The Impact Of High Down Payments On Canadian Homebuyers

Table of Contents

Reduced Mortgage Payments and Interest Costs

A larger down payment translates directly into a smaller mortgage loan amount. This seemingly simple fact has profound implications for your monthly budget and long-term financial health. By reducing the principal amount you borrow, you significantly decrease your monthly mortgage payments. This is because you'll be paying interest on a smaller sum of money. The cumulative effect over the life of your mortgage is substantial, resulting in significant savings on total interest paid.

- Example: Let's compare a $500,000 home. A 5% down payment ($25,000) leaves a $475,000 mortgage, while a 20% down payment ($100,000) reduces the mortgage to $400,000. The difference in monthly payments and total interest paid over 25 years can be substantial, potentially saving tens of thousands of dollars.

- Lower monthly mortgage payments free up funds for other financial priorities, such as investments, retirement savings, or paying off other debts, thus improving overall household budget and financial stability.

- The long-term savings achieved through reduced interest payments contribute significantly to building wealth and achieving financial security.

Improved Mortgage Approval Rates and Better Loan Terms

Lenders perceive high down payments as a lower risk. A larger down payment demonstrates your financial commitment and reduces the lender's potential loss in case of default. This translates to a significantly higher likelihood of mortgage approval, even in a competitive market.

- Loan-to-Value (LTV) Ratio: The LTV ratio (the loan amount divided by the property value) is a key factor influencing mortgage rates. A higher down payment lowers your LTV ratio, making you a more attractive borrower and often resulting in securing more favorable interest rates.

- Mortgage Options: With a substantial down payment (often 20% or more), you unlock access to a wider range of mortgage products and potentially more competitive interest rates, including conventional mortgages offering the best terms. Smaller down payments may necessitate high-ratio mortgages (insured mortgages), which come with additional insurance premiums.

- Pre-Approval Advantage: Securing pre-approval with a high down payment can strengthen your offer when competing with other buyers, giving you a competitive edge in the current Canadian real estate market.

Faster Homeownership and Reduced Time Spent Saving

Saving for a down payment is a significant undertaking for many aspiring Canadian homeowners. A larger down payment dramatically shortens this timeline. Reaching your target faster means you can enjoy the benefits of homeownership sooner, both financially and psychologically.

- Saving Timeline Comparison: Saving for a 20% down payment on a $500,000 home requires significantly more time than saving for a 5% down payment. This difference can be several years, potentially impacting career progression, family planning, and overall life goals.

- Achieving homeownership earlier provides a sense of stability and financial security, contributing to improved mental well-being and a more positive lifestyle.

- The faster you achieve homeownership, the faster you begin building equity in your property and accumulating wealth.

Challenges and Drawbacks of High Down Payments

While the advantages of high down payments are clear, it's crucial to acknowledge the significant financial commitment involved. Saving a large sum of money requires discipline and sacrifice, potentially impacting other financial goals.

- First-Time Homebuyers' Challenges: For first-time homebuyers with limited savings, accumulating a substantial down payment can present a major obstacle. Many find it difficult to balance saving for a down payment with other financial responsibilities.

- Opportunity Cost: Tying up a large portion of your savings in a down payment means you’re foregoing the potential returns from investing that money elsewhere, such as in stocks, bonds, or other investment vehicles.

- Emergency Funds: It’s crucial to maintain adequate emergency funds, even after making a large down payment. Unexpected expenses could create severe financial stress if a significant portion of your savings is tied up in real estate.

- Government Assistance: Programs like the First-Time Home Buyers’ Incentive can help mitigate the burden of high down payments for eligible Canadians.

Conclusion: Making Informed Decisions About High Down Payments in Canada

High down payments in Canada offer significant advantages, including lower mortgage payments, improved mortgage approval rates, and faster homeownership. However, they also require a substantial financial commitment and may present challenges for those with limited savings. Understanding the interplay between these benefits and drawbacks is crucial for making an informed decision. Before committing to a specific down payment amount, carefully assess your individual financial circumstances, long-term goals, and risk tolerance. Explore various mortgage options, compare interest rates, and seek professional financial advice to optimize your down payment strategy and make informed decisions regarding high down payments for your Canadian home purchase. Weigh the pros and cons of high down payments for Canadian homebuyers carefully to ensure you're making the best choice for your future.

Featured Posts

-

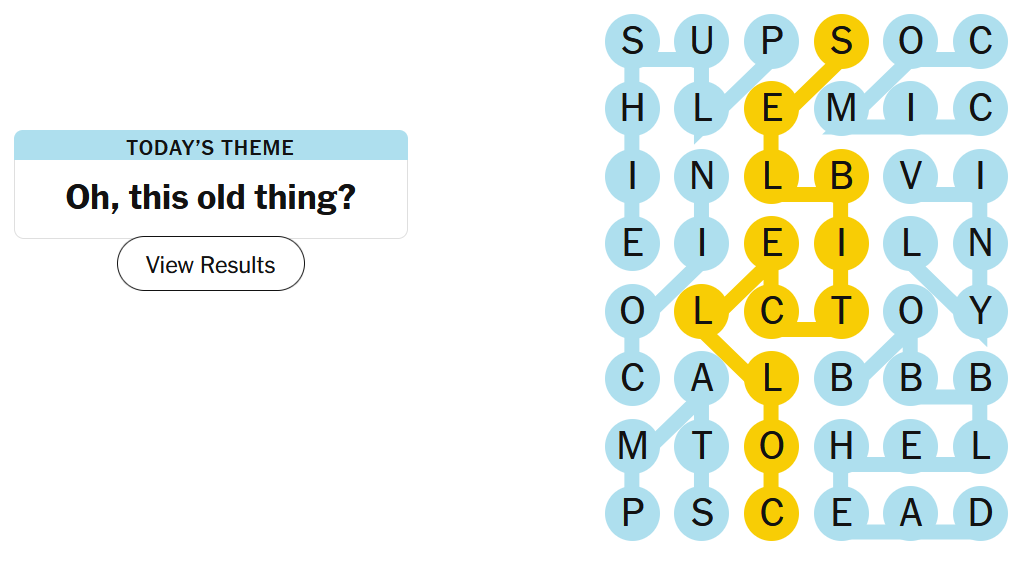

Nyt Strands Game 357 Complete Hints And Solutions For February 23rd

May 09, 2025

Nyt Strands Game 357 Complete Hints And Solutions For February 23rd

May 09, 2025 -

Silniy Snegopad Aeroport Permi Otmenil Reysy

May 09, 2025

Silniy Snegopad Aeroport Permi Otmenil Reysy

May 09, 2025 -

Makron I Tusk Oboronnoe Soglashenie 9 Maya Detali I Posledstviya Dlya Ukrainy

May 09, 2025

Makron I Tusk Oboronnoe Soglashenie 9 Maya Detali I Posledstviya Dlya Ukrainy

May 09, 2025 -

Vs

May 09, 2025

Vs

May 09, 2025 -

Kas Nutiko Dakota Johnson Nuotraukos Su Kraujosruvomis

May 09, 2025

Kas Nutiko Dakota Johnson Nuotraukos Su Kraujosruvomis

May 09, 2025

Latest Posts

-

Microsoft And Asus Xbox Handheld Leaked Images Surface Online

May 10, 2025

Microsoft And Asus Xbox Handheld Leaked Images Surface Online

May 10, 2025 -

The Kilmar Abrego Garcia Story Immigration Politics And The Challenges Of Asylum

May 10, 2025

The Kilmar Abrego Garcia Story Immigration Politics And The Challenges Of Asylum

May 10, 2025 -

Leaked Photos Show Microsoft And Asus Xbox Handheld Console

May 10, 2025

Leaked Photos Show Microsoft And Asus Xbox Handheld Console

May 10, 2025 -

El Salvadors Gang Violence And The Kilmar Abrego Garcia Case A Us Political Debate

May 10, 2025

El Salvadors Gang Violence And The Kilmar Abrego Garcia Case A Us Political Debate

May 10, 2025 -

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 10, 2025

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 10, 2025