The Reasons Behind D-Wave Quantum (QBTS) Stock's Thursday Drop

Table of Contents

Broader Market Downturn and Tech Sector Weakness

Thursday's decline in QBTS stock price wasn't an isolated incident. The overall stock market experienced a downturn, with the tech sector particularly hard hit. This broader negative sentiment significantly impacted QBTS, a company heavily reliant on investor confidence in the future of quantum computing.

- Market Indicators: The major market indices, such as the NASDAQ Composite and the S&P 500, experienced substantial drops on Thursday, indicating a general risk-off sentiment among investors. Negative economic news, such as rising inflation concerns or unexpected interest rate hikes, could have contributed to this widespread sell-off.

- Tech Sector Weakness: The tech sector, already facing headwinds from increased regulatory scrutiny and slowing growth in certain areas, experienced a particularly sharp decline. This negative sentiment spilled over into quantum computing stocks like QBTS, as investors reassessed their positions in the high-growth, high-risk technology sector. Negative news regarding other major tech companies might have further dampened investor enthusiasm.

Lack of Significant Recent Positive News or Catalysts

The absence of positive news or significant announcements from D-Wave Quantum in the lead-up to Thursday's drop likely played a role in the price decline. A lack of positive catalysts can lead to profit-taking and a shift in investor sentiment.

- Missed Milestones: Were there any anticipated product launches, partnerships, or research breakthroughs that failed to materialize? The absence of such expected announcements could have disappointed investors, leading them to sell their QBTS shares.

- Importance of Positive Momentum: Positive news and milestones are crucial for maintaining positive stock price momentum. Without fresh catalysts, QBTS stock became vulnerable to broader market pressures and profit-taking.

- Competitor Activity: Announcements or advancements from competitors in the quantum computing field could have negatively impacted investor perception of D-Wave Quantum's competitive position, leading to selling pressure.

Investor Sentiment and Profit-Taking

After previous price increases, some investors may have decided to take profits, contributing to the downward pressure on QBTS stock. Shifts in investor sentiment can rapidly impact stock prices, particularly in a relatively new and volatile sector like quantum computing.

- Social Media Sentiment: Analysis of social media sentiment surrounding QBTS in the days preceding the drop might reveal a shift towards negativity or increased uncertainty among retail investors.

- Analyst Reports: Any negative analyst reports or downgrades of QBTS stock could have fueled selling pressure and contributed to the price decline. Changes in ratings or price targets from key analysts can significantly sway investor opinion.

Specific Financial News or Announcements Related to D-Wave Quantum

It's essential to consider whether any company-specific news directly impacted QBTS's stock price. Negative financial news, even if unrelated to the core technology, can cause significant drops.

- Earnings Reports: Were there any unexpected financial disclosures or a less-than-stellar earnings report released before or on Thursday? Disappointing financial results can severely impact investor confidence and lead to selling.

- Contract Losses or Delays: Any announcements regarding significant contract losses or project delays could have shaken investor confidence in D-Wave Quantum's future prospects.

Analysis of Trading Volume and Volatility

Examining the trading volume on Thursday compared to previous days provides valuable insights into investor behavior. High trading volume often suggests significant shifts in sentiment.

- Volume Data: A comparison of Thursday's trading volume with the average daily volume over the preceding period can reveal whether the drop was driven by a large number of investors selling their shares.

- Volatility Amplification: High volatility in the quantum computing sector can amplify price swings. Even relatively small changes in investor sentiment can lead to significant price fluctuations in a volatile market.

Conclusion: Interpreting the D-Wave Quantum (QBTS) Stock Dip and Future Outlook

Thursday's drop in QBTS stock price was likely a result of a confluence of factors. The broader market downturn, weakness in the tech sector, the absence of positive catalysts for D-Wave Quantum, potential profit-taking, and possibly company-specific news all contributed to the decline. It's crucial to remember that investing in quantum computing stocks involves inherent risk and volatility. The sector is still in its nascent stages, and price fluctuations are likely.

To make informed investment decisions regarding QBTS stock and other quantum computing companies, diligently follow D-Wave Quantum's news, analyze market trends, and conduct thorough research. Understanding the interplay between macroeconomic conditions and company-specific events is key to navigating this exciting, but unpredictable, market. Stay informed about QBTS and related quantum computing stocks to manage your investment risk effectively.

Featured Posts

-

Dusan Tadic In Fenerbahce Macerasi Basliyor

May 20, 2025

Dusan Tadic In Fenerbahce Macerasi Basliyor

May 20, 2025 -

Gangsta Granny Review And Analysis Of David Walliams Novel

May 20, 2025

Gangsta Granny Review And Analysis Of David Walliams Novel

May 20, 2025 -

Hmrc Website Crash Hundreds Unable To Access Accounts Across Uk

May 20, 2025

Hmrc Website Crash Hundreds Unable To Access Accounts Across Uk

May 20, 2025 -

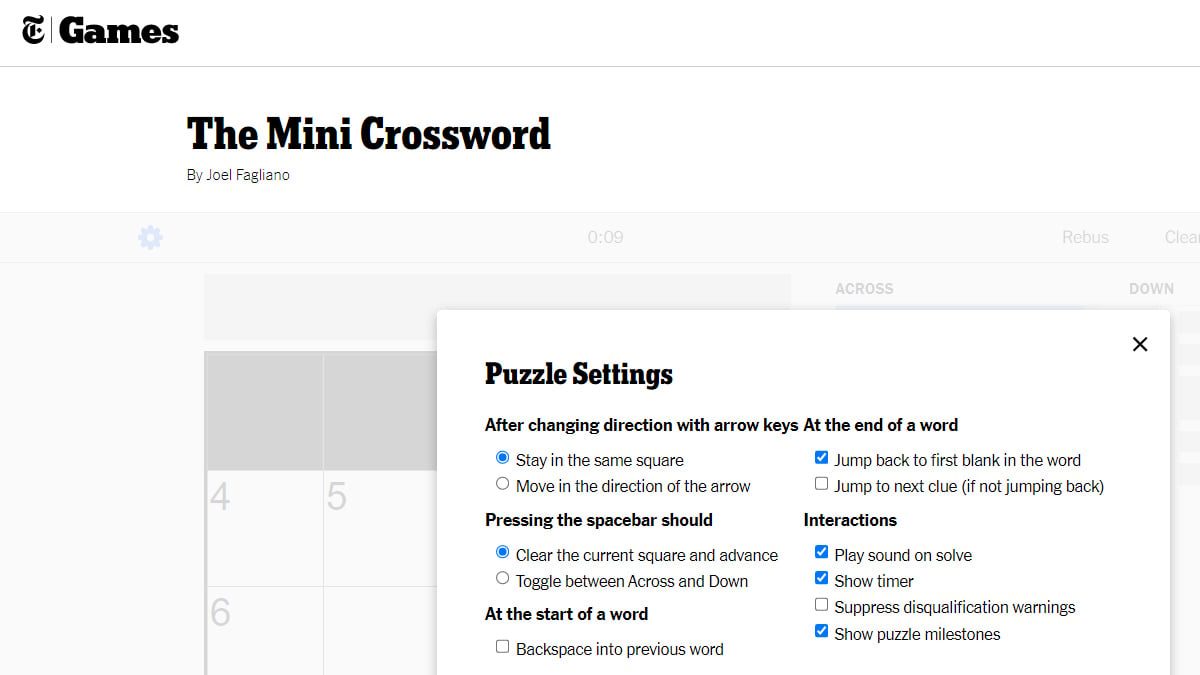

Solve The Nyt Mini Crossword April 25th Answers

May 20, 2025

Solve The Nyt Mini Crossword April 25th Answers

May 20, 2025 -

Zoey Starks Injury Details From Wwe Raw Match

May 20, 2025

Zoey Starks Injury Details From Wwe Raw Match

May 20, 2025