The GOP's Internal Battle Over Trump's Tax Reform

Table of Contents

The TCJA, championed by the Trump administration, significantly lowered the top corporate tax rate from 35% to 21% and implemented various individual tax cuts. Initially, the measure received broad, albeit not unanimous, support within the Republican Party. However, underlying disagreements about economic philosophy and political strategy have since intensified, leading to the ongoing internal battle that defines the GOP's current landscape. This article will explore the persistent divisions within the party regarding Trump's tax reform, examining the economic arguments and political fallout that continue to shape the Republican Party.

The Economic Arguments for and Against Trump's Tax Cuts

The economic impact of the TCJA remains a central point of contention within the GOP. Supporters and critics cite different data to support their fundamentally opposing viewpoints.

Proponents' Claims of Economic Growth

Proponents of the TCJA, often aligning with the "trickle-down economics" philosophy, point to indicators of economic growth following its implementation.

- Increased Investment: They argue the lower corporate tax rate spurred increased business investment, leading to job creation and expansion. While some studies have shown a correlation between the TCJA and increased capital expenditures, [cite a source showing increased investment], the extent to which this is directly attributable to the tax cuts remains debated.

- Job Creation: Advocates claim the TCJA fueled job growth. However, [cite a source questioning the job creation claims], disentangling the effects of the tax cuts from other economic factors proves challenging.

- Higher Wages: While some sectors saw wage increases, [cite a source showing wage increases in specific sectors], the overall impact on wage growth for the average American worker is fiercely disputed. The claim of widespread wage increases due to the TCJA lacks conclusive empirical support.

The core argument rests on the idea that tax cuts stimulate the economy by encouraging businesses to invest more, ultimately benefiting workers through job creation and higher wages.

Critics' Concerns about Income Inequality and the National Debt

Critics within the GOP, often prioritizing fiscal responsibility and addressing income inequality, express serious concerns about the long-term effects of the TCJA.

- Increased National Debt: They point to a significant increase in the national debt following the tax cuts, arguing that the revenue loss was not offset by sufficient economic growth. [Cite a source showing the increase in national debt]. This raises concerns about the long-term sustainability of the US economy.

- Income Inequality: Critics argue that the benefits of the TCJA disproportionately favored wealthy corporations and high-income individuals, exacerbating income inequality. [Cite a source showing the disproportionate benefits of the tax cuts]. The lack of targeted relief for low and middle-income families is a major point of contention.

- Lack of Long-Term Economic Sustainability: The long-term economic sustainability of the tax cuts is questioned, given the rising national debt and the lack of evidence for sustained, broad-based economic growth that offsets the revenue loss. [Cite a source outlining concerns about long-term sustainability].

These arguments emphasize the importance of fiscal responsibility and highlight the negative societal consequences of widening income disparities.

Political Fallout and the 2024 Elections

The economic arguments surrounding the TCJA have significant political ramifications, particularly as the 2024 election approaches.

Impact on Republican Voters

The tax cuts have not created a unified front within the Republican party.

- Varying Opinions among Republican Voters: Working-class Republicans may feel the tax cuts did not benefit them sufficiently, while wealthier donors may see them as a success. This internal divide presents a significant challenge for the party. [Cite a source showing differing opinions among Republican voters on the TCJA]

- Impact on Different Demographics: The effect of the TCJA varies across demographic groups, creating further divisions within the party and affecting the party’s ability to appeal to a broader electorate. [Cite a source showing the varied impact on different demographics]. This makes attracting swing voters exceptionally difficult.

Internal Divisions and Future Policy

The internal disagreements over Trump's tax reform are casting a long shadow over the GOP's future.

- Potential Challenges for Future GOP Policymaking: The ongoing debate about the TCJA highlights deep divisions regarding economic policy within the party, making it difficult to develop and implement a unified agenda. [Cite a source discussing challenges for future GOP policymaking].

- The Ongoing Debate about Future Tax Reforms: The lingering controversy surrounding the TCJA is likely to dominate discussions about future tax reforms within the GOP, further hindering the party's ability to present a cohesive policy platform. [Cite a source about the ongoing debate on future tax reforms].

The divisions within the GOP on tax policy are hindering the party's ability to develop a coherent and unified approach to critical economic issues.

Conclusion: The Enduring Legacy of Trump's Tax Reform on the GOP

The Trump administration's Tax Cuts and Jobs Act continues to reverberate through the Republican Party. The economic arguments for and against the TCJA have exposed deep ideological fissures within the GOP, fueling intense internal debate and impacting the party's electoral strategy. The varying impact on different voter segments, the unresolved questions regarding economic sustainability, and the rising national debt all contribute to the enduring legacy of the TCJA. The unresolved tensions within the party highlight the challenges the GOP faces in developing a cohesive economic platform moving forward.

Key Takeaways: The TCJA has had a lasting impact on the GOP, creating deep divisions over economic policy and electoral strategy. The disagreements surrounding its effectiveness and fairness continue to shape internal party dynamics and its future prospects.

Call to action: Stay informed about the ongoing debate surrounding Trump's tax reform. Follow the future legislative battles on tax policy and learn more about the impact of the Tax Cuts and Jobs Act on the American economy. Further research into the economic data surrounding the TCJA and its political consequences is crucial for a full understanding of this pivotal moment in American political and economic history.

Featured Posts

-

February 26th Nyt Spelling Bee Puzzle Answers And Strategies

Apr 29, 2025

February 26th Nyt Spelling Bee Puzzle Answers And Strategies

Apr 29, 2025 -

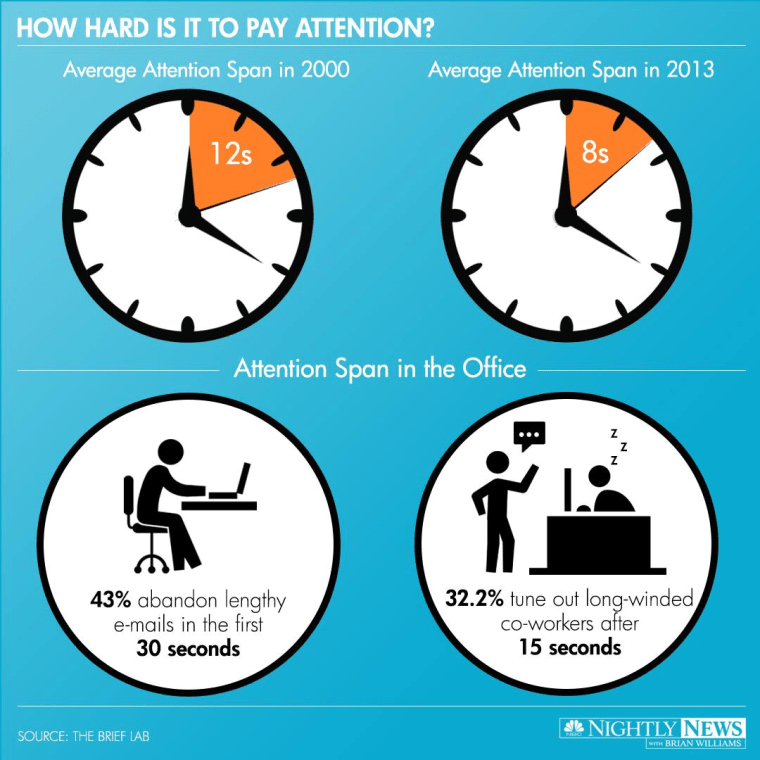

Tik Tok And Adhd Is The Algorithm Making Us Question Our Attention Spans

Apr 29, 2025

Tik Tok And Adhd Is The Algorithm Making Us Question Our Attention Spans

Apr 29, 2025 -

Nyt Spelling Bee Answers For April 27 2025 Find The Pangram

Apr 29, 2025

Nyt Spelling Bee Answers For April 27 2025 Find The Pangram

Apr 29, 2025 -

Who Is Emilie Livingston Jeff Goldblums Wife Family And Biography

Apr 29, 2025

Who Is Emilie Livingston Jeff Goldblums Wife Family And Biography

Apr 29, 2025 -

Is This The New Quinoa Exploring The Latest Superfood

Apr 29, 2025

Is This The New Quinoa Exploring The Latest Superfood

Apr 29, 2025