The Looming Bond Crisis: What Investors Need To Know

Table of Contents

The global bond market, a traditional safe haven for investors, is facing a potential crisis. Rising interest rates, persistent inflation, and escalating geopolitical risks are creating a perfect storm that threatens the stability of bond portfolios worldwide. Understanding these challenges is crucial for investors seeking to protect their capital and navigate these turbulent times. This article examines the key factors contributing to the looming bond crisis and offers strategies for mitigating the risks. Ignoring these warnings could have significant consequences for your investment portfolio.

Rising Interest Rates and Their Impact on Bond Prices

The inverse relationship between interest rates and bond prices is a fundamental concept in finance. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This results in a decline in the market value of previously issued bonds, causing potential capital losses for investors. The recent aggressive interest rate hikes by central banks, particularly the Federal Reserve, have significantly amplified this risk, making it a critical concern for bondholders.

- Increased risk of capital losses: Investors holding long-term bonds are especially vulnerable to price declines in a rising-rate environment. The longer the maturity, the greater the potential loss.

- Reduced bond yields: Lower yields on existing bonds directly reduce the income generated from bond investments, impacting overall returns.

- Potential for defaults: Rising interest rates can increase the debt servicing burden for corporations and governments, potentially leading to defaults and credit downgrades, further impacting bond values.

Inflation's Role in the Potential Bond Crisis

High inflation erodes the purchasing power of fixed-income investments like bonds. When inflation outpaces bond yields, the real return on a bond investment diminishes, making them less attractive compared to other investment options. This is further exacerbated by central banks' actions to combat inflation through interest rate hikes, creating a double bind for bondholders.

- Purchasing power erosion: Inflation diminishes the real value of bond returns, reducing an investor's actual wealth despite nominal returns.

- Increased demand for higher-yielding alternatives: Investors are likely to seek assets that provide returns exceeding the inflation rate, shifting away from bonds. This increased demand for higher-yielding alternatives puts downward pressure on bond prices.

Geopolitical Risks and Their Influence

Global uncertainties, including political instability, international conflicts, and trade wars, significantly impact the bond market's stability. These events introduce volatility and uncertainty, making it difficult to predict bond performance. During periods of heightened geopolitical risk, investors often seek the perceived safety of government bonds, driving up their prices temporarily. However, this "flight to safety" is often short-lived and doesn't guarantee protection from long-term losses.

- Political instability: Political upheaval in major economies can trigger rapid sell-offs in bond markets, leading to sharp price declines.

- International conflicts: Geopolitical tensions increase risk aversion among investors, reducing demand for bonds and impacting prices.

- Sanctions and trade wars: These disrupt global markets and can negatively affect the creditworthiness of bond issuers, increasing the risk of default.

Diversification Strategies for Mitigating Risk

Diversification is crucial for managing risk in a volatile bond market. Relying solely on government bonds exposes investors to significant risk in a rising-rate environment. Consider diversifying your portfolio across various bond types and maturities to mitigate potential losses.

- Corporate bonds: Offer potentially higher yields than government bonds, but carry a higher default risk. Careful due diligence is essential.

- Municipal bonds: Provide tax advantages in many jurisdictions and can offer diversification benefits.

- International bonds: Investing in international bond markets offers geographical diversification and potentially higher yields but introduces currency risk.

Effective interest rate risk management strategies include:

- Laddered portfolio approach: Spreading investments across bonds with varying maturities reduces the impact of interest rate changes.

- Short-term bond investments: Minimizes exposure to interest rate fluctuations by investing in bonds with shorter maturities.

- Floating-rate bonds: These bonds adjust their interest rates periodically, offering some protection against rising rates.

Conclusion: Navigating the Uncertainties of the Bond Market

The potential for a bond crisis is a serious concern for investors. Rising interest rates, high inflation, and geopolitical instability create a challenging environment for bondholders. Proactive risk management, encompassing diversification and careful consideration of interest rate risk, is paramount. Consult with a qualified financial advisor to develop a personalized investment strategy that addresses the complexities of the current bond market and helps you mitigate the risks associated with the looming bond crisis. Don't delay; seek professional guidance to effectively manage your bond investments and protect your portfolio from the potential impacts of this looming bond crisis.

Featured Posts

-

El Clasico 4 3 Immediate Reactions And Key Moments

May 29, 2025

El Clasico 4 3 Immediate Reactions And Key Moments

May 29, 2025 -

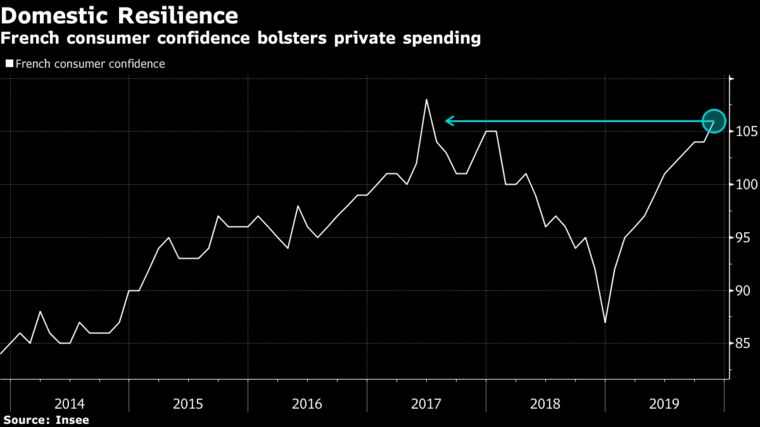

French Consumer Spending Growth Underwhelms In April

May 29, 2025

French Consumer Spending Growth Underwhelms In April

May 29, 2025 -

Everything Going To Be Great Movie Trailer Cast Plot And Release Details

May 29, 2025

Everything Going To Be Great Movie Trailer Cast Plot And Release Details

May 29, 2025 -

Snag Nike Court Legacy Lift Sneakers Prices Starting At 58

May 29, 2025

Snag Nike Court Legacy Lift Sneakers Prices Starting At 58

May 29, 2025 -

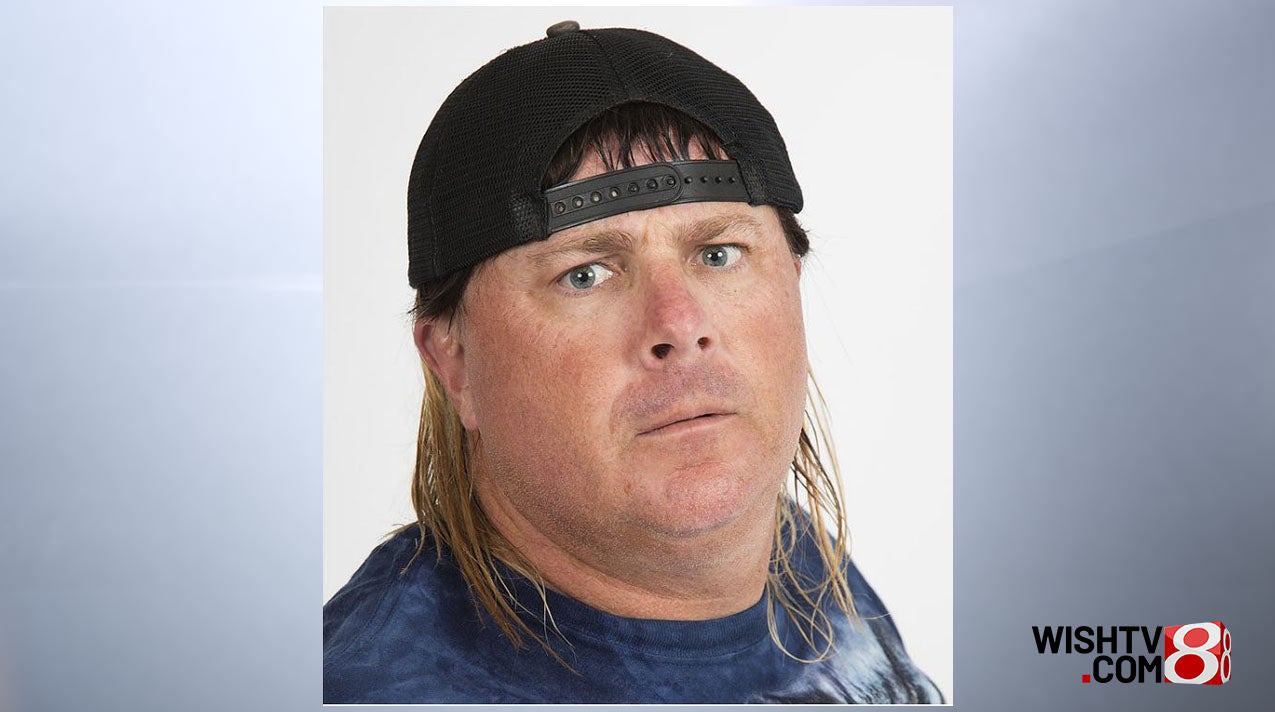

Deadly Baker Park Shooting Murder Charges Announced

May 29, 2025

Deadly Baker Park Shooting Murder Charges Announced

May 29, 2025