The Posthaste Threat: Unrest In The Global Bond Market

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This causes a decrease in the demand for older bonds, leading to a decline in their prices. Central bank policies play a pivotal role in influencing this dynamic. The Federal Reserve (Fed) in the US, the European Central Bank (ECB), and other central banks worldwide have been aggressively raising interest rates to combat inflation. This has had a significant ripple effect across global bond markets.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, impacting their ability to fund projects and potentially slowing economic growth.

- Reduced attractiveness of fixed-income investments: With rising rates, the returns from existing bonds become less competitive compared to newer, higher-yielding options, reducing their appeal to investors.

- Potential for capital losses on existing bond holdings: Investors holding bonds with fixed interest rates face potential capital losses if interest rates continue to rise.

- Flight to safety into shorter-term bonds: Investors are shifting towards shorter-term bonds to minimize their exposure to interest rate risk.

The recent interest rate hikes by the Fed have led to a notable decline in the prices of US Treasury bonds, a benchmark for global bond markets. Similarly, the yield curve, which illustrates the relationship between bond yields and maturities, has steepened, reflecting investors' expectations of future rate increases. Understanding the interplay between interest rates, inflation, and monetary policy is crucial for navigating this complex environment.

Geopolitical Uncertainty and its Influence on Bond Markets

Geopolitical events, such as wars, political instability, and trade disputes, significantly impact investor sentiment and the performance of bond markets. Uncertainty often drives investors towards safe-haven assets, including government bonds, particularly those issued by countries perceived as politically stable and economically sound.

- Impact of the war in Ukraine on global bond markets: The ongoing conflict has created considerable uncertainty, leading to increased demand for safe-haven assets and impacting global bond yields.

- The role of political risk premiums in bond yields: Higher political risk premiums are added to bond yields in countries perceived as having higher political instability, reflecting the added risk for investors.

- Diversification strategies to mitigate geopolitical risk: Diversifying bond holdings across different countries and currencies can help mitigate the impact of geopolitical risks.

Keywords like "risk aversion," "safe haven assets," "geopolitical risk," and "credit default swaps" are increasingly relevant as investors grapple with the implications of global events on their bond portfolios.

Inflation and the Erosion of Bond Yields

High inflation erodes the real return on fixed-income investments. When inflation rises faster than the interest rate on a bond, the real return—the return after adjusting for inflation—becomes negative. Inflation expectations also significantly influence bond yields. If investors anticipate high inflation, they demand higher yields to compensate for the erosion of purchasing power.

- The impact of persistent inflation on purchasing power: High inflation reduces the purchasing power of future bond payments, making fixed-income investments less attractive.

- The relationship between inflation and real interest rates: Real interest rates represent the return on an investment after accounting for inflation. When inflation is high, real interest rates can be negative, even if nominal interest rates are positive.

- Strategies for inflation hedging in a bond portfolio: Investing in inflation-protected securities (TIPS), which adjust their principal value based on inflation, or diversifying into assets like real estate or commodities can help hedge against inflation.

Understanding the relationship between inflation, real yield, and inflation expectations is key to making informed investment decisions in the current environment.

The Growing Threat of Default

The potential for sovereign debt defaults or corporate bankruptcies poses a significant threat to the stability of global bond markets. Countries or entities facing unsustainable debt levels can trigger a domino effect, leading to widespread losses and market instability.

- Increased credit spreads on high-risk bonds: Credit spreads, which measure the difference between the yield on a high-risk bond and a risk-free bond, tend to widen as the risk of default increases.

- Contagion effects on other markets: A default in one country or sector can trigger a contagion effect, spreading fear and uncertainty to other markets.

- Potential for sovereign debt defaults: Several countries are grappling with high debt levels and face the risk of sovereign debt defaults, potentially creating significant instability in global bond markets.

Monitoring credit ratings, understanding sovereign debt crises, and analyzing bond defaults are crucial for investors aiming to manage risk effectively.

Conclusion

The "posthaste threat" of unrest in the global bond market presents substantial challenges for investors. Rising interest rates, geopolitical uncertainty, and persistent inflation are creating a volatile environment. Understanding these factors and proactively managing risk through diversification and careful asset allocation are crucial for navigating this complex landscape. Staying informed about the latest developments in the global bond market and adapting your investment strategy accordingly is essential to mitigate the "posthaste threat" and ensure long-term financial health. Learn more about protecting your portfolio from future market instability and discover effective strategies to manage your bond investments in this turbulent environment. Don't let the posthaste threat catch you unprepared.

Featured Posts

-

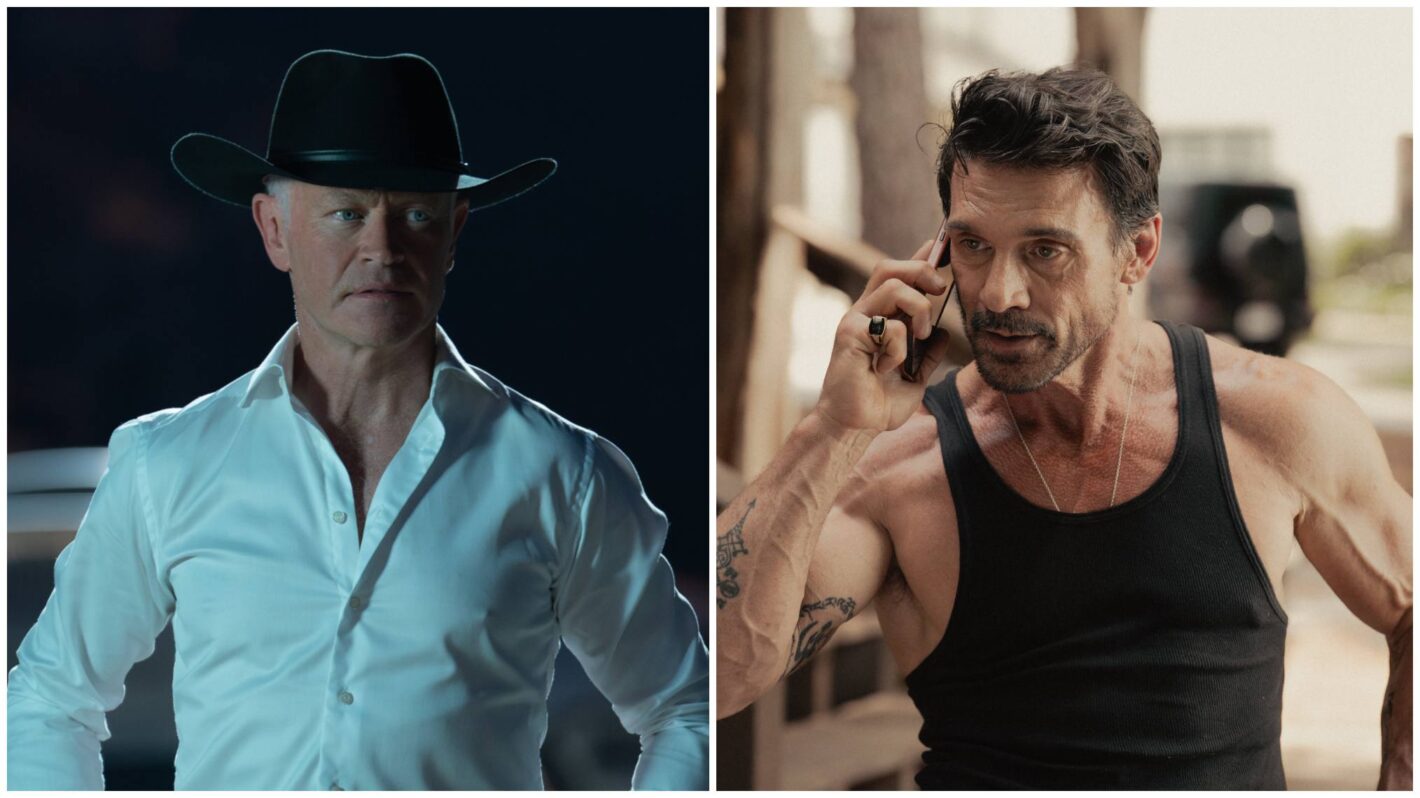

Tulsa King Season 3 Will Neal Mc Donough Be Back Sylvester Stallones New Look And Filming News

May 24, 2025

Tulsa King Season 3 Will Neal Mc Donough Be Back Sylvester Stallones New Look And Filming News

May 24, 2025 -

Apple Stock Aapl Where Will The Price Go Next A Technical Analysis

May 24, 2025

Apple Stock Aapl Where Will The Price Go Next A Technical Analysis

May 24, 2025 -

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025 -

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025 -

Maryland Softball Defeats Delaware 11 1 Aubrey Wursts Impact

May 24, 2025

Maryland Softball Defeats Delaware 11 1 Aubrey Wursts Impact

May 24, 2025