The Rise Of Deutsche Bank's FIC Trading Team: Excellence In The Global Market

Table of Contents

Strategic Initiatives Driving Deutsche Bank's FIC Success

Deutsche Bank's FIC trading triumph isn't accidental; it's the result of a carefully orchestrated strategy encompassing several key areas.

Focus on Key Market Segments

Deutsche Bank's strategic approach involves a laser focus on specific, high-growth market segments. This targeted expansion strategy has yielded significant results.

- Targeted expansion in high-growth emerging markets: The team has strategically invested in expanding its presence in dynamic emerging markets, capitalizing on opportunities presented by these rapidly evolving economies. Specific examples include focusing on [mention specific regions if available, e.g., Southeast Asia, Latin America]. This targeted approach allows for a deeper understanding of local market dynamics and client needs.

- Strengthened relationships with key institutional clients: Building strong, long-term relationships with institutional clients is paramount. The FIC team fosters these relationships through personalized service, tailored solutions, and a commitment to understanding client objectives. This client-centric approach fosters loyalty and repeat business.

- Strategic partnerships for enhanced market access: Collaborations with strategic partners have broadened Deutsche Bank's reach and access to new markets and client segments. These partnerships provide opportunities for increased trading volume and diversification of revenue streams.

Technological Innovation and Investment

Technological prowess is another cornerstone of Deutsche Bank's FIC trading success. The team's commitment to cutting-edge technology provides a distinct competitive edge.

- Adoption of cutting-edge trading technologies: The implementation of high-frequency trading platforms and advanced analytics tools significantly enhances trading speed and efficiency. This allows the team to react swiftly to market changes and capitalize on fleeting opportunities.

- Algorithmic trading strategies: Sophisticated algorithmic trading strategies optimize trading decisions and minimize risks. These algorithms leverage vast datasets and advanced analytics to identify profitable trading opportunities.

- Advanced risk management systems: Robust risk management systems ensure the team operates within defined risk parameters, safeguarding against potential losses and maintaining financial stability. This commitment to responsible trading practices builds trust with clients and regulators. Specific examples of technologies utilized (if publicly available) would strengthen this section.

Talent Acquisition and Development

The success of Deutsche Bank's FIC trading team hinges on attracting and retaining top talent within the broader financial markets landscape.

- Recruitment of top-tier trading professionals: Deutsche Bank actively recruits experienced and highly skilled traders from across the global financial industry. Attracting individuals with diverse backgrounds and expertise is a priority.

- Focus on diversity and inclusion: A diverse and inclusive workplace fosters creativity and innovation, leading to better decision-making and performance. The team actively promotes a culture of inclusivity.

- Robust training and development programs: Continuous professional development is essential to maintain a competitive edge. The team invests heavily in comprehensive training programs to keep its personnel at the forefront of industry knowledge and best practices. This includes training on new technologies and regulatory developments.

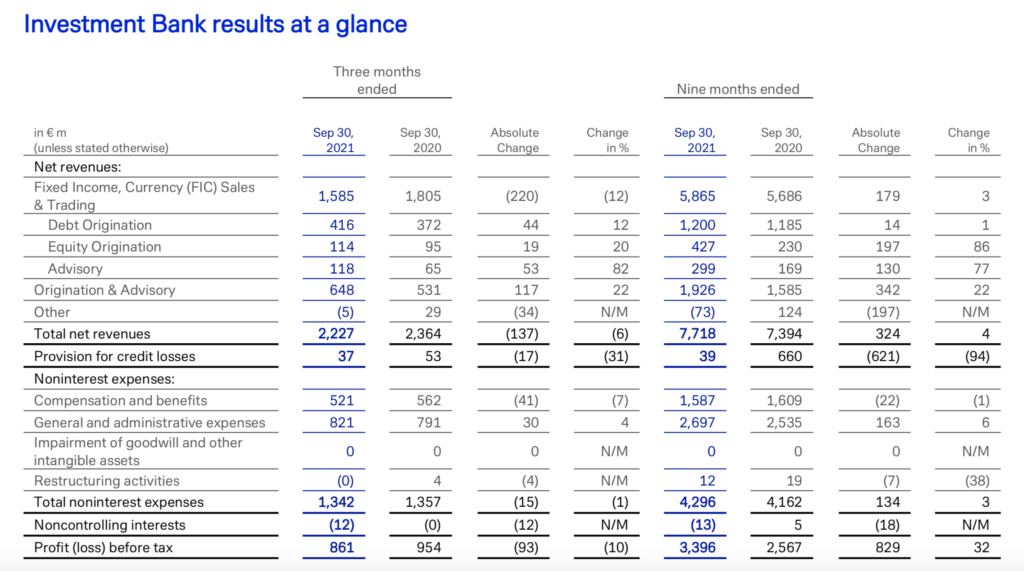

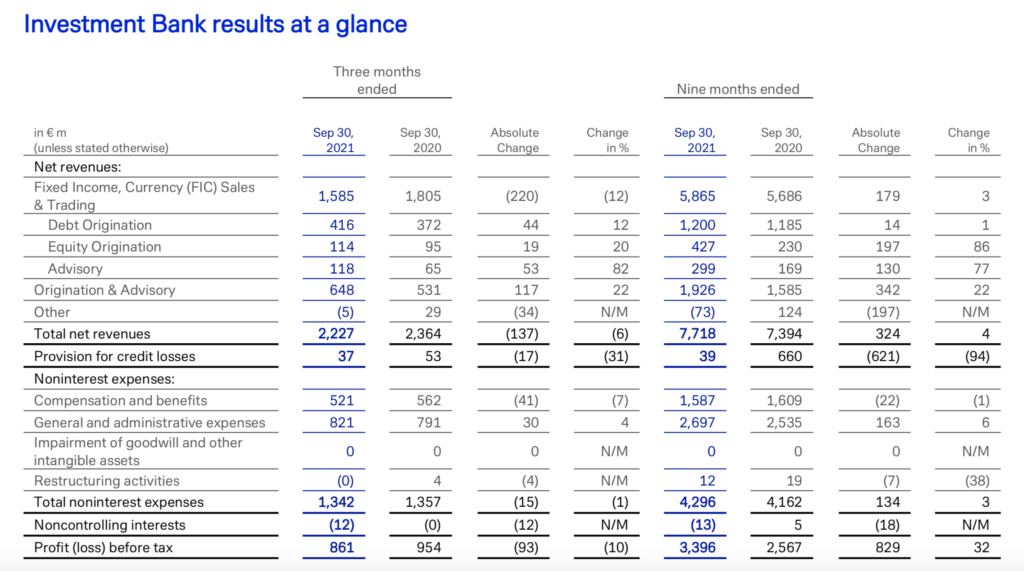

Deutsche Bank FIC's Performance and Market Share

Deutsche Bank's FIC trading team consistently demonstrates exceptional performance and holds a significant market share.

Consistent Strong Performance

The team's success is evidenced by tangible results.

- Year-over-year growth in trading volume: [Insert data on year-over-year growth if available. For example: "Trading volume has increased by X% year-over-year for the past Y years."] This demonstrates the team’s ability to capture market share and adapt to market trends.

- Increased market share in key areas: [Insert data on market share increase if available. For example: "Market share in [specific area] has increased from X% to Y%."] This showcases the effectiveness of their strategic initiatives.

- Consistently exceeding performance targets: The team consistently surpasses its internal performance targets, reflecting their commitment to excellence and their ability to navigate the complexities of the global financial markets.

Reputation and Client Trust

Building and maintaining client trust is a critical factor in Deutsche Bank's FIC team's success.

- Strong client relationships built on trust and reliability: The team's success is built on a foundation of strong, long-term relationships with institutional clients. This trust is fostered through consistent performance, transparency, and proactive communication.

- Reputation for exceptional service: The team is known for providing exceptional client service, adapting to individual client needs and providing tailored solutions.

- Positive client feedback and testimonials: [Insert client testimonials if available. This would add significant credibility to the claims made.] Positive feedback reinforces the team's reputation for excellence.

Future Outlook and Challenges for Deutsche Bank FIC Trading

Despite its success, Deutsche Bank's FIC trading team faces ongoing challenges in an ever-evolving landscape.

Navigating Regulatory Changes

The financial industry is subject to constant regulatory changes.

- Adapting to evolving regulatory landscapes: The team proactively adapts to new regulations and compliance requirements, ensuring its operations remain fully compliant.

- Proactive compliance measures: Investing in compliance technology and training is crucial to remain ahead of regulatory changes.

- Investment in regulatory technology: Adopting cutting-edge regulatory technology allows for efficient monitoring and reporting, minimizing risks and ensuring compliance.

Maintaining Competitive Advantage

Maintaining a competitive edge requires continuous innovation and strategic planning.

- Continued investment in technology and talent: Ongoing investment in state-of-the-art technology and highly skilled personnel is crucial to maintaining a competitive advantage.

- Strategic partnerships: Strategic partnerships allow for access to new markets and diversified revenue streams, enhancing competitiveness.

- Expansion into new markets: Exploring new markets and identifying emerging opportunities is essential for continued growth and maintaining a leading position in the global financial markets.

Conclusion

The rise of Deutsche Bank's FIC trading team exemplifies the power of strategic planning, technological innovation, and exceptional talent. Their consistently strong performance and dedication to client service have established them as a leader in the global financial markets. By continually adapting to the dynamic landscape and investing in cutting-edge technologies and skilled professionals, Deutsche Bank's FIC trading team is well-positioned for enduring success. Learn more about Deutsche Bank's commitment to excellence in Fixed Income Currencies (FIC) trading and explore career opportunities with this top-performing team. Discover the future of Deutsche Bank FIC trading and how you can be a part of it!

Featured Posts

-

Sierra Leone The Silencing Of Journalists Investigating Dutch Drug Trafficker Bolle Jos

May 30, 2025

Sierra Leone The Silencing Of Journalists Investigating Dutch Drug Trafficker Bolle Jos

May 30, 2025 -

Danmark Vs Portugal Analyse For Kampen

May 30, 2025

Danmark Vs Portugal Analyse For Kampen

May 30, 2025 -

Fbi Most Wanted Season 6 Sneak Peek Remy Questions A Widower

May 30, 2025

Fbi Most Wanted Season 6 Sneak Peek Remy Questions A Widower

May 30, 2025 -

Vaccine Packaging Market A Rapidly Expanding Industry

May 30, 2025

Vaccine Packaging Market A Rapidly Expanding Industry

May 30, 2025 -

Erstatning For Dolberg Tipsbladets Oversigt Over Mulige Spillere

May 30, 2025

Erstatning For Dolberg Tipsbladets Oversigt Over Mulige Spillere

May 30, 2025