The Importance Of Net Asset Value (NAV) For Amundi Dow Jones Industrial Average UCITS ETF Investors

Table of Contents

How NAV is Calculated for the Amundi Dow Jones Industrial Average UCITS ETF

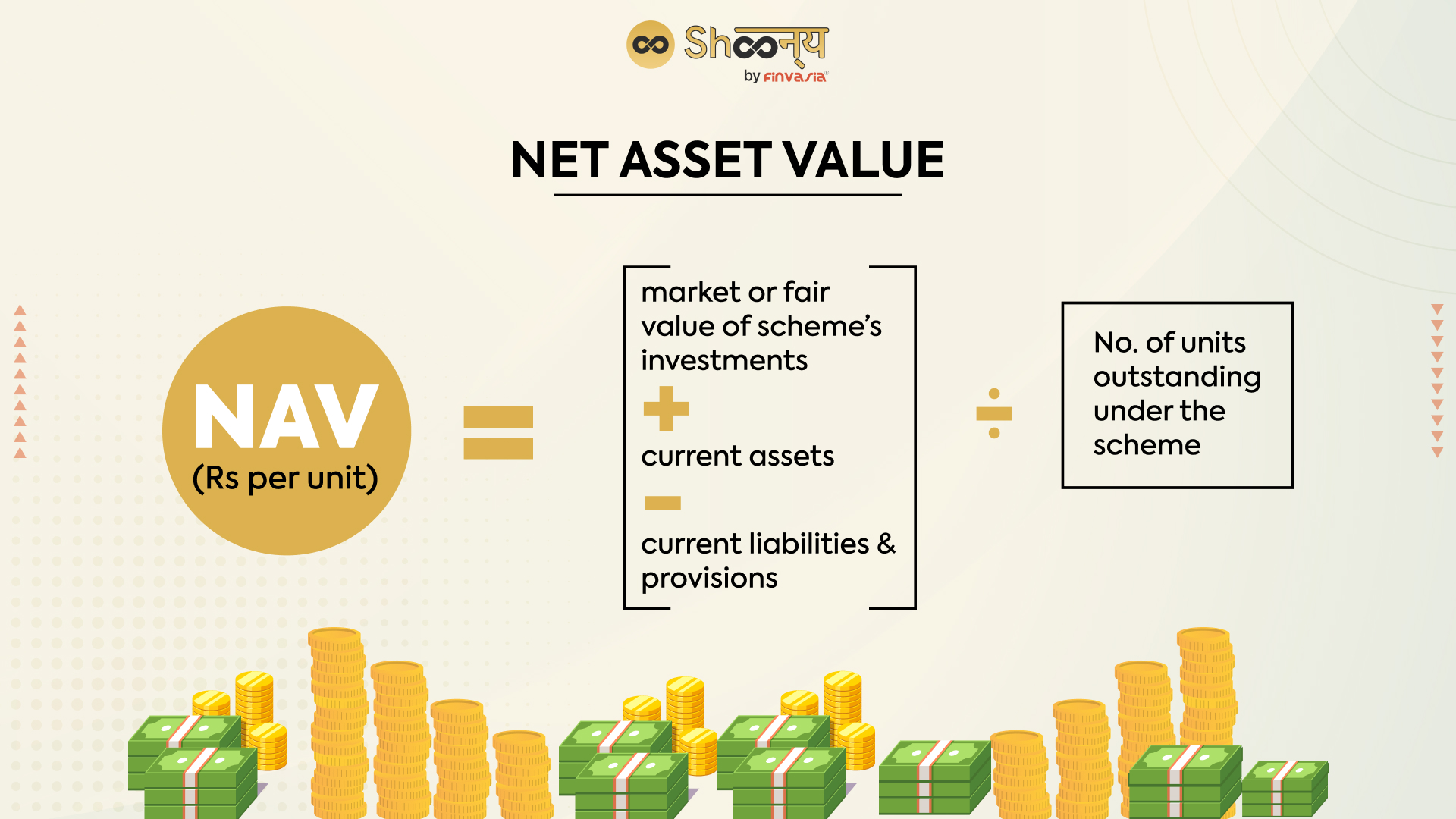

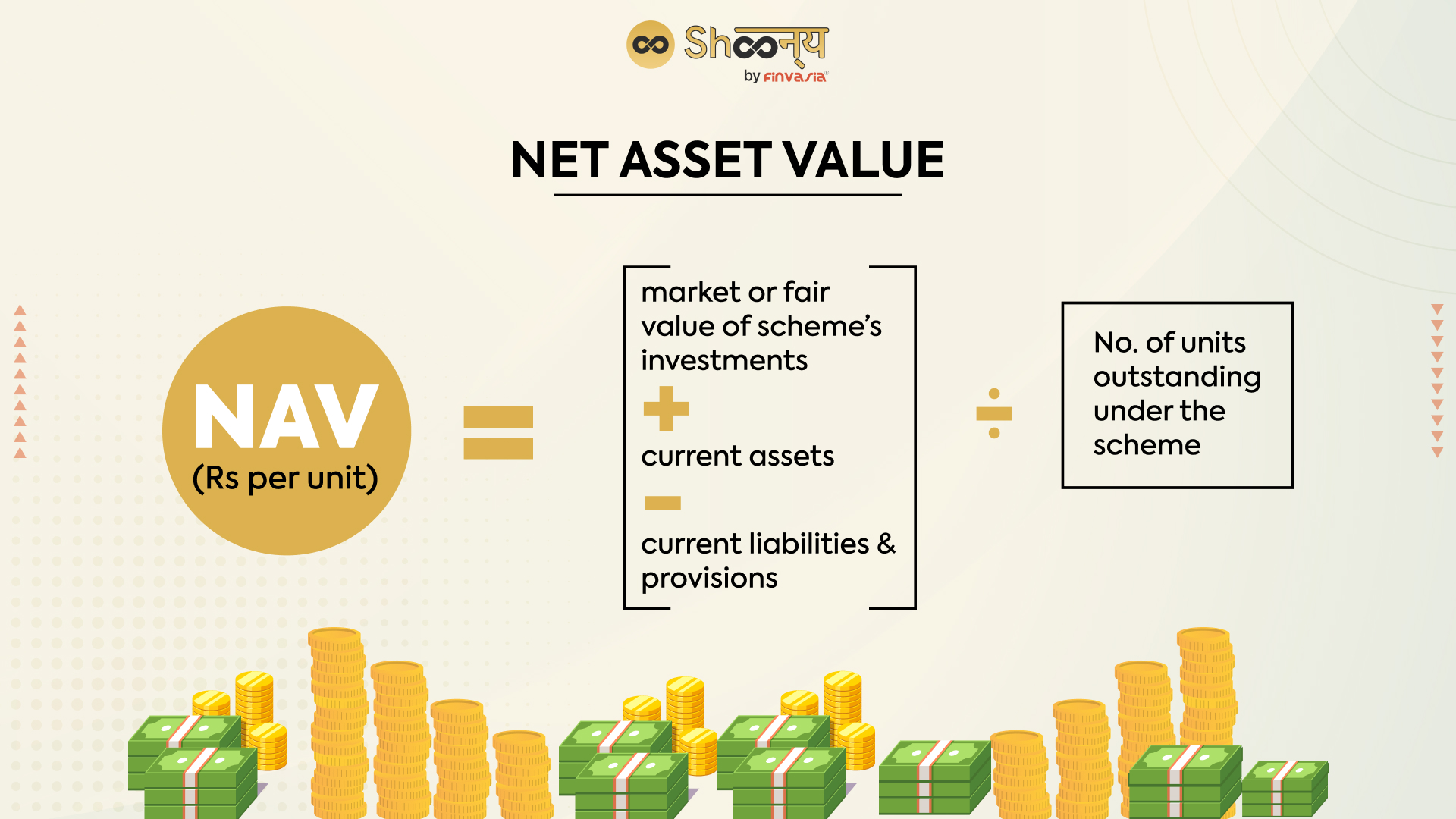

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, reflecting the current market value of the fund's holdings. This calculation is a crucial aspect of ETF valuation and provides investors with a snapshot of the fund's performance.

- Daily Calculation Process: At the close of each trading day, Amundi, the fund manager, calculates the NAV. This involves determining the market value of all the underlying assets (the 30 Dow Jones Industrial Average constituent stocks) held within the ETF portfolio.

- Components of NAV Calculation: The NAV calculation includes:

- The total market value of all the securities held in the ETF, reflecting the current market prices.

- Any accrued income (dividends received from the underlying stocks).

- Less any liabilities, such as accrued expenses and management fees.

- Amundi's Role: Amundi, as the fund manager, is responsible for the accurate and timely calculation of the NAV. Their expertise ensures the reported NAV accurately represents the fund's net asset value. This transparency is essential for investor confidence. The assets under management (AUM) directly impact the NAV calculation, as a larger AUM generally means a higher NAV.

Using NAV to Track Investment Performance

Monitoring your investment returns is simplified by tracking the NAV of the Amundi Dow Jones Industrial Average UCITS ETF.

- NAV and ETF Share Price: While the NAV is a key indicator, the ETF's share price on the exchange might fluctuate slightly throughout the day. The difference between the NAV and the share price is called tracking error and usually is small.

- Interpreting NAV Changes: By comparing the NAV at different intervals (daily, weekly, monthly, yearly), you can easily assess the growth or decline of your investment. For example, you can calculate the percentage change in NAV using this simple formula:

[(New NAV - Old NAV) / Old NAV] x 100. A positive percentage indicates growth, while a negative percentage shows a decline. - Example: If the NAV was €100 on January 1st and €105 on February 1st, the percentage change is [(105-100)/100] x 100 = 5%. This reflects a 5% increase in the value of your investment during that period. This performance tracking is essential for evaluating your portfolio performance and making informed investment decisions.

The Importance of NAV in Comparing ETFs

NAV is a powerful tool when comparing different ETFs.

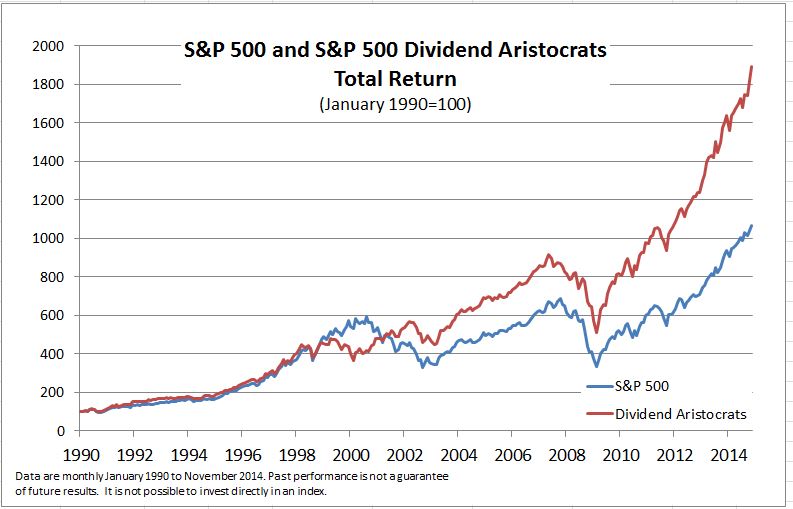

- Comparing Similar ETFs: By comparing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF with other ETFs tracking the same index (Dow Jones Industrial Average) or investing in the same asset class, you can see which fund offers better value.

- Cost-Effective Investment: A lower expense ratio, often reflected in a higher NAV relative to the share price, indicates a more cost-effective investment option. Analyzing the NAV in conjunction with the expense ratio helps identify the most efficient investment opportunities.

- Assessing ETF Efficiency: Comparing the NAV performance against the index it tracks reveals how efficiently the ETF is managed. A higher NAV relative to the index indicates superior performance, but remember to account for the expense ratio. Competitive analysis using NAV is crucial for making smart investment choices.

Accessing NAV Information for the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is straightforward.

- Amundi's Website: Amundi's official website is the primary source for the most up-to-date NAV information. Look for dedicated fund fact sheets or performance pages.

- Financial News Sources: Many financial news websites and data providers (like Bloomberg or Yahoo Finance) regularly publish ETF NAV data. However, always verify the data source's reliability.

- Frequency of Updates: The NAV is typically updated daily, reflecting the closing market prices of the underlying assets.

- Additional Information: Along with the NAV, you'll typically find other relevant information, such as the total assets under management (AUM), the number of shares outstanding, and historical NAV data. Real-time NAV data may also be available through specialized platforms.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for any investor. By regularly monitoring NAV changes, you can effectively track investment performance and compare your ETF against competitors. Remember to utilize the NAV data, available on Amundi's website and other financial sources, to make informed decisions. Actively monitoring your investment's NAV is key to successful portfolio management. Visit Amundi's website today for more information on the Amundi Dow Jones Industrial Average UCITS ETF and its Net Asset Value to optimize your investment strategy.

Featured Posts

-

Kyle And Teddis Explosive Dog Walker Dispute

May 24, 2025

Kyle And Teddis Explosive Dog Walker Dispute

May 24, 2025 -

Nyt Mini Sunday Crossword Puzzle April 6 2025 Complete Guide

May 24, 2025

Nyt Mini Sunday Crossword Puzzle April 6 2025 Complete Guide

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Tracking The Nav And Its Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Tracking The Nav And Its Implications

May 24, 2025 -

Yevrobachennya 2025 Chi Spravdyatsya Prognozi Konchiti Vurst

May 24, 2025

Yevrobachennya 2025 Chi Spravdyatsya Prognozi Konchiti Vurst

May 24, 2025 -

Europese Aandelenmarkt Krijgt De Recente Koerswijziging Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025

Europese Aandelenmarkt Krijgt De Recente Koerswijziging Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025