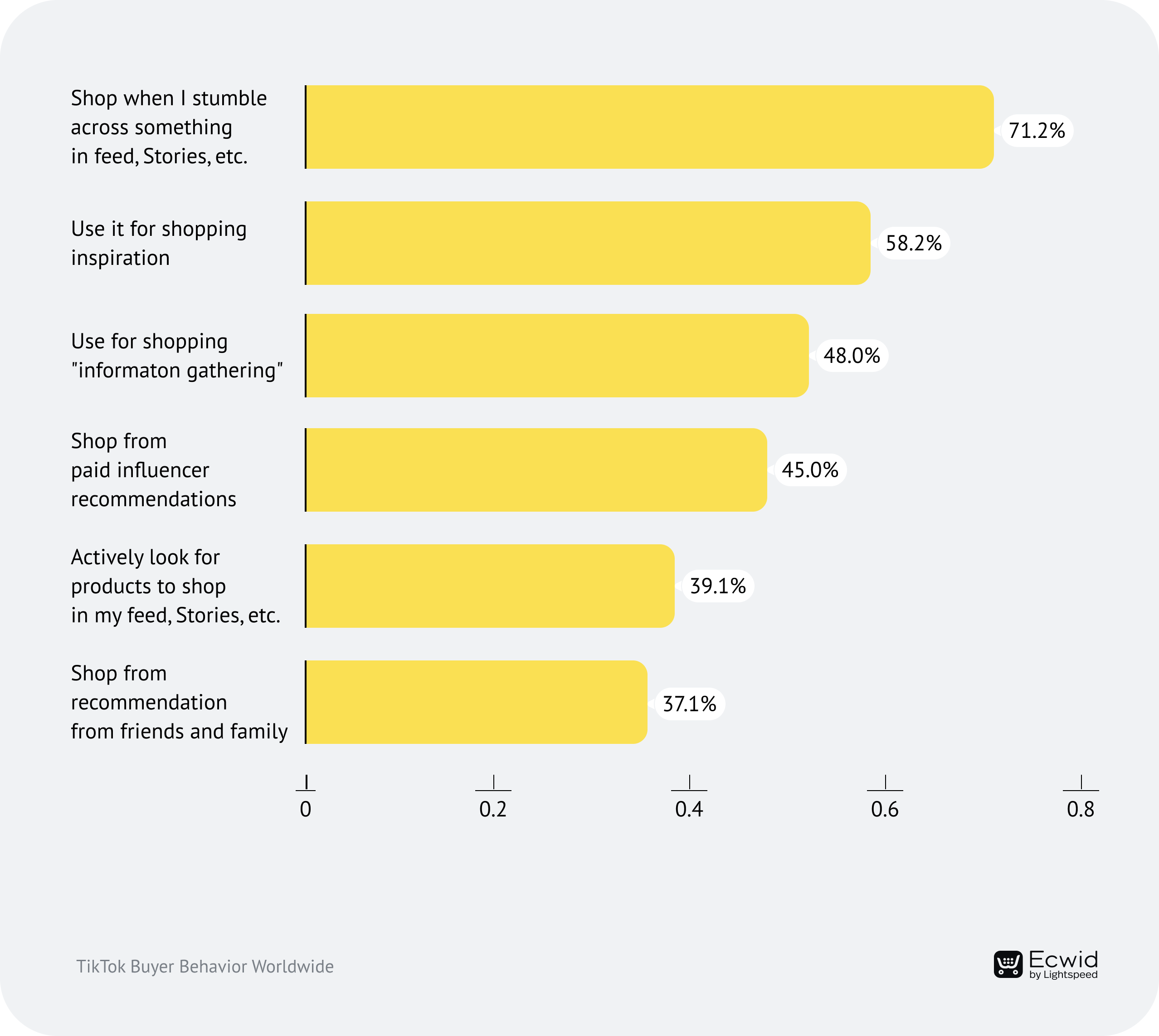

Understanding The Just Contact Us Trend On Tik Tok And Its Implications For Tariffs

Apr 22, 2025

Understanding The Just Contact Us Trend On Tik Tok And Its Implications For Tariffs

Apr 22, 2025 -

E Bay Faces Legal Action Over Banned Chemicals Listed Under Section 230

Apr 22, 2025

E Bay Faces Legal Action Over Banned Chemicals Listed Under Section 230

Apr 22, 2025 -

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025