The Trade War And Cryptocurrencies: A Look At Potential Winners And Losers

Table of Contents

Impact on Global Trade and Cryptocurrency Adoption

Reduced Trade, Increased Cryptocurrency Use?

The imposition of tariffs and trade restrictions disrupts traditional payment systems, making cross-border transactions slower and more expensive. This friction can potentially boost the adoption of cryptocurrencies as a faster and cheaper alternative for international trade.

- Decentralized nature of crypto bypasses traditional banking systems affected by trade wars. Crypto transactions aren't subject to the same geopolitical hurdles as traditional bank transfers, offering a more resilient payment option during trade disputes.

- Increased transaction fees and delays in traditional finance drive businesses towards faster crypto alternatives. Businesses seeking to circumvent trade barriers might find the speed and lower fees of cryptocurrencies particularly attractive.

- Examples of cryptocurrencies used for cross-border payments (e.g., Ripple, Stellar). Specific cryptocurrencies designed for facilitating international payments, such as Ripple (XRP) and Stellar Lumens (XLM), could see increased usage as businesses seek to bypass trade restrictions. These platforms offer faster and potentially cheaper cross-border transactions compared to traditional banking systems.

Safe-Haven Asset Status of Cryptocurrencies

Flight to Safety During Economic Uncertainty?

During periods of economic uncertainty fueled by trade wars, investors often seek safe-haven assets. Gold has traditionally held this position, but cryptocurrencies, particularly Bitcoin, are increasingly viewed as a digital safe haven.

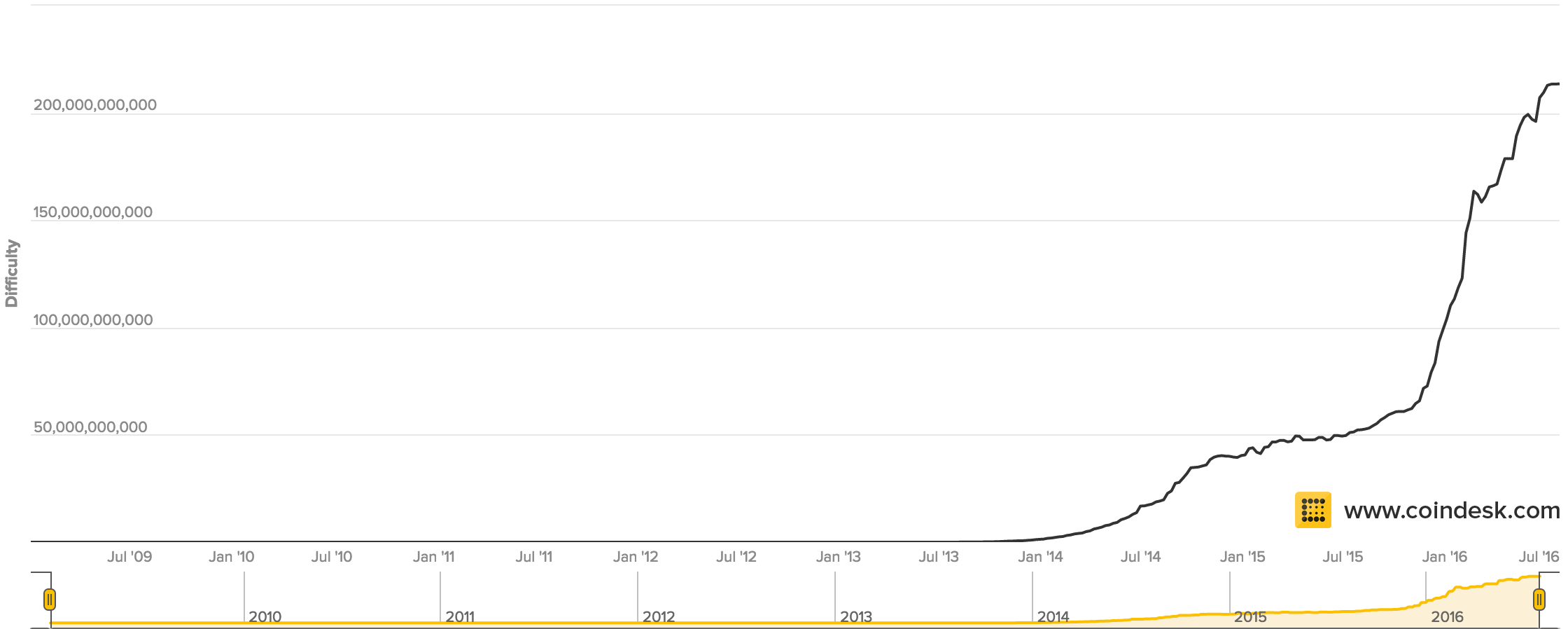

- Analysis of Bitcoin's price correlation with global market volatility during trade war periods. Studies have shown a tendency for Bitcoin's price to increase during periods of heightened market uncertainty, suggesting a growing perception of Bitcoin as a hedge against geopolitical risk.

- Discussion of Bitcoin’s decentralized and scarce nature as contributing factors to its safe-haven appeal. Bitcoin's limited supply and its independence from government control contribute to its perceived value as a store of value during times of economic instability.

- Comparison with other cryptocurrencies and their potential as safe havens. While Bitcoin often leads the charge as a safe-haven asset, other cryptocurrencies with similar characteristics, such as Ethereum, may also experience increased demand during periods of economic turmoil.

Regulatory Uncertainty and its Impact

Navigating the Regulatory Landscape

Trade wars often lead to increased regulatory scrutiny across various sectors, including finance. This can negatively impact cryptocurrency exchanges and businesses operating in the crypto space, creating uncertainty and potentially hindering growth.

- Discussion of varying regulatory approaches to cryptocurrencies across different countries involved in trade disputes. The inconsistent regulatory frameworks for cryptocurrencies across different nations involved in trade wars creates challenges for businesses attempting to operate globally.

- Analysis of the impact of regulatory uncertainty on investor confidence and cryptocurrency market capitalization. Regulatory uncertainty can significantly impact investor sentiment, leading to volatility in the cryptocurrency market.

- Examples of regulatory actions affecting cryptocurrency businesses during trade tensions. Specific instances of governments tightening regulations on cryptocurrencies during periods of heightened trade tensions illustrate the challenges faced by the industry.

Winners and Losers in the Cryptocurrency Market

Identifying Specific Cryptocurrencies and Businesses

Some cryptocurrencies may thrive in a trade war environment (e.g., those focused on cross-border payments), while others might suffer due to decreased investor confidence or regulatory crackdowns.

- Identification of potential winning cryptocurrencies (e.g., privacy coins, cross-border payment solutions). Cryptocurrencies that offer enhanced privacy or facilitate cross-border transactions might experience increased demand during trade wars.

- Identification of potential losing cryptocurrencies (e.g., those heavily reliant on centralized exchanges or specific jurisdictions). Cryptocurrencies with high dependence on specific exchanges or governments might suffer if those exchanges face regulatory challenges or if those governments implement stricter controls.

- Discussion of the impact on cryptocurrency businesses such as exchanges, mining operations and blockchain developers. The overall impact of the trade war extends beyond individual cryptocurrencies, affecting the entire ecosystem of businesses and services related to blockchain and cryptocurrencies.

Conclusion

The impact of the trade war on cryptocurrencies is multifaceted and complex. While some cryptocurrencies may benefit from increased demand for faster, cheaper cross-border transactions and a flight to safety, others face challenges from regulatory uncertainty and overall market volatility. Understanding these dynamics is crucial for navigating the ever-evolving landscape of digital assets. To stay informed about how future trade tensions may affect the cryptocurrency market, continue to follow the latest developments and analyses concerning the relationship between the trade war and cryptocurrencies.

Featured Posts

-

Bitcoin Rebound Market Trends And Future Outlook

May 08, 2025

Bitcoin Rebound Market Trends And Future Outlook

May 08, 2025 -

Understanding The Recent Spike In Bitcoin Mining Activity

May 08, 2025

Understanding The Recent Spike In Bitcoin Mining Activity

May 08, 2025 -

Grave Pelea Entre Flamengo Y Botafogo La Violencia Se Desata En El Campo Y Vestuarios

May 08, 2025

Grave Pelea Entre Flamengo Y Botafogo La Violencia Se Desata En El Campo Y Vestuarios

May 08, 2025 -

Alex Caruso Enters Nba Playoff History Books With Thunder Game 1 Win

May 08, 2025

Alex Caruso Enters Nba Playoff History Books With Thunder Game 1 Win

May 08, 2025 -

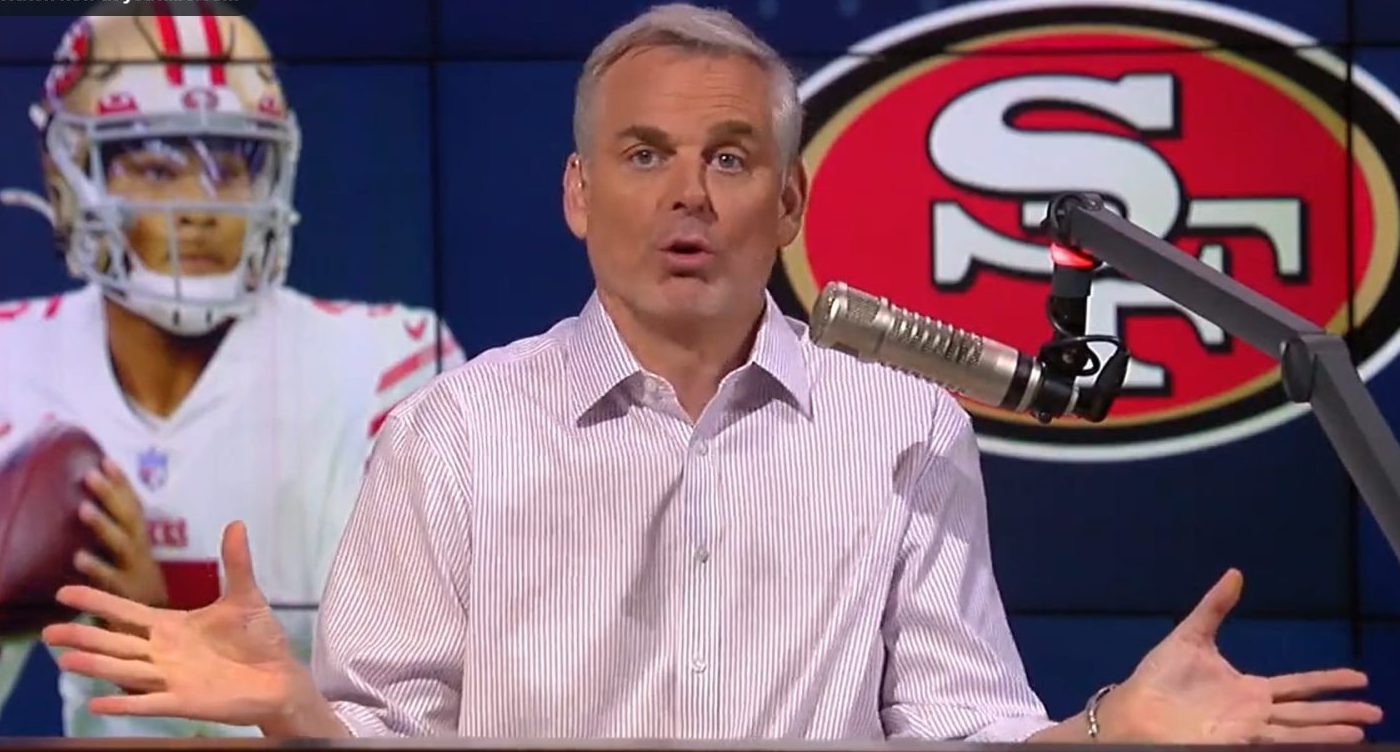

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025