The Fallout Of US Tariffs: Shein's London IPO On Hold

Table of Contents

The Impact of US Tariffs on Shein's Supply Chain and Profitability

US tariffs on imported goods, particularly textiles and clothing, have directly increased Shein's production costs, significantly impacting its profitability and ultimately contributing to the delay of its London IPO. This increase in costs stems from several key factors:

- Increased costs of raw materials: A significant portion of Shein's raw materials, such as fabrics and textiles, are sourced from China and other countries affected by US tariffs. These tariffs translate directly into higher input costs for Shein.

- Higher shipping and logistics expenses: Trade restrictions and increased customs procedures resulting from the tariffs have led to significant increases in shipping and logistics expenses. Navigating the complexities of tariff regulations adds further costs.

- Reduced profit margins: The combined effect of higher raw material and logistics costs has squeezed Shein's profit margins, making the company less attractive to potential investors and impacting its IPO valuation.

- Pressure to increase prices: To offset increased costs, Shein faces pressure to increase its prices, which could negatively impact sales volume and market share in a highly competitive fast-fashion market. Maintaining its competitive pricing strategy becomes increasingly challenging.

Geopolitical Uncertainty and Investor Sentiment

The ongoing trade war and uncertainty surrounding future US trade policies have created a risk-averse environment for investors, significantly impacting Shein's IPO prospects. This uncertainty translates into:

- Investor hesitancy: Investors are hesitant to commit substantial capital to a company operating in a volatile geopolitical climate where trade relations are unpredictable. The risk of future tariffs or trade restrictions is a major concern.

- Concerns about future growth: The potential for further tariffs or trade restrictions casts doubt on Shein's future growth prospects, discouraging investment. Predicting future profitability becomes more difficult in this environment.

- Impact on Shein's brand image: The association with trade disputes and tariff-related challenges could negatively impact Shein's brand image and reputation, lowering investor confidence. Negative publicity can hurt investor perception.

- Comparison to industry peers: Other fashion companies are also facing similar challenges due to trade protectionism, highlighting the systemic nature of the problem and the industry-wide impact.

Shein's Strategic Response and Alternatives

To mitigate the impact of tariffs and improve investor confidence, Shein is likely exploring several strategic options:

- Supply chain diversification: Diversifying sourcing and manufacturing locations to reduce reliance on tariff-affected regions is a crucial strategy. This might involve shifting production to countries with more favorable trade agreements.

- Technological investments: Investment in automation and technology can enhance efficiency and lower production costs, reducing the impact of tariffs. This could involve integrating more advanced manufacturing techniques.

- Alternative financing: Shein may explore alternative financing options beyond a traditional IPO, such as private equity funding or strategic partnerships, to secure the necessary capital for growth.

- Supplier relationship management: Strengthening relationships with key suppliers and securing stable supply chains can help mitigate disruptions caused by tariffs and geopolitical uncertainty. This involves establishing long-term contracts and partnerships.

The Broader Implications for the Fast Fashion Industry and Global Trade

The situation with Shein's delayed IPO has wider implications for the fast-fashion industry and international trade relationships:

- Increased consumer prices: The increased costs associated with tariffs are likely to be passed on to consumers, leading to higher prices for fast fashion globally. This can affect consumer purchasing power and demand.

- Supply chain shifts: The situation may accelerate a shift in manufacturing and supply chains away from tariff-affected regions towards countries with more favorable trade policies. This could reshape the global landscape of fast-fashion production.

- Increased competition: Fast fashion brands will face increased competition as they navigate these economic challenges, forcing them to innovate and adapt to survive. Strategic agility becomes crucial for success.

- Consequences for global trade: The long-term consequences could extend to international trade agreements and global economic stability, highlighting the interconnectedness of global trade and its susceptibility to protectionist measures.

Conclusion

The delay of Shein's London IPO underscores the profound impact of US tariffs on global businesses, particularly within the fast-fashion industry. The increased costs, geopolitical uncertainties, and investor anxieties are significant hurdles that necessitate strategic adaptation and resilience. The case of Shein serves as a stark reminder of the interconnectedness of global trade and the vulnerability of businesses operating within this complex environment.

Call to Action: Understanding the fallout of US tariffs and their impact on global companies like Shein is crucial. Stay informed about developments in international trade and the evolving landscape of the fast-fashion industry to anticipate future challenges and opportunities. Further research on the effects of US trade policies on Shein's London IPO is recommended to fully grasp the complexities of this evolving situation.

Featured Posts

-

Fotosesiya Rianni Spokuslive Merezhivo Ta Rozhevi Vidtinki

May 06, 2025

Fotosesiya Rianni Spokuslive Merezhivo Ta Rozhevi Vidtinki

May 06, 2025 -

Nay Golemite Khitove Na Ed Shiyrn Vdkhnoveni Ot Riana

May 06, 2025

Nay Golemite Khitove Na Ed Shiyrn Vdkhnoveni Ot Riana

May 06, 2025 -

New Jazz Album From Unexpected Source Jeff Goldblum

May 06, 2025

New Jazz Album From Unexpected Source Jeff Goldblum

May 06, 2025 -

Zendayas Sister Alleges Abandonment During Cancer A Familys Broken Trust

May 06, 2025

Zendayas Sister Alleges Abandonment During Cancer A Familys Broken Trust

May 06, 2025 -

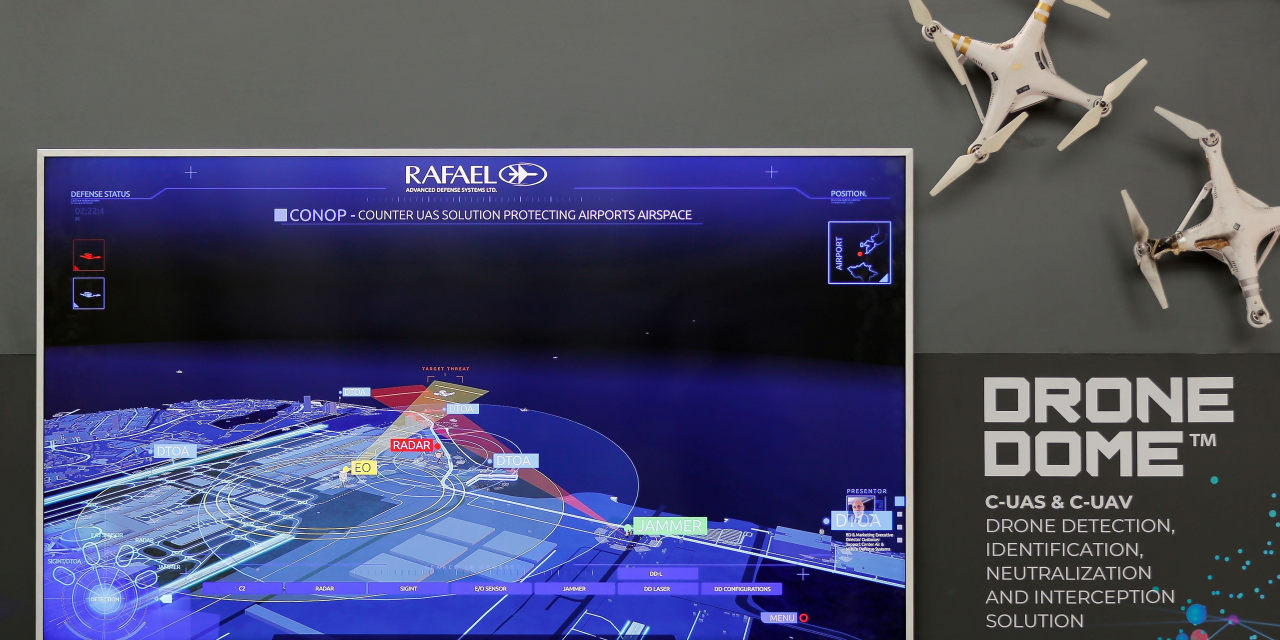

The Evolving Dynamics Of The Us Israel Azerbaijan Strategic Partnership

May 06, 2025

The Evolving Dynamics Of The Us Israel Azerbaijan Strategic Partnership

May 06, 2025