The Growing Appeal Of The Venture Capital Secondary Market

Table of Contents

Increased Liquidity for Venture Capital Investors

Traditional venture capital investments are notoriously illiquid. Investors typically commit capital for a long period, often seven to ten years or more, before realizing any returns through an exit event such as an initial public offering (IPO) or acquisition. This illiquidity presents significant challenges for limited partners (LPs) in venture capital funds and other investors needing to manage their portfolio's liquidity effectively. The secondary market offers a solution by providing a pathway to realize returns well before a traditional exit.

This liquidity is particularly beneficial for:

- Limited Partners (LPs): LPs often face pressure to meet capital calls for other investments and may need to divest some of their venture capital holdings to maintain a balanced portfolio.

- Early-stage investors: Angel investors or seed-stage fund managers may prefer to quickly recycle capital into new opportunities.

- Investors needing to manage cash flow: The secondary market allows for a more predictable cash flow stream.

The key advantages of accessing this liquidity include:

- Faster return on investment: Generate returns significantly sooner than waiting for a traditional exit.

- Diversification opportunities: Reinvest proceeds into other promising ventures or asset classes.

- Effective portfolio risk management: Reduce concentration risk and adjust portfolio allocation more dynamically.

Attractive Returns and Diversification Opportunities

The venture capital secondary market offers the potential for attractive returns, sometimes exceeding those available in the primary market. This is partly due to discounted valuations in certain situations, offering a compelling entry point for buyers. Moreover, this asset class presents a unique diversification benefit, often exhibiting a low correlation with traditional public markets. This makes it an appealing addition to a well-diversified investment portfolio.

Investing in the secondary market can offer various strategies to manage risk, including:

- Upside participation: Benefit from the potential appreciation of the underlying company's value.

- Downside protection: Employ strategies to limit potential losses, such as purchasing stakes at a discounted valuation.

Specific benefits of this approach include:

- Access to seasoned investments: Invest in companies with established track records and proven business models.

- Potential for higher returns: Leverage discounted valuations to achieve superior returns compared to primary market investments.

- Reduced concentration risk: Diversify across a wider range of companies and sectors, mitigating the risk associated with concentrating investments in a limited number of ventures.

Sophisticated Investment Strategies and Due Diligence

Navigating the venture capital secondary market requires a sophisticated approach. The complexity of valuations and the nature of private investments necessitate thorough due diligence. This is far more involved than typical public market investments. Investors must understand the nuances of private company valuations, including factors like revenue growth, profitability, and market position.

Several investment strategies are employed in this market, including:

- Direct purchases: Buying stakes directly from existing investors.

- Fund-of-funds: Investing in secondary funds managed by specialized firms.

The role of specialized firms and advisors is critical. They bring expertise in:

- Valuation: Determining the fair market value of the stake being traded.

- Negotiation: Securing favorable terms for buyers and sellers.

- Legal and regulatory compliance: Ensuring all transactions comply with relevant rules and regulations.

Investors should consider:

- Understanding portfolio company fundamentals: Conduct thorough due diligence on the underlying companies.

- Expertise in pricing and negotiation: Employ skilled professionals to assist in determining fair pricing and negotiating favorable terms.

- Robust risk management strategies: Implement strategies to mitigate potential losses, considering factors such as market conditions and the financial health of the portfolio company.

Technological Advancements and Market Efficiency

Technological advancements have significantly improved the venture capital secondary market's efficiency and accessibility. Online platforms facilitate faster and more transparent transactions, connecting buyers and sellers more effectively. Data analytics and AI are increasingly utilized to enhance due diligence and valuation processes, providing investors with deeper insights into the performance and potential of target companies.

These improvements have led to:

- Faster transaction processing: Reduce the time and costs associated with closing deals.

- Improved access to market data and insights: Provide investors with more comprehensive information to support investment decisions.

- Greater efficiency in matching buyers and sellers: Connect investors with suitable opportunities more effectively.

Conclusion: Navigating the Growing Appeal of the Venture Capital Secondary Market

The venture capital secondary market presents a compelling opportunity for investors seeking increased liquidity, attractive returns, and diversification. The combination of enhanced liquidity, sophisticated investment strategies, and technological advancements has significantly increased its appeal. However, navigating this complex market requires a thorough understanding of the underlying dynamics and careful due diligence. Professional guidance is crucial.

To capitalize on the growing venture capital secondary market, explore the potential of this exciting asset class and consider engaging with experienced professionals who can help you navigate the complexities of investing in the secondary market. Don't miss the opportunity to diversify your portfolio and potentially unlock superior returns in this dynamic and evolving sector of private equity.

Featured Posts

-

60 911 Cayenne

Apr 29, 2025

60 911 Cayenne

Apr 29, 2025 -

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 29, 2025

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 29, 2025 -

Kortere Levensverwachting Bij Volwassenen Met Adhd Feiten En Fabels

Apr 29, 2025

Kortere Levensverwachting Bij Volwassenen Met Adhd Feiten En Fabels

Apr 29, 2025 -

Trumps Decision A Posthumous Pardon For Pete Rose

Apr 29, 2025

Trumps Decision A Posthumous Pardon For Pete Rose

Apr 29, 2025 -

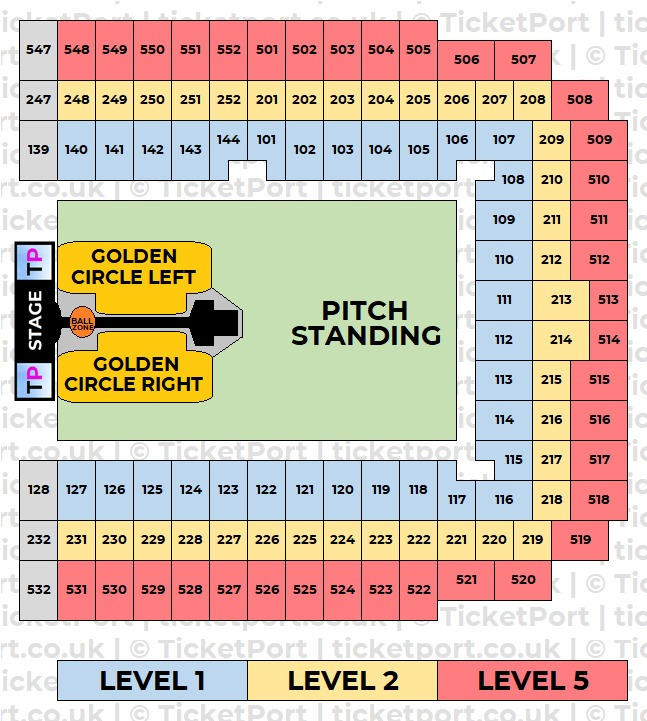

Getting Tickets For The Capital Summertime Ball 2025 Tips And Strategies

Apr 29, 2025

Getting Tickets For The Capital Summertime Ball 2025 Tips And Strategies

Apr 29, 2025