The Real Safe Bet: Investing Strategies For Secure Returns

Table of Contents

Understanding Risk Tolerance and Investment Goals

Before diving into specific investment strategies, it's crucial to understand your own risk profile and define your financial goals. These two factors will significantly influence the types of investments you choose and the level of risk you're comfortable taking.

Defining Your Risk Profile:

Understanding your personal risk tolerance is fundamental to selecting appropriate investments. Are you a conservative, moderate, or aggressive investor? Your risk profile determines how much volatility you can handle in your portfolio.

- Conservative: Prioritizes capital preservation over high returns. Comfortable with low-risk investments like high-yield savings accounts and government bonds. These investors are typically less concerned with maximizing returns and more focused on protecting their principal.

- Moderate: Balances risk and return, seeking a mix of stability and growth. A moderate investor might allocate their portfolio across stocks, bonds, and other asset classes, aiming for a balance between risk and reward.

- Aggressive: Willing to accept higher risk for the potential of higher returns. Aggressive investors typically invest a larger portion of their portfolio in stocks and other high-growth assets, accepting greater volatility in exchange for potentially higher long-term returns.

Setting Realistic Financial Goals:

Clearly defined goals—retirement, a down payment on a house, funding your children's education—shape your investment strategy. Your investment timeline is directly related to your goals.

- Short-term goals (less than 5 years): Focus on liquidity and preservation of capital. Investments should be easily accessible and minimize the risk of loss. High-yield savings accounts or short-term certificates of deposit (CDs) might be suitable options.

- Long-term goals (5 years or more): Allow for a more aggressive approach with a longer time horizon to ride out market fluctuations. Long-term investors can typically tolerate more risk and may consider investments with higher growth potential, such as stocks and real estate.

Diversification: Spreading Your Investments Across Asset Classes

One of the cornerstones of secure investing is diversification. It's the age-old adage of "don't put all your eggs in one basket." Diversification reduces risk by spreading your investments across various asset classes.

The Power of Diversification:

Diversification minimizes the impact of poor performance in any single asset class. If one investment underperforms, others may offset those losses, leading to a more stable overall portfolio.

- Stocks: Offer potential for high growth but carry higher risk. Stocks represent ownership in a company and their value can fluctuate significantly based on market conditions.

- Bonds: Generally less risky than stocks, offering steady income. Bonds represent a loan to a company or government, and they typically pay a fixed interest rate.

- Real Estate: Can provide diversification and potential for rental income. Real estate is a tangible asset that can appreciate in value over time and provide a stream of rental income.

- Mutual Funds: Offer instant diversification across multiple asset classes. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but often with lower fees. ETFs are traded on stock exchanges, offering greater flexibility and often lower expense ratios than mutual funds.

Asset Allocation Strategies:

Tailor your portfolio allocation based on your risk tolerance and goals.

- 60/40 Portfolio (60% stocks, 40% bonds): A classic moderate approach balancing growth potential and stability.

- Conservative Portfolio (Higher percentage in bonds and lower in stocks): Suitable for investors with a low risk tolerance and a focus on capital preservation.

- Growth Portfolio (Higher percentage in stocks and lower in bonds): Appropriate for investors with a higher risk tolerance and a longer time horizon who are seeking higher growth potential.

Low-Risk Investment Options for Secure Returns

Several investment options offer relatively secure returns with lower risk. These are ideal for investors prioritizing capital preservation.

High-Yield Savings Accounts and CDs:

Offer FDIC insurance (in the US) and relatively secure returns, though returns might lag inflation. These are excellent options for short-term savings goals.

Government Bonds:

Considered very low-risk investments, backed by the government. Government bonds are generally considered less risky than corporate bonds.

Dividend-Paying Stocks:

Offer a steady stream of income, but still carry some market risk. Focus on established, dividend-paying companies with a history of consistent payouts. Dividend income can supplement your returns.

Index Funds and ETFs:

Offer broad market exposure at low costs, providing diversification and relatively secure long-term growth potential. These are passive investment strategies that track a specific market index.

Regular Monitoring and Rebalancing Your Portfolio

Consistent monitoring and rebalancing are crucial for maintaining a secure investment portfolio.

The Importance of Monitoring:

Regularly review your portfolio's performance and adjust as needed. Monitoring allows you to identify any significant shifts in your asset allocation or overall risk level.

Rebalancing Your Portfolio:

Periodically adjust your asset allocation to maintain your desired risk level and re-align with your investment goals. This involves selling some assets that have grown significantly and buying others that have underperformed, bringing your portfolio back to your target allocation.

Conclusion

Finding the "real safe bet" in investing requires a thoughtful approach that considers your personal risk tolerance, financial goals, and a diversified investment strategy. By understanding and implementing the strategies discussed—diversification, selecting appropriate low-risk options, regular monitoring, and rebalancing—you can significantly increase your chances of achieving secure returns. Don't leave your financial future to chance; start building a secure investment portfolio today by exploring the best strategies for secure returns. Learn more about creating your own safe bet investment plan now!

Featured Posts

-

New Canola Suppliers Emerge As China Canada Relations Strain

May 10, 2025

New Canola Suppliers Emerge As China Canada Relations Strain

May 10, 2025 -

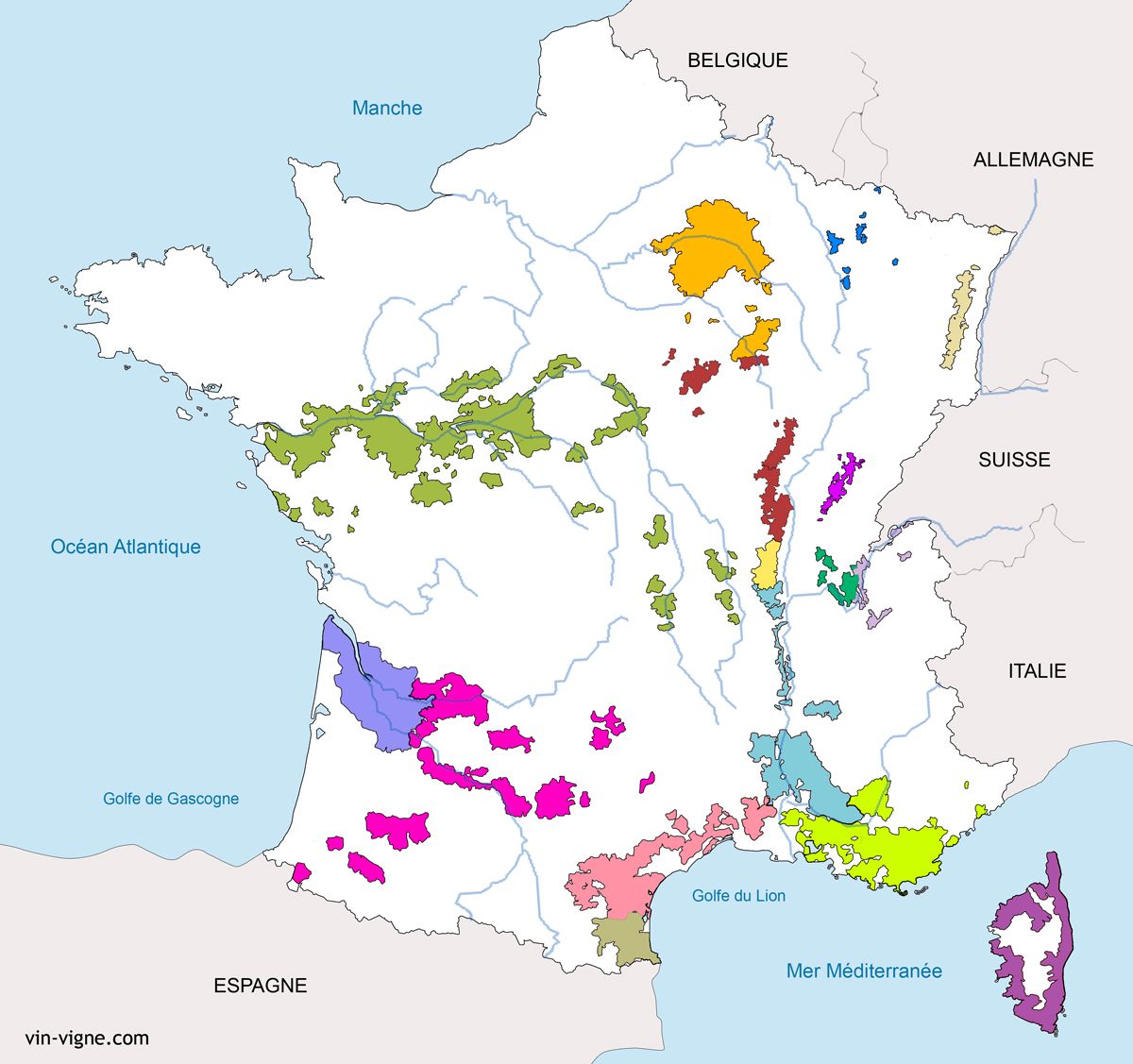

Developpement Viticole A Dijon 2 500 M De Vignes Aux Valendons

May 10, 2025

Developpement Viticole A Dijon 2 500 M De Vignes Aux Valendons

May 10, 2025 -

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025 -

Transgender Girls Banned From Ihsaa Sports After Trump Order

May 10, 2025

Transgender Girls Banned From Ihsaa Sports After Trump Order

May 10, 2025 -

The Trump Administration And Transgender Rights Personal Stories

May 10, 2025

The Trump Administration And Transgender Rights Personal Stories

May 10, 2025