The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

Projected Revenue Loss Under the GOP Tax Plan

The GOP tax plan proposes substantial cuts to both corporate and individual income taxes, leading to significant projected revenue losses. This section analyzes these projected losses and the underlying assumptions.

Corporate Tax Cuts

The proposed reduction in the corporate tax rate is a central component of the plan. This cut is expected to dramatically reduce government revenue.

- Specific Rate Changes and Impact: A reduction from [previous corporate tax rate]% to [proposed corporate tax rate]% is projected to decrease annual revenue by an estimated [dollar amount] over [timeframe], according to [Source 1, e.g., Congressional Budget Office].

- Loopholes and Tax Collection: Concerns exist regarding potential loopholes and deductions that could further reduce the effective tax rate and exacerbate revenue loss. [Source 2, e.g., Tax Policy Center analysis] highlights the potential for [specific loophole] to significantly impact tax collections.

- Visual Representation: [Insert graph or chart visualizing projected revenue loss from corporate tax cuts].

Individual Tax Cuts

The plan also includes significant cuts to individual income taxes, impacting various income brackets.

- Changes to Tax Brackets, Deductions, etc.: The plan proposes [describe specific changes, e.g., changes to standard deduction, tax bracket thresholds, child tax credit].

- Impact on Different Income Groups: The impact of these cuts varies across income groups. Lower-income households may experience [describe impact], while higher-income households may see [describe impact]. [Source 3, e.g., Tax Foundation analysis] provides a detailed breakdown by income bracket.

- Revenue Loss Breakdown: [Insert table showing projected revenue loss by income bracket].

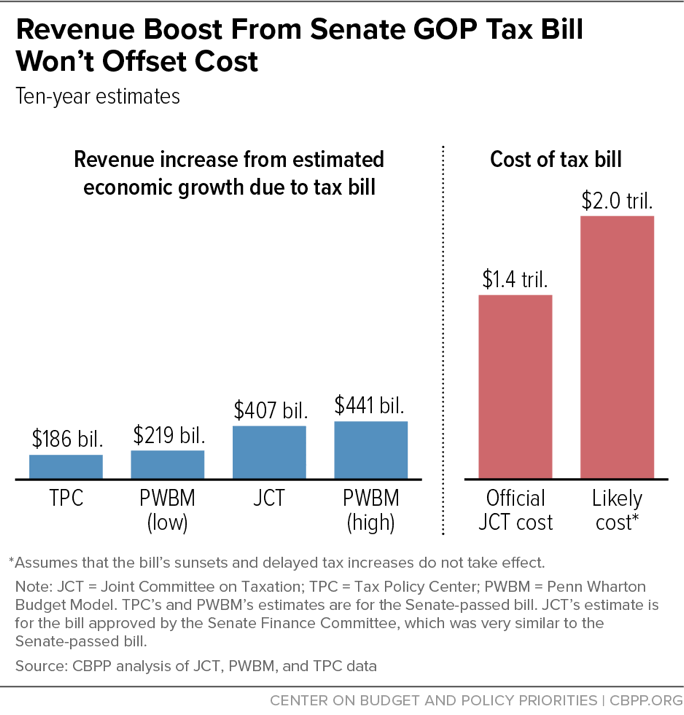

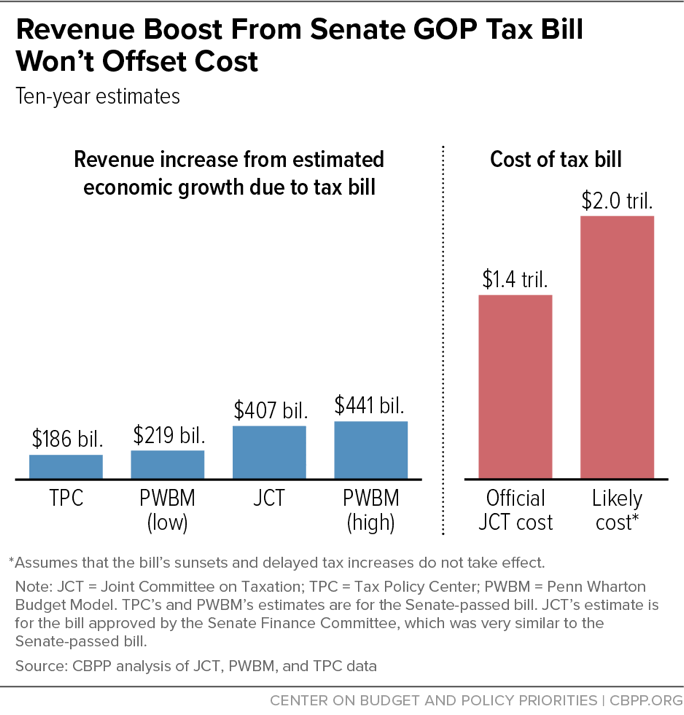

Dynamic Scoring vs. Static Scoring

Estimating the impact of tax cuts involves different methodologies: static and dynamic scoring.

- Static Scoring: This approach assumes that tax cuts do not affect economic behavior (e.g., investment, employment). It provides a more conservative estimate of revenue loss.

- Dynamic Scoring: This approach considers the potential stimulative effects of tax cuts on economic growth. It projects higher revenue in the long run due to increased economic activity. However, this approach is often criticized for its reliance on uncertain assumptions.

- Methodology Used: This analysis uses [explain the chosen methodology, and justify the choice based on its strengths and limitations].

Increased Government Spending and its Contribution to the Deficit

Even if the economy grows as a result of the tax cuts, increased government spending could significantly impact the deficit.

Mandatory Spending

Mandatory spending programs like Social Security and Medicare are a significant portion of the federal budget.

- Impact of GOP Tax Plan: The GOP tax plan's potential economic impact could lead to increased demand for these programs, resulting in higher costs. [Source 4, e.g., Committee for a Responsible Federal Budget report] provides projections for increased spending in these areas.

Discretionary Spending

Discretionary spending, subject to annual appropriations, could also be affected.

- Impact of Tax Cuts: Tax cuts may lead to calls for reduced discretionary spending to offset revenue losses, potentially impacting crucial government programs and services.

Long-Term Implications of the GOP Tax Plan on the National Debt

The cumulative effect of revenue losses and potential spending increases will significantly impact the national debt.

Debt-to-GDP Ratio

The debt-to-GDP ratio is a key indicator of a nation's fiscal health.

- Projected Changes: The GOP tax plan is projected to increase the debt-to-GDP ratio from [current ratio]% to [projected ratio]% within [timeframe]. [Source 5, e.g., Peterson Institute for International Economics analysis] provides long-term projections.

- Risks of High Debt-to-GDP Ratio: A high debt-to-GDP ratio can lead to higher interest rates, reduced investor confidence, and slower economic growth.

Interest Payments on the National Debt

Increased borrowing to finance the deficit will lead to higher interest payments.

- Impact of Rising Interest Rates: Rising interest rates, even slightly, will dramatically increase the cost of servicing the national debt, placing further strain on the budget.

Conclusion

This analysis of the GOP tax plan highlights the significant projected increases in the national deficit. The substantial revenue losses from proposed corporate and individual tax cuts, coupled with the potential for increased government spending, paint a concerning picture of the plan's long-term fiscal implications. Understanding the stark math behind the GOP Tax Plan Deficit Impact is vital for responsible policymaking. We urge readers to delve deeper into the data and engage in informed discussions about the potential consequences of this legislation. Further research on the GOP tax plan deficit impact, including alternative scoring methodologies and long-term economic forecasts, is encouraged to fully grasp the potential economic ramifications.

Featured Posts

-

Sound Perimeter How Music Unites Us

May 21, 2025

Sound Perimeter How Music Unites Us

May 21, 2025 -

Coping Mechanisms For Dealing With Love Monsters

May 21, 2025

Coping Mechanisms For Dealing With Love Monsters

May 21, 2025 -

Borussia Dortmund Defeat Mainz Thanks To Maximilian Beiers Brace

May 21, 2025

Borussia Dortmund Defeat Mainz Thanks To Maximilian Beiers Brace

May 21, 2025 -

Wayne Gretzkys Loyalty Questioned Amidst Trumps Trade Policies And Statehood Comments

May 21, 2025

Wayne Gretzkys Loyalty Questioned Amidst Trumps Trade Policies And Statehood Comments

May 21, 2025 -

Abn Amro Dutch Central Bank Investigates Bonus Payments

May 21, 2025

Abn Amro Dutch Central Bank Investigates Bonus Payments

May 21, 2025