The IMF's Assessment: How Trump's Trade War Impacts The Financial System

Table of Contents

IMF's Assessment: Key Findings on Global Trade Disruptions

The IMF, a critical institution monitoring global economic stability, played a vital role in analyzing the effects of Trump's Trade War. Their assessment consistently highlighted the overwhelmingly negative consequences of the escalating trade tensions. The IMF's reports documented a significant reduction in global trade volume, directly attributable to the increased tariffs and retaliatory measures. This disruption to the free flow of goods and services created considerable uncertainty in global markets, eroding investor confidence and severely impacting businesses reliant on international trade.

- Reduction in global trade volume: The IMF quantified the decrease in global trade, showing a noticeable slowdown compared to pre-trade-war projections. This impacted numerous sectors, from manufacturing to agriculture.

- Increased uncertainty in global markets: The unpredictable nature of the trade policies fueled market volatility, making it difficult for businesses to plan long-term strategies. This uncertainty extended beyond the directly affected industries.

- Negative impact on investor confidence: Investor sentiment soured significantly as the trade war unfolded, leading to decreased investment and a reluctance to engage in cross-border transactions.

- Disruption of supply chains: Global supply chains, intricately woven across nations, suffered major disruptions. Businesses faced delays, increased costs, and difficulties in sourcing essential components.

Impact on Global Growth and Economic Forecasts

The IMF's revised growth forecasts during and after the Trump administration's trade war painted a stark picture. Projected GDP growth for major economies, including the US, China, and the European Union, was significantly lowered. The increased risk of recession became a prominent concern, especially as the trade conflict intensified and uncertainty lingered. The impact wasn't uniform; some regions suffered more severely than others, highlighting the regional disparities in the economic effects of the trade war.

- Lower projected GDP growth for major economies: The IMF's models demonstrated a quantifiable reduction in GDP growth for most major global economies due to the trade war.

- Increased risk of recession: The sustained uncertainty and decreased trade created a heightened risk of global recession.

- Regional disparities in economic impact: The impact varied, with some export-oriented economies suffering more intensely than others less dependent on international trade.

- Impact on employment and investment: Reduced economic activity led to job losses and a decrease in investment, further hindering economic recovery.

The Role of Currency Fluctuations

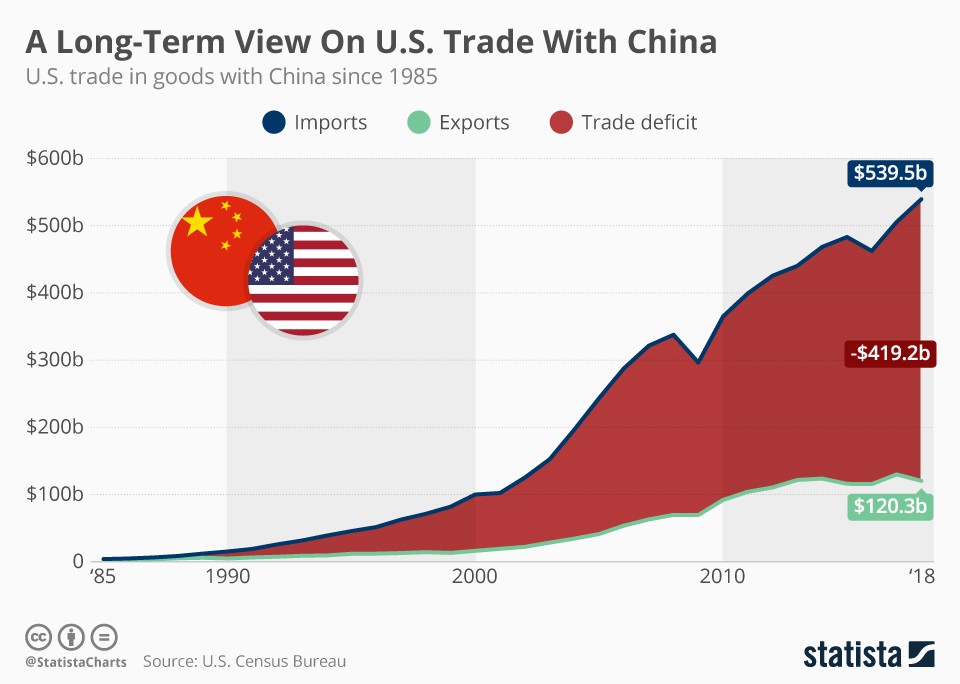

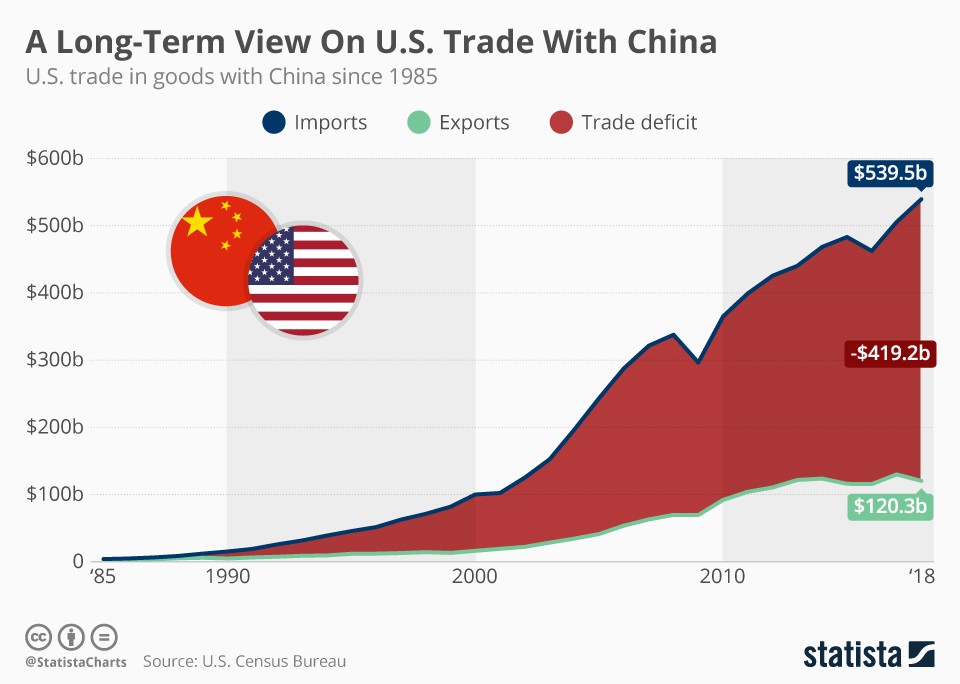

The trade war also significantly impacted exchange rates. Currency volatility increased dramatically, amplifying the negative consequences. For example, fluctuations in the US dollar impacted international trade competitiveness, making US exports either more or less attractive depending on the direction of the exchange rate. This created currency risks for investors and businesses engaged in international commerce.

- Dollar appreciation/depreciation impact: Fluctuations in the dollar's value relative to other currencies influenced the price of imports and exports, further impacting trade balances.

- Impact on international trade competitiveness: A strong dollar could make US exports less competitive while simultaneously making imports cheaper, hurting domestic producers.

- Currency risk for investors and businesses: Businesses involved in international trade faced increased exchange rate risks, adding to the uncertainty and volatility.

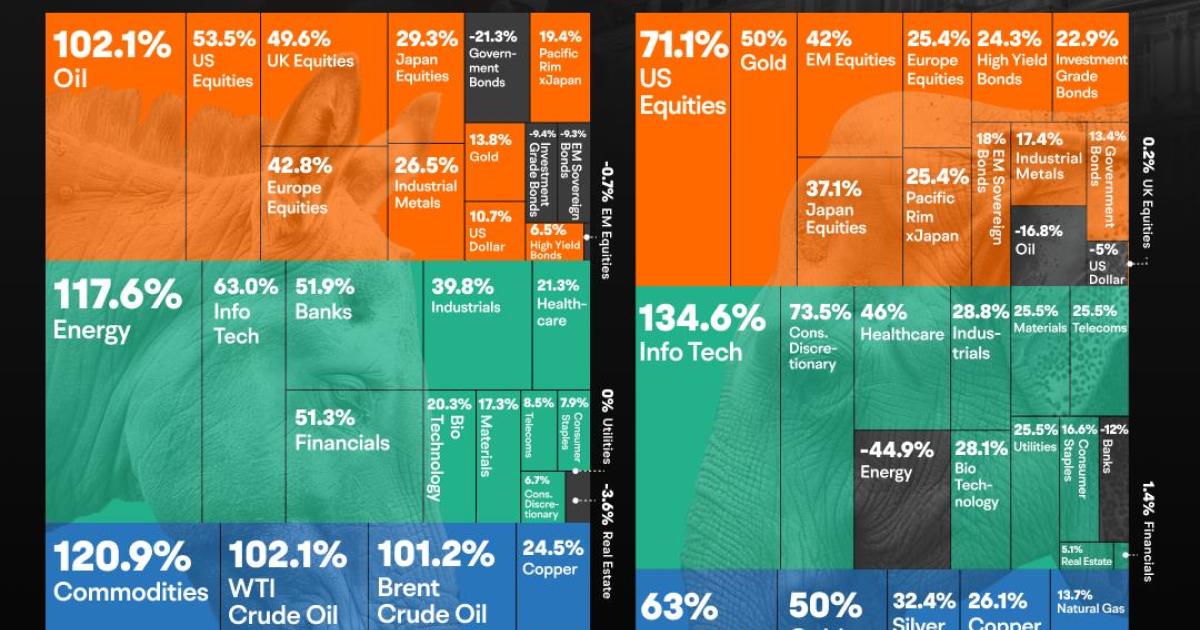

Financial Market Volatility and Investor Sentiment

Trump's Trade War significantly impacted financial markets. Stock markets experienced increased volatility, bond yields fluctuated, and commodity prices were affected by the uncertainty. Investors, reacting to the heightened uncertainty, shifted their behavior, exhibiting a flight to safety by increasing their holdings in safer assets. This impacted portfolio diversification strategies as investors sought to minimize risk amidst the turbulent environment.

- Increased market volatility: Stock markets experienced significant swings as investors reacted to news and developments related to the trade war.

- Changes in investor risk appetite: Investors became more risk-averse, reducing their exposure to riskier assets.

- Impact on portfolio diversification strategies: Investors adjusted their investment strategies to mitigate the increased uncertainty.

- Rise in safe-haven assets (e.g., gold): Demand for safe-haven assets, such as gold, increased as investors sought to protect their investments.

Long-Term Consequences and Policy Recommendations

The IMF's assessment highlights the potential for long-term damage to global trade relationships resulting from Trump's Trade War. The organization issued policy recommendations urging a return to predictable and transparent trade policies, emphasizing the importance of international cooperation to mitigate the negative consequences. These recommendations included trade policy reforms aimed at fostering a more stable and predictable global trading environment.

- Long-term damage to global trade relationships: The trade war damaged trust and cooperation between nations, potentially leading to longer-term disruptions in global trade.

- Recommendations for trade policy reform: The IMF advocated for more transparent and predictable trade policies to reduce uncertainty and improve the stability of the global trading system.

- Importance of international cooperation: The IMF underscored the importance of multilateral cooperation and dialogue to address trade disputes effectively.

- Need for predictable trade policies: The IMF stressed the necessity of clear and consistent trade policies to enhance investor confidence and encourage global trade.

Conclusion: Understanding the Lasting Impact of Trump's Trade War on the Global Financial System

The IMF's assessment unequivocally demonstrates the significant negative impact of Trump's Trade War on the global financial system. The resulting disruptions to global trade, decreased economic growth, increased market volatility, and damaged investor confidence underscore the considerable long-term consequences. The IMF's policy recommendations offer a path towards mitigating these lasting effects. To gain a deeper understanding, we encourage readers to further research the IMF's reports on Trump's Trade War and its global implications. Explore related topics, such as the impact on specific sectors or regions, to gain a comprehensive perspective on this crucial economic event.

Featured Posts

-

Violenza Contro Ristoranti Palestinesi 200 Manifestanti In Piazza

Apr 23, 2025

Violenza Contro Ristoranti Palestinesi 200 Manifestanti In Piazza

Apr 23, 2025 -

Chistiy Ponedelnik 2025 Traditsii Chto Mozhno I Nelzya Kak Postitsya

Apr 23, 2025

Chistiy Ponedelnik 2025 Traditsii Chto Mozhno I Nelzya Kak Postitsya

Apr 23, 2025 -

White House Pressure Mounts On Fed Chair Powell Amidst Trumps Criticism

Apr 23, 2025

White House Pressure Mounts On Fed Chair Powell Amidst Trumps Criticism

Apr 23, 2025 -

Analyzing The Trump Administrations Impact On The Biotech Industry

Apr 23, 2025

Analyzing The Trump Administrations Impact On The Biotech Industry

Apr 23, 2025 -

Complete 2025 Us Holiday Calendar Federal And Non Federal Holidays

Apr 23, 2025

Complete 2025 Us Holiday Calendar Federal And Non Federal Holidays

Apr 23, 2025