The Saudi ABS Market: How A Regulatory Change Created A Major Opportunity

Table of Contents

H2: The Regulatory Landscape Before and After the Change

The Saudi ABS market previously faced significant hurdles. Strict regulations limited the types of assets eligible for securitization, primarily focusing on traditional asset classes. The approval processes were cumbersome, involving extensive documentation and lengthy waiting periods, often discouraging potential issuers. A lack of clarity regarding regulatory frameworks further contributed to market uncertainty, deterring investors.

- Previous limitations on asset types eligible for securitization: Only a narrow range of assets, primarily related to real estate, could be securitized.

- Complex approval processes and lengthy timelines: Securitization transactions could take months, if not years, to complete.

- Lack of clarity regarding regulatory frameworks, leading to uncertainty: The absence of a clear and comprehensive regulatory framework created significant uncertainty for investors and issuers.

The new regulatory framework has dramatically changed this landscape. Key improvements include:

- Simplified documentation: The streamlining of documentation requirements has significantly reduced the time and cost involved in securitization transactions.

- Faster approval times: The approval process has been significantly expedited, enabling quicker access to capital for businesses.

- Broader asset eligibility: A wider range of assets, including those related to consumer lending and project finance, are now eligible for securitization, significantly expanding the market’s potential.

H2: Unlocking Investment Opportunities in the Saudi ABS Market

The regulatory reforms have opened the floodgates for investment opportunities in the Saudi ABS market. The potential for high returns is significant, particularly given the previously limited supply of ABS and the increasing demand. This presents a compelling opportunity for diversification within investment portfolios, offering exposure to a previously untapped asset class.

- Attractive yields for investors: High demand and previously limited supply of ABS are driving attractive yields for investors.

- Opportunities for diversification within investor portfolios: The Saudi ABS market offers a unique opportunity to diversify investment portfolios and reduce overall risk.

- Potential for growth in the Islamic ABS segment: The burgeoning Islamic finance sector in Saudi Arabia presents a significant opportunity for growth in the Islamic ABS segment, catering to Sharia-compliant investors.

- Increased participation of international investors: The improved regulatory clarity and increased transparency are attracting significant interest from international investors.

H2: Driving Forces Behind the Growth of the Saudi ABS Market

Several factors are driving the rapid expansion of the Saudi ABS market. These are closely intertwined with the Kingdom's broader economic diversification strategy, particularly Vision 2030.

- Government initiatives aimed at boosting economic diversification: The Saudi government's commitment to economic diversification is creating a favorable environment for the growth of the ABS market.

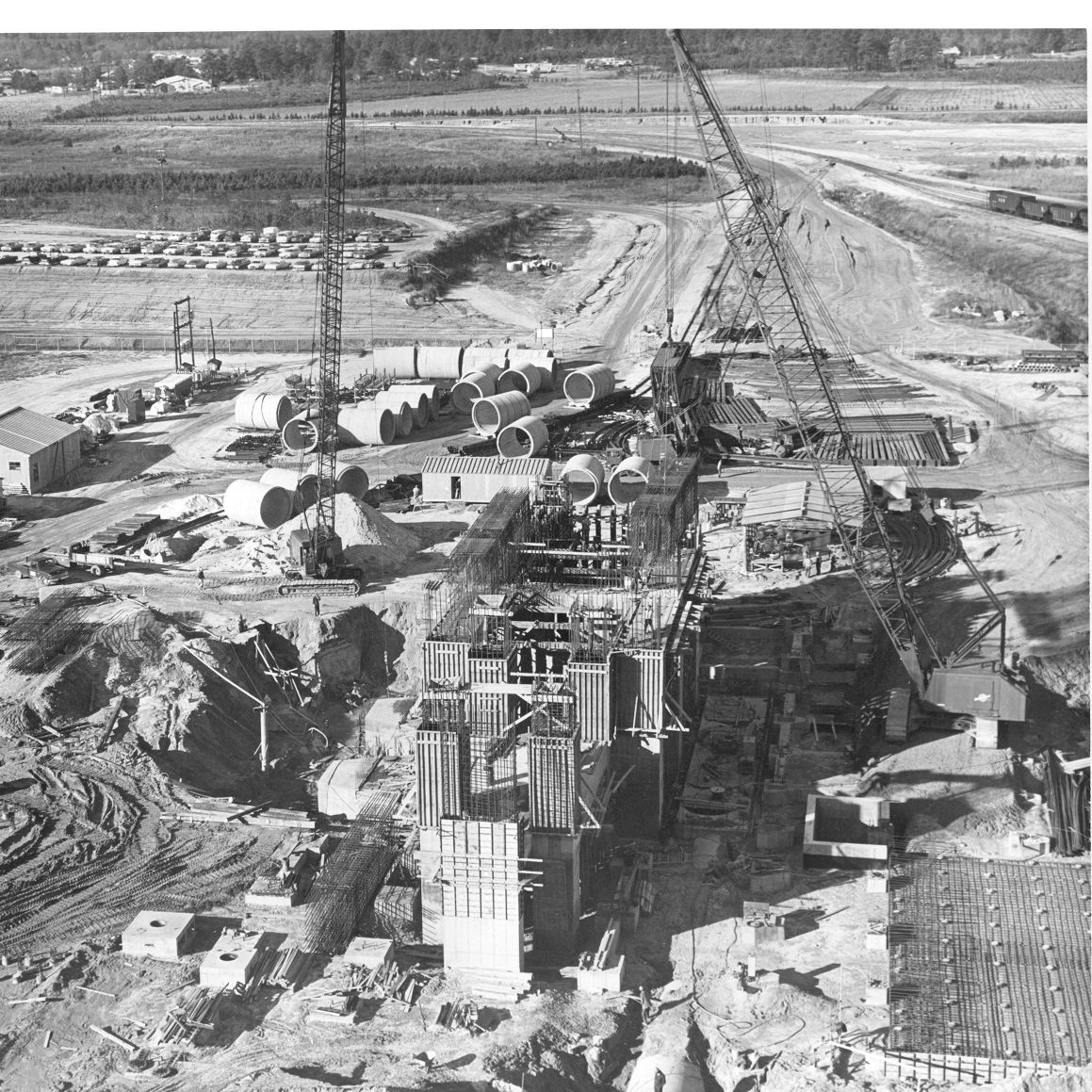

- Significant infrastructure development projects creating asset-backed opportunities: Massive infrastructure projects across the country are generating a wealth of asset-backed opportunities for securitization.

- Growth in the consumer lending and real estate sectors: The robust growth in these sectors provides a large pool of assets for securitization.

- Increasing awareness and understanding of ABS amongst investors: Improved investor education and a greater understanding of the benefits of ABS are contributing to increased market participation.

H3: Specific Asset Classes Driving Growth

Several asset classes are playing a key role in the Saudi ABS market's growth.

- Mortgage-backed securities (MBS) Saudi Arabia: The flourishing real estate sector provides a substantial foundation for mortgage-backed securities.

- Auto loan ABS Saudi Arabia: The increasing popularity of vehicle ownership fuels growth in this segment.

- Consumer loan ABS Saudi Arabia: Expanding consumer credit opportunities create a growing pool of assets for securitization.

- Project finance Saudi Arabia: Large-scale infrastructure projects are generating significant opportunities for project finance ABS.

3. Conclusion

The regulatory reforms in Saudi Arabia have dramatically reshaped the landscape of the Saudi ABS market. The streamlined processes, clearer guidelines, and increased investor protection have unlocked substantial investment opportunities, fostering economic growth and diversification. The potential for high returns, coupled with the increasing demand from both domestic and international investors, makes the Saudi ABS market a compelling prospect.

To capitalize on this dynamic market, we encourage further research into specific asset classes and their potential. For more in-depth information and guidance on investing in the Saudi ABS market, we recommend contacting a qualified financial advisor specializing in Saudi Arabian investment opportunities. Explore the potential – invest in the future of the Saudi ABS market.

Featured Posts

-

Samoas Miss Pacific Islands 2025 Victory

May 02, 2025

Samoas Miss Pacific Islands 2025 Victory

May 02, 2025 -

Robinson Nuclear Plants Safety Inspection Success License Extension To 2050

May 02, 2025

Robinson Nuclear Plants Safety Inspection Success License Extension To 2050

May 02, 2025 -

Leaked 2008 Disney Game Now Available On Ps Plus Premium

May 02, 2025

Leaked 2008 Disney Game Now Available On Ps Plus Premium

May 02, 2025 -

South Korean Architecture A Major New Exhibition Unveils Unique Housing Styles

May 02, 2025

South Korean Architecture A Major New Exhibition Unveils Unique Housing Styles

May 02, 2025 -

Mqbwdh Kshmyr Eyd Alftr Pr Bharty Mzalm Jary Shhadt Ka Slslh

May 02, 2025

Mqbwdh Kshmyr Eyd Alftr Pr Bharty Mzalm Jary Shhadt Ka Slslh

May 02, 2025