The Semiconductor Market's Recent Surge: A Look At Leveraged ETF Performance

Table of Contents

Understanding the Semiconductor Market Boom

The current boom in the semiconductor market is fueled by several converging factors. Increased demand for electronics across various sectors is a primary driver. The rollout of 5G technology necessitates advanced chips with higher processing power, while the rapid advancements in artificial intelligence (AI) and machine learning are creating a voracious appetite for sophisticated semiconductor components. Furthermore, the automotive industry's shift towards electric vehicles and autonomous driving systems is significantly boosting demand.

- Growth in data centers and cloud computing: The expansion of cloud computing services requires massive data center infrastructure, leading to a surge in demand for high-performance semiconductors.

- Expansion of the Internet of Things (IoT): The proliferation of connected devices, from smart homes to industrial sensors, fuels the need for a vast number of smaller, more energy-efficient chips.

- Government investments and subsidies in semiconductor manufacturing: Many governments are actively investing in domestic semiconductor production, aiming to reduce reliance on foreign suppliers and bolster national technological capabilities. This injection of capital is stimulating further growth in the sector.

- Shortage of semiconductors and increased pricing power: Recent supply chain disruptions have highlighted the critical role of semiconductors and led to increased pricing power for manufacturers.

According to Gartner, the worldwide semiconductor revenue is projected to reach [insert relevant statistic and source], showcasing the explosive growth of this market. This robust demand is a key factor driving the performance of semiconductor-related investments.

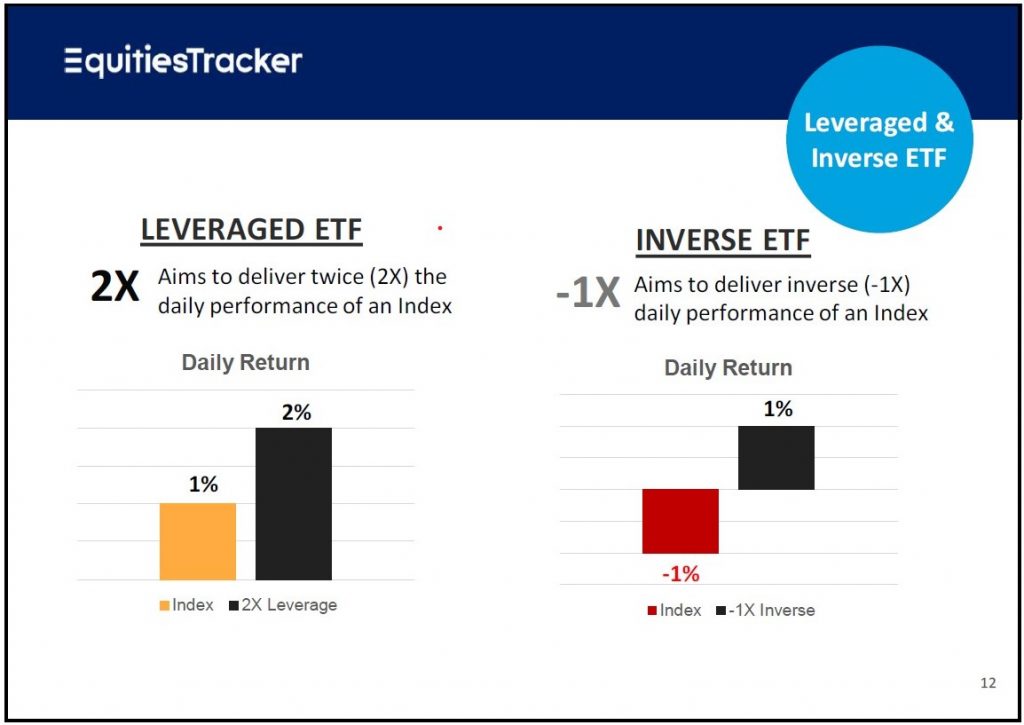

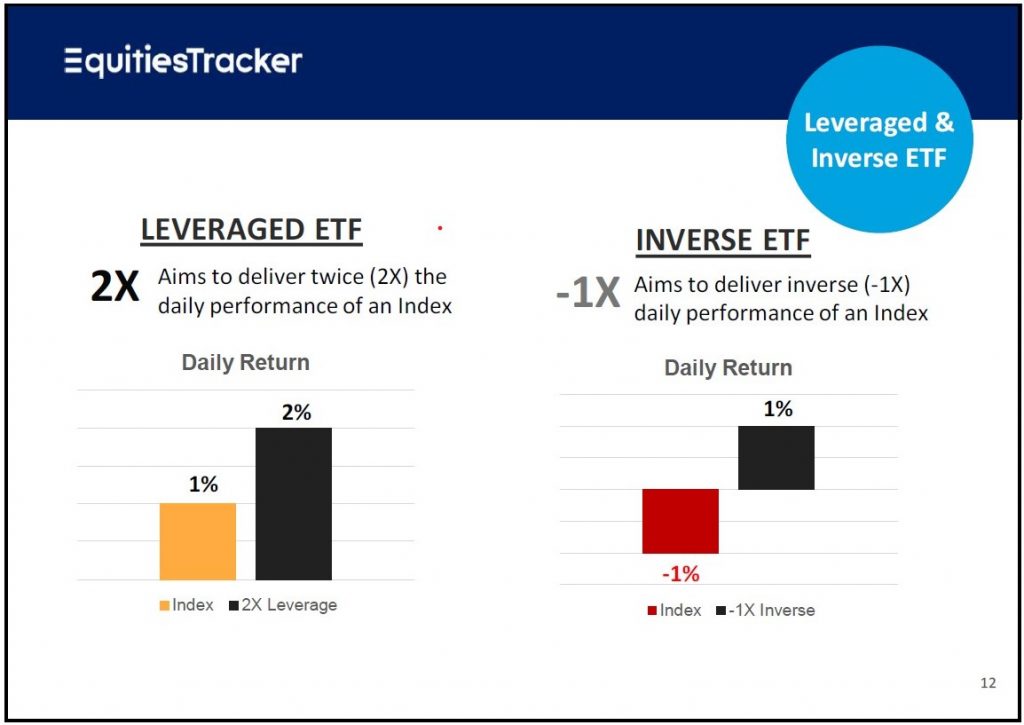

Leveraged ETFs: A High-Risk, High-Reward Investment Strategy

Leveraged ETFs are designed to deliver amplified returns compared to the underlying index they track. For example, a 2x leveraged ETF aims to provide double the daily return of its benchmark index, while a 3x leveraged ETF aims for triple the daily return. However, this amplification works both ways – losses are also magnified.

The risks associated with leveraged ETFs are substantial:

- Volatility: These ETFs are inherently volatile due to their leveraged nature, making them unsuitable for risk-averse investors.

- Decay: Daily resetting of leverage can lead to a phenomenon known as "decay," where the long-term performance lags behind the underlying index, especially in sideways or slightly declining markets.

- Expense ratios: Leveraged ETFs typically have higher expense ratios than traditional index funds, further impacting their overall returns.

It's crucial to understand these risks:

- Daily Resetting: Leveraged ETFs reset their leverage daily. This means that the fund's performance is recalculated each day based on the previous day's closing price, potentially leading to significant deviations from the intended leverage over longer periods.

- Types of Leveraged ETFs: Investors should be aware of the different leverage multiples available (2x, 3x, etc.) and choose an ETF that aligns with their risk tolerance.

- Comparison to Traditional Index Funds: Traditional index funds offer diversification and lower risk compared to leveraged ETFs, but they also provide more modest returns.

Analyzing Leveraged ETF Performance in the Semiconductor Sector

Several leveraged ETFs track the semiconductor market. Examples include [mention specific ETF ticker symbols, e.g., SOXL (Direxion Daily Semiconductor Bull 3x Shares), SMH (iShares PHLX Semiconductor ETF) – note that these are examples and should be checked for relevance and current availability]. Their performance should be compared against the broader semiconductor market index, such as the PHLX Semiconductor Index (SOX).

Analyzing their performance requires considering various factors:

- Performance Data over Different Timeframes: Evaluating performance over short-term (e.g., 1 month, 3 months) and long-term (e.g., 1 year, 5 years) periods provides a comprehensive picture.

- Comparison of Returns and Volatility: Comparing the returns of leveraged ETFs to the underlying index and assessing the associated volatility is crucial for understanding the risk-reward profile.

- Analysis of Risk-Adjusted Returns: Metrics such as the Sharpe ratio can help assess the risk-adjusted returns of leveraged ETFs compared to traditional index funds.

Disclaimer: Past performance is not indicative of future results.

Case Studies: Successful and Unsuccessful Investments

[Include specific examples of leveraged semiconductor ETFs and their performance during specific market conditions. Analyze the factors contributing to their success or failure, such as market timing and overall market trends. For example, discuss how a particular ETF performed during a period of strong growth versus a period of market correction.]

- Example 1: [ETF ticker] performed exceptionally well during [time period] due to [market conditions].

- Example 2: [ETF ticker] underperformed during [time period] because of [market conditions and investor strategies].

Conclusion: Harnessing the Semiconductor Market's Recent Surge with Leveraged ETFs

The semiconductor market's recent surge presents a compelling investment opportunity, but leveraging ETFs in this sector requires a deep understanding of the associated risks. While the potential for high returns exists, the magnified volatility and decay inherent in leveraged ETFs necessitate careful consideration. Thorough research and a thorough risk assessment are paramount before investing in leveraged semiconductor ETFs.

To capitalize on the semiconductor market's recent surge, learn more about leveraged ETFs in the semiconductor market and explore various investment strategies. Remember to consult with a financial advisor before making any investment decisions.

[Include links to relevant resources, such as ETF provider websites (e.g., Direxion, Invesco), financial news articles, and educational materials on leveraged ETFs.]

Featured Posts

-

Kulturna Dediscina Prekmurja Vloga Romskih Muzikantov

May 13, 2025

Kulturna Dediscina Prekmurja Vloga Romskih Muzikantov

May 13, 2025 -

Espns Nba Draft Lottery Coverage A New Approach

May 13, 2025

Espns Nba Draft Lottery Coverage A New Approach

May 13, 2025 -

Great 8s Pursuit Ovechkin Matches Gretzkys Nhl Record

May 13, 2025

Great 8s Pursuit Ovechkin Matches Gretzkys Nhl Record

May 13, 2025 -

Where To Stream Den Of Thieves 2 Netflix And Other Options

May 13, 2025

Where To Stream Den Of Thieves 2 Netflix And Other Options

May 13, 2025 -

Securing A Professorship In Fine Arts A Focus On Spatial Theory And Practice

May 13, 2025

Securing A Professorship In Fine Arts A Focus On Spatial Theory And Practice

May 13, 2025