The Threat Of Stagflation: Higher Inflation And Unemployment Fuel Economic Uncertainty

Table of Contents

Understanding Stagflation: Defining the Economic Beast

Stagflation is a particularly nasty economic beast, defined by the simultaneous occurrence of high inflation, high unemployment, and slow or stagnant economic growth. It's the worst of both worlds – the inflationary pressures of a booming economy coupled with the high unemployment typically associated with a recession. This paradoxical situation makes it incredibly difficult to address using traditional economic policy tools.

Historical examples illuminate the devastating impact of stagflation. The 1970s, for instance, saw many developed nations grapple with a period of stagflation triggered by oil price shocks and other economic disruptions. This period demonstrated the challenges inherent in simultaneously addressing high inflation and high unemployment.

- Definition: Persistent inflation coupled with high unemployment and slow or negative economic growth (as measured by GDP).

- Historical Context: The 1970s oil crisis, the Great Inflation of the 1970s, and other instances throughout history showcase the disruptive and prolonged nature of stagflation.

- Key Characteristics: Slow or negative GDP growth, rising prices for goods and services (inflation), and a significant increase in unemployment. This creates a vicious cycle where reduced consumer spending further dampens economic growth.

Causes of Stagflation: Unraveling the Complex Web

The causes of stagflation are complex and often intertwined. No single factor is solely responsible; instead, it typically arises from a combination of supply-side shocks, demand-pull inflation, and potentially flawed monetary policy.

- Supply-Side Shocks: Disruptions to supply chains, such as oil crises (like those in the 1970s), pandemics (like the COVID-19 pandemic), or natural disasters, lead to reduced output and higher prices for essential goods. This simultaneously decreases economic growth and increases inflation. Supply chain bottlenecks and shortages further exacerbate this effect.

- Demand-Pull Inflation: While counterintuitive alongside high unemployment, demand-pull inflation can occur when excessive government spending or other factors boost aggregate demand, leading to increased prices even as a significant portion of the workforce remains unemployed. This often happens when certain sectors boom while others struggle.

- Monetary Policy Errors: Inappropriate monetary policies, such as excessive money printing without corresponding increases in productivity, can fuel inflation and contribute to stagflationary pressures. The pursuit of overly expansionary monetary policies can create an environment where inflation rises without commensurate economic growth.

- Geopolitical Instability: Global conflicts, trade wars, and political uncertainty can create volatility in markets and disrupt supply chains, leading to increased prices and reduced economic activity, driving the conditions for stagflation.

Consequences of Stagflation: A Cascade of Negative Impacts

Stagflation's consequences are far-reaching and significantly impact consumers, businesses, and governments. The economic uncertainty it creates undermines confidence and triggers a cascade of negative effects.

- Reduced Consumer Spending: Rising prices and unemployment erode consumer purchasing power, leading to a decrease in overall demand. Consumers delay major purchases, opting to save money amidst economic uncertainty.

- Business Investment Decline: Businesses become hesitant to invest during periods of stagflation due to uncertain demand and increased production costs. This dampens economic growth further, creating a vicious cycle. Investment in new projects and expansion is postponed.

- Increased Government Debt: Governments face increased spending needs (e.g., unemployment benefits, social programs) while experiencing reduced tax revenues due to slow economic growth. This can lead to a substantial increase in government debt.

- Social Unrest: The economic hardship caused by stagflation can lead to social unrest and political instability as individuals and groups struggle with job losses, rising living costs, and a diminished quality of life.

Mitigating the Risks of Stagflation: Strategies for Stability

Addressing stagflation requires a multifaceted approach that acknowledges the complexity of the problem. There's no easy solution, and balancing inflation control with employment goals presents significant challenges.

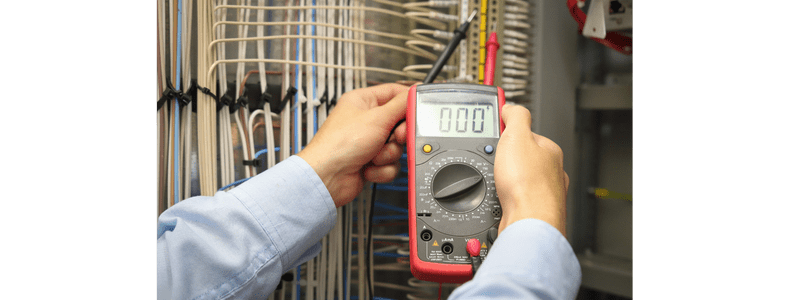

- Prudent Monetary Policy: Central banks need to carefully manage monetary policy, aiming to control inflation without triggering a recession. This involves a delicate balancing act between controlling inflation and supporting economic growth.

- Targeted Fiscal Policies: Governments can use fiscal policy (e.g., targeted tax cuts, infrastructure investments) to stimulate demand and support employment without exacerbating inflation. These policies must be carefully designed to avoid fueling inflationary pressures.

- Supply-Side Reforms: Policies that boost productivity and efficiency, such as investments in education and infrastructure, can improve the economy's ability to supply goods and services, combating inflationary pressures. Removing supply-chain bottlenecks is a key aspect of this strategy.

- International Cooperation: Global cooperation is crucial in addressing shared economic challenges, particularly those relating to supply chains and global commodity prices. International collaboration can help to mitigate the impact of global shocks.

Conclusion

The threat of stagflation presents a formidable challenge to global economic stability. Understanding the underlying causes, consequences, and potential mitigation strategies is crucial for navigating this complex economic terrain. While there is no single solution to preventing or overcoming stagflation, a proactive and coordinated approach involving sound monetary and fiscal policies, coupled with supply-side reforms, is essential. Ignoring the warning signs of stagflation could lead to prolonged economic hardship. Staying informed about the evolving economic landscape and understanding the implications of stagflation is vital for businesses, investors, and policymakers alike. Proactive planning and adaptation are key to mitigating the risks posed by stagflation and building a more resilient economy. Understanding and addressing the threat of stagflation is paramount for ensuring economic stability and growth.

Featured Posts

-

Minimizing The Impact Of San Diego Airport Flight Delays Tips And Tricks

May 30, 2025

Minimizing The Impact Of San Diego Airport Flight Delays Tips And Tricks

May 30, 2025 -

Innovative Materials For A Cooler Urban India Addressing Climate Change Through Construction

May 30, 2025

Innovative Materials For A Cooler Urban India Addressing Climate Change Through Construction

May 30, 2025 -

Trump Zelenski Analiza Kluczowych Punktow Rozmowy

May 30, 2025

Trump Zelenski Analiza Kluczowych Punktow Rozmowy

May 30, 2025 -

Late Kramaric Penalty Secures Draw For Hoffenheim Against Augsburg

May 30, 2025

Late Kramaric Penalty Secures Draw For Hoffenheim Against Augsburg

May 30, 2025 -

Inquietude A Bouton D Or Florange Absence De Remplacement Et Infestation De Rats

May 30, 2025

Inquietude A Bouton D Or Florange Absence De Remplacement Et Infestation De Rats

May 30, 2025