The Ripple (XRP) Phenomenon: Can You Become A Millionaire?

Table of Contents

Understanding Ripple (XRP) and its Technology

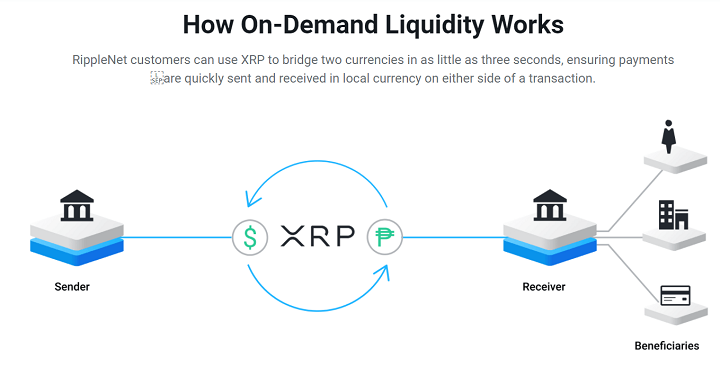

Ripple is a real-time gross settlement system (RTGS), currency exchange, and remittance network. XRP is the native cryptocurrency of the Ripple network, designed to facilitate fast and low-cost cross-border transactions. Unlike Bitcoin, which relies on a decentralized, proof-of-work blockchain, Ripple uses a unique consensus mechanism that allows for significantly faster transaction speeds and lower fees. This makes it a compelling alternative for institutions seeking efficient solutions for international payments.

Compared to other cryptocurrencies like Bitcoin and Ethereum, XRP distinguishes itself through its focus on institutional adoption and its speed. Bitcoin's transaction times can be slow and its fees can be high, while Ethereum, though faster, can still face scalability challenges during periods of high network activity.

- RippleNet: RippleNet is a global network of financial institutions using Ripple's technology to process cross-border payments. Its widespread adoption is a key factor in XRP's value proposition.

- Speed and Low Transaction Fees: XRP transactions are significantly faster and cheaper than many other cryptocurrencies, making it attractive for large-scale payments.

- Scalability: Ripple's technology is designed to handle a large volume of transactions, making it more scalable than some other blockchain networks.

XRP Price Volatility and Market Factors

XRP's price history is marked by significant volatility. While it has experienced periods of substantial growth, it has also seen dramatic price drops. This volatility is influenced by several key factors:

- Regulatory News: Regulatory decisions and announcements concerning XRP, especially from the Securities and Exchange Commission (SEC) in the United States, have a considerable impact on its price. Positive news tends to drive the price up, while negative news can trigger sharp declines.

- Adoption by Financial Institutions: Increased adoption of Ripple's technology by banks and other financial institutions can lead to increased demand for XRP and consequently, a rise in its price. Conversely, a slowdown in adoption can negatively impact the price.

- Market Sentiment: Like all cryptocurrencies, XRP's price is heavily influenced by overall market sentiment. Periods of general cryptocurrency market optimism often lead to XRP price increases, while periods of fear and uncertainty can cause significant drops.

Market Capitalization: XRP's market capitalization, the total value of all XRP in circulation, is a key indicator of its overall value and potential. A higher market capitalization generally suggests greater investor confidence and potentially higher future price appreciation.

- Major Price Highs and Lows: XRP has experienced both significant price highs and devastating lows throughout its history, highlighting its inherent risk. Understanding this historical volatility is crucial for informed investment decisions.

- Regulatory Uncertainty: The ongoing regulatory uncertainty surrounding XRP significantly contributes to its price fluctuations, making it a high-risk investment.

- Whale Activity: The actions of large XRP holders ("whales") can significantly impact the price, creating both opportunities and risks for smaller investors.

Investment Strategies and Risk Management

Investing in XRP, like any cryptocurrency, requires a carefully considered strategy and a strong understanding of risk management principles. Several investment strategies can be employed:

- Long-Term Holding (HODLing): This strategy involves buying and holding XRP for an extended period, aiming to benefit from potential long-term price appreciation.

- Day Trading: This involves buying and selling XRP within the same day to profit from short-term price fluctuations. It's a higher-risk strategy requiring significant market knowledge and experience.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money in XRP at regular intervals, regardless of price fluctuations, mitigating the risk of investing a large sum at a market peak.

Risk Management: It is absolutely crucial to manage risk when investing in XRP.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments across different asset classes, including other cryptocurrencies and traditional investments.

- Only Invest What You Can Afford to Lose: Cryptocurrency investments are inherently risky. Only invest money you can afford to lose without impacting your financial stability.

- Thorough Research: Before investing in XRP, conduct thorough research to understand the technology, the market, and the inherent risks involved.

Real-World Examples and Success Stories (or Lack Thereof)

While finding publicly verifiable examples of individuals who have become millionaires solely through XRP investments is challenging due to privacy concerns, it's important to understand both potential successes and failures. Anecdotal evidence suggests some early investors in XRP have seen significant returns, while others have experienced substantial losses. These experiences highlight the importance of realistic expectations and avoiding get-rich-quick schemes.

- Successful XRP Investors (Anecdotal): While specific examples are difficult to verify publicly, early adopters of XRP who held onto their investments during periods of growth have likely seen substantial returns.

- Cautionary Tales: Many investors have experienced significant losses in XRP due to its volatility and market downturns. These cautionary tales underscore the importance of careful risk management.

- Realistic Investment Goals: It's crucial to set realistic investment goals and avoid unrealistic expectations of overnight riches. Sustainable, long-term growth is more likely than quick, massive gains.

Conclusion: Can You Really Become a Millionaire with Ripple (XRP)?

While the potential for significant returns with Ripple (XRP) exists, it's crucial to acknowledge the inherent risks. Becoming a millionaire in the cryptocurrency market, including through XRP, requires careful planning, diligent research, and a comprehensive understanding of risk management. The volatility of the market, regulatory uncertainty, and the influence of market sentiment all contribute to the unpredictable nature of XRP investments. Do your own thorough research before investing in XRP or any other cryptocurrency. Remember, responsible investing and realistic expectations are key to navigating the complexities of the cryptocurrency market.

Featured Posts

-

Fortnite Community Outraged Over Backward Music Update

May 02, 2025

Fortnite Community Outraged Over Backward Music Update

May 02, 2025 -

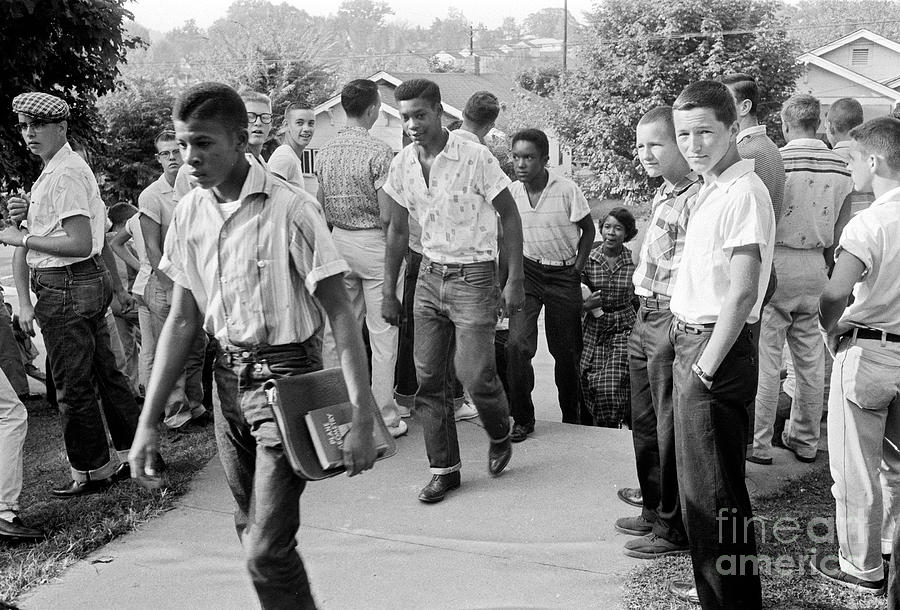

Justice Departments Decision On Louisiana School Desegregation Whats Next

May 02, 2025

Justice Departments Decision On Louisiana School Desegregation Whats Next

May 02, 2025 -

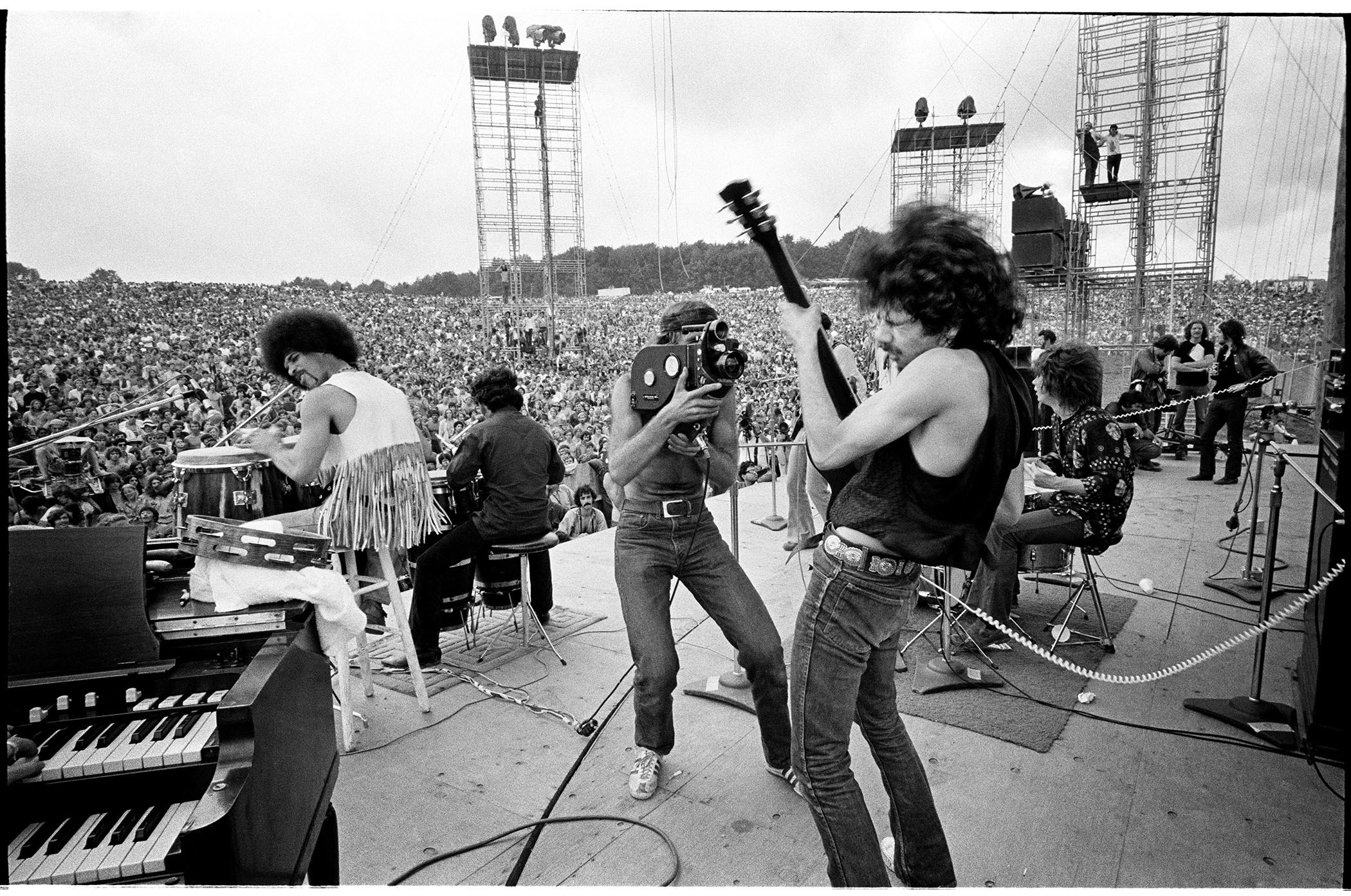

Iconic Bands Strict Festival Rule Life Or Death Situation Only

May 02, 2025

Iconic Bands Strict Festival Rule Life Or Death Situation Only

May 02, 2025 -

Sleet And Snow Expected In Tulsa City Crews Pre Treating Roads

May 02, 2025

Sleet And Snow Expected In Tulsa City Crews Pre Treating Roads

May 02, 2025 -

Understanding Sonys New Play Station Beta Program A Comprehensive Guide

May 02, 2025

Understanding Sonys New Play Station Beta Program A Comprehensive Guide

May 02, 2025