The Private Credit Hiring Process: 5 Do's And Don'ts To Know

Table of Contents

- Do's of the Private Credit Hiring Process

- Do Your Research

- Network Strategically

- Tailor Your Resume and Cover Letter

- Master the Interview

- Follow Up Professionally

- Don'ts of the Private Credit Hiring Process

- Don't Neglect the Fundamentals

- Don't Underestimate the Importance of Networking

- Don't Be Generic in Your Application

- Don't Wing the Interview

- Don't Neglect the Follow-Up

- Conclusion

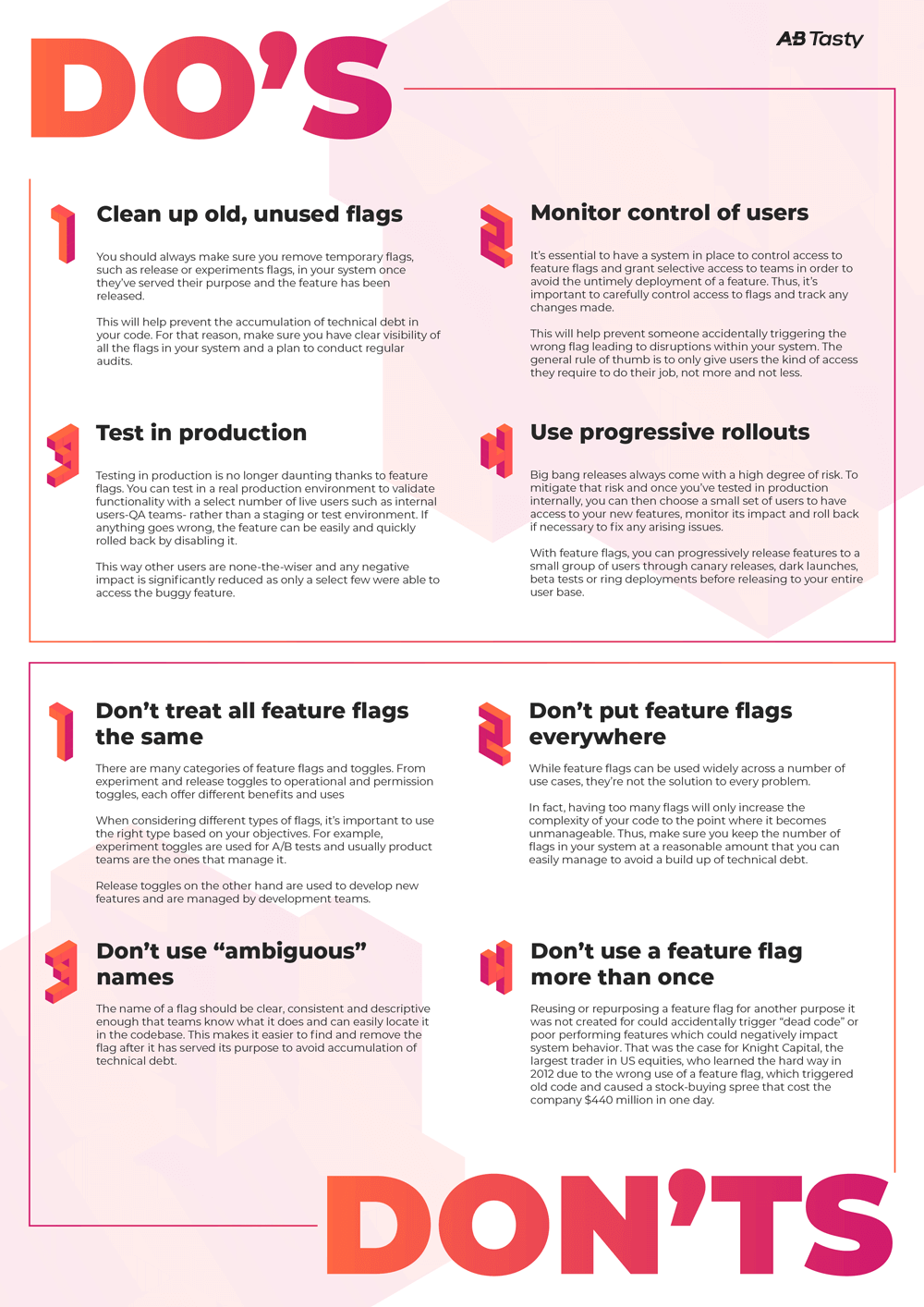

Do's of the Private Credit Hiring Process

Do Your Research

Thoroughly investigate the firm and the specific private credit role. Understand their investment strategy, recent deals, and the team's expertise. Demonstrating this knowledge showcases your genuine interest and preparedness.

- Analyze the firm's website: Explore their "About Us" section, investment strategies, and recent news releases to grasp their overall approach to private credit investing.

- LinkedIn profile research: Investigate the LinkedIn profiles of employees, particularly those in the roles you're targeting. This provides insights into their career paths and the firm's culture. Look for common threads in their experience to better understand the skills valued by the firm.

- News and press releases: Stay updated on the firm's recent activities and announcements. Understanding their current projects and market positioning will help you tailor your responses during interviews.

- Demonstrate understanding: During the interview, subtly incorporate your research findings to illustrate your understanding of their investment thesis and current market position within the private credit landscape.

Network Strategically

Leveraging your network is crucial in the private credit industry, where many opportunities are unadvertised. Building relationships can provide invaluable leads and insights.

- Industry events and conferences: Attend relevant industry events to connect with professionals and learn about new opportunities. These events offer valuable networking opportunities and often feature recruiters from private credit firms.

- LinkedIn outreach: Reach out to your existing connections on LinkedIn, informing them of your job search and the types of private credit roles that interest you. Request informational interviews to learn more about specific firms and roles.

- Informational interviews: Don't underestimate the power of informational interviews. They provide invaluable insights into the private credit industry and can lead to unexpected job opportunities. Prepare thoughtful questions beforehand to maximize the value of your conversation.

Tailor Your Resume and Cover Letter

Your resume and cover letter should highlight relevant experiences and skills directly applicable to private credit investing. Quantify your achievements whenever possible to demonstrate your impact.

- Keyword optimization: Incorporate keywords from the job description into your resume and cover letter. This helps applicant tracking systems (ATS) identify your application as a potential match.

- Showcase analytical skills: Emphasize your proficiency in financial modeling, valuation, and due diligence. Provide specific examples of your analytical abilities and problem-solving skills.

- Financial statement expertise: Demonstrate your understanding of financial statements, including balance sheets, income statements, and cash flow statements. Highlight your experience with analyzing these statements to assess creditworthiness.

- Quantify achievements: Whenever possible, quantify your accomplishments using metrics and data to illustrate your impact in previous roles. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15% through process optimization."

Master the Interview

Prepare for behavioral, technical, and case study interviews. Practice your responses and showcase your passion for private credit. This demonstrates your commitment and preparedness.

- Behavioral questions: Practice answering common behavioral questions, such as those assessing your teamwork, problem-solving, and leadership skills. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Technical questions: Be prepared for technical questions related to financial modeling, valuation, and credit analysis. Brush up on your knowledge of key financial ratios and metrics.

- Case studies: Practice solving case studies that assess your analytical and problem-solving skills. These often involve evaluating a potential investment opportunity in the context of the private credit market.

- Enthusiasm: Demonstrate your genuine passion for private credit investing throughout the interview process. Your enthusiasm will make you stand out from other candidates.

Follow Up Professionally

Send thank-you notes after each interview, reiterating your interest and highlighting key points of the conversation. This demonstrates your professionalism and continued interest.

- Personalized thank-you notes: Personalize each thank-you note to each interviewer, referencing specific points discussed during the conversation.

- Reiterate qualifications: Reiterate your key qualifications and enthusiasm for the role, highlighting how your skills align with the firm's needs and the specific role's requirements.

- Timely follow-up: Follow up within 24-48 hours of the interview to demonstrate your professionalism and continued interest.

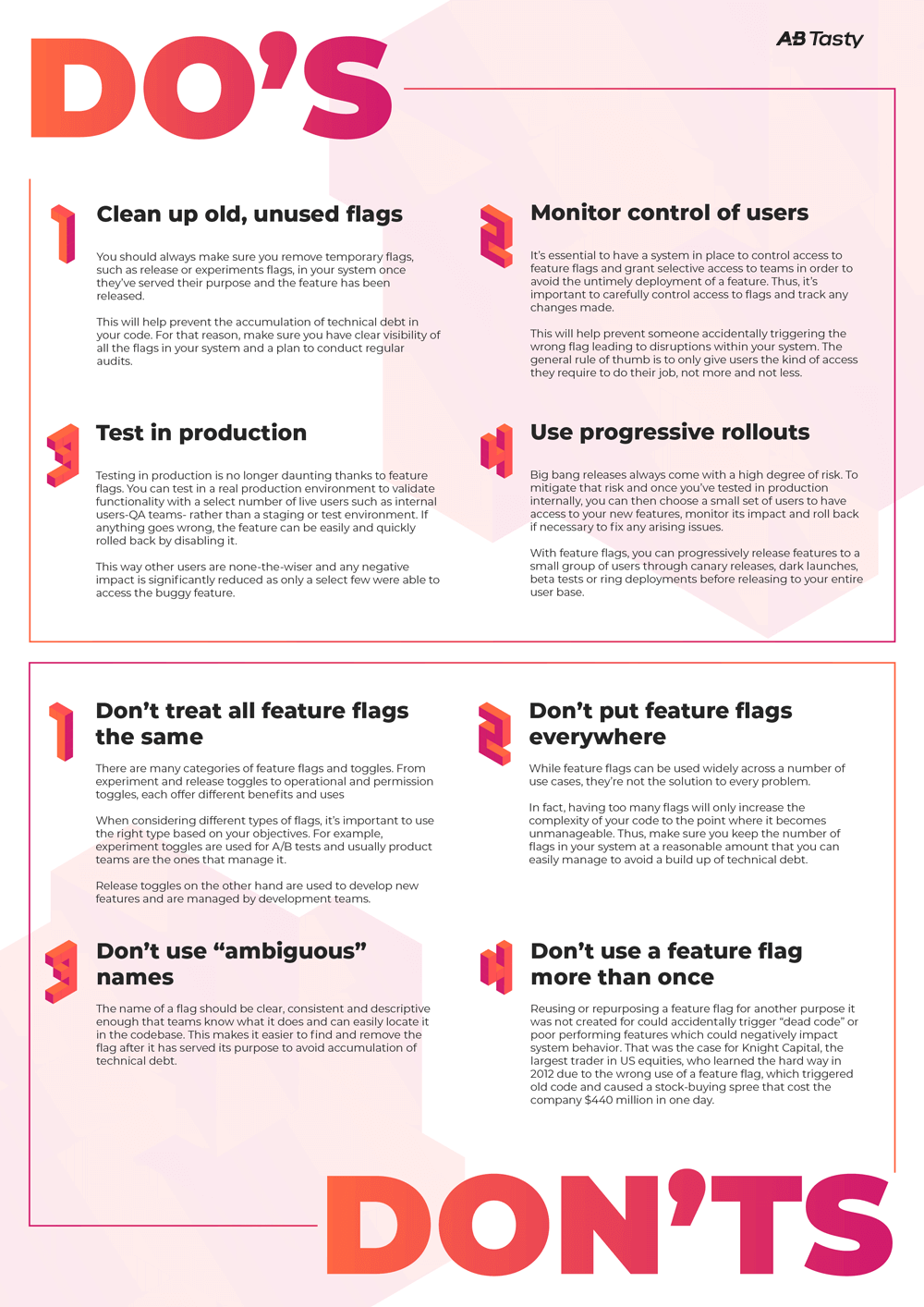

Don'ts of the Private Credit Hiring Process

Don't Neglect the Fundamentals

A strong understanding of financial statements, accounting principles, and valuation methods is non-negotiable.

- Financial ratios: Brush up on your knowledge of key financial ratios and metrics, such as leverage ratios, profitability ratios, and liquidity ratios.

- Valuation methodologies: Understand different valuation methodologies, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

- Credit risk assessment: Be prepared to discuss your understanding of credit risk and how to assess the creditworthiness of potential borrowers.

Don't Underestimate the Importance of Networking

Relying solely on online applications significantly limits your chances of success. Active networking is essential.

- Industry events: Actively participate in industry events and conferences to build relationships and learn about unadvertised opportunities.

- LinkedIn engagement: Engage with professionals on LinkedIn, sharing insightful content and participating in relevant discussions.

- Proactive outreach: Don't hesitate to reach out to people you don't know – informational interviews can be incredibly valuable.

Don't Be Generic in Your Application

A generic resume and cover letter won't stand out. Tailor your application to each specific role and firm.

- Research the firm: Thoroughly research each firm's investment strategy and tailor your application to highlight your relevant skills and experience.

- Job description alignment: Carefully review the job description and highlight the skills and experiences that directly align with the requirements.

- Quantify your achievements: Use metrics and data to quantify your accomplishments and demonstrate your impact in previous roles.

Don't Wing the Interview

Thorough preparation is paramount. Practice your responses to common interview questions and case studies.

- Interviewer research: Research the interviewers to understand their backgrounds and expertise.

- Example preparation: Prepare specific examples that showcase your skills and accomplishments using the STAR method.

- Practice your responses: Practice your responses aloud to ensure you can articulate your thoughts clearly and concisely.

Don't Neglect the Follow-Up

A timely and thoughtful thank-you note demonstrates professionalism and continued interest.

Conclusion

Successfully navigating the private credit hiring process requires a combination of meticulous preparation, strategic networking, and strong communication skills. By following these do's and don'ts, you can significantly improve your chances of landing your dream job in this exciting and lucrative field. Remember to thoroughly research firms, tailor your application materials, and master the art of the interview to stand out from the competition. Start optimizing your job search strategy today and unlock your potential in the world of private credit.

Timeless Tale Modern Adaptation A Review Of The Count Of Monte Cristo

Timeless Tale Modern Adaptation A Review Of The Count Of Monte Cristo

Ajagbas Strong Words Before Bakole Fight

Ajagbas Strong Words Before Bakole Fight

Bradley Coopers New Relationship Impact On His Friendship With Leonardo Di Caprio

Bradley Coopers New Relationship Impact On His Friendship With Leonardo Di Caprio

Karaoke Night Sydney Sweeney Channels Breakup Emotions After Split

Karaoke Night Sydney Sweeney Channels Breakup Emotions After Split

Nhl Playoff Matchups Predicting The Stanley Cup Champion

Nhl Playoff Matchups Predicting The Stanley Cup Champion