The Impact Of Trump's First 100 Days On Elon Musk's Fortune

Table of Contents

Regulatory Changes and Their Influence on Tesla's Stock

Trump's first 100 days saw significant shifts, or in some cases, a lack of shifts, in various regulatory areas that profoundly impacted Tesla's performance and, consequently, Elon Musk's net worth.

Impact of Environmental Regulations (or lack thereof):

The Trump administration's approach to environmental regulations, characterized by a rollback of certain Obama-era policies, had a complex effect on Tesla. While some argued that relaxed regulations could ease the burden on Tesla's production and potentially lower costs, others worried about the long-term impact on the electric vehicle market and consumer perception.

- Specific examples: The weakening of fuel efficiency standards could have potentially reduced the competitive advantage of electric vehicles. Conversely, reduced scrutiny on emissions could have simplified the production process.

- Actual impact: Tesla's stock price saw fluctuations during this period, making it difficult to definitively isolate the impact of environmental policy changes. However, broader market trends and investor sentiment likely played a significant role.

- Data points: Analyzing Tesla's stock performance against relevant indices during Trump's first 100 days alongside changes in environmental regulations provides a clearer picture, although causality is difficult to definitively establish.

Tax Policies and Corporate Incentives:

The Trump administration's proposed tax cuts, particularly the reduction in the corporate tax rate, were anticipated to benefit companies like Tesla. Lower corporate taxes could boost Tesla's profitability, positively impacting its stock price and, by extension, Elon Musk's net worth.

- Specific policies: The Tax Cuts and Jobs Act of 2017, passed after Trump's first 100 days but influenced by the administration's early policy intentions, significantly lowered the corporate tax rate.

- Impact on Tesla: This tax reduction likely contributed to Tesla's improved profitability in subsequent years, though isolating its impact during the first 100 days is challenging.

- Comparative analysis: Comparing Tesla's financial performance under Trump's tax policies with previous administrations' tax regimes could reveal the relative impact of these changes.

Infrastructure Spending and its Potential Impact on Tesla's Infrastructure Needs:

Trump's initial focus on infrastructure spending, though largely still in the planning stages during his first 100 days, held potential implications for Tesla. Increased investment in national infrastructure could potentially create opportunities for Tesla's charging network expansion and overall growth.

- Infrastructure plans: The initial proposals for infrastructure development included investments in transportation, which could have benefited the electric vehicle sector.

- Relevance to Tesla: Enhanced charging infrastructure could have significantly boosted Tesla's sales and expansion potential.

- Long-term strategy: A substantial investment in nationwide charging infrastructure would have undoubtedly been a long-term benefit for Tesla, contributing positively to Musk’s wealth.

The Space Exploration Frontier: SpaceX and Government Contracts

SpaceX, Elon Musk's space exploration company, also felt the indirect effects of policy changes during Trump's first 100 days. Changes in NASA funding and the overall approach to space exploration had a direct impact on SpaceX's prospects.

Changes in NASA Funding and Contracts:

Trump's administration’s stance on NASA's budget and contracting practices could have impacted SpaceX's revenue streams and valuation. Increased funding for space exploration generally benefited private companies like SpaceX.

- Specific NASA contracts: Analyzing specific contracts awarded to SpaceX during this period and comparing them with previous administrations reveals the impact of Trump’s early policies.

- Value to SpaceX: These contracts are crucial for SpaceX's financial health and growth, directly influencing Musk’s net worth.

- Comparison with previous administrations: A comparison of NASA spending under Trump with prior administrations provides context for evaluating the impact on SpaceX and Musk's financial position.

Military Contracts and Defense Spending:

Changes in defense spending and related policies could affect SpaceX's involvement in military or related space projects. Increased defense spending could lead to opportunities for SpaceX, boosting its revenue and valuation.

- Specific contracts or proposals: While pinpointing specific contracts secured by SpaceX directly due to Trump's early policies is difficult, analyzing overall defense spending trends during this period and their correlation with SpaceX’s activities provides valuable insights.

- Impact on SpaceX's financial performance: Any contract secured by SpaceX in this sector would undoubtedly impact its financial performance and thereby Musk's overall wealth.

The Broader Economic Climate and Its Influence

The overall economic climate under Trump's early administration, characterized by both optimism and uncertainty, significantly impacted investor confidence in tech companies like Tesla and SpaceX. This sentiment directly influenced Musk's net worth.

Overall Market Sentiment:

Investor sentiment toward technology stocks, including Tesla, influenced the company's stock price and, consequently, Musk's wealth. Positive market sentiment boosted Tesla's valuation, and conversely, negative sentiment dampened it.

- Market indices during this period: Analyzing the performance of relevant market indices (like the Nasdaq) during Trump's first 100 days provides context for understanding the broader market forces impacting Tesla and SpaceX.

- Trends in the tech sector: Examining the overall trends within the tech sector during this time offers further context for evaluating Tesla's performance and Musk's net worth.

- Investor sentiment analysis: Assessing investor sentiment toward Tesla specifically and the tech sector as a whole provides a more nuanced understanding.

Geopolitical Events and Their Impact:

Geopolitical events during Trump's first 100 days, including trade negotiations and international relations, affected Tesla and SpaceX's global operations and, therefore, Musk's financial position.

- Relevant international events: Analyzing the effects of significant international events during this period on Tesla's global supply chains and SpaceX's international partnerships offers insight into their impact on Musk's wealth.

- Trade policies: Trump's early trade policies, particularly his stance on international trade agreements, could have impacted Tesla's manufacturing and supply chains, influencing Musk's net worth.

Conclusion: Trump's Early Days and the Shaping of Elon Musk's Fortune

In conclusion, Trump's first 100 days in office had a multifaceted impact on Elon Musk's fortune. While disentangling the direct cause-and-effect relationship between specific policies and Musk’s net worth remains complex, analyzing changes in environmental regulations, tax policies, and the overall economic climate, alongside shifts in NASA funding and the broader geopolitical landscape, paints a clearer picture of the influence of Trump's early administration on the financial trajectories of Tesla and SpaceX. Further research into specific policy implementation and its effects on the financial performance of these companies is crucial for a more comprehensive understanding. To delve deeper, explore further research on "Trump's first 100 days" and its impact on "Elon Musk's fortune," "Tesla stock," and "SpaceX valuation."

Featured Posts

-

Nhl 2025 Trade Deadline Predicting The Playoff Picture

May 09, 2025

Nhl 2025 Trade Deadline Predicting The Playoff Picture

May 09, 2025 -

2 360

May 09, 2025

2 360

May 09, 2025 -

The High Cost Of Childcare One Mans Experience With Babysitting And Daycare

May 09, 2025

The High Cost Of Childcare One Mans Experience With Babysitting And Daycare

May 09, 2025 -

Federal Reserve Rate Outlook Pressures Mount Pause Likely

May 09, 2025

Federal Reserve Rate Outlook Pressures Mount Pause Likely

May 09, 2025 -

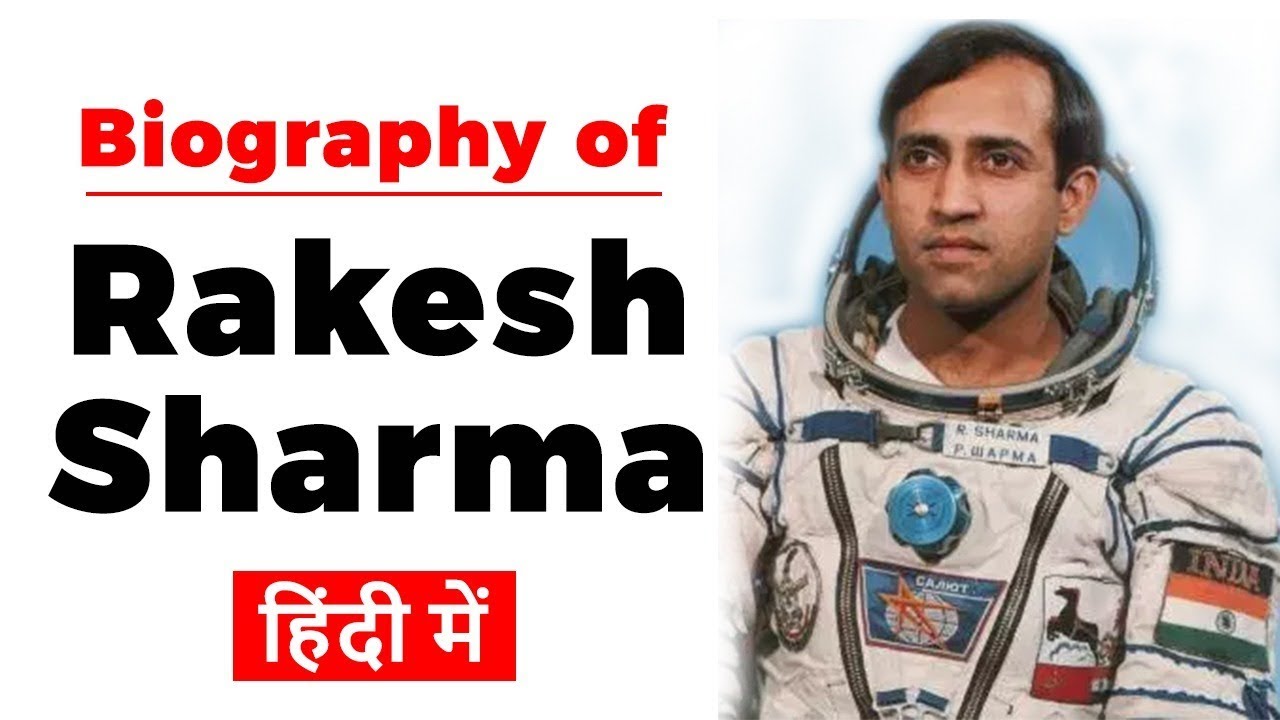

The Life And Legacy Of Rakesh Sharma Indias Pioneer In Space Exploration

May 09, 2025

The Life And Legacy Of Rakesh Sharma Indias Pioneer In Space Exploration

May 09, 2025