The Impact Of Reduced Consumer Spending On The Credit Card Industry

Table of Contents

Decreased Credit Card Transactions and Revenue

Reduced consumer spending directly translates to a decline in credit card transactions and, consequently, lower revenue for credit card companies. This is a fundamental link impacting the entire financial ecosystem.

Lower Transaction Volumes

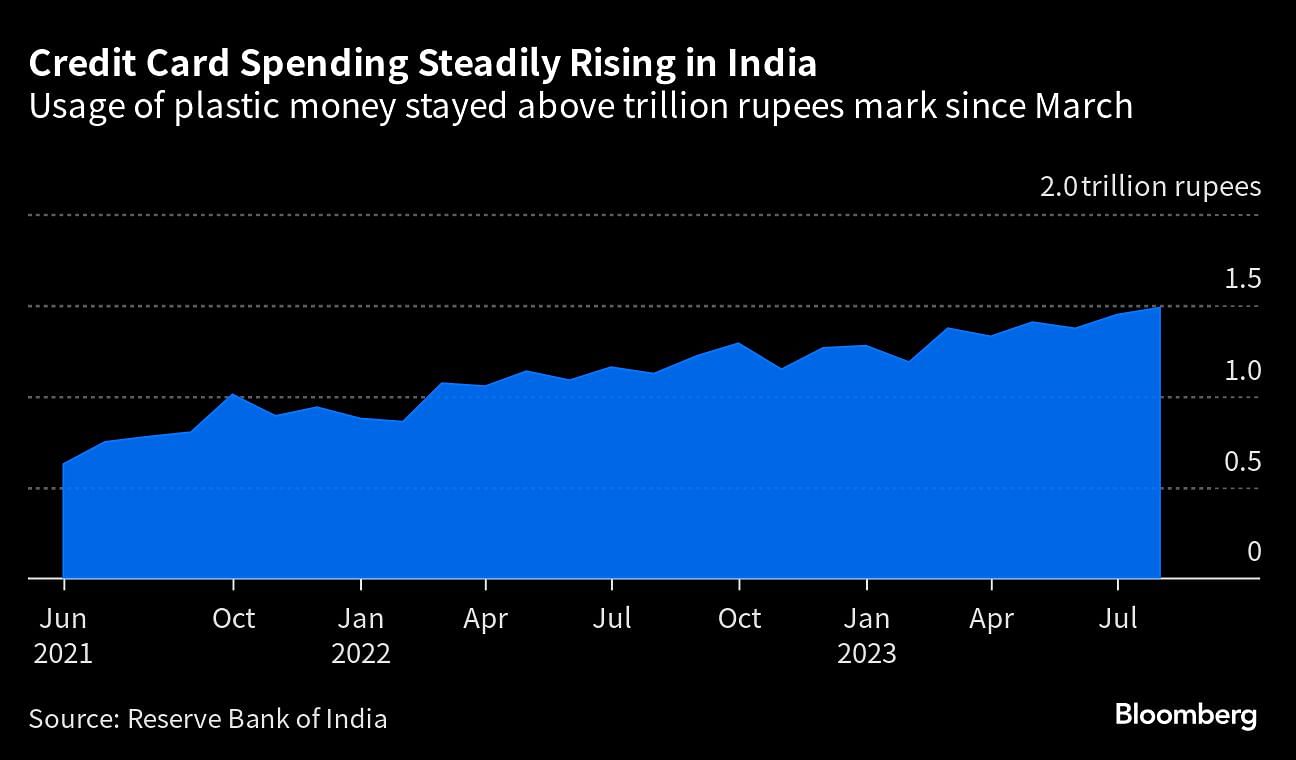

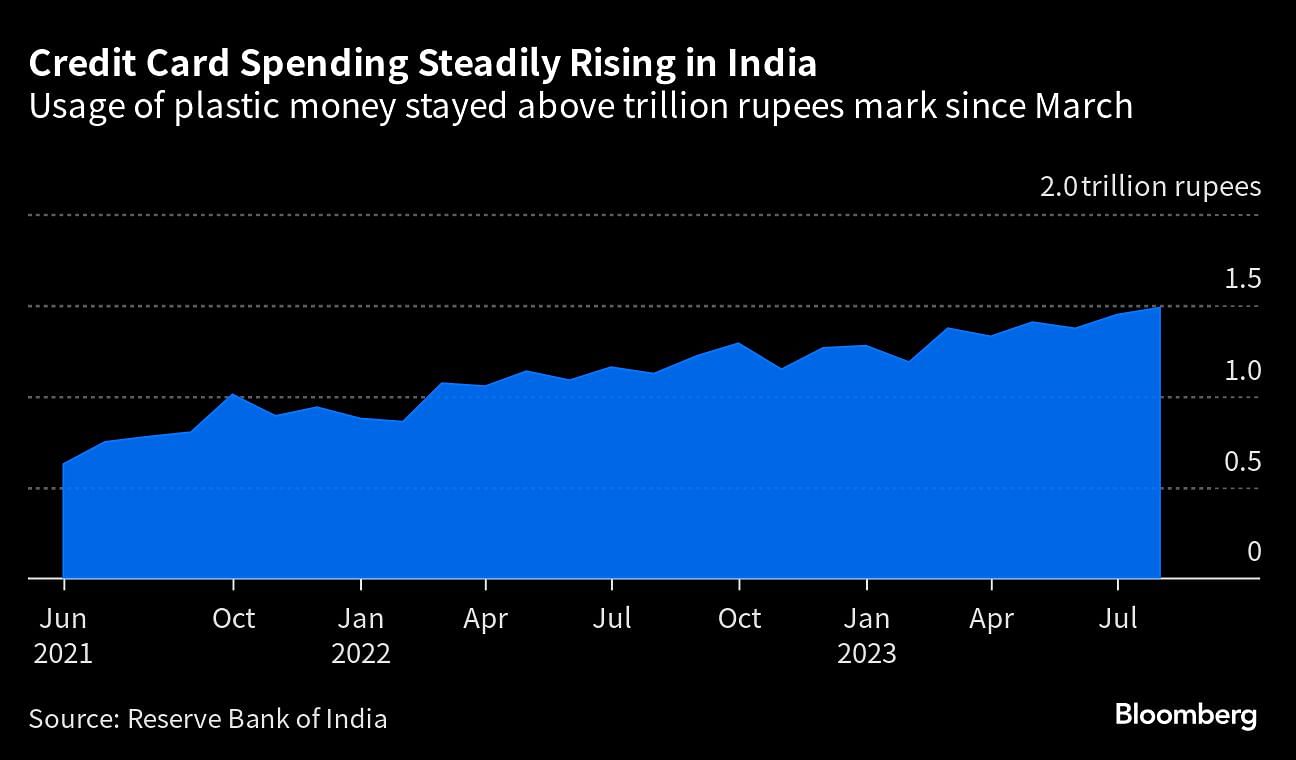

The correlation between consumer spending and credit card transaction volume is undeniable. As consumers tighten their belts, spending less on discretionary items, the number of credit card transactions naturally decreases.

- Reduced spending in various sectors: Retail sales, particularly in non-essential goods, are significantly impacted. Travel and tourism have also seen a sharp decline, resulting in fewer credit card transactions for flights, hotels, and related services. Dining out and entertainment spending are also down.

- Declining transaction volumes: Recent data from [Insert reputable source, e.g., a financial news publication or industry report] indicates a [Insert percentage]% decrease in credit card transactions compared to [Time period]. This figure underscores the gravity of the situation.

- Impact on credit card companies' revenue streams: Lower transaction volumes directly translate to reduced interchange fees (fees merchants pay for each transaction) and interest income (on outstanding balances), significantly affecting the bottom line of credit card companies.

Impact on Merchant Fees

Merchant fees constitute a crucial revenue stream for credit card companies. Lower transaction volumes directly impact this revenue source.

- Merchant fee structure: Credit card companies charge merchants a percentage of each transaction processed using their cards. This percentage varies depending on factors like the merchant's industry and transaction volume.

- Decline in transactions affecting merchant fees: A reduction in overall transaction volume directly reduces the total merchant fees collected by credit card companies. A [Insert percentage]% decrease in transaction volume can result in a comparable or even higher percentage reduction in merchant fee revenue.

- Implications for credit card companies' profitability: The reduced income from merchant fees, coupled with lower interest income, creates a significant challenge to the profitability of credit card companies. This necessitates strategic adjustments to maintain financial stability.

Increased Credit Card Delinquency Rates

Reduced consumer spending is intrinsically linked to increased credit card delinquency rates. As economic hardship mounts, many consumers struggle to manage their debt.

Economic Hardship and Missed Payments

Job losses, inflation, and stagnant wage growth are major contributors to the rise in credit card delinquency. Consumers facing financial strain are more likely to miss credit card payments.

- Impact of job losses and inflation: The combination of job losses and rising inflation significantly reduces disposable income, leaving many consumers with insufficient funds to cover their credit card payments.

- Rising delinquency rates: Data from [Insert reputable source, e.g., credit bureaus] shows a [Insert percentage]% increase in credit card delinquency rates over the past [Time period]. This trend reflects the increasing economic pressure on consumers.

- Impact on credit card companies' balance sheets: Increased delinquency rates lead to increased charge-offs (write-offs of bad debt) and a significant reduction in the credit card companies' profitability. This can trigger a domino effect across the entire financial system.

Strategies to Mitigate Delinquency

Credit card companies are implementing various strategies to address the rising delinquency rates and minimize financial losses.

- Debt consolidation programs: These programs allow consumers to consolidate their credit card debt into a single, lower-interest loan, making it easier to manage their payments.

- Hardship assistance programs: These programs offer temporary payment reductions or waivers to consumers experiencing financial difficulties.

- Effectiveness of strategies: The effectiveness of these strategies varies. While some consumers benefit significantly, others may still struggle despite these measures. The long-term impact of these strategies on delinquency rates remains to be seen.

Adapting to the Changing Consumer Landscape

The reduced consumer spending trend is forcing credit card companies to adapt to a rapidly changing consumer landscape.

Shifting Consumer Behaviors

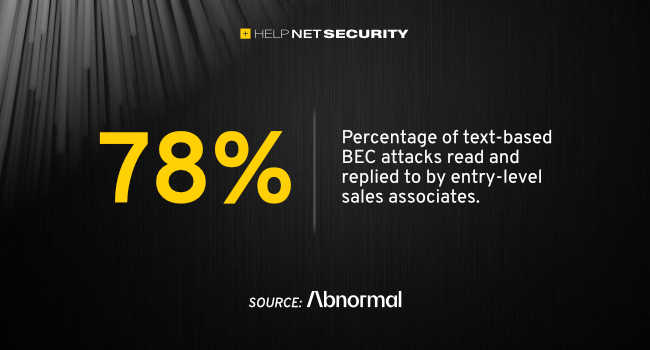

Consumers are increasingly adopting alternative payment methods in response to economic pressures.

- Increased use of cash and debit cards: Many consumers are resorting to cash and debit cards to avoid accumulating credit card debt.

- Rise of Buy Now Pay Later (BNPL) services: BNPL services offer consumers a way to purchase goods and services in installments, often without the high interest rates associated with credit cards, creating stiff competition.

- Impact on credit card companies' market share: The shift in consumer payment preferences poses a significant challenge to the credit card industry's market share and requires innovative strategies to retain customers.

Innovation and New Strategies

Credit card companies are actively seeking new strategies to maintain their market share and competitiveness.

- Reward program adjustments: Credit card companies are adjusting their reward programs to offer more attractive incentives to retain and acquire customers.

- Personalized offers: Tailored offers and personalized services cater to individual consumer needs and spending habits, aiming to encourage continued usage.

- Improved fraud prevention: Robust fraud prevention measures build customer trust and security, enhancing the appeal of credit card usage.

- Impact on future strategies: The success of these strategies will determine the future trajectory of the credit card industry's response to reduced consumer spending.

Conclusion

Reduced consumer spending has a profound and multifaceted impact on the credit card industry. It directly leads to decreased transaction volumes, lower revenue from merchant fees and interest, and significantly higher credit card delinquency rates. This necessitates a fundamental shift in the industry's approach, driving innovation and the implementation of strategic adjustments to address these challenges. Understanding the impact of reduced consumer spending on the credit card industry is crucial for both consumers and businesses. Stay informed about these trends to make informed financial decisions and navigate the changing economic climate effectively. Explore further resources on personal finance management to better understand your options and strategies for navigating these challenging economic times.

Featured Posts

-

Land Your Dream Private Credit Job 5 Essential Tips

Apr 24, 2025

Land Your Dream Private Credit Job 5 Essential Tips

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025 -

Deportation Flights A New Revenue Stream For A Budget Airline

Apr 24, 2025

Deportation Flights A New Revenue Stream For A Budget Airline

Apr 24, 2025 -

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025 -

Cybercriminals Office 365 Exploit Nets Millions Investigation Reveals

Apr 24, 2025

Cybercriminals Office 365 Exploit Nets Millions Investigation Reveals

Apr 24, 2025