The Rise Of Wildfire Betting: A Reflection Of Our Times

Table of Contents

The Growing Threat of Wildfires Fuels the Market

The frequency and intensity of wildfires are dramatically increasing. Climate change, with its rising temperatures and prolonged droughts, is a major culprit. Alongside this, factors like poor forest management and increased human activity in vulnerable areas exacerbate the problem. The economic consequences are immense, extending far beyond the immediate cost of property damage. Businesses suffer from interruption, entire communities are displaced, and the overall economic impact ripples across various sectors.

- Rising insurance premiums and payouts: The escalating wildfire risk translates directly into higher insurance premiums for homeowners and businesses in affected areas. Insurance companies are facing record payouts, forcing them to reassess their risk models and adjust their pricing strategies accordingly.

- Increased demand for catastrophe bonds and other risk-transfer mechanisms: In response to the growing uncertainty, there's a surge in demand for innovative financial instruments designed to transfer wildfire risk.

- Government spending on wildfire prevention and response: Governments are increasingly investing in wildfire prevention measures, including controlled burns, improved forest management, and enhanced firefighting capabilities. This spending represents a significant financial commitment reflecting the severity of the problem.

How Wildfire Betting Works (Indirectly)

Directly betting on whether a specific wildfire will occur or its severity is largely prohibited. However, indirect exposure to wildfire risk is achieved through various financial instruments:

Catastrophe Bonds (CAT Bonds)

CAT bonds are a type of insurance-linked security. Investors essentially lend money to insurance companies; if a specified catastrophic event, such as a large wildfire exceeding a pre-defined threshold, occurs, the investors may lose some or all of their principal. Conversely, if the event doesn't meet the threshold, investors receive a higher return. The value of these bonds fluctuates directly based on the perceived risk of wildfires.

Insurance-Linked Securities (ILS)

ILS encompass a broader range of financial instruments designed to transfer insurance risk. These securities can be linked to wildfire insurance payouts, allowing investors to gain exposure to the performance of the underlying insurance portfolios. The value of ILS is directly tied to the frequency and severity of wildfire events.

Stock Market Impacts

Companies in sectors directly affected by wildfires, such as insurance providers, forestry companies, and construction firms involved in rebuilding efforts, experience significant stock price fluctuations based on wildfire activity. A surge in wildfires can negatively impact the stock prices of insurance companies facing increased payouts while potentially benefiting companies involved in rebuilding and wildfire mitigation.

The Ethical and Societal Implications of Wildfire Betting

The prospect of profiting from natural disasters raises complex ethical concerns. The idea of making money from events that cause widespread suffering, displacement, and loss of life is troubling to many.

- The argument for better risk management: Proponents argue that wildfire betting encourages better risk assessment and management, leading to improved prevention strategies and more effective resource allocation.

- Counterarguments: Critics argue that such betting trivializes the human cost of wildfires, potentially overshadowing the focus on helping victims and rebuilding communities.

- The role of regulation: Careful regulation is crucial to mitigate potential ethical issues and ensure that wildfire betting doesn't exacerbate the problems it aims to address.

The Future of Wildfire Betting and Risk Assessment

Advancements in wildfire prediction and modeling are likely to significantly influence the wildfire betting market.

- Advancements in technology and data analysis: Improved data collection, satellite imagery, and sophisticated computer models offer more accurate predictions of wildfire risk.

- The role of artificial intelligence (AI): AI can analyze vast datasets to identify patterns and predict wildfire behavior with greater accuracy, impacting risk assessment and pricing of related financial instruments.

- The impact on insurance premiums and investment strategies: More accurate prediction will lead to more precise insurance pricing and more informed investment decisions within the wildfire betting market.

Conclusion: Understanding the Rise of Wildfire Betting

The rise of wildfire betting reflects a complex interplay between escalating wildfire threats, the development of sophisticated financial instruments, and the inherent human tendency to seek opportunity even in the face of disaster. While the potential for better risk management exists, the ethical considerations surrounding profiting from tragedy must be carefully addressed. Understanding the intricacies of wildfire betting, and its interconnectedness with climate change betting and catastrophe bonds, is vital for responsible risk assessment and management. Learn more about the complex world of wildfire betting and how you can contribute to responsible risk management in the face of escalating climate-related disasters.

Featured Posts

-

Higher Prices Empty Shelves The Lingering Impact Of Trumps Trade War With China

Apr 29, 2025

Higher Prices Empty Shelves The Lingering Impact Of Trumps Trade War With China

Apr 29, 2025 -

The January 29th Dc Air Disaster Examining The Ny Times Narrative

Apr 29, 2025

The January 29th Dc Air Disaster Examining The Ny Times Narrative

Apr 29, 2025 -

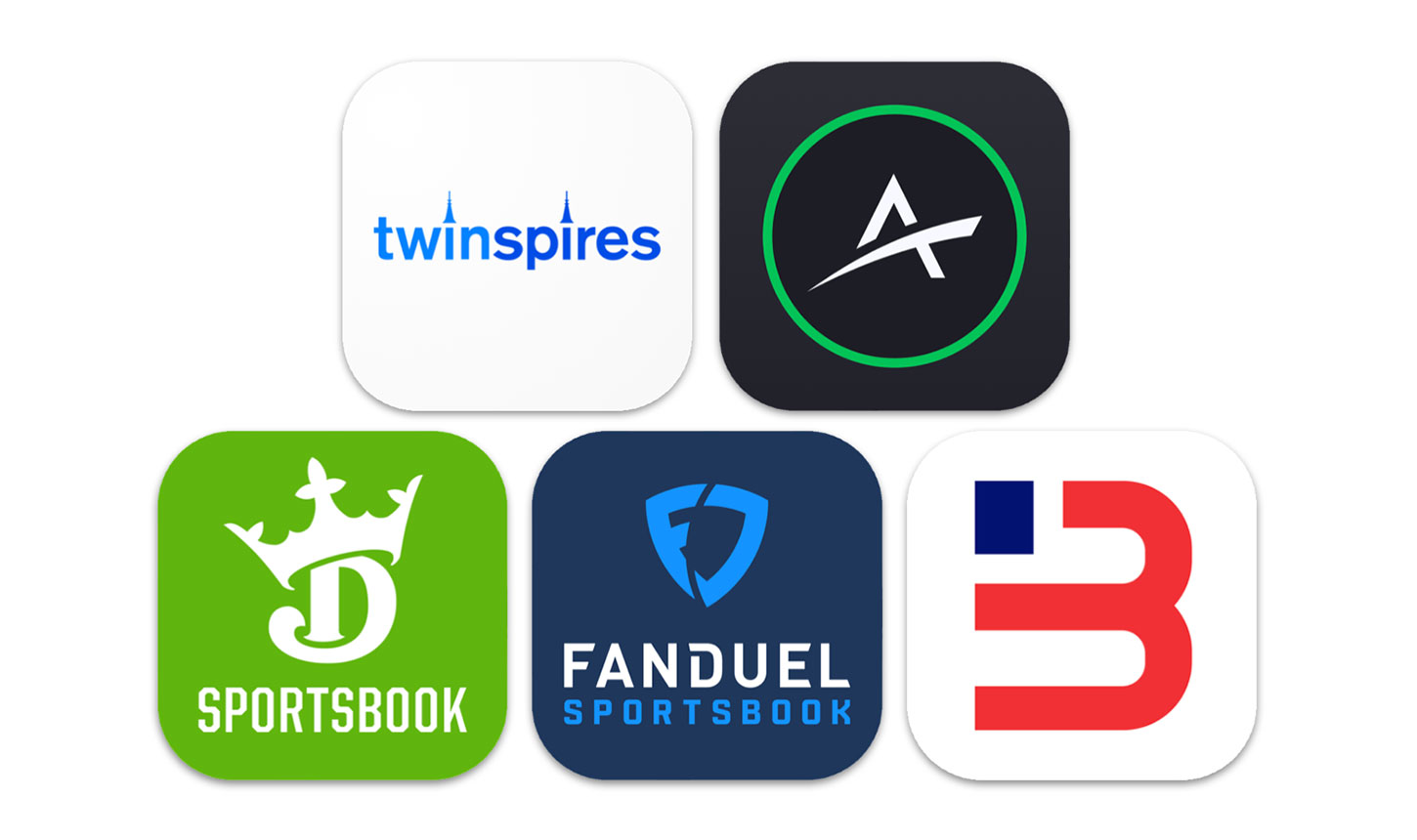

Willie Nelson Honors His King Of The Road Crew In New Documentary

Apr 29, 2025

Willie Nelson Honors His King Of The Road Crew In New Documentary

Apr 29, 2025 -

Obnova Konania V Pripade Unosu Studentky Sone Rozhodnutie V Stredu

Apr 29, 2025

Obnova Konania V Pripade Unosu Studentky Sone Rozhodnutie V Stredu

Apr 29, 2025 -

Nintendos Action Leads To Ryujinx Emulator Development Cessation

Apr 29, 2025

Nintendos Action Leads To Ryujinx Emulator Development Cessation

Apr 29, 2025