The House Votes On The Amended Trump Tax Bill: Implications Explained

Table of Contents

Key Changes in the Amended Trump Tax Bill

The original Trump Tax Cuts and Jobs Act of 2017 significantly lowered corporate and individual income tax rates. However, the amended version presented to the House introduces several key modifications. These changes aim to address criticisms leveled against the original bill, and potentially achieve specific political objectives. While the exact details may vary depending on the final version, some key amendments reportedly include:

- Corporate Tax Rates: While the original bill reduced the corporate tax rate to 21%, the amended version may propose further adjustments, potentially influenced by economic performance and revenue projections. [Link to relevant government document or news source].

- Individual Income Tax Brackets: The amended bill may modify existing individual income tax brackets, potentially adjusting the rates for different income levels. [Link to relevant government document or news source].

- Standard Deductions: Changes to standard deductions could impact taxpayers, particularly those with lower incomes, potentially increasing or decreasing their tax liabilities. [Link to relevant government document or news source].

- Tax Credits (e.g., Child Tax Credit): The child tax credit, a significant aspect of the original bill, may see modifications in the amended version, affecting families with children. These changes could alter eligibility requirements or credit amounts. [Link to relevant government document or news source].

- State and Local Tax (SALT) Deductions: The original bill placed a cap on SALT deductions, a point of contention for many taxpayers. The amended version might adjust this cap or even eliminate it altogether, impacting taxpayers in high-tax states significantly. [Link to relevant government document or news source].

The reasoning behind these amendments is multifaceted and subject to ongoing political debate. Some argue they address flaws in the original legislation, while others believe they serve specific political agendas.

Economic Impact of the Amended Trump Tax Bill

The economic implications of the amended Trump Tax Bill are far-reaching and complex, prompting diverse predictions from economic experts.

- GDP Growth: Some economists predict a short-term boost in GDP growth due to increased consumer spending, while others foresee a more muted impact, or even a negative long-term effect. [Cite economic source: e.g., Brookings Institution].

- Inflation: The potential for increased inflation is a key concern, as reduced taxes could lead to increased consumer demand. [Cite economic source: e.g., Congressional Budget Office].

- Job Creation: The impact on job creation is also debated. While tax cuts can stimulate business investment, leading to job growth, the effect may depend on other economic factors and the specific nature of the tax changes. [Cite economic source: e.g., Tax Foundation].

- Income Inequality: Critics argue that the original Trump Tax Bill exacerbated income inequality, and the amendments might either mitigate or worsen this trend, depending on their specific provisions. [Cite economic source: e.g., Institute on Taxation and Economic Policy].

These predictions highlight the need for continued analysis and careful observation of the economic data following the bill’s implementation.

Political Ramifications of the House Vote

The House vote on the amended Trump Tax Bill carries significant political weight, impacting various facets of the political landscape.

- Upcoming Elections: The bill's impact on voters will likely play a significant role in upcoming elections, influencing voter sentiment and shaping political campaigns.

- Public Opinion: Public opinion on the amended bill is highly divided, with strong support from some and staunch opposition from others. This division will likely shape the political narrative and influence future legislation.

- Relationship Between the House and the Senate: The bill’s passage in the House doesn’t guarantee its approval in the Senate. Disagreements between the two chambers could lead to further amendments or even the bill's failure to become law.

- The President's Legislative Agenda: The success or failure of the amended Trump Tax Bill will be a key indicator of the President's legislative power and influence.

Analyzing voting patterns within the House reveals strong partisan divides, with support largely concentrated among one political party and opposition among the other. This further underscores the bill’s highly politicized nature.

Impact on Different Income Groups

The amended Trump Tax Bill’s impact varies considerably depending on income levels.

- Low-Income Families: The effect on low-income families is complex and depends on the specific changes to tax credits and deductions. Some might benefit from increased credits, while others could see a negligible impact or even a slight increase in their tax burden.

- Middle-Class Families: The middle class is likely to experience a mixed impact, with some families potentially benefitting from tax cuts while others may not see significant changes.

- High-Income Earners: High-income earners typically stand to gain the most from significant tax cuts, though this could be offset by adjustments to capital gains taxes or other provisions.

Detailed simulations and calculations are necessary to determine the precise impact on specific income brackets.

Conclusion

The amended Trump Tax Bill introduces significant changes to the original legislation, impacting corporate tax rates, individual income tax brackets, and various tax credits and deductions. The potential economic consequences are far-reaching and complex, affecting GDP growth, inflation, job creation, and income inequality. Politically, the bill’s passage through the House signifies a key moment in the ongoing legislative battle and will heavily influence upcoming elections and the President's agenda. The varying impacts on different income groups, from low-income to high-income families, underscore the bill’s multifaceted nature and potential for unequal effects. Understanding the implications of the amended Trump Tax Bill is paramount. Stay informed about ongoing developments, research the bill's implications for your personal finances, and engage in responsible civic discourse on this crucial issue. Understand the amended Trump Tax Bill's impact on you and your community – your informed participation is vital to shaping its future.

Featured Posts

-

Yurskiy 90 Let So Dnya Rozhdeniya Nasledie Ostroumiya I Paradoksalnogo Talanta

May 24, 2025

Yurskiy 90 Let So Dnya Rozhdeniya Nasledie Ostroumiya I Paradoksalnogo Talanta

May 24, 2025 -

Evrovidenie 2013 2023 Kuda Propali Pobediteli Konkursa

May 24, 2025

Evrovidenie 2013 2023 Kuda Propali Pobediteli Konkursa

May 24, 2025 -

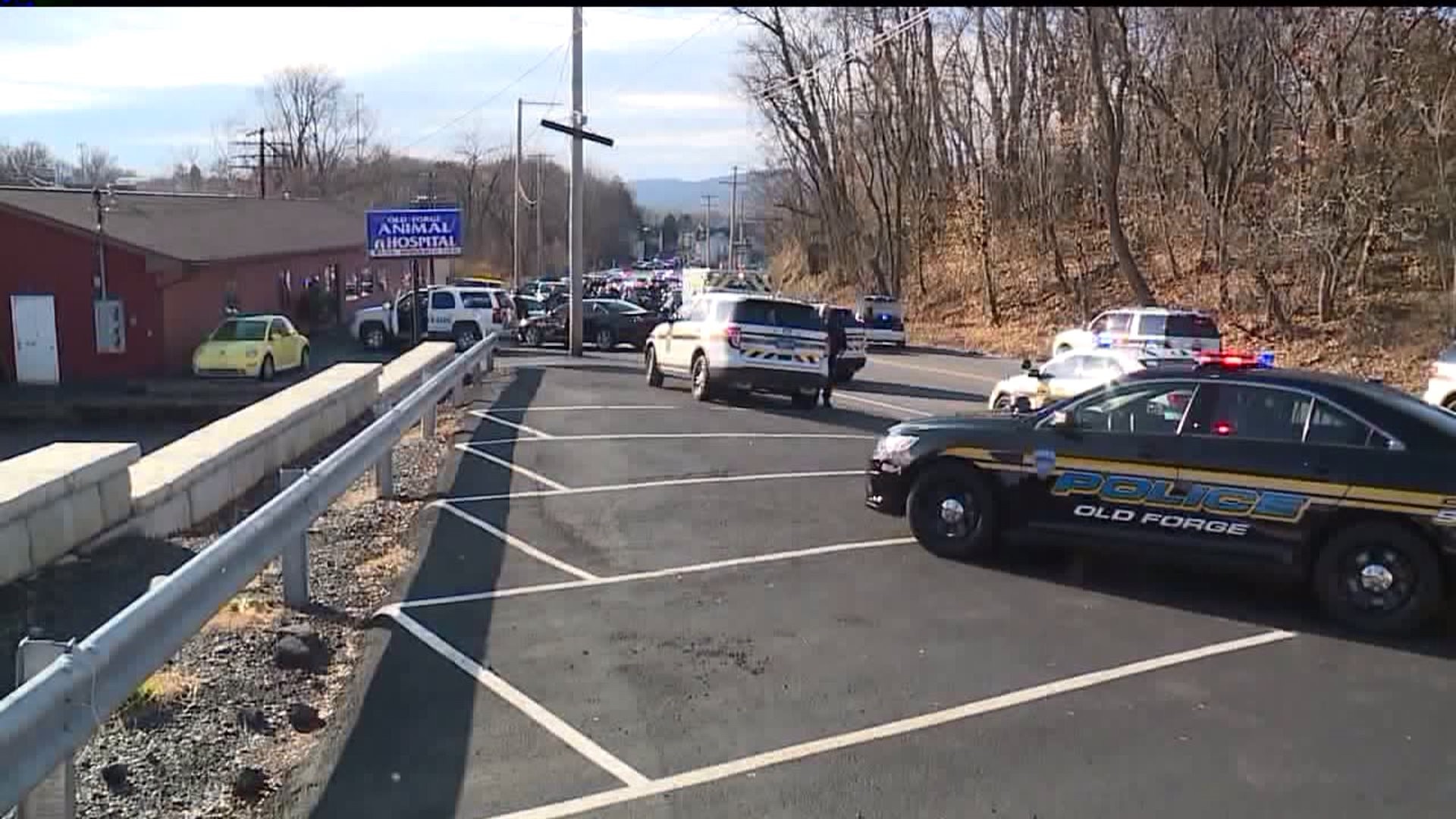

Dramatic Highway Refuel During Police Chase

May 24, 2025

Dramatic Highway Refuel During Police Chase

May 24, 2025 -

Stitchpossible Weekend Box Office 2025 Showdown Could Shatter Records

May 24, 2025

Stitchpossible Weekend Box Office 2025 Showdown Could Shatter Records

May 24, 2025 -

Dylan Dreyers Postpartum Weight Loss Her Inspiring Story On The Today Show

May 24, 2025

Dylan Dreyers Postpartum Weight Loss Her Inspiring Story On The Today Show

May 24, 2025