The Power Of Simplicity: A Profitable Dividend Investing Approach

Table of Contents

Understanding the Basics of Dividend Investing

Dividend investing is a strategy focused on acquiring shares in companies that regularly distribute a portion of their profits to shareholders as dividends. This passive income stream complements potential capital appreciation, making it an attractive option for long-term investors. Understanding key terms is crucial for success.

- Dividend Yield: This represents the annual dividend per share relative to the stock price, expressed as a percentage. A higher yield generally indicates a higher dividend payout.

- Payout Ratio: This shows the percentage of a company's earnings paid out as dividends. A sustainable payout ratio (typically below 70%) signals financial health and the likelihood of consistent dividend payments.

- Dividend Growth: Companies that consistently increase their dividends year over year offer the potential for growing passive income alongside capital appreciation.

Benefits of Dividend Investing:

- Passive Income Generation: Receive regular dividend payments, providing a steady stream of income.

- Potential for Capital Appreciation: The value of your investments can increase over time, leading to capital gains.

- Reduced Risk (Compared to Growth Stocks): Dividend-paying companies tend to be more established and financially stable, mitigating some of the risk associated with growth stocks.

- Reinforces Disciplined Investing Habits: The focus on long-term growth encourages a disciplined and patient approach to investing.

Choosing the Right Dividend Stocks for Simplicity

Simplicity in dividend investing doesn't mean settling for low returns. Instead, it means focusing on quality over quantity. Select established, financially sound companies with a proven track record of consistent dividend payments. Avoid "dividend traps"—high-yield stocks from companies struggling financially, where the high yield is unsustainable.

Key Criteria for Stock Selection:

- Long History of Dividend Payments: Look for companies with a minimum of 5-10 years of consecutive dividend payments. This demonstrates financial stability and a commitment to returning value to shareholders.

- Sustainable Payout Ratio: Prioritize companies with a payout ratio below 70%, indicating that they have sufficient earnings to cover dividend distributions and reinvest in their business.

- Dividend Growth Potential: Companies that consistently increase their dividends show commitment to shareholder returns and long-term growth. Analyze their past dividend growth and assess the potential for future increases.

- Diversification: Spread your investments across various sectors (e.g., technology, healthcare, consumer staples) to reduce overall portfolio risk. Avoid concentrating your investments in a single company or sector.

Building a Simple Dividend Investing Portfolio

Building a simple, yet effective, dividend investing portfolio doesn't require extensive market knowledge or constant monitoring. A low-cost, diversified approach using ETFs or mutual funds is often the most efficient strategy.

Strategies for Portfolio Building:

- Index Funds: These funds track a specific market index (like the S&P 500), providing broad market exposure at a low cost. They offer instant diversification across many dividend-paying companies.

- Dividend ETFs: Exchange-traded funds (ETFs) specifically designed to invest in dividend-paying stocks offer targeted exposure to particular sectors or investment styles.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, regardless of market fluctuations. This strategy helps mitigate risk and reduces the impact of market volatility.

- Dividend Reinvestment: Reinvest your dividend payments to buy additional shares, accelerating the power of compounding returns over time. This is a simple way to maximize your long-term growth.

The Importance of Patience and Long-Term Perspective

Dividend investing is a long-term strategy. Success requires patience and a "buy-and-hold" approach. Avoid emotional decision-making based on short-term market fluctuations.

Key Principles for Long-Term Success:

- Avoid Emotional Reactions: Don't panic-sell during market downturns. Remember your long-term investment goals.

- Regular Portfolio Review and Rebalancing: Periodically review your portfolio to ensure it aligns with your risk tolerance and investment objectives. Rebalance your holdings to maintain your desired asset allocation.

- Focus on Long-Term Growth: Dividend investing is a marathon, not a sprint. Stay focused on the long-term growth of your investments, not daily or weekly market movements.

- Stay Disciplined and Consistent: Stick to your investment plan. Consistency and discipline are key to building wealth through dividend investing.

Conclusion

Simplifying your dividend investing approach doesn't mean sacrificing returns. By focusing on established companies, building a diversified portfolio, and adopting a long-term perspective, you can generate passive income and build significant wealth over time. The power of simplicity in dividend investing lies in its ease of management and its proven track record of success.

Call to Action: Ready to harness the power of simplicity and start building your profitable dividend investing portfolio today? Begin researching reliable dividend-paying stocks or explore low-cost ETFs. Embrace a straightforward strategy and watch your wealth grow with a simplified approach to dividend investing. Start your journey towards financial freedom with a simple, yet powerful, dividend investing strategy!

Featured Posts

-

Conor Mc Gregor And The Bkfc Fighters Jose Aldo Tribute

May 11, 2025

Conor Mc Gregor And The Bkfc Fighters Jose Aldo Tribute

May 11, 2025 -

Building Voice Assistants Open Ais New Tools Unveiled

May 11, 2025

Building Voice Assistants Open Ais New Tools Unveiled

May 11, 2025 -

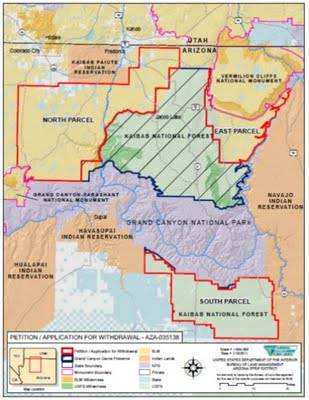

Perus Emergency Gold Mining Ban 200 Million Economic Consequence

May 11, 2025

Perus Emergency Gold Mining Ban 200 Million Economic Consequence

May 11, 2025 -

Thomas Mueller Quitte Le Bayern Munich Apres 25 Ans La Fin D Une Ere

May 11, 2025

Thomas Mueller Quitte Le Bayern Munich Apres 25 Ans La Fin D Une Ere

May 11, 2025 -

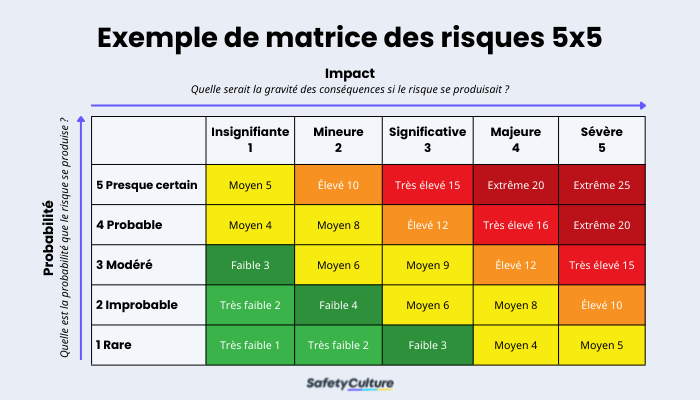

Diversification Des Investissements Reduire Les Risques Et Optimiser Les Rendements

May 11, 2025

Diversification Des Investissements Reduire Les Risques Et Optimiser Les Rendements

May 11, 2025